Prepare Number Application For Free

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

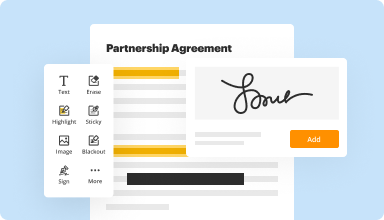

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

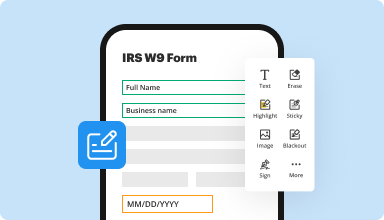

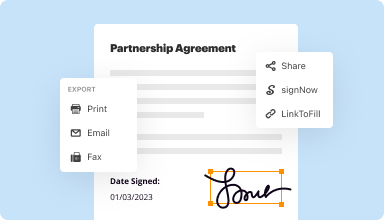

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

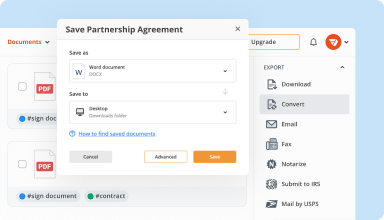

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

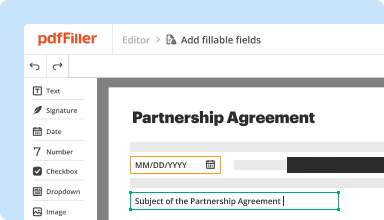

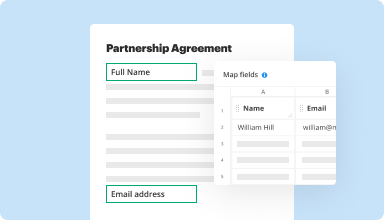

Collect data and approvals

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

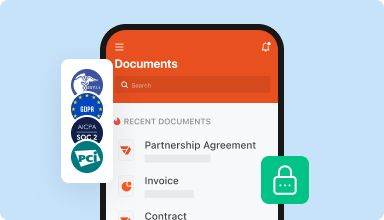

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

Does what it says. The only thing it says it does that I cannot perform on my Macbook is the ability to shift+tab to the next fill-in section after filling in a previous section.

2014-09-04

People want to type into box which needs signed into is one problem another is email comes from PDF filler and a lot of people don't know I'm one sending stuff to be signed

2017-05-31

I complete 1099Misc for my office annually. I just discovered your site which is handy as far as anticipated amending and last minute entries. I am having trouble with the How To's of IRS submitting and multiple entries.

2018-01-31

I have had limited use since I became a subscriber. I have difficulty printing the PDF file

I was working on and asked your online help desk what I could do to remedy that but

without success.

2019-02-19

Simple and easy to use even for the novice computer user. It's made my documents look professional and well presented which has received a few thumbs up from people I have forwarded the documents to.

2019-09-29

It was easy to navigate and find the forms that i needed and fill them out without confusion. I was able to fill iin information and send to my email with ease.

2024-09-02

What do you like best?

I appreciate the prompt communication and assistance in resolving my concern immediately without any hassles.

What do you dislike?

I am pleased with the product and do not have anything I dislike.

What problems is the product solving and how is that benefiting you?

very easy to use to allow online completion of forms

2022-05-23

The platform itself is just brilliant

The platform itself is just brilliant. All the features available make everything so much better, i do wish more companies would start to see it's potential and use it.

2021-08-23

Awesome Platform, got my offer letter prepared in minutes. I wished I could delete pages easily. overall, I'm satisfied. Also, how can I remove the watermark from my signature?

2020-12-18

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How do I complete an EIN application?

Go to the IRS website. Identify the legal and tax structure of your business entity. If your business is an LLC, provide information about the members. State why you are requesting an EIN. Identify and describe a contact person for the business.

What is the format of a tax ID number?

Understanding the Tax Identification Number (TIN)? SSNs are tax identification numbers for individuals, and the Social Security Administration (SSA) issues them in the format of XXX-XX-XXXX. Employer tax ID numbers are also nine digits long, but they are read as XX-XXXXXXX.

How do I become an IRS tax preparer?

Take a 60-hour qualifying education course from a CTC approved provider within the past 18 months. Purchase a $5,000 tax preparer bond from an insurance/surety agent. Obtain a Preparer Tax Identification Number (PAIN) from the IRS, and. Pay a $33 registration fee.

How much does it cost to become a tax preparer?

IRS registration to become a Tax Preparer (obtain a Preparer Tax Identification Number (PAIN) FREE right now! Voluntary IRS Annual Filing Season Program around $100 or less. Professional tax preparation software (lower cost options are available) $500. Tax preparation Marketing and Tax Office Supplies $500.

How do I become a certified tax preparer?

Take a 60-hour qualifying education course from a CTC approved provider within the past 18 months. Purchase a $5,000 tax preparer bond from an insurance/surety agent. Obtain a Preparer Tax Identification Number (PAIN) from the IRS, and. Pay a $33 registration fee.

Do tax preparers make good money?

During the 3-month tax season tax preparers can earn up to $50,000 or more. Successful independent (self-employed) tax preparers, operating their own tax preparation businesses, can make substantially more money than a tax preparer who is an employee. Many independent tax preparers earn $100,000 or more per tax season.

Do you have to be licensed to be a tax preparer?

All tax preparers must obtain an identification number from the IRS, and, in many cases, pass an exam before they can prepare federal tax returns. Some states also require tax preparers to become licensed or to register with the state before practicing.

Why do tax preparers charge so much?

Most tax preparers base their charges on the complexity of your tax situation and the completeness of your information. In fact, many say they'll charge extra when a client is poorly organized and has incomplete records of their income and deductions.

#1 usability according to G2

Try the PDF solution that respects your time.