Last updated on

Jul 12, 2024

Lock Up Comment Accreditation For Free

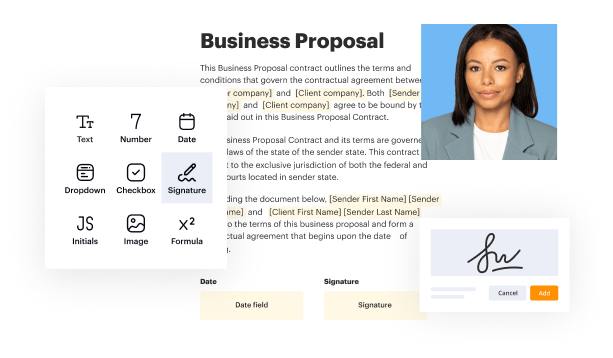

Create a legally-binding electronic signature and add it to contracts, agreements, PDF forms, and other documents – regardless of your location. Collect and track signatures with ease using any device.

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

Upload a document

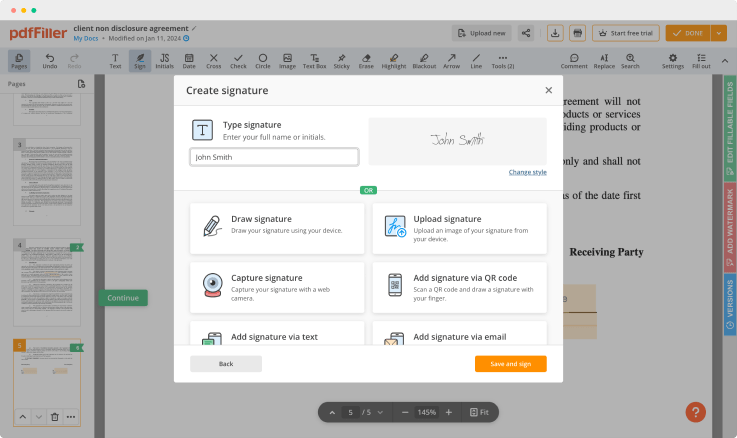

Generate your customized signature

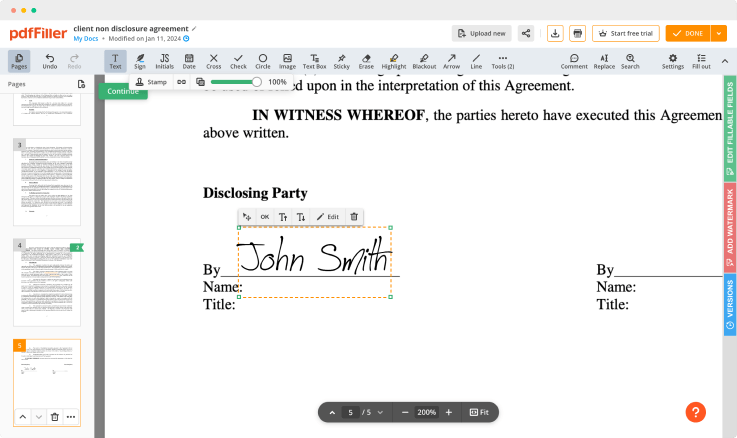

Adjust the size and placement of your signature

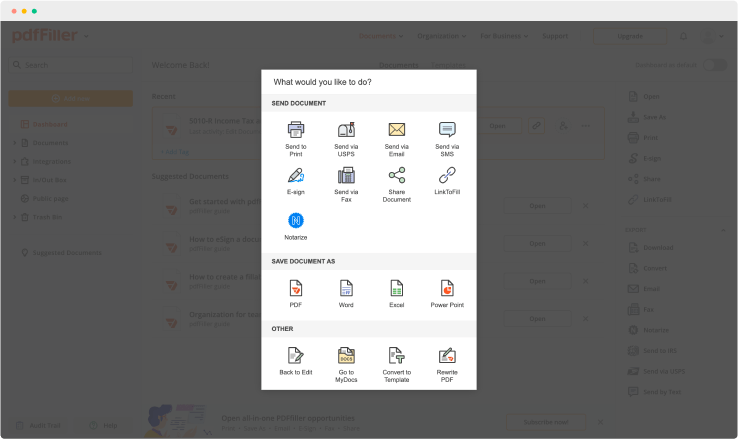

Download, share, print, or fax your signed document

Join the world’s largest companies

Employees at these companies use our products.

Video Review on How to Lock Up Comment Accreditation

pdfFiller scores top ratings in multiple categories on G2

4.6/5

— from 710 reviews

Why choose pdfFiller for eSignature and PDF editing?

Cross-platform solution

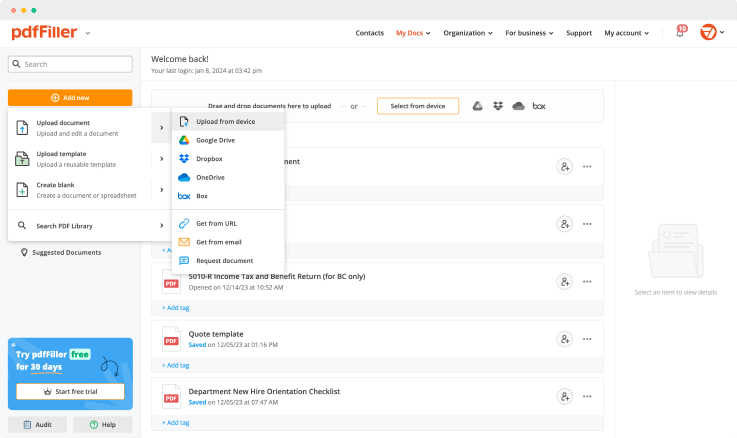

Upload your document to pdfFiller and open it in the editor.

Unlimited document storage

Generate and save your electronic signature using the method you find most convenient.

Widely recognized ease of use

Resize your signature and adjust its placement on a document.

Reusable templates & forms library

Save a signed, printable document on your device in the format you need or share it via email, a link, or SMS. You can also instantly export the document to the cloud.

The benefits of electronic signatures

Bid farewell to pens, printers, and paper forms.

Efficiency

Enjoy quick document signing and sending and reclaim hours spent on paperwork.

Accessibility

Sign documents from anywhere in the world. Speed up business transactions and close deals even while on the go.

Cost savings

Eliminate the need for paper, printing, scanning, and postage to significantly cut your operational costs.

Security

Protect your transactions with advanced encryption and audit trails. Electronic signatures ensure a higher level of security than traditional signatures.

Legality

Electronic signatures are legally recognized in most countries around the world, providing the same legal standing as a handwritten signature.

Sustainability

By eliminating the need for paper, electronic signatures contribute to environmental sustainability.

Enjoy straightforward eSignature workflows without compromising data security

GDPR compliance

Regulates the use and holding of personal data belonging to EU residents.

SOC 2 Type II Certified

Guarantees the security of your data & the privacy of your clients.

PCI DSS certification

Safeguards credit/debit card data for every monetary transaction a customer makes.

HIPAA compliance

Protects the private health information of your patients.

CCPA compliance

Enhances the protection of personal data and the privacy of California residents.

Lock Up Comment Accreditation Feature

The Lock Up Comment Accreditation feature empowers you to manage your online presence effectively. With this tool, you can verify and secure authentic comments, enhancing trust in your community interactions.

Key Features

User verification system to confirm comment authenticity

Flexible settings for comment approval and moderation

Real-time notifications of new comments and accreditation status

Integration with existing platforms for seamless functionality

Comprehensive analytics to track engagement and sentiment

Potential Use Cases and Benefits

Boost trust by publishing verified comments in forums or social media

Reduce spam and irrelevant content through effective moderation

Encourage user engagement by fostering a sense of community security

Assist brands in maintaining a polished online reputation

Provide valuable insights through analytics, informing content strategy

This feature mainly solves the challenge of managing online conversations. By securing and accrediting comments, you can build a reliable community that values genuine feedback. This not only enhances your brand's credibility but also encourages more meaningful interactions among users.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

What is the purpose of a lockup provision?

What Is a Lock-Up Agreement? A lock-up agreement is a contractual provision preventing insiders of a company from selling their shares for a specified period of time. They are commonly used as part of the initial public offering (IPO) process.

What is the purpose of a lock-up agreement?

Key Takeaways. A lock-up agreement temporarily prevents company insiders from selling shares following an IPO. It is used to protect investors against excessive selling pressure by insiders. Share prices often decline following the expiration of a lock-up agreement.

What does lock-up mean in finance?

Lock-up periods are when investors cannot sell particular shares or securities. Lock-up periods are used to preserve liquidity and maintain market stability. Hedge fund managers use them to maintain portfolio stability and liquidity.

What is a lockup provision and why is it required by the lead underwriter?

Describe a lockup provision and explain why it is required by the lead underwriter. The lockup provision restricts insiders and venture capital firms from selling their shares until a specified period (usually 6 months) after the IPO.

What is a lockup transaction?

A lock-up agreement is a contractual provision preventing insiders of a company from selling their shares for a specified period of time. They are commonly used as part of the initial public offering (IPO) process.

What is lock-up option in M&A?

Lock-Up (M&A Glossary) In an underwriting agreement, the lock-up provision prohibits the issuer from selling shares during a period of time after the closing of an initial public offering.

What is lock-up in business?

Lockup agreements prohibit company insiders—including employees, their friends and family, and large shareholders—from selling their shares for a set period of time after an IPO.

Ready to try pdfFiller's? Lock Up Comment Accreditation

Upload a document and create your digital autograph now.