Itemize Break Release For Free

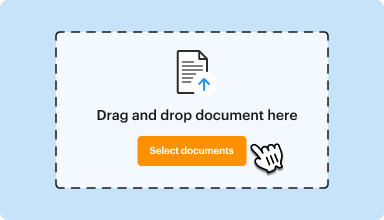

Discover the simplicity of processing PDFs online

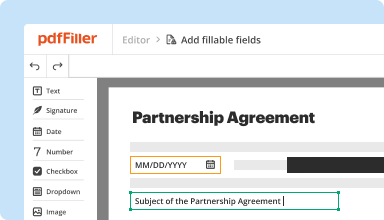

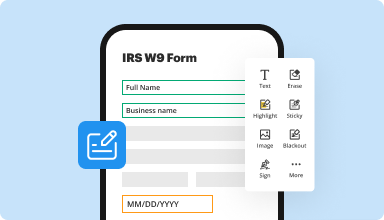

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

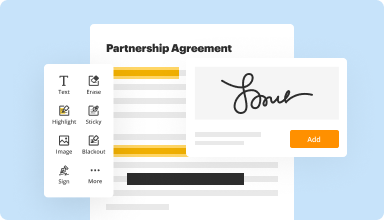

Fill out & sign PDF forms

Organize & convert PDFs

Collect data and approvals

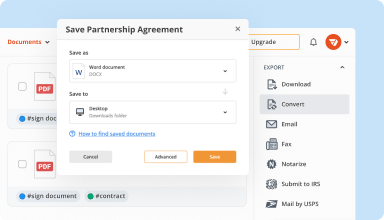

Export documents with ease

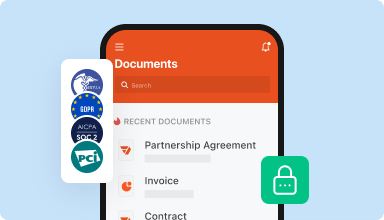

Store documents safely

Customer trust by the numbers

Why choose our PDF solution?

Cloud-native PDF editor

Top-rated for ease of use

Industry-leading customer service

What our customers say about pdfFiller

The Best Part is the Ease of Use and very intuitive.. The ease of editing any PDF files and so easy to send my real estate contracts to be signed from anywhere!!! And it is Priced just right!!!

What do you dislike?

Hummm.... I really can not think of any! At first it was hard to navigate, but once you know where everything is .. its very easy.. I really don't know why anyone would use DocuSign, the y charge so much for so little.

Recommendations to others considering the product:

I would give it a try.. I did and love it.. so easy to use.. and so affordable.

What problems are you solving with the product? What benefits have you realized?

I mainly use Pdf Filler for having real estate contracts signed by my sellers & buyers.. but its great for editing any pdf file..

Itemize Break Release Feature

The Itemize Break Release feature is designed to streamline your workflow by allowing you to manage breaks in your processes with ease. This powerful tool helps you maintain efficiency while giving you control over how and when to pause activities. It's perfect for those who aim to maximize productivity without sacrificing comfort.

Key Features

Potential Use Cases and Benefits

By using the Itemize Break Release feature, you can effectively tackle the common issue of work fatigue and inefficiency. This tool allows you to take structured breaks that promote better concentration and performance. With its user-friendly design, you will find it easier to implement breaks into your schedule and keep your workflow steady. Start utilizing this feature today to see improved productivity and overall job satisfaction.

For pdfFiller’s FAQs

#1 usability according to G2