Lock Up Date Accreditation For Free

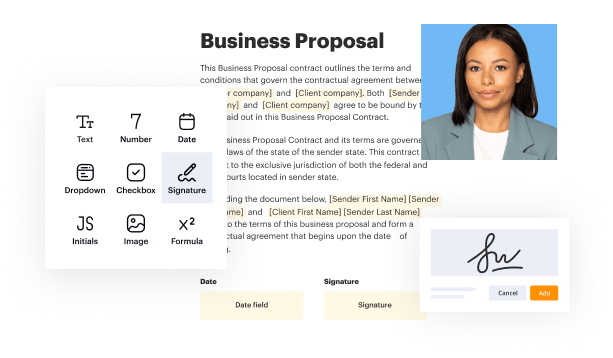

Create a legally-binding electronic signature and add it to contracts, agreements, PDF forms, and other documents – regardless of your location. Collect and track signatures with ease using any device.

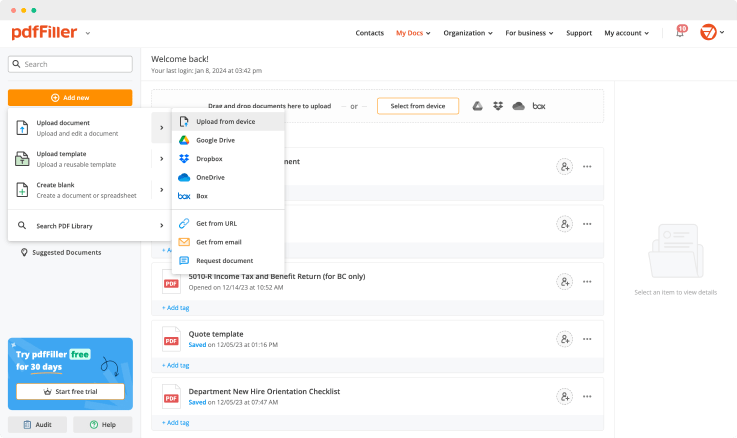

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

Upload a document

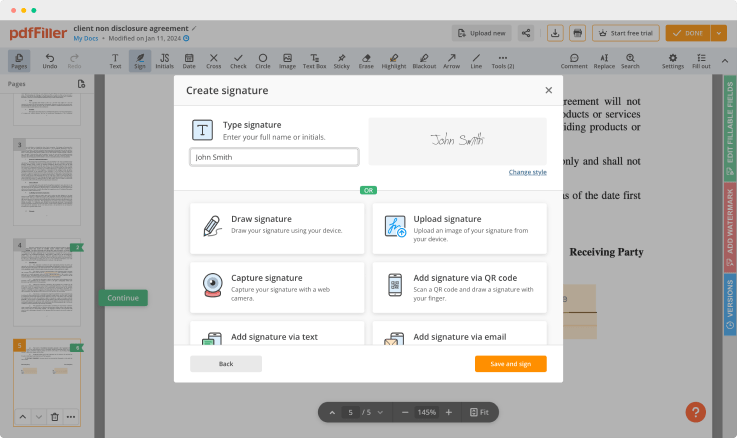

Generate your customized signature

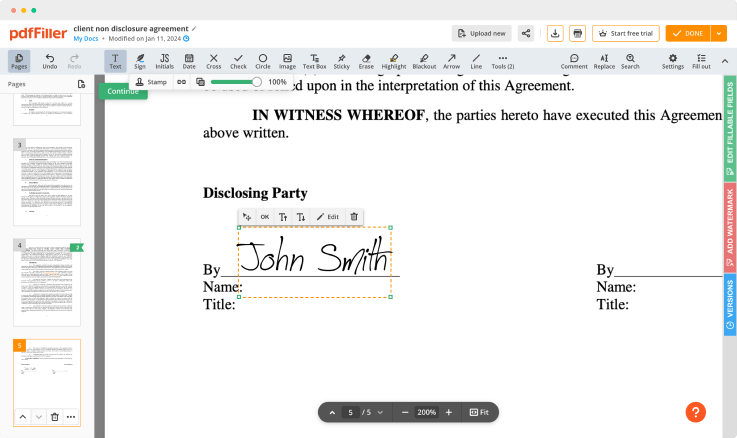

Adjust the size and placement of your signature

Download, share, print, or fax your signed document

Join the world’s largest companies

Employees at these companies use our products.

pdfFiller scores top ratings in multiple categories on G2

4.6/5

— from 710 reviews

Why choose pdfFiller for eSignature and PDF editing?

Cross-platform solution

Upload your document to pdfFiller and open it in the editor.

Unlimited document storage

Generate and save your electronic signature using the method you find most convenient.

Widely recognized ease of use

Resize your signature and adjust its placement on a document.

Reusable templates & forms library

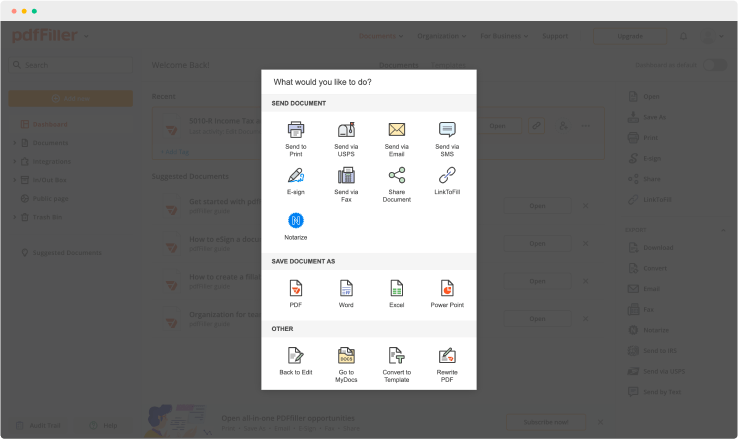

Save a signed, printable document on your device in the format you need or share it via email, a link, or SMS. You can also instantly export the document to the cloud.

The benefits of electronic signatures

Bid farewell to pens, printers, and paper forms.

Efficiency

Enjoy quick document signing and sending and reclaim hours spent on paperwork.

Accessibility

Sign documents from anywhere in the world. Speed up business transactions and close deals even while on the go.

Cost savings

Eliminate the need for paper, printing, scanning, and postage to significantly cut your operational costs.

Security

Protect your transactions with advanced encryption and audit trails. Electronic signatures ensure a higher level of security than traditional signatures.

Legality

Electronic signatures are legally recognized in most countries around the world, providing the same legal standing as a handwritten signature.

Sustainability

By eliminating the need for paper, electronic signatures contribute to environmental sustainability.

Enjoy straightforward eSignature workflows without compromising data security

GDPR compliance

Regulates the use and holding of personal data belonging to EU residents.

SOC 2 Type II Certified

Guarantees the security of your data & the privacy of your clients.

PCI DSS certification

Safeguards credit/debit card data for every monetary transaction a customer makes.

HIPAA compliance

Protects the private health information of your patients.

CCPA compliance

Enhances the protection of personal data and the privacy of California residents.

Lock Up Date Accreditation Feature

The Lock Up Date Accreditation feature streamlines the process of managing accreditation deadlines. It offers clarity, organization, and peace of mind for users who want to stay on top of their accreditation tasks. With this feature, you can effectively manage your deadlines and improve compliance.

Key Features

Automated reminders for upcoming deadlines

User-friendly interface for easy navigation

Customizable accreditation calendar

Centralized tracking of all accreditation statuses

Detailed reporting to monitor progress

Potential Use Cases and Benefits

Educational institutions managing program accreditations

Healthcare organizations ensuring compliance with licensing requirements

Businesses needing to adhere to industry-specific standards

Nonprofits seeking to maintain grant eligibility

Government agencies tracking regulatory deadlines

This feature solves the problem of missed deadlines by providing timely notifications and organized documentation. By utilizing the Lock Up Date Accreditation feature, you will reduce stress, enhance compliance, and streamline your accreditation processes, allowing you to focus on what truly matters.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

What does lock up period mean?

A lock-up period, also known as a lock in, lock out, or locked up period, is a predetermined amount of time following an initial public offering where large shareholders, such as company executives and investors representing considerable ownership, are restricted from selling their shares.

What does lock up expiration mean?

Lock-Up Expiration The anticipation of a price drop can result in an increase in short interest as traders short-sell stock into the expiration. Investors that are concerned about the upcoming lock-up expiration may try to collar or hedge their long positions with options.

What is a lockup agreement?

Lockup agreements prohibit company insiders including employees, their friends and family, and venture capitalists from selling their shares for a set period of time. In other words, the shares are “locked up.” ... The terms of lockup agreements may vary, but most prevent insiders from selling their shares for 180 days.

What is the primary purpose of a lockup agreement?

Lock-up agreements are meant to help protect investors. The scenario that the lock-up agreement is meant to avoid is a group of insiders taking an overvalued company public, then dumping it on investors while running away with the proceeds.

What is a stock lockup?

A lock-up period, also known as a lock in, lock out, or locked up period, is a predetermined amount of time following an initial public offering where large shareholders, such as company executives and investors representing considerable ownership, are restricted from selling their shares.

Do I have to sign a lock-up agreement?

A lock-up agreement prohibits company insiders, such as employees and venture capitalists, from selling their shares for a set period of time. ... That agreement may require you to sign the lock-up agreement. If not, and if you are no longer affiliated with the company, you may not have to sign.

What happens when a stock lockup expires?

Once past that date (the lockup expiry date), these shareholders are generally free to trade their stock unless they remain insiders. ... Since a lockup expiry releases a number of shareholders to trade, volume usually increases on that day and thereafter, increasing the liquidity or float of a given stock.

How long is IPO quiet period?

The quiet period begins when the registration statement is made effective and lasts for 40 days after the stock begins trading.

How long is the IPO process?

It can last between two weeks and three months, depending on the company and its advisors. If handled properly, it should take an average company between six and nine months to go public via an initial public offering (IPO) or direct public offering (DPO) — if it is coordinated and managed properly.

What does a quiet period mean in stocks?

During that period, the federal securities laws limited what information a company and related parties can release to the public.” ... In business finance, a waiting period (or quiet period) is the time in which a company making an IPO must be silent about it, so as not to inflate the value of the stock artificially.

Ready to try pdfFiller's? Lock Up Date Accreditation

Upload a document and create your digital autograph now.