Convert On Us Contact Settlement For Free

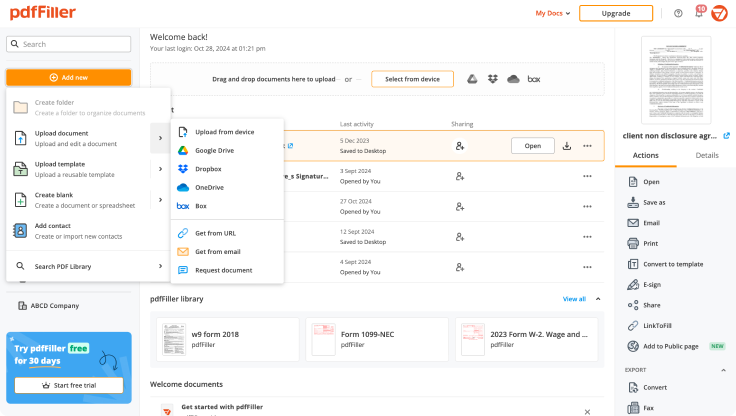

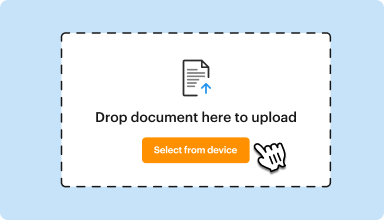

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

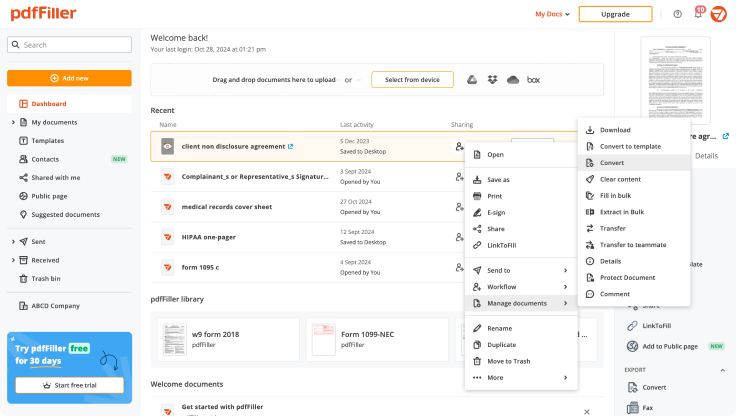

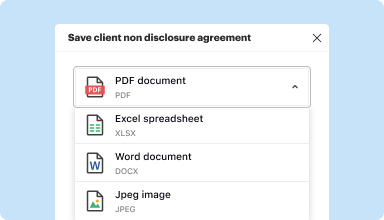

Edit, manage, and save documents in your preferred format

Convert documents with ease

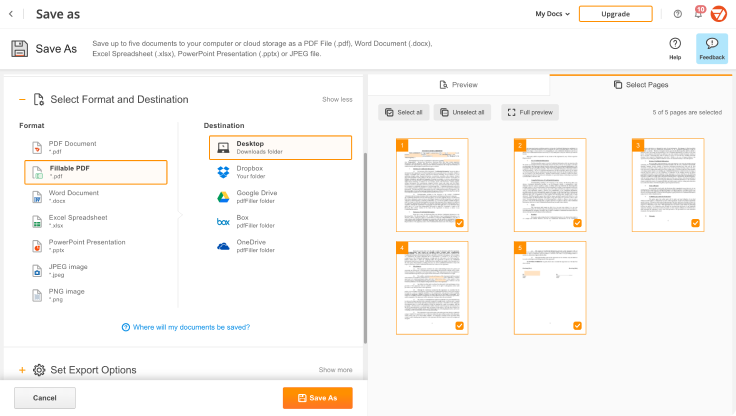

Convert text documents (.docx), spreadsheets (.xlsx), images (.jpeg), and presentations (.pptx) into editable PDFs (.pdf) and vice versa.

Start with any popular format

You can upload documents in PDF, DOC/DOCX, RTF, JPEG, PNG, and TXT formats and start editing them immediately or convert them to other formats.

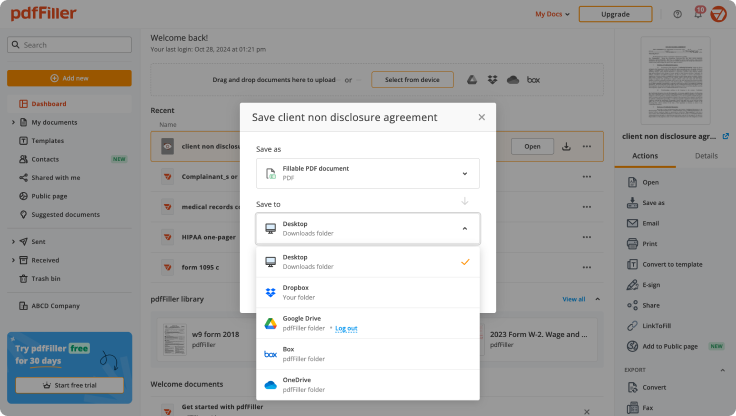

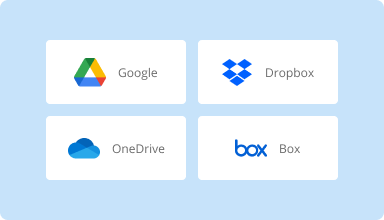

Store converted documents anywhere

Select the necessary format and download your file to your device or export it to your cloud storage. pdfFiller supports Google Drive, Box, Dropbox, and OneDrive.

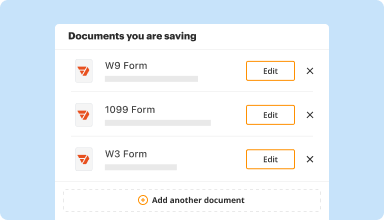

Convert documents in batches

Bundle multiple documents into a single package and convert them all in one go—no need to process files individually.

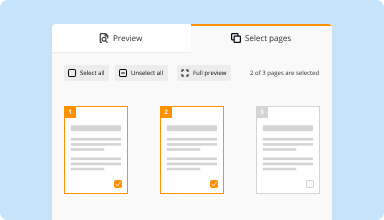

Preview and manage pages

Review the documents you are about to convert and exclude the pages you don’t need. This way, you can compress your files without losing quality.

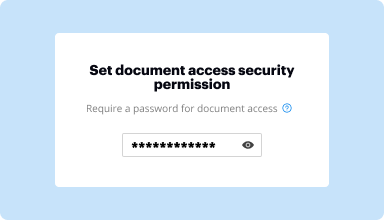

Protect converted documents

Safeguard your sensitive information while converting documents. Set up a password and lock your document to prevent unauthorized access.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

good solid editor-- would like to see other payment choices, like a quarterly option, and even instead of relying on automatic renewal, send a reminder email prior to the renewal to ensure the user is still consistently using product

2014-08-27

very amazing and interesting web as well as very useful and has a lot of options to be used. I recommend everyone to try it especially those people who they need to edit their pdf files but the one disadvantage i found is the high cost.

2014-09-04

Very grateful for excellent technical support available 24/7. Now that I know how to use the system, I'm amazed at how well it works and how it's streamlining my billing process.

2015-12-09

It was easy enough to use the first time I tried. I was able to fill out my 1099's within a couple hours and file them with the IRS. It was so simple! I appreciate your service.

2018-02-07

With this document I had to learn how to rotate the document which took an inquiry on the internet to find the instructions. Could not seem to open any help window for the instruction.

2018-08-14

A nice format that allows a professional presentation but the data input is still tedious and could be streamlined. All things considered, I'm satisfied with the product.

2018-10-14

What do you like best?

I like the ease to update a document quickly and effectively.

What do you dislike?

I wish that it was more intuitive I.e. when I erase something, ask what I’d like to do next and learn my behavior.

What problems are you solving with the product? What benefits have you realized?

I’m able to fix mistakes on PDFs that have already been executed.

I like the ease to update a document quickly and effectively.

What do you dislike?

I wish that it was more intuitive I.e. when I erase something, ask what I’d like to do next and learn my behavior.

What problems are you solving with the product? What benefits have you realized?

I’m able to fix mistakes on PDFs that have already been executed.

2020-02-05

Edit and create PDFs easily

If you work daily with PDF documents, this is a must for you

It has a lot of PDF Tools in one on the cheapest plan

Maybe they can unify the first and mid tier plans. They don't add a lot to the mid tier plan to increase the price. It just don't worth it

2022-06-17

The NC OTP was a perfect match and was all that we needed to get the buyer and seller on the same page. Although it wasn't used by the attorneys it could have easily been used since it was identical to the one they used.

2020-09-15

Convert On Us Contact Settlement Feature

The Convert On Us Contact Settlement feature simplifies how you manage and settle your contact transactions. This tool empowers you to handle settlements seamlessly while ensuring accuracy. You can rely on it to maintain transparency and efficiency in your operations.

Key Features

Real-time transaction monitoring

Automated settlement processes

User-friendly interface for easy navigation

Comprehensive reporting and analytics tools

Potential Use Cases and Benefits

Small businesses looking to streamline payment processes

Financial institutions needing accurate transaction oversight

Organizations aiming to improve customer trust through transparency

With Convert On Us Contact Settlement, you can solve the common problems of manual transaction management, errors in settlements, and lack of visibility in transactions. This feature helps you save time, reduce mistakes, and enhance customer satisfaction. Experience better control over your contact settlements today.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How can I avoid paying taxes on a lawsuit settlement?

If you receive a settlement for personal physical injuries or physical sickness and did not take an itemized deduction for medical expenses related to the injury or sickness in prior years, the full amount is non-taxable. Do not include the settlement proceeds in your income.

How much tax do you pay on a lawsuit settlement?

Taxes on Lawsuit Settlements. The tax liability for recipients of lawsuit settlements depends on the type of settlement. In general, damages from a physical injury are not considered taxable income. However, if you've already deducted, say, your medical expenses from your injury, your damages will be taxable.

How much taxes do I pay on a settlement?

If you receive a settlement for personal physical injuries or physical sickness and did not take an itemized deduction for medical expenses related to the injury or sickness in prior years, the full amount is non-taxable. Do not include the settlement proceeds in your income.

Do you pay taxes on a lawsuit settlement?

Notably, any amount of a settlement payment for damages with respect to personal injury or death is exempt from tax. However, if an amount awarded for damages is held in a deposit account and interest accrues on that amount before it is paid out, that interest is taxable as income.

Is emotional distress settlement taxable?

Emotional distress even though it includes physical symptoms such as insomnia, headaches, and stomach disorders is not considered a physical injury or physical sickness. Therefore, settlement and award payments arising from claims for emotional distress are generally taxable.

Do you have to pay taxes on money from a lawsuit?

If you receive money from a lawsuit judgment or settlement, you may have to pay taxes on that money. After you collect a settlement, the IRS typically regards that money as income, and taxes it accordingly. However, every rule has exceptions. The IRS does not tax award settlements for personal injury cases.

How much tax do you pay on settlement money?

If you sue someone for a claim not involving personal injury for example, a discrimination suit or a suit to collect back pay any award or settlement you receive is generally taxable as ordinary income. This means you'll pay tax on the amount at your personal income tax rate.

#1 usability according to G2

Try the PDF solution that respects your time.