Excise Required Field Charter For Free

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

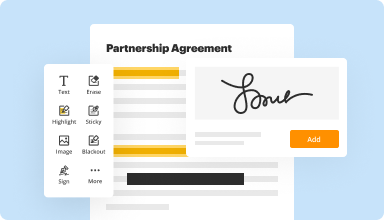

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

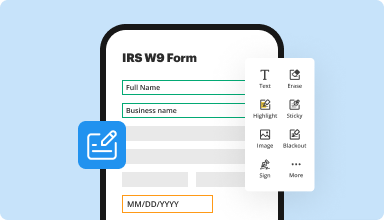

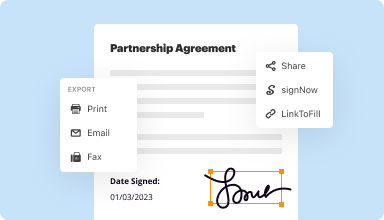

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

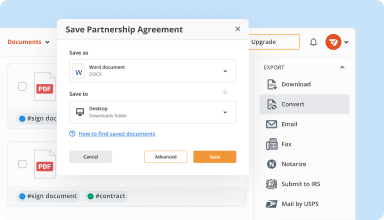

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

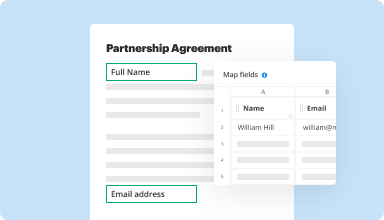

Collect data and approvals

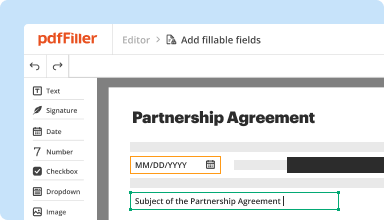

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

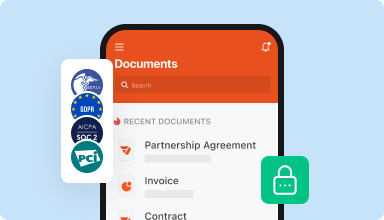

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

The service produces a very handsome document, and facilitates changes when necessary. I had a little trouble navigating back and forth between the document and the print function, but that may be attributable to my lack of familiarity with the product.

2017-11-28

I wish I didn't have to pay. I would have found another free site, like going to SSI site, but I had already filled in all the blanks and it was so time consuming that it wasn't worth the effort. I will cancel as soon as I get the bill.

2018-11-11

can be a little tricky to set up at first but I do love the ease of having a form filled out and emailed rather than printing, hand writing and then scanning to save to the cloud!

2019-07-01

Great for using templates

I work in real estate investment and handle documents and other forms that are basically fill-ins for our tenants. PDF Filler has to make the job 300 times easier because it will add space or make everything look like its in its right space. It makes filling out a document legibly easy and fast so you then can be more productive in your work day.

There are similar programs that allow you to do the same thing it might change spacing, or other aspects of a document.

2018-05-04

PdfFiller is very convenient and easy…

PdfFiller is very convenient and easy to navigate. There is a lot of resources to help facilitate whatever project I am working on.

2021-12-05

I enjoy the accessibility to a large variety of legal forms without preparing them, but the process is not that easy. For a novice user, it is cumbersome and complicated. There should be a tutorial on how to maneuver the program and all of its features seamlessly.

2021-07-22

We use PDF Filler with SignNow for documents for clients and employees.

All seems to work very well. I did 6 documents, each several times as the requirements changed.

I updated the company logos, just erase the old ones in the PDF and Word documents.

So far, I only worked on a Fillable Signable document for clients

I used erase, and then inserted better wording.

2021-03-03

I tested the free trial and it's easy…

I tested the free trial and it's easy to use. Will definitely subscribe when I need to. Customer service is great. Very quick response.

2021-01-10

IT IS VERY CONVENIENT WHEN WE NEED PRIOR YEAR TAX FORMS AT OUR FINGER TIPS. AS FOR ADMINISTRATIVE TEMPLATES, IT IS VERY RESOURCEFUL AND ABLE TO COMMUNICATE THROUGH EMAIL, FAX, ETC. THANK YOU.

2020-08-16

Excise Required Field Charter Feature

The Excise Required Field Charter feature simplifies compliance by ensuring all necessary fields are accurately filled out in your excise tax forms. By using this feature, you can streamline the data collection process and reduce errors, making it easier to meet regulatory requirements.

Key Features

Mandatory field identification for excise forms

Automated alerts for missing information

User-friendly interface for data entry

Integration with existing tax reporting systems

Customizable templates to fit specific needs

Potential Use Cases and Benefits

Businesses new to excise tax reporting can quickly learn compliance requirements

Tax professionals can efficiently manage multiple clients' forms without oversight

Company accountants can reduce time spent on data validation and corrections

Organizations can improve accuracy and speed in their tax submissions

This feature addresses the common problem of incomplete tax documentation, which can lead to penalties and delays. By ensuring that all required fields are completed, the Excise Required Field Charter feature empowers you to meet compliance standards confidently. You save time, reduce stress, and maintain a strong reputation while navigating complex tax regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How is Tennessee excise tax calculated?

The franchise tax is based on the greatest of Tennessee apportioned net worth (assets less liabilities) or real and tangible property owned or used in Tennessee. The tax rate is $0.25 per $100 (0.25%) of the tax base. There is a $100 minimum tax.

How is Tennessee franchise and excise tax calculated?

How is franchise tax computed? The franchise tax is based on the greatest of Tennessee apportioned net worth (assets less liabilities) or real and tangible property owned or used in Tennessee. The tax rate is $0.25 per $100 (0.25%) of the tax base. There is a $100 minimum tax.

How much is franchise and excise tax in TN?

The franchise tax has a minimum payment of $100. Franchise tax is figured at. 25% of the net worth of corporation or the tangible property. The excise tax is 6.5% of the net taxable income made in TN.

How do I file franchise and excise tax in Tennessee?

File a franchise and excise tax return (Form FAE170).

File a franchise and excise tax return for an entity that only owes the $100 minimum franchise tax.

Make quarterly estimated payments.

Make an extension payment.

File the annual exemption renewal (Form FAE183).

Make a payment for an e-filed annual return.

What is Tennessee excise tax?

Tennessee's excise tax, which effectively is an income tax, is a flat 6.5% tax on net earnings from doing business in the state. All capital losses are claimed in the year incurred. Generally speaking, only general partnerships and sole proprietorship are exempt from the excise tax.

Who Must File Tennessee franchise tax return?

Entities with limited liability protection that are doing business and have substantial nexus in the state must file a franchise tax return on form FAE170. If the computed franchise tax is less than $100, the minimum $100 franchise tax is due.

Does Tennessee have excise tax?

Tennessee has both an excise tax, which is a tax on net earnings, and a franchise tax, which is a tax on net worth. Both of these taxes apply to most Tennessee businesses other than general partnerships and sole proprietorship.

Does Tennessee have a corporate income tax?

Tennessee Corporate Income Tax Brackets. Tennessee has a flat corporate income tax rate of 6.500% of gross income. The federal corporate income tax, by contrast, has a marginal bracketed corporate income tax. There are a total of twenty-nine states with higher marginal corporate income tax rates then Tennessee.

What is TN franchise and excise tax?

All Corporations, LCS, and Partnerships, regardless of their tax status with the IRS, are subject to the Tennessee Franchise tax and Tennessee Excise tax. ... Franchise tax is figured at .25% of the net worth of corporation or the tangible property. The excise tax is 6.5% of the net taxable income made in TN.

What do excise taxes pay for?

Excise taxes are taxes required on specific goods or services like fuel, tobacco, and alcohol. Excise taxes are primarily taxes that must be paid by businesses, usually increasing prices for consumers indirectly. Excise taxes can be ad valor em (paid by percentage) or specific (cost charged by unit).

#1 usability according to G2

Try the PDF solution that respects your time.