Publish Payment Form For Free

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

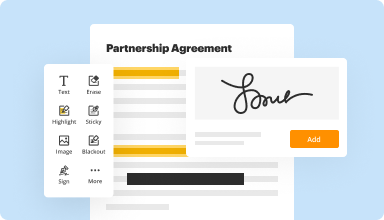

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

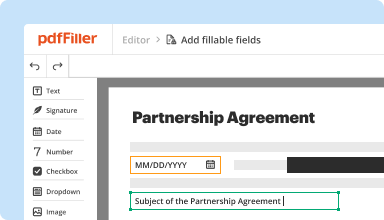

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

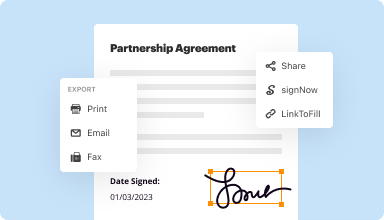

Fill out & sign PDF forms

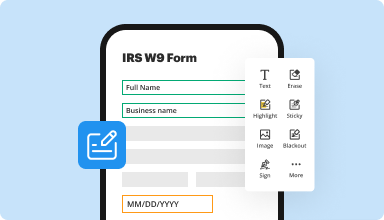

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

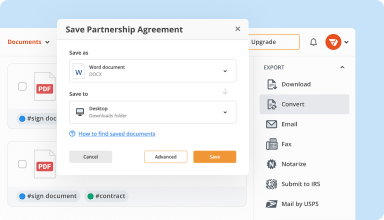

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

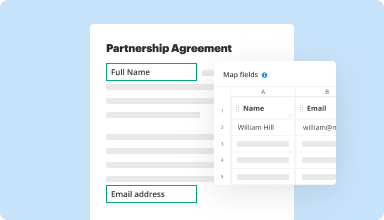

Collect data and approvals

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

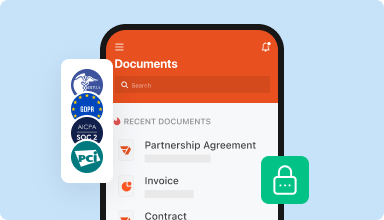

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

So far so good. I don't know why when I add pictures it doesn't come through in the email. Plus, I don't know how to edit a form once I've completed it.

2014-07-01

I have used a couple of the other apps and I believe that the PDFfiller is the easiest with very self explained instructions. I love the fact that the mobile app is just as user friendly as the app on my computer. Thanks

2019-05-07

I love that you can turn any document or picture into pdf. As a loan officer, I need copies of driver's license and social security. Everyone has a nice phone but the format is not PDF. This PDFfiller is the best. It only has a few fonts. That is the reason for the 4 out of 5.

2020-01-08

Provided ease by timely consistence and effortless interface in preparing & modifying quality forms.

Ease of use. From downloading to modifying. Short learning curve. Provided easy solution to modifying old forms by scanning/uploading and easy modification.

From what little I used it to create new forms, more flexibility would have been nice for import and modifying images. But since I rarely used this program for creation I may not have explored the features properly.

2017-11-15

Took me a while to figure out how to…

Took me a while to figure out how to delete an entire page. My one suggestion would be to leave the previously used tool activated. I get tired of having to click on "eraser" when I'm trying to erase multiple blotches on a scanned article.

2022-02-05

I subscribed to a trial period for the…

I subscribed to a trial period for the PDFiller product but forgot to unsubscribe when the trial period was over. Once I realized my error, I contacted the company and explained my error. Katrina in customer service had my refund processed within minutes. Thank you Katrina and, as I promised, when our company is financially able to afford this wonderful product, I will once again be a customer. This experience earned 5 stars because of Katrina's kind ear and quick action. Thanks to you, Katrina, and whoever trained you in customer service protocols.

2021-07-07

THIS PROGRAM IS VERY EASY TO USE

THIS PROGRAM IS VERY EASY TO USE, YES IT HAS ALWAYS BEEN A NO ONE CARES WHEN IT COMES TO SIGNING AN E-PAD.THIS TO HAD A FEW ISSUES AS FAR AS SIGNING MY NAME, IT WAS STILL VERY HARD TO SIGN MY NAME, BUT THE DIFFERENT OPTIONS THEY OFFER TO HELP YOU ARE GREAT!

2021-02-24

What do you like best?

Fill In, Signing and Saving to Computer and to all

What do you dislike?

I dislike nothing with the system it is all great!

Recommendations to others considering the product:

Yes to all of my colleagues

What problems are you solving with the product? What benefits have you realized?

All good here...I use it weekly for my workflows and I recommend it to my colleagues....

2021-02-16

Well , I'm learning

Well I'm still learning But the Draw option is AWESOME ,It lets you Sign in Real Time + It's Your Real Signature,Not a Generated one from putting text in a box and using thePC's script font to generate a signature .. Thanks Guys David Simmonsp.s.I'll let you know more as I learn to do more..Again Thanks..

2020-07-28

Publish Payment Form Feature

The Publish Payment Form feature streamlines your online transactions, making it easy for you to accept payments from customers. This tool is designed to enhance your payment process, allowing for a more efficient and user-friendly experience.

Key Features

User-friendly interface for easy navigation

Customizable payment forms to match your brand

Secure payment processing to protect sensitive information

Multiple payment options including credit cards and digital wallets

Real-time transaction tracking for better management

Use Cases and Benefits

Ideal for businesses looking to accept online payments effortlessly

Useful for freelancers and service providers to collect project fees

Facilitates donations and fundraising efforts for nonprofits

Helps event organizers manage ticket sales efficiently

Simplifies monthly subscriptions and recurring payments for users

By using the Publish Payment Form feature, you can eliminate the hassles of managing payments manually. This tool solves your problem of complex payment processes by offering a simple, secure, and effective solution. You can focus more on growing your business and less on payment logistics, enhancing your overall customer satisfaction.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

What is the purpose of Form 945?

IRS Form 945 is titled Annual Return of Withheld Federal Income Tax. Form 945 is used to report withheld federal income tax from nonpayroll payments, including distributions from qualified retirement plans.

What is the 945 form used for?

IRS Form 945 is titled Annual Return of Withheld Federal Income Tax. Form 945 is used to report withheld federal income tax from nonpayroll payments, including distributions from qualified retirement plans.

Do I need to file Form 945?

If you withhold federal income tax (including backup withholding) from nonpayroll payments, you must file Form 945. ... You don't have to file Form 945 for those years in which you don't have a nonpayroll tax liability.

What is a 945 tax return?

IRS Form 945 is used to report on federal income taxes withheld from non-employees, specifically backup withholding. Payments to non-employees must be reported to the IRS using a version of Form 1099 or Form W-2G. Normally no withholding of income tax is required for these payments.

What is backup withholding and what is its purpose?

When it applies, backup withholding requires a payer to withhold tax from payments not otherwise subject to withholding. You may be subject to backup withholding if you fail to provide a correct taxpayer identification number (TIN) when required or if you fail to report interest, dividend, or patronage dividend income.

How do I prepay my taxes?

To prepay your income taxes, you must complete an estimated tax worksheet to determine the amount of your payments and prepay your taxes by each quarterly deadline. Obtain Form 1040ES from the IRS website. If you plan to itemize your deductions, you should also obtain a copy of Schedule A.

Who Must File Form 945?

Paper filers and filers must file form 945 to the IRS by January 31, 2018. If you made on-time deposits in full payment of the taxes due for the year, you may file the return by February 10, 2018.

How do I file a 945 electronically?

You're encouraged to file Form 945 electronically. Go to IRS.gov/EmploymentEfile for more information on electronic filing. If you file a paper return, where you file depends on whether you include a payment with Form 945.

When should I start backup withholding?

When the IRS Requires Backup Withholding The IRS notifies the payer to start withholding on interest or dividends because you have underreported interest or dividends on your income tax return. The IRS will do this only after it has mailed you four notices over at least a 120-day period.

Who files a Form 945?

Form 945 is an annual return, showing all the federal income taxes you withheld under backup withholding requirements from all non-employees, independent contractors, or freelancers. Information you must report on Form 945 includes: All federal income tax withheld from all individuals subject to backup withholding.

#1 usability according to G2

Try the PDF solution that respects your time.