Note Over Payment Transcript For Free

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

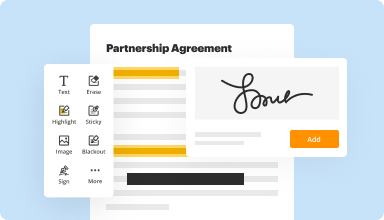

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

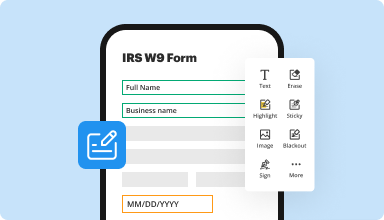

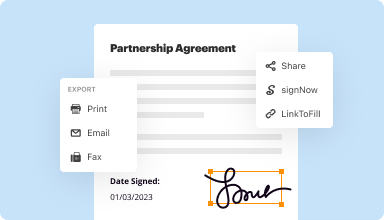

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

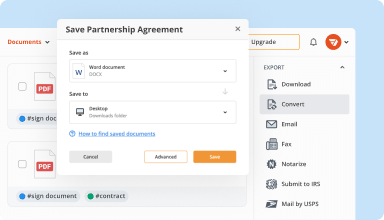

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

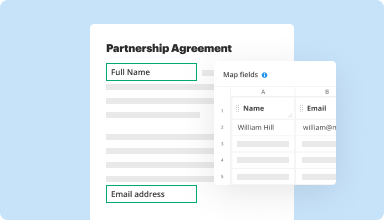

Collect data and approvals

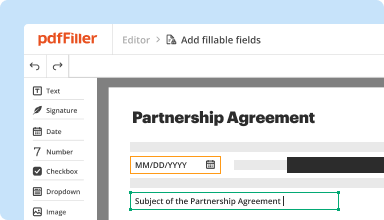

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

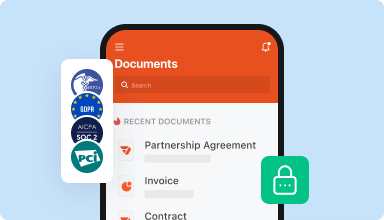

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

EASY TO USE- This program satisfies my need and most important, it is very easy to use. Im not one for reading directions- This program is so easy- it is a joy to use. Love It!

2015-02-17

So easy to use not being rejected

My bank required my signature not an electronic signature. Maybe if I used my signature on pdf format I will try that next time.

2017-12-28

its been really difficult for me to use this progrsm but it does work once i get the hang of it. i think it needs to have a few more features that it might actually have i just cant find how to do it

2018-05-20

Easy to Use

Easy to Use, Excellent Editing Techniques. Loved the opportunity to email, fax and input notes. Especially loved the notification to be sent to me when my email is accessed by the recipients. GREAT SERVICE! I plan on keeping this service and using it not just for editing PDF's sent to my business, but for creating my own. THANKS PDFfiller!!! LOVE YOUR PRODUCT AND THE LOW PRICE TO USE IT.www. giftbaskets-usa. com will definitely place a link to your site on our page just for having a great service!!! No strings attached!! Respectfully,Owner of GiftBaskets-USA

2019-02-17

I have NO ablity for photoshop

I have NO ablity for photoshop, etc. But this software is easy to use and I can easily edit the few things I need to do. Highly recommend it for those who aren't to tech savy.

2023-12-08

good enough but I am being billed $30…

good enough but I am being billed $30 and $30 for this month October alone and I only have one license. Just me. I need this corrected immediately.

Aaron McCartney

(561)336-8012

2022-10-19

I thought it was a bit difficult to get a form completed. All I wanted was a statement that I paid my neighbor for a dent in his car. I had to hunt for a form that would allow me to enter that statement.

2021-06-05

What do you like best?

The best feature is that you can use the check and cross marks easily!

What do you dislike?

I dislike the fact that there isnt a hand-free drawing feature. I wish I could draw lines and curves on top of some pictures, for example!

What problems are you solving with the product? What benefits have you realized?

I use it to grade my students papers in Pdf. It is easier to attach hand written exercises to pdf, and then go directly to pdffiller.

2021-04-19

I activated to try for the first time and only needed for a single transaction. Very easy to use and should I need a service in the future, would definitely purchase.

2021-01-10

Note Over Payment Transcript Feature

The Note Over Payment Transcript feature streamlines the process of recording and tracking payment notes. This tool enhances clarity and ensures accurate financial documentation. With this feature, you can manage payment details efficiently and effectively.

Key Features

Simple entry for payment notes

Automatic organization of transcripts

In-line editing for easy updates

Secure data storage

User-friendly interface

Potential Use Cases and Benefits

Track payment history for audits

Enhance communication between team members

Reduce errors in financial records

Improve client billing inquiries

Support compliance with financial regulations

By using the Note Over Payment Transcript feature, you address common challenges like miscommunication and inconsistent record-keeping. This tool offers you a reliable solution for maintaining accurate payment information, enabling you to focus on your core business activities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How do I get an overpayment back from the IRS?

If you receive notification of your tax overpayment from the IRS via a CP 268 notice, you'll be able to request your refund directly from an IRS agent over the phone. If you identify the overpayment on your own, you should file an amended tax return for the year or years in which you overpaid.

What can I do if I overpaid the IRS?

If you overpay your taxes, the IRS will simply return the excess to you as a refund. Generally, it takes about three weeks for the IRS to process and issue refunds. Prefer not to receive a refund? You can choose to get ahead on the following year's payments and apply the overpayment to next year's taxes.

How long does it take to get overpaid tax back?

If you do not do this within 45 days, HMRC should send you a check, which should arrive within 60 days of the date on your P800. HMRC's guidance says that if you are not given the option to have the P800 refund paid directly into your bank account, then you'll get a check within 14 days.

How do I get my overpaid tax back?

In most cases you can get back the tax you have overpaid, as long as you claim on time. You have up to four years to make a claim. Remember, even if you only want HMRC to look at one particular tax year, HMRC may take the opportunity to look over the four 'open' tax years.

Is there an IRS penalty for overpayment?

Though there aren't penalties for overpaying your taxes, the IRS does impose penalties for underpaying your taxes. You are required to pay taxes as you earn income throughout the year. Second, you won't owe any interest or penalties as long as you paid 90 percent of your total tax liability.

Why do I have an overpayment on my taxes?

An overpayment on your tax return is the amount of refund you would receive. An overpayment occurs when a taxpayer pays too much in income taxes. At the end of the year, if the actual tax return shows that a lesser amount is due than the sum of the payments, an overpayment has occurred.

What happens if you overpay your taxes?

If you overpay your taxes, the IRS will simply return the excess to you as a refund. Generally, it takes about three weeks for the IRS to process and issue refunds. It's possible that you realize at a later date that you missed a deduction or credit that would have lowered your tax liability or resulted in a refund.

Video Review on How to Note Over Payment Transcript

#1 usability according to G2

Try the PDF solution that respects your time.