Protected Salary Document For Free

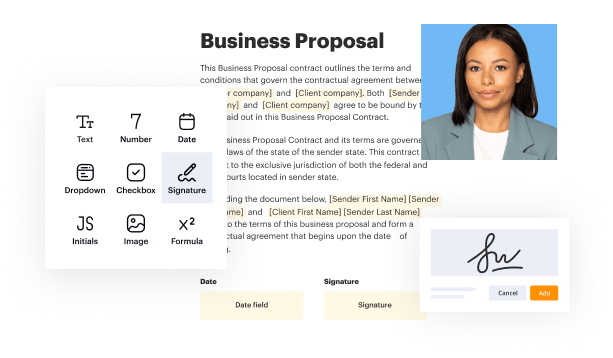

Create a legally-binding electronic signature and add it to contracts, agreements, PDF forms, and other documents – regardless of your location. Collect and track signatures with ease using any device.

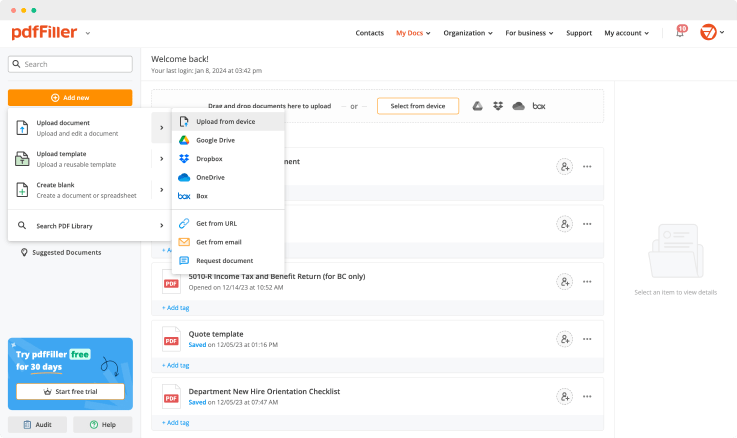

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

Upload a document

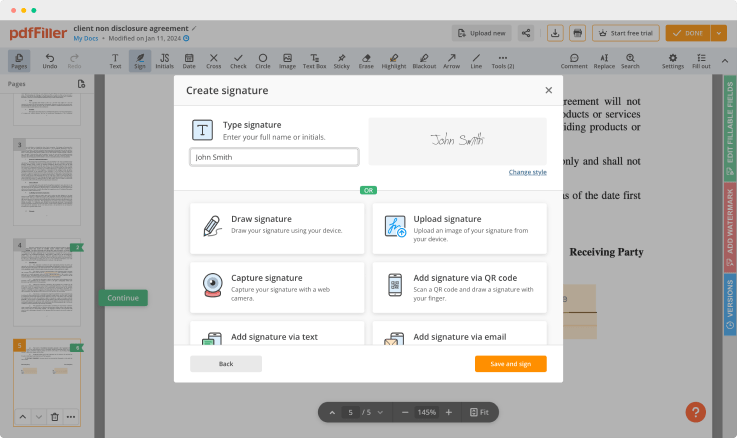

Generate your customized signature

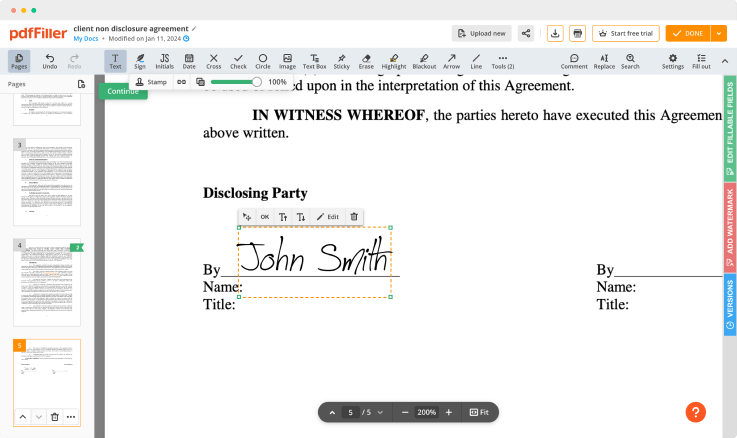

Adjust the size and placement of your signature

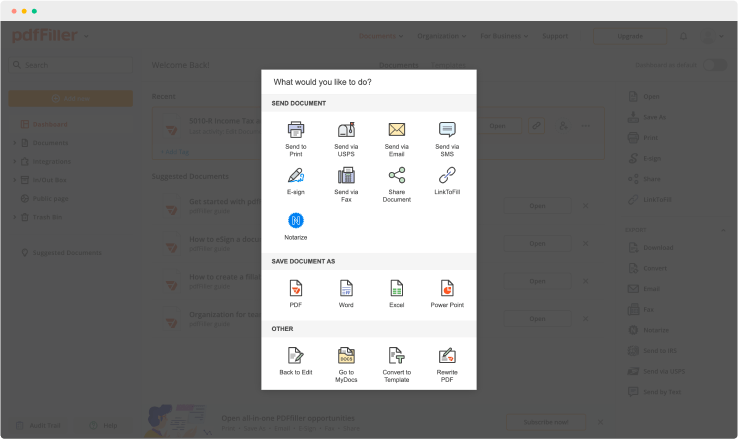

Download, share, print, or fax your signed document

Join the world’s largest companies

Employees at these companies use our products.

How to Add a Signature to PDF (and Send it Out for Signature)

Watch the video guide to learn more about pdfFiller's online Signature feature

pdfFiller scores top ratings in multiple categories on G2

4.6/5

— from 710 reviews

Why choose pdfFiller for eSignature and PDF editing?

Cross-platform solution

Upload your document to pdfFiller and open it in the editor.

Unlimited document storage

Generate and save your electronic signature using the method you find most convenient.

Widely recognized ease of use

Resize your signature and adjust its placement on a document.

Reusable templates & forms library

Save a signed, printable document on your device in the format you need or share it via email, a link, or SMS. You can also instantly export the document to the cloud.

The benefits of electronic signatures

Bid farewell to pens, printers, and paper forms.

Efficiency

Enjoy quick document signing and sending and reclaim hours spent on paperwork.

Accessibility

Sign documents from anywhere in the world. Speed up business transactions and close deals even while on the go.

Cost savings

Eliminate the need for paper, printing, scanning, and postage to significantly cut your operational costs.

Security

Protect your transactions with advanced encryption and audit trails. Electronic signatures ensure a higher level of security than traditional signatures.

Legality

Electronic signatures are legally recognized in most countries around the world, providing the same legal standing as a handwritten signature.

Sustainability

By eliminating the need for paper, electronic signatures contribute to environmental sustainability.

Enjoy straightforward eSignature workflows without compromising data security

GDPR compliance

Regulates the use and holding of personal data belonging to EU residents.

SOC 2 Type II Certified

Guarantees the security of your data & the privacy of your clients.

PCI DSS certification

Safeguards credit/debit card data for every monetary transaction a customer makes.

HIPAA compliance

Protects the private health information of your patients.

CCPA compliance

Enhances the protection of personal data and the privacy of California residents.

Protected Salary Document Feature

The Protected Salary Document feature provides a secure way to manage and safeguard sensitive salary information. This feature is designed to ensure that your financial data remains confidential while allowing for easy access and management. With this feature, you can take control of your financial information effectively.

Key Features

Robust encryption for data protection

User-friendly interface for easy navigation

Access controls to limit who can view or edit documents

Audit trails to monitor changes and access

Cloud storage for secure backup and retrieval

Potential Use Cases and Benefits

Employers can protect employee salary details during audits

Employees can securely store their pay stubs and tax documents

HR departments can manage sensitive compensation data without risk

Financial advisors can access client salary documents safely

Organizations can ensure compliance with data protection regulations

This feature addresses common concerns about the privacy and security of salary information. By using the Protected Salary Document feature, you can prevent unauthorized access, maintain compliance, and ultimately reduce the risk of data breaches. You benefit from peace of mind knowing that your financial data is secure and accessible only to authorized users.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

Who qualifies for payroll protection?

Who Qualifies for the Paycheck Protection Program? The program is designed for employers with 500 employees or less this includes sole proprietorship, independent contractors and the self-employed, private non-profits and 501(c)(19) veterans organizations.

How does payroll protection plan work?

What is the Paycheck Protection Program? The Paycheck Protection Program is a Small Business Association (SBA) loan program specifically designed to help small businesses continue to make payroll at their staff's current pay rate, as well as cover key expenses that keep the lights on (think rent and utilities).

Do you have to pay back paycheck protection program?

You must use at least 75% of PPP funds to cover qualifying payroll costs and the remainder may be used for qualifying non-payroll costs over the eight-week period following the date of the loan. If you do not use PPP for these purposes, your PPP loan will not be forgiven, and you will be required to pay back the loan.

How do you calculate average monthly payroll for paycheck protection program?

Step 1: Take your 2019 IRS 1040 Schedule C line 31 net profit (if you have not filed a 2019 return, fill out the schedule C and compute the value). Step 2: Divide that number by 12 to get the average monthly net profit. Step 3: Multiply that number by 2.5.

How do you fill out a paycheck protection program?

What do I need to apply? You will need to complete the Paycheck Protection Program loan application and submit the application with the required documentation to an approved lender that is available to process your application by June 30, 2020. Click HERE for the application.

How do I get a payroll protection plan?

You can apply for your PPP loan through any of the 1,800 participating SBA approved 7(a) lenders or through any participating federally insured depository institution, federally insured credit union, and Farm Credit System institution.

How do I apply for payroll protection plan?

You can apply for your PPP loan through any of the 1,800 participating SBA approved 7(a) lenders or through any participating federally insured depository institution, federally insured credit union, and Farm Credit System institution.

How can I get my PPP loan forgiven?

Remember: Lenders will forgive your PPP loan if you spend 100 percent of the funds on payroll, mortgage interest, rent, and utilities in the eight weeks after receiving the loan. You must spend at least 75 percent specifically on payroll.

Ready to try pdfFiller's? Protected Salary Document

Upload a document and create your digital autograph now.