Reliable Company Settlement For Free

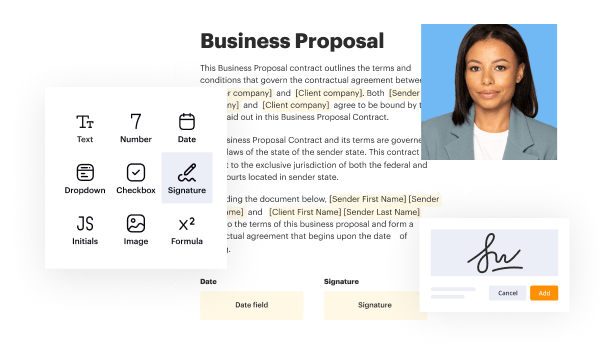

Create a legally-binding electronic signature and add it to contracts, agreements, PDF forms, and other documents – regardless of your location. Collect and track signatures with ease using any device.

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

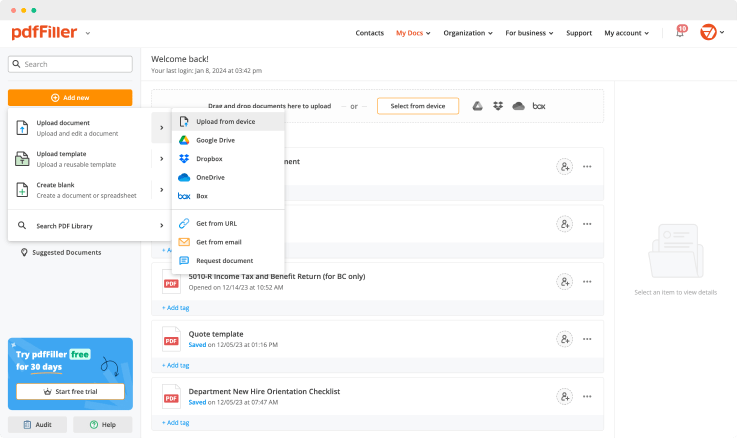

Upload a document

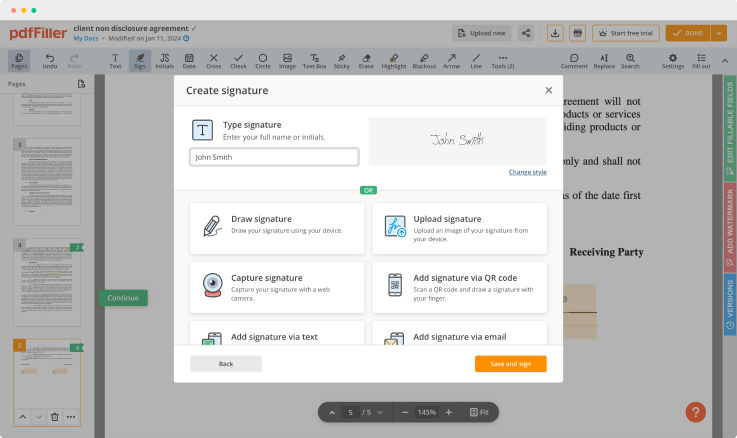

Generate your customized signature

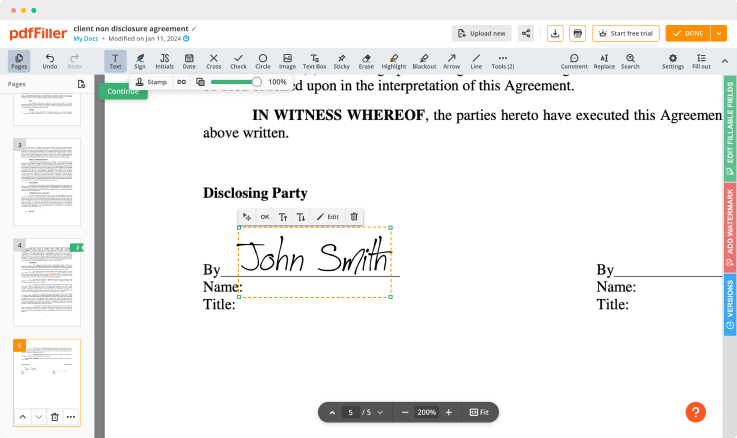

Adjust the size and placement of your signature

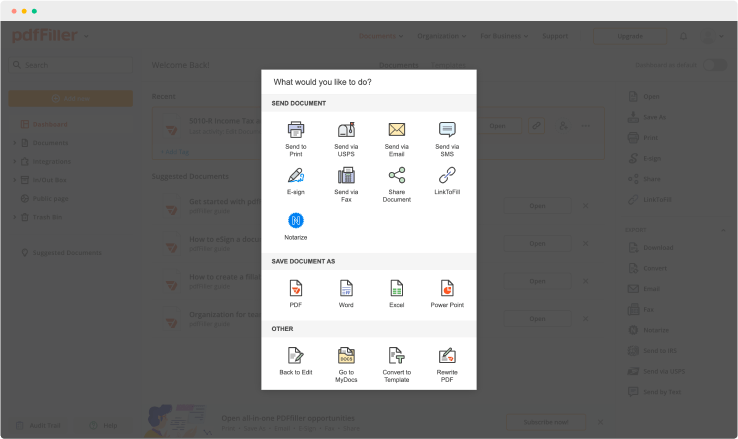

Download, share, print, or fax your signed document

Join the world’s largest companies

Employees at these companies use our products.

How to Add a Signature to PDF (and Send it Out for Signature)

Watch the video guide to learn more about pdfFiller's online Signature feature

pdfFiller scores top ratings in multiple categories on G2

4.6/5

— from 710 reviews

Why choose pdfFiller for eSignature and PDF editing?

Cross-platform solution

Upload your document to pdfFiller and open it in the editor.

Unlimited document storage

Generate and save your electronic signature using the method you find most convenient.

Widely recognized ease of use

Resize your signature and adjust its placement on a document.

Reusable templates & forms library

Save a signed, printable document on your device in the format you need or share it via email, a link, or SMS. You can also instantly export the document to the cloud.

The benefits of electronic signatures

Bid farewell to pens, printers, and paper forms.

Efficiency

Enjoy quick document signing and sending and reclaim hours spent on paperwork.

Accessibility

Sign documents from anywhere in the world. Speed up business transactions and close deals even while on the go.

Cost savings

Eliminate the need for paper, printing, scanning, and postage to significantly cut your operational costs.

Security

Protect your transactions with advanced encryption and audit trails. Electronic signatures ensure a higher level of security than traditional signatures.

Legality

Electronic signatures are legally recognized in most countries around the world, providing the same legal standing as a handwritten signature.

Sustainability

By eliminating the need for paper, electronic signatures contribute to environmental sustainability.

Enjoy straightforward eSignature workflows without compromising data security

GDPR compliance

Regulates the use and holding of personal data belonging to EU residents.

SOC 2 Type II Certified

Guarantees the security of your data & the privacy of your clients.

PCI DSS certification

Safeguards credit/debit card data for every monetary transaction a customer makes.

HIPAA compliance

Protects the private health information of your patients.

CCPA compliance

Enhances the protection of personal data and the privacy of California residents.

Reliable Company Settlement Feature

Ensure your transactions are smooth and dependable with the Reliable Company Settlement feature. This tool simplifies your payment processes and enhances your transaction management, directly addressing common financial challenges that businesses face today.

Key Features

Automated transaction tracking

Instant payment notifications

Customizable reporting tools

Secure data handling protocols

User-friendly interface

Potential Use Cases and Benefits

Streamline payment processing for e-commerce businesses

Enhance financial reporting for accountants

Improve cash flow management for small enterprises

Increase transparency in payment histories for clients

Support faster dispute resolution in transactions

This feature addresses common problems like delayed payments and unclear transaction histories. By automating and organizing your settlements, you save time, reduce errors, and build trust with your stakeholders. With Reliable Company Settlement, you can focus on growing your business while we handle the complexities of payment management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

Are debt settlement companies a good option?

Is debt settlement a good idea? The short answer: reviews are mixed. Debt settlement can help some people get out of debt at a cost that is less than what they owe. Here's how debt settlement works: you stop making payments to your creditors for a period of time, often six months or more.

How much does debt settlement affect your credit score?

A debt settlement remains on your credit report for seven years. As with all debts, larger balances have a proportionately larger impact on your credit score. If you are settling small accounts particularly if you are current on other, bigger loans then the impact of a debt settlement may be negligible.

Is debt settlement a good idea?

Is debt settlement a good idea? The short answer: reviews are mixed. Debt settlement can help some people get out of debt at a cost that is less than what they owe. Here's how debt settlement works: you stop making payments to your creditors for a period of time, often six months or more.

How does a credit card settlement affect your credit score?

Yes, settling a debt instead of paying the full amount can affect your credit scores. When you settle an account, its balance is brought to zero, but your credit report will show the account was settled for less than the full amount.

How long does it take to improve credit score after debt settlement?

If you have a poor and/or thin credit history, it could take 12 to 24 months from the time you settled your last debt for your credit score to recover. Either way, you'll benefit from debt settlement if that means you're no longer missing payments.

What percentage of a debt is typically accepted in a settlement?

Average Debt Settled by Debt Settlement Companies Then there are the fees to the debt settlement company, which are typically 15%. Sometimes that is 15% of the amount you originally owed. Sometimes that is 15% of the amount you paid.

Should I take a debt settlement offer?

”If you're happy with their offer, and you should be because it's less than what you actually owe them, then you should at least consider it,” he says. The alternative, according to Alzheimer, is the creditor either outsourcing the debt to a collector or even suing you.

What percentage should I offer to settle debt?

Offer a Lump Sum Settlement Some want 75%80% of what you owe. Others will take 50%. Those that have given up on you may settle for one-third or less. Before you make an offer, however, decide your top amount and stick to it.

Ready to try pdfFiller's? Reliable Company Settlement

Upload a document and create your digital autograph now.