Structure Payment Contract For Free

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Last updated on

Aug 16, 2021

Discover the simplicity of processing PDFs online

Upload your document in seconds

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

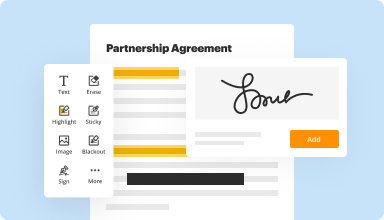

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

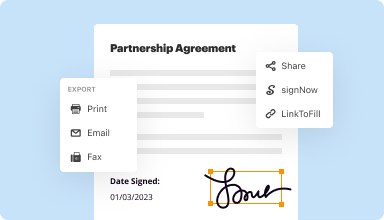

Fill out & sign PDF forms

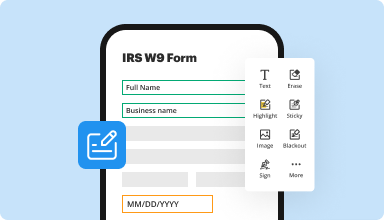

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

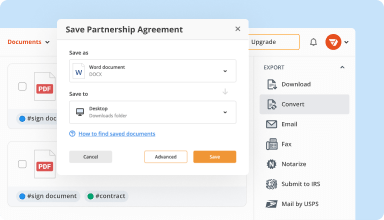

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

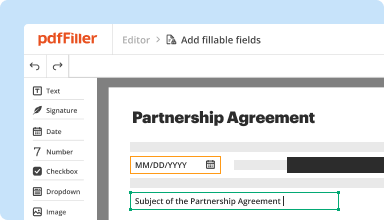

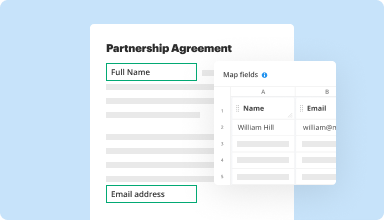

Collect data and approvals

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

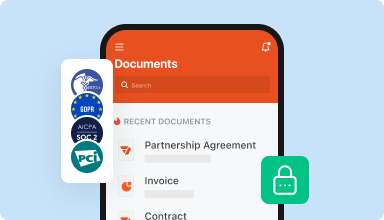

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

I had a problem printing a draft of a form. "Blocked plug-in".

Had a chat with Paul on the site, and followed his suggestions for a fix.

Then was able to print the form. I am a new user and have yet to make changes to the form and print it.

Hoping for the best with that. Thanks, Verne

2015-06-01

Its "the perfect" software. Easy to use without any guess work. It's hard to find a product as simple as this one in today's market. Thumbs up to the folks who created this.

2018-05-22

This is a great tool to expedite routine tasks like filling out forms

Ease of use and flexibility of product are what I like the most. I have found product to be a great time saver.

I haven't experienced any negative problems except sometimes I have had a problem saving my template.

2017-11-14

Pauline took care of my concerns in a…

Pauline took care of my concerns in a timely, polite and expeditious manner. I wish more customer service representatives were like here. She is a boon to her company.

2024-09-20

CUSTOMER SERVICE THE WAY IT SHOULD BE!!

I was using pdfFiller to edit divorce documents I downloaded from the Court Clerks website. Being able to edit these documents was going to save me around $500 in attorney fees. When it was time to save and print I was directed to purchase the subscription. There are 2 options... you can pay for the whole year at once (paying $8 per month) or you can pay $20 per month and be billed each month. I accidentally authorized the whole year @$96 to be charged to my debit card. This was not my intention but I knew it was going to be such a hassle to get them to refund my money that had already cleared only to spend $20 with them. I contacted support thru the chat option anyway and found I was very wrong in my assumption. I was connected to Ray who in less than 5 minutes had refunded the difference of $76 back to my card and was inquiring if there was anything else I needed help with. This is how customer service should be and very rarely do I experience anyone who should bear the title of a customer service representative. THANK YOU RAY FOR YOUR HELP AND PDFFILLER FOR HIRING COMPETANT ENJOYABLE PEOPLE TO DEAL WITH YOUR CUSTOMERS.

2022-04-17

IF YOU HAVE DOCUMENTS TO BE FILLED OUT…

IF YOU HAVE DOCUMENTS TO BE FILLED OUT OR SIGNED, THIS IS DEFINETLY THE PROGRAM TO USE. ITS EASY TO GET AROUND. THE PROGRAM DOES EXACTLY WHAT IT SAYS.

2021-08-23

Easy to Use

It's been fantastic to use to add whole sections into a document without having to re-do everything.

We haven't required something like this often, so I love that I can access this software for free, on an as-needed basis.

Haven't needed to use the software enough to have any issues arise that I couldn't troubleshoot on my own.

2021-06-10

Well I am finding this to be quite convenient and plus...

Well I am finding this to be quite convenient and plus having all types of forms, but since most things come in PDF I am loving it for my small business, I can duplicate the state tax for for each company and only fill in the "seller" info and that is so time saving! I think I am going to absolutely love this, its my first day here and already feel super pleased!

2020-08-21

I signed up originally to utilise this service. Whilst I did not wish to continue with the service (just wouldnt need it again) I did struggle to cancel the service. I sent an email outlining my issue and got the quickest response back and my account fixed and funds returned. Great service if you do require all the time. Easy to use. Highly recommend.

2020-07-25

Structure Payment Contract Feature

The Structure Payment Contract feature helps you manage payments with ease. It allows you to set clear terms, timelines, and responsibilities for all parties involved. This tool caters to the needs of businesses looking to streamline their payment processes.

Key Features

Customizable payment terms

Automated payment reminders

Secure transaction tracking

Easily shareable contracts

Real-time updates and notifications

Potential Use Cases and Benefits

Freelancers managing client payments

Businesses ensuring timely invoice settlements

Service providers structuring payment agreements

eCommerce platforms handling installment payments

Partners creating clear financial arrangements

This feature addresses common payment concerns. It ensures that both parties understand their obligations, which reduces disputes. By automating reminders and providing a clear structure, you increase trust and efficiency in financial dealings. With the Structure Payment Contract feature, you simplify your payment processes, allowing you to focus on growing your business.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

Is a payment plan a contract?

Payment Plan Contract: Everything You Need to Know. A payment plan contract is a document that outlines the important conditions of a loan and states the responsibilities of both the borrower and the lender, ultimately setting legal expectations on both ends.

What is a payment plan agreement?

A payment plan is an agreement with the IRS to pay the taxes you owe within an extended timeframe. You should request a payment plan if you believe you will be able to pay your taxes in full within the extended time frame. If you qualify for a short-term payment plan you will not be liable for a user fee.

What is a payment agreement?

A payment agreement template, also known as a payment agreement contract is a document which contains relevant information about a loan. ... It will explain the terms and conditions of the loan, the amount of interest, the parties involved and the details regarding when the loan will be repaid.

Can you set up a payment plan with the IRS?

Setting up a Payment Plan Now fill out Form 9465, the Installment Agreement Request. You can use the Online Payment Agreement Application on the IRS website if your tax debt is $50,000 or less including interest and penalties. ... You must pay at least this amount each month, although you can always pay more.

What if I miss a payment on my IRS installment agreement?

You have several options available if your ability to pay has changed, and you are unable to make payments on your installment agreement or your offer in compromise agreement with the IRS. Call the IRS immediately at 1-800-829-1040.

Can you make payments on taxes?

File Form 9465, Installment Agreement Request, to set up installment payments with the IRS. ... Completing the form online can reduce your installment payment user fee, which is the fee the IRS charges to set up a payment plan. The IRS must allow you to make payments on your overdue taxes if: you owe $10,000 or less, or.

How do I set up a payment plan with the IRS?

Setting up a Payment Plan First, determine how much you owe in unpaid taxes. Contact the IRS or check your copies of your tax returns to verify the amount. The total will include your original tax due plus penalties and interest. Now fill out Form 9465, the Installment Agreement Request.

How long can you do a payment plan with the IRS?

When you file your tax return, fill out IRS Form 9465, Installment Agreement Request (PDF). The IRS will then set up a payment plan for you, which can last as long as six years.

What do you do if you owe taxes?

Set up an installment agreement with the IRS. ...

Request a short-term extension to pay the full balance. ...

Apply for a hardship extension to pay taxes. ...

Get a personal loan. ...

Borrow from your 401(k). ...

Use a debit/credit card.

Can you pay your tax return in installments?

Seeking time to pay. If you can't afford to pay your tax bill in one go, HMRC may agree to payment by installments. Sometimes you may be contacted by a Debt Collection Agency on behalf of HMRC. ... Any queries about the amount should be raised with HMRC.

#1 usability according to G2

Try the PDF solution that respects your time.