Amend Amount Application For Free

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

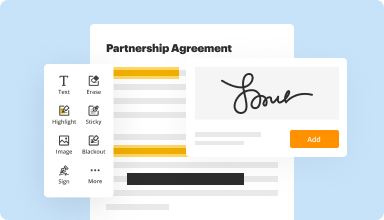

Fill out, edit, or eSign your PDF hassle-free

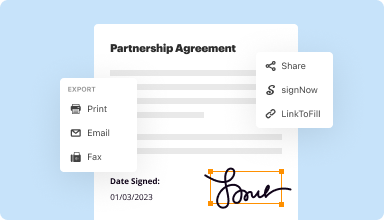

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

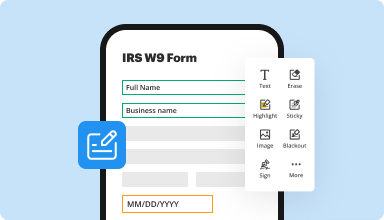

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

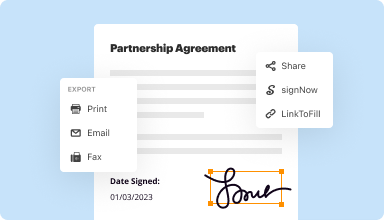

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

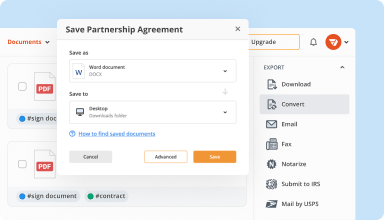

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

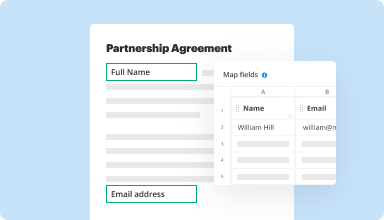

Collect data and approvals

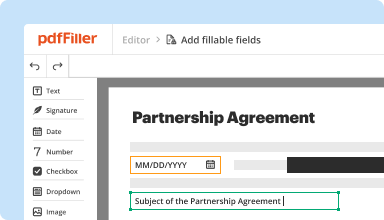

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

I really love this program - saves me SO much time because I can merge documents or remove pages, along with making changes and corrections. SO much better than rescanning documents!

2017-06-22

It is very user friendly. I do have questions that I think attending a webinar would probably answer. It would save me time trying to figure things out.

2018-04-26

Some of the text sizes seemed to change when editing, and the positioning of the text didn't always seem to be consistent with existing and added text

2019-05-17

I absolutely love it!!! Every type of document I need all in one place. I tell everyone about this service. It's amazing and has helped my business grow in many ways. Thank you for this amazing product.

2019-09-16

What do you like best?

I like the choice of fonts because one can add changes or complete empty fields to a pdf and by using a different font from the original text it is clear that the additions are different from the original.. Also I like that one can add circles, check marks, "X" to a doc. And can erase portions of text.

What do you dislike?

I dislike that you have to pay extra to add or subtract pages from a pdf.

What problems are you solving with the product? What benefits have you realized?

My hand writing is very poor. So I use PDFiller to compensate for this deficiency..

I like the choice of fonts because one can add changes or complete empty fields to a pdf and by using a different font from the original text it is clear that the additions are different from the original.. Also I like that one can add circles, check marks, "X" to a doc. And can erase portions of text.

What do you dislike?

I dislike that you have to pay extra to add or subtract pages from a pdf.

What problems are you solving with the product? What benefits have you realized?

My hand writing is very poor. So I use PDFiller to compensate for this deficiency..

2019-05-21

I have never seen anything like it as it almost talks with you and advise you. loved it and have an issue now I missed som work ro do but was not able to leave so I need to boorrow this for free 48 hours?

2024-10-07

PdfFiller has been an extremely convenient tool and service for me and my business. I basically have admin on demand without all the extra machinery of fax, printers, Scanners, etc. I can do it all from my device. I am happy to have found this service.

2024-04-05

IT WAS A GREAT SOFTWARE BUT I HOPE YOU…

IT WAS A GREAT SOFTWARE BUT I HOPE YOU CAN HAVE PESO CURRENCY TO PURCHASE THIS PREMIUM SINCE I AM STILL AT TRIAL USE.

2024-02-13

Great customer experience with this company. Very responsive to technical questions and billing service cared more about our satisfaction than most companies even though it wasn't to their direct bottom line advantage. Will use them again surely.

2020-06-10

Amend Amount Application Feature

The Amend Amount Application feature offers a straightforward way to adjust amounts within your transactions, ensuring accuracy and efficiency in your financial operations.

Key Features

User-friendly interface for quick adjustments

Secure data processing to protect your information

Real-time updates to reflect changes immediately

Comprehensive audit trail for accountability

Flexible integration with existing systems

Potential Use Cases and Benefits

Correcting transaction errors to maintain financial integrity

Updating budgets for improved resource allocation

Adjusting bids in response to changing market conditions

Ensuring accurate invoicing for enhanced customer trust

Facilitating compliance with regulatory requirements

This feature addresses common issues like incorrect amounts or changing circumstances. By allowing easy adjustments, you retain control over your finances and foster confidence in your reporting. With the Amend Amount Application, you can make timely changes, avoid potential disputes, and enhance overall accuracy in your transactions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How can I amend my tax return?

Step 1: Collect your documents. Gather your original return and all new documents. Step 2: Get the right forms together. Download the necessary forms for the tax year you are amending. Step 3: Fill out a 1040X. Download a current IRS Form 1040X, Amended U.S. Individual Income Tax Return. Step 4: Submit your amended return.

Is it bad to file an amended tax return?

Are you concerned that if you file an amended return that it will trigger an IRS audit? If soon't be. Amending a return is not unusual, and it doesn't raise any red flags with the IRS. In fact, the IRS doesn't want you to overpay or underpay your taxes because of mistakes you make on the original return you file.

What happens if you file an amended tax return?

You will receive any additional refund you are owed. Amending to pay additional tax. If you're filing an amended tax return because you owe more tax, you should file Form 1040X and pay the tax as soon as possible. This will limit interest and penalty charges.

Is it hard to file an amended tax return?

The IRS will only accept an amended return within three years of the date you filed the original return or within two years of the date you paid the tax for that year, whichever is later. You can't e-file your amended return. You can prepare amended returns online, but you can't electronically file them.

How long should I wait to file an amended tax return?

The IRS advises that you generally must file Form 1040X to amend a return within three years from the date you filed your original tax return, or within two years of the date you paid the tax, whichever is later. Be sure to enter the year of the return you are amending at the top of Form 1040X.

Does file an amended return trigger an audit?

Amending your return will likely not result in an audit unless there is a substantial change in your taxable income without a reasonable cause. Of course, you're more likely to be audited if you claim the IRS owes you money, rather than the other way around.

How do I amend my tax return after filing?

Login to e-Filing portal and under the 'e-File' tab, go to 'Rectification Request'. Fill in a short form. On successful validation, an additional drop-down is displayed to select the 'Rectification Request Type' option.

How do I correct my tax return?

Complete and mail the paper Form 1040X, Amended U.S. Individual Income Tax Return, to correct errors to an original tax return the taxpayer has already filed. Prepare Form 1040X. Know when not to amend. Use separate forms for each tax year. Wait to file for corrected refund for tax year 2017.

#1 usability according to G2

Try the PDF solution that respects your time.