Reliable Approve Application For Free

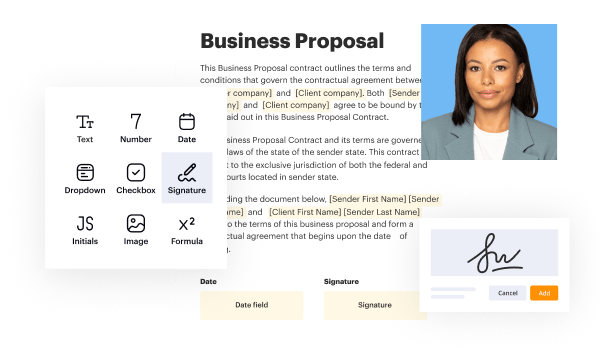

Create a legally-binding electronic signature and add it to contracts, agreements, PDF forms, and other documents – regardless of your location. Collect and track signatures with ease using any device.

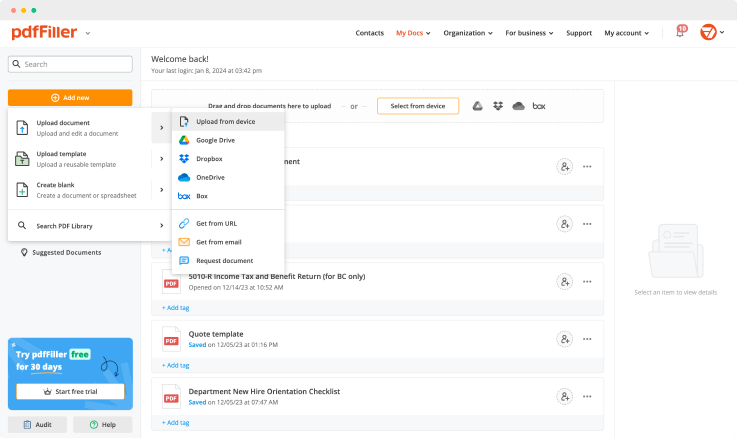

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

Upload a document

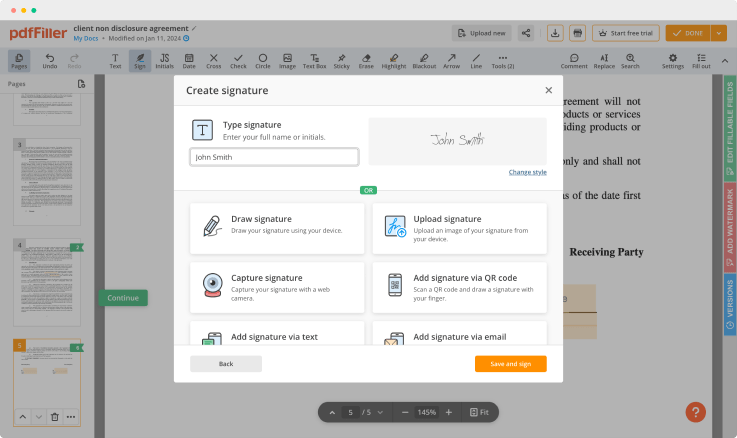

Generate your customized signature

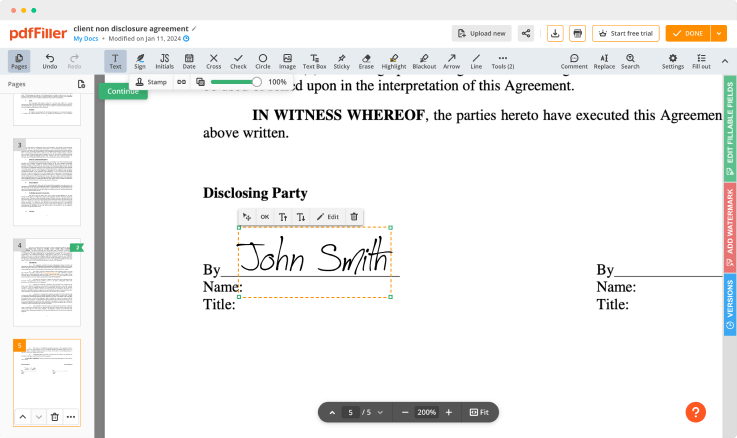

Adjust the size and placement of your signature

Download, share, print, or fax your signed document

Join the world’s largest companies

Employees at these companies use our products.

How to Add a Signature to PDF (and Send it Out for Signature)

Watch the video guide to learn more about pdfFiller's online Signature feature

pdfFiller scores top ratings in multiple categories on G2

4.6/5

— from 710 reviews

Why choose pdfFiller for eSignature and PDF editing?

Cross-platform solution

Upload your document to pdfFiller and open it in the editor.

Unlimited document storage

Generate and save your electronic signature using the method you find most convenient.

Widely recognized ease of use

Resize your signature and adjust its placement on a document.

Reusable templates & forms library

Save a signed, printable document on your device in the format you need or share it via email, a link, or SMS. You can also instantly export the document to the cloud.

The benefits of electronic signatures

Bid farewell to pens, printers, and paper forms.

Efficiency

Enjoy quick document signing and sending and reclaim hours spent on paperwork.

Accessibility

Sign documents from anywhere in the world. Speed up business transactions and close deals even while on the go.

Cost savings

Eliminate the need for paper, printing, scanning, and postage to significantly cut your operational costs.

Security

Protect your transactions with advanced encryption and audit trails. Electronic signatures ensure a higher level of security than traditional signatures.

Legality

Electronic signatures are legally recognized in most countries around the world, providing the same legal standing as a handwritten signature.

Sustainability

By eliminating the need for paper, electronic signatures contribute to environmental sustainability.

Enjoy straightforward eSignature workflows without compromising data security

GDPR compliance

Regulates the use and holding of personal data belonging to EU residents.

SOC 2 Type II Certified

Guarantees the security of your data & the privacy of your clients.

PCI DSS certification

Safeguards credit/debit card data for every monetary transaction a customer makes.

HIPAA compliance

Protects the private health information of your patients.

CCPA compliance

Enhances the protection of personal data and the privacy of California residents.

Reliable Approve Application Feature

The Reliable Approve Application feature streamlines your approval processes, ensuring clarity and speed in decision-making. This tool is designed for users who seek a dependable solution to manage approvals effectively.

Key Features

Simple interface for easy navigation

Real-time notifications for pending approvals

Customizable approval workflows

Integration with popular project management tools

Detailed reporting and analytics features

Potential Use Cases and Benefits

Businesses can enhance productivity by reducing approval time

Teams can improve collaboration through shared access to approval requests

Managers can track progress and compliance with minimal effort

Organizations can ensure accuracy and accountability in decision-making

Enterprises can standardize processes to maintain consistency across departments

By implementing the Reliable Approve Application feature, you can tackle common challenges like slow approvals and unclear workflows. This feature provides a straightforward solution that empowers you to take control of your approval process, ensuring that nothing slips through the cracks while you focus on achieving your goals.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

Can a loan be denied after preapproval?

You can certainly be denied for a mortgage loan after being pre-approved for it. The pre-approval process goes deeper. This is when the lender actually pulls your credit score, verifies your income, etc. But neither of these things guarantees you will get the loan.

Does preapproval guarantee a loan?

Pre-approval is not a commitment to lend you money. Nor is it a guarantee from the lender. It is simply the lender's way of saying they will likely approve you for a certain amount, as long as you clear the underwriting process with all of its checkpoints and requirements.

Can you be denied a loan after preapproval?

When you get pre-approved by a mortgage lender, they will start gathering a variety of financial documents. But the pre-approval is not a guarantee. Therefore, it's possible to be denied for a mortgage even after you've been pre-approved.

Does preapproval guarantee a personal loan?

Pre-qualifying for a personal loan is a preliminary step in the loan approval process. Getting pre-qualified, however, does not guarantee you a loan. Lenders will verify your information before final approval.

What does preapproved mean for a loan?

In lending, pre-approval is the pre-qualification for a loan or mortgage of a certain value range. Although, to a typical consumer, “you're pre-approved” means “you already passed the approval process and therefore are guaranteed to be immediately granted the loan if you apply,” the literal meaning is different.

What happens after preapproval?

If you're granted a pre-approved mortgage loan, the lender gives you a pre-approval letter, which says your loan will be approved once you make a purchase offer on a home and submit the following documents: the purchase contract, preliminary title information, appraisal and your income and asset documentation.

How can I be denied a home loan after preapproval?

Negative Marks on Your Credit Report. Your lender ran a credit check when you applied for Pre-Approval. Changing Jobs. Taking on New Debt. Lacking the Cash for A Down Payment. A Sudden Influx of Cash. A Surprise Appraisal Value.

What is the next step after being preapproved for home loan?

After you're pre-qualified, your next step is to get pre-approved. This is an in-depth process. You'll need to submit paperwork about your income, assets, employment history and residency status to a lender. Getting pre-approved is almost like applying for a real loan, but it happens before you select a home.

Ready to try pdfFiller's? Reliable Approve Application

Upload a document and create your digital autograph now.