Signature Block Mortgage Deed For Free

Join the world’s largest companies

How to Send a PDF for eSignature

Why choose pdfFiller for eSignature and PDF editing?

Cross-platform solution

Unlimited document storage

Widely recognized ease of use

Reusable templates & forms library

The benefits of electronic signatures

Efficiency

Accessibility

Cost savings

Security

Legality

Sustainability

Enjoy straightforward eSignature workflows without compromising data security

GDPR compliance

SOC 2 Type II Certified

PCI DSS certification

HIPAA compliance

CCPA compliance

Signature Block Mortgage Deed Feature

The Signature Block Mortgage Deed feature simplifies the process of signing important mortgage documents. With this tool, you can confidently manage your mortgage agreements with ease and clarity.

Key Features

Potential Use Cases and Benefits

By utilizing the Signature Block Mortgage Deed feature, you address the challenges of time-consuming paperwork and lost documents. This solution provides a reliable, efficient way to keep your mortgage agreements organized and accessible, allowing you to focus on your next steps without unnecessary stress.

Create a legally-binding Signature Block Mortgage Deed in minutes

pdfFiller enables you to handle Signature Block Mortgage Deed like a pro. No matter what system or device you run our solution on, you'll enjoy an user-friendly and stress-free way of completing documents.

The entire pexecution process is carefully safeguarded: from uploading a document to storing it.

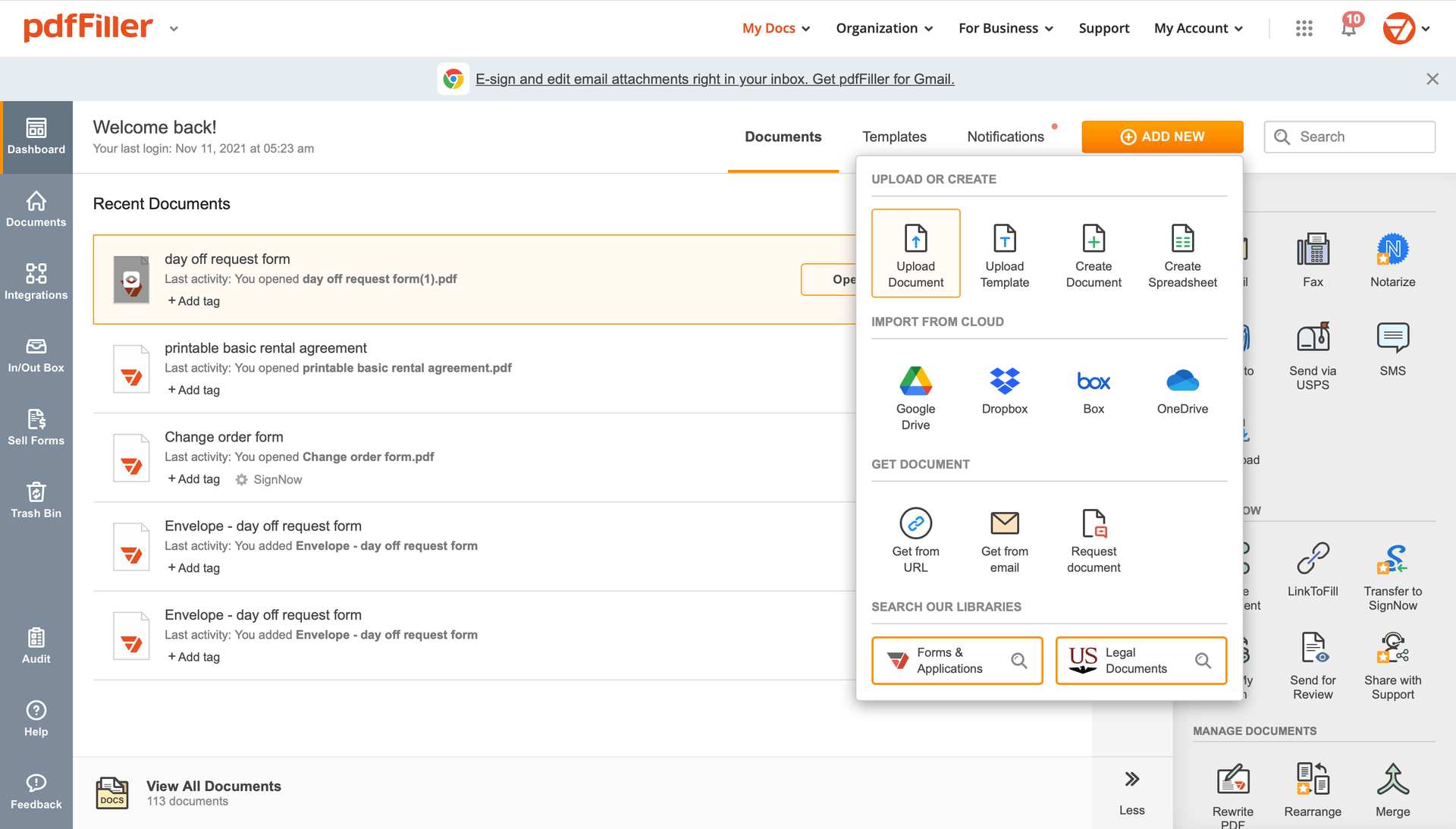

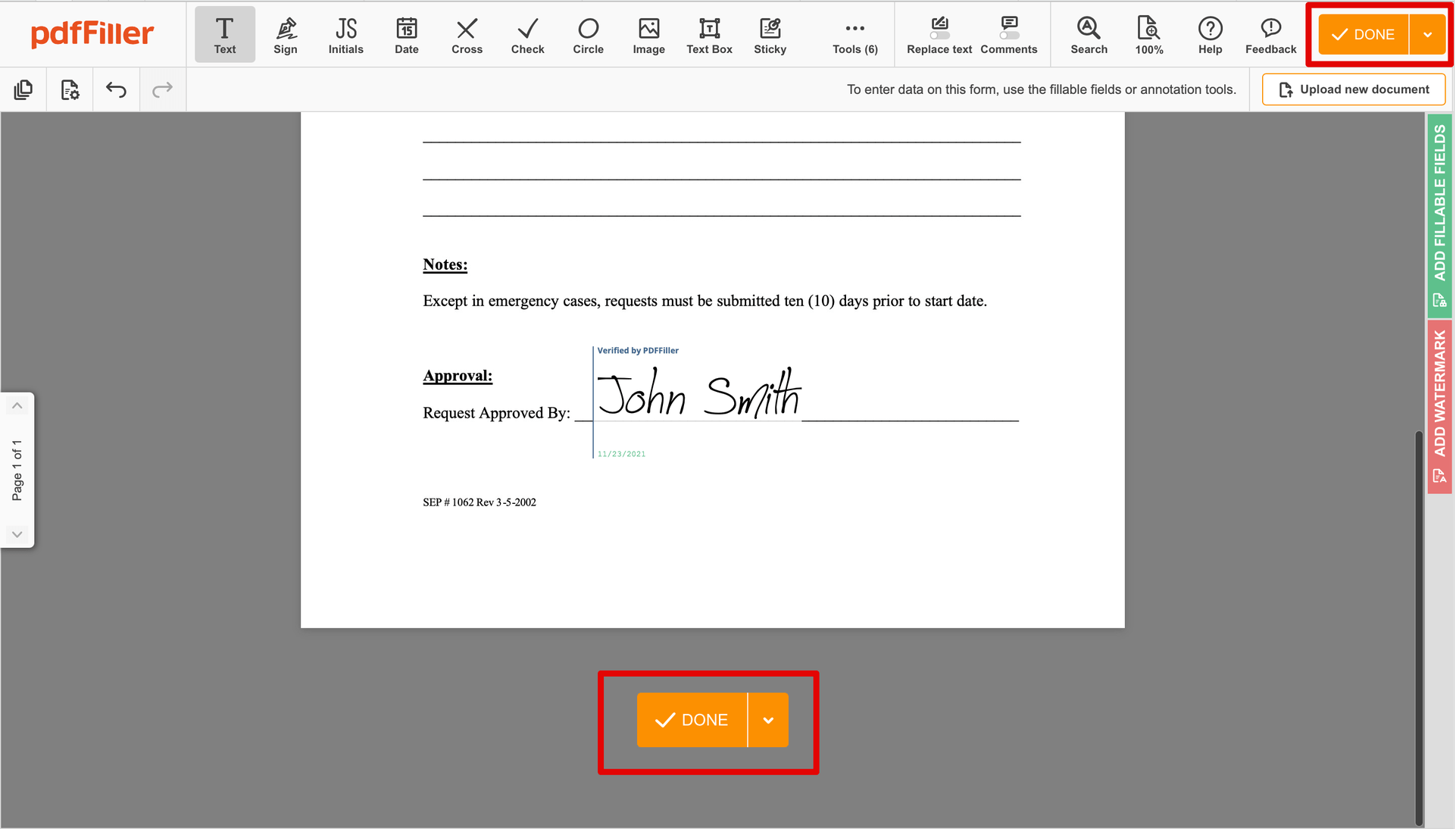

Here's how you can create Signature Block Mortgage Deed with pdfFiller:

Choose any available way to add a PDF file for signing.

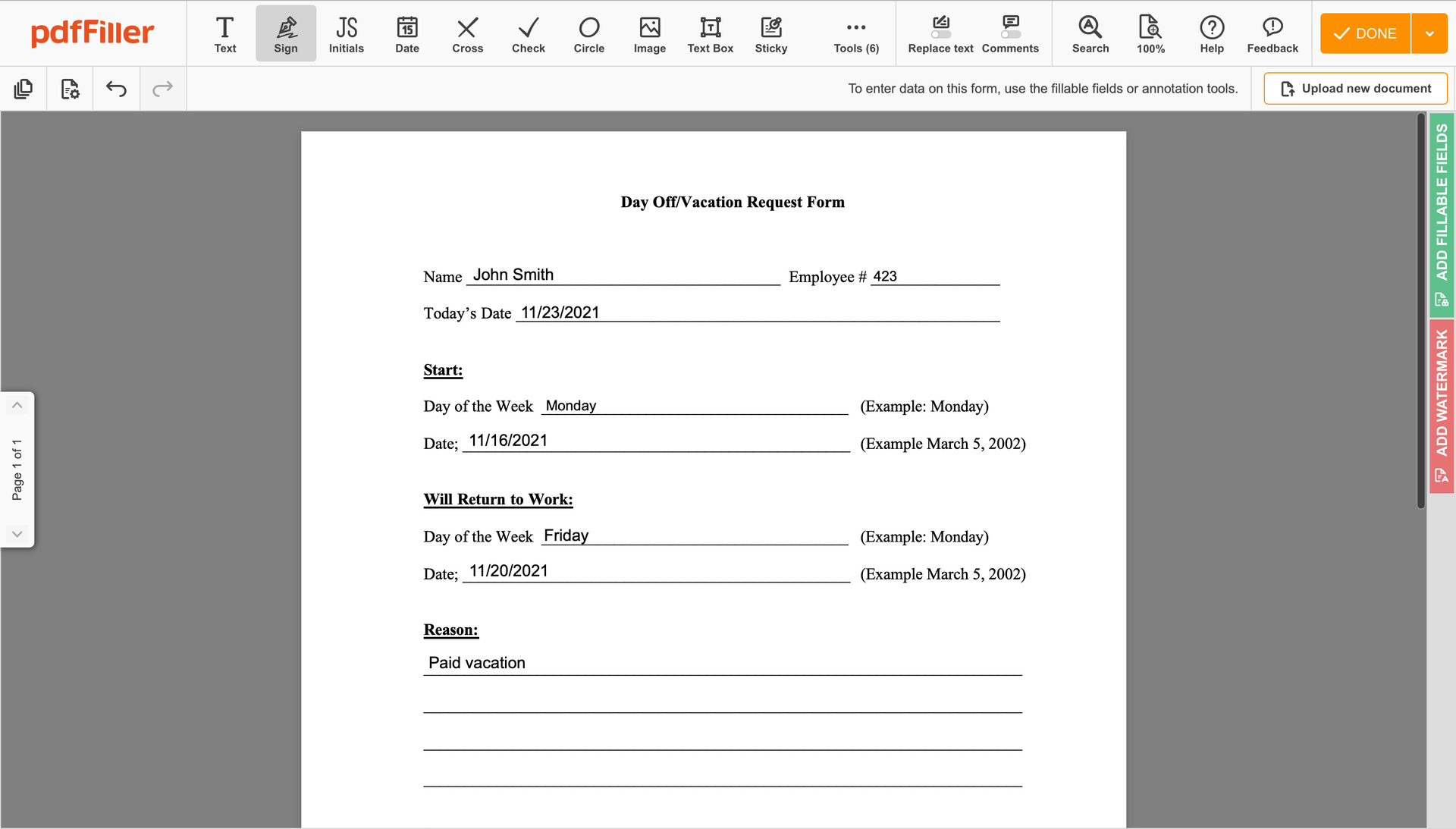

Utilize the toolbar at the top of the interface and choose the Sign option.

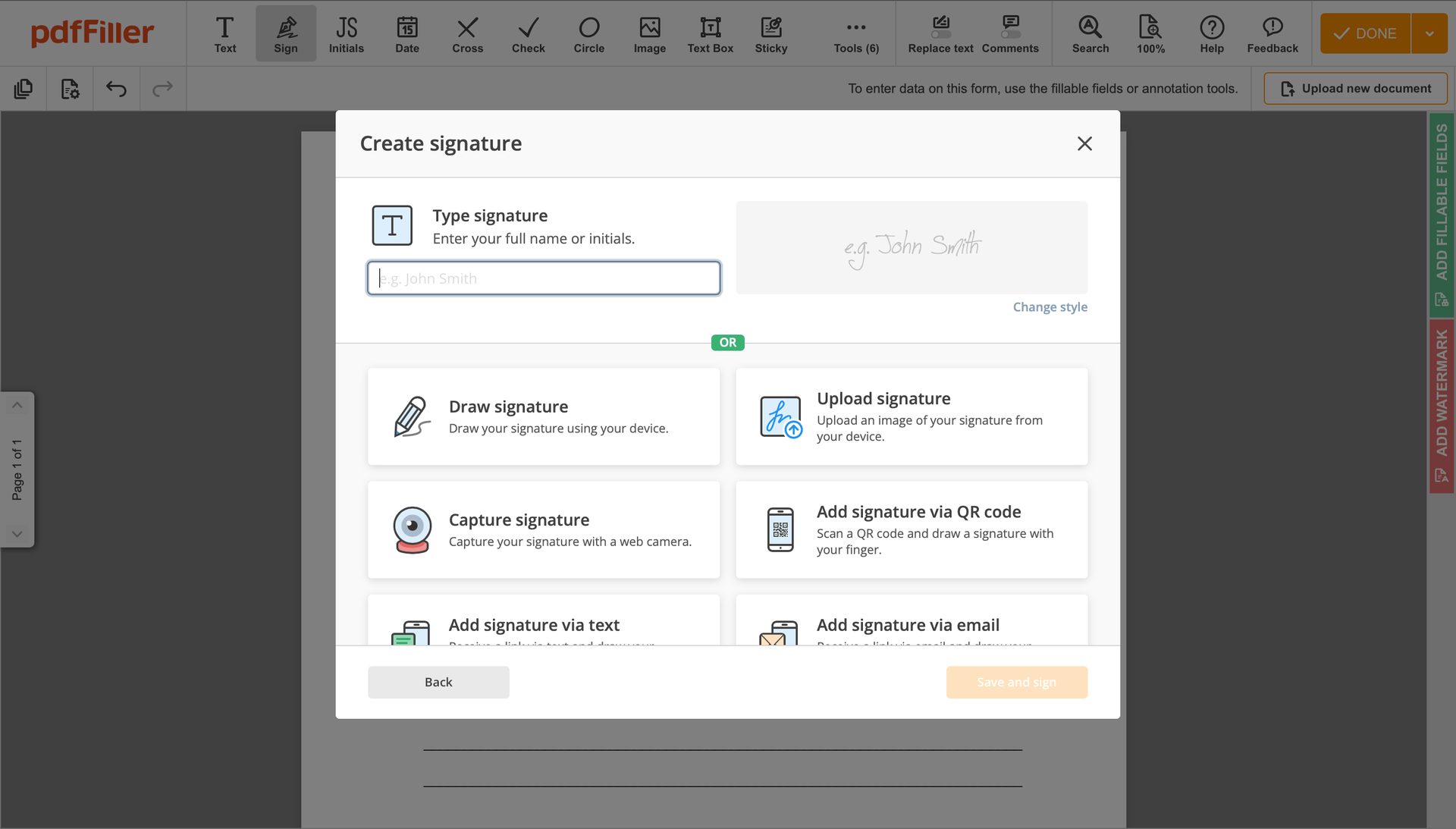

You can mouse-draw your signature, type it or upload a photo of it - our tool will digitize it in a blink of an eye. As soon as your signature is set up, click Save and sign.

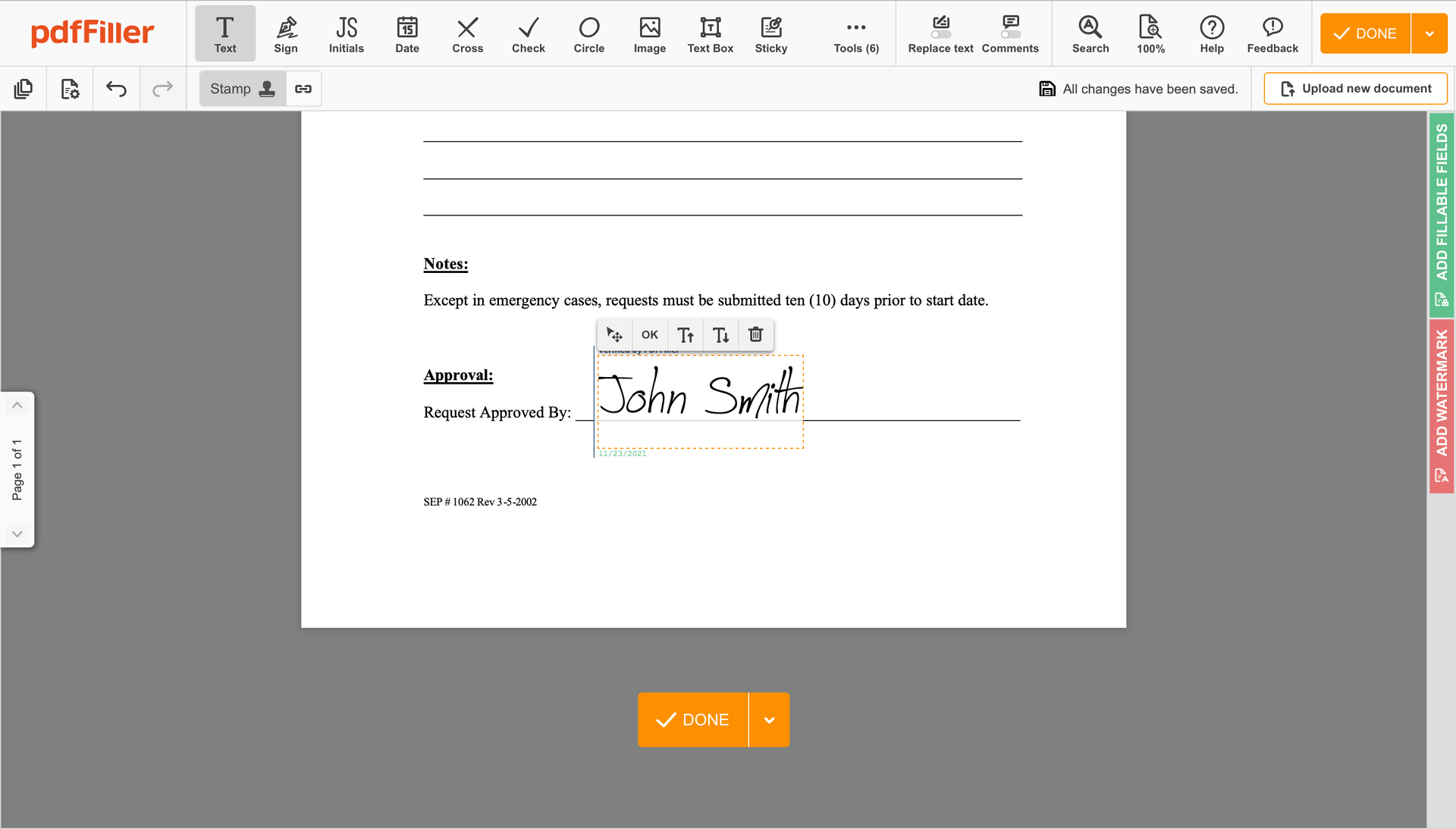

Click on the form place where you want to put an Signature Block Mortgage Deed. You can drag the newly generated signature anywhere on the page you want or change its settings. Click OK to save the adjustments.

Once your form is ready to go, click on the DONE button in the top right corner.

As soon as you're through with signing, you will be taken back to the Dashboard.

Utilize the Dashboard settings to download the completed copy, send it for further review, or print it out.

Stuck with different applications to manage and edit documents? Try this solution instead. Use our document management tool for the fast and efficient work flow. Create document templates completely from scratch, modify existing form sand even more useful features, without leaving your account. You can use Signature Block Mortgage Deed right away, all features, like orders signing, reminders, requests , are available instantly. Have the value of full featured platform, for the cost of a lightweight basic app.

How to edit a PDF document using the pdfFiller editor:

For pdfFiller’s FAQs

Ready to try pdfFiller's? Signature Block Mortgage Deed