Protected Footnote Certificate For Free

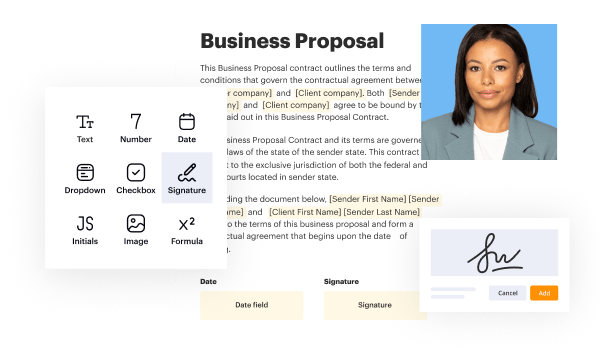

Create a legally-binding electronic signature and add it to contracts, agreements, PDF forms, and other documents – regardless of your location. Collect and track signatures with ease using any device.

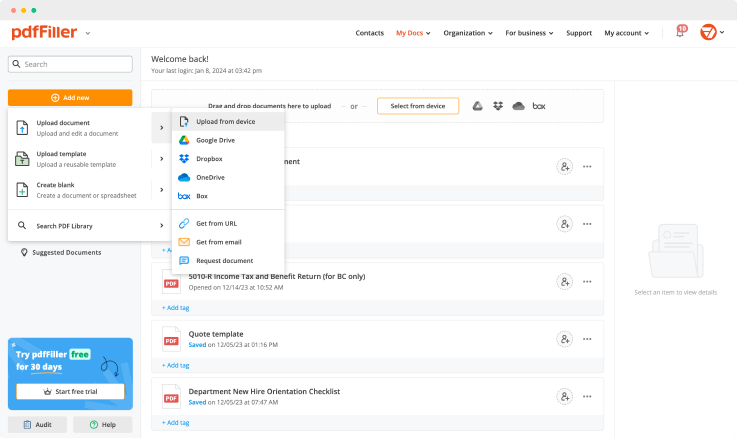

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

Upload a document

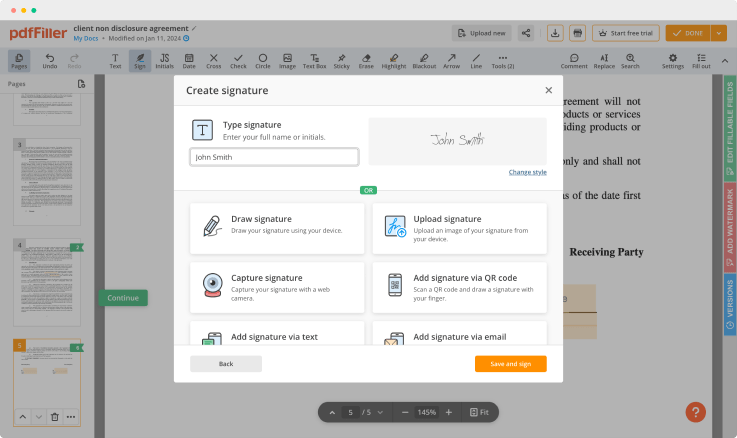

Generate your customized signature

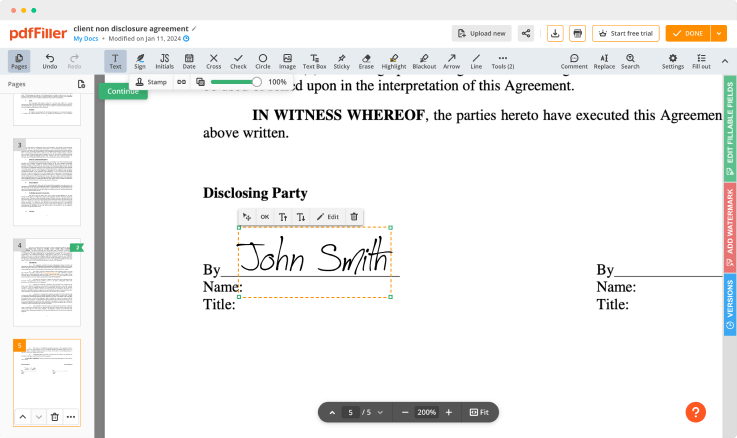

Adjust the size and placement of your signature

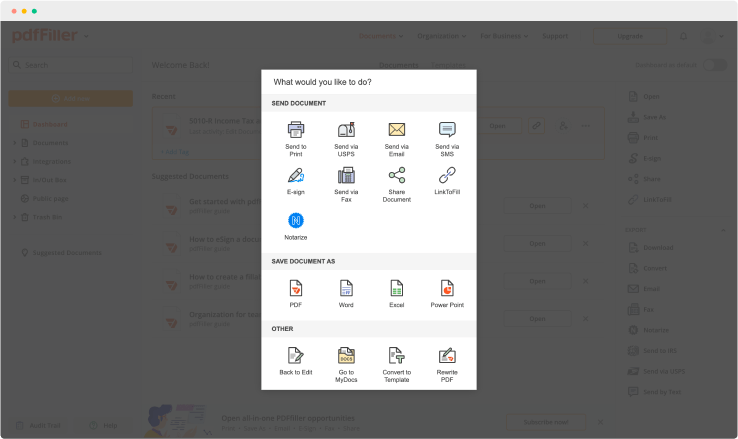

Download, share, print, or fax your signed document

Join the world’s largest companies

Employees at these companies use our products.

Video Review on How to Protected Footnote Certificate

pdfFiller scores top ratings in multiple categories on G2

4.6/5

— from 710 reviews

Why choose pdfFiller for eSignature and PDF editing?

Cross-platform solution

Upload your document to pdfFiller and open it in the editor.

Unlimited document storage

Generate and save your electronic signature using the method you find most convenient.

Widely recognized ease of use

Resize your signature and adjust its placement on a document.

Reusable templates & forms library

Save a signed, printable document on your device in the format you need or share it via email, a link, or SMS. You can also instantly export the document to the cloud.

The benefits of electronic signatures

Bid farewell to pens, printers, and paper forms.

Efficiency

Enjoy quick document signing and sending and reclaim hours spent on paperwork.

Accessibility

Sign documents from anywhere in the world. Speed up business transactions and close deals even while on the go.

Cost savings

Eliminate the need for paper, printing, scanning, and postage to significantly cut your operational costs.

Security

Protect your transactions with advanced encryption and audit trails. Electronic signatures ensure a higher level of security than traditional signatures.

Legality

Electronic signatures are legally recognized in most countries around the world, providing the same legal standing as a handwritten signature.

Sustainability

By eliminating the need for paper, electronic signatures contribute to environmental sustainability.

Enjoy straightforward eSignature workflows without compromising data security

GDPR compliance

Regulates the use and holding of personal data belonging to EU residents.

SOC 2 Type II Certified

Guarantees the security of your data & the privacy of your clients.

PCI DSS certification

Safeguards credit/debit card data for every monetary transaction a customer makes.

HIPAA compliance

Protects the private health information of your patients.

CCPA compliance

Enhances the protection of personal data and the privacy of California residents.

Protected Footnote Certificate Feature

Introduce the Protected Footnote Certificate feature, designed to enhance the security and credibility of your documents. This feature ensures that any footnote associated with your documents is reliably safeguarded, preventing unauthorized changes and maintaining integrity throughout your usage.

Key Features

Automated protection for footnotes

Easy integration with existing document systems

User-friendly interface for managing certificates

Real-time alerts for unauthorized access attempts

Detailed audit trails for compliance

Potential Use Cases and Benefits

Securing academic papers to maintain research integrity

Protecting legal documents to uphold confidentiality

Ensuring financial reports remain unaltered for transparency

Safeguarding regulatory filings for compliance requirements

Helping authors maintain credibility in published works

With the Protected Footnote Certificate feature, you can trust that your essential footnotes are secure. This feature addresses common concerns around document integrity, providing you with peace of mind. By protecting your footnotes, you enhance the overall reliability of your work, making it easier for you to focus on your goals.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How do certificate deposits work?

Certificates of deposit are a secure form of time deposit, where money must stay in the bank for a certain length of time to earn a promised return. A CD, also called a share certificate at credit unions, almost always earns more interest than a regular savings account.

Do CDs pay interest monthly?

A CD's APY depends on the frequency of compounding and the interest rate. Generally, CDs compound on a daily or monthly basis. DO CDs PAY DAILY, MONTHLY, OR YEARLY. The answer varies by account, but most CDs credit interest monthly.

How much interest will I earn on a CD?

This varies based on your deposit, CD rate and term length. For example, a $10,000 deposit in a five-year CD with 2% APY will earn about $1,040 in interest, while a CD with 0.01% APY, all other factors the same, only earns $5 in interest. CD rate is quoted in annual percentage yield.

Are CD's a good investment?

In general, CDs are a good investment if you: Are in a low tax bracket. Want no investment risk. Have a primary goal of preservation of capital.

How does CD interest work?

Just How Do CDs Work? A traditional CD is essentially a time-bound deposit. In exchange for a higher interest rate, you enter into an agreement to let the bank use your money for a fixed period of time. The bank rewards you by paying you a higher interest rate than it does for a savings account or money market account.

Are CD's worth it?

CDs are seen as safe bets for saving or investing since they are federally insured and returns are guaranteed. And when CD rates go up, as they have in the past year, you'll earn more money. But locking up funds in CDs for months or years isn't the best move for everyone.

How does a CD account work example?

Annual Percentage Rate As an example, a CD that offers 5 percent interest would gain $500 on a $10,000 CD, calculated as 0.05 x $10,000. However, most CDs pay compound interest, so the annual percentage yield, or APY, more exactly describes the CD's accrued interest.

How does a CD account work?

A certificate of deposit, commonly called a CD, is a special savings account you can open at most banks and credit unions. But unlike a regular savings account, CDs require you to lock your funds away for a specific period of time until a maturity date. In return, you'll get a higher interest rate.

Ready to try pdfFiller's? Protected Footnote Certificate

Upload a document and create your digital autograph now.