Review Wage Permit For Free

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

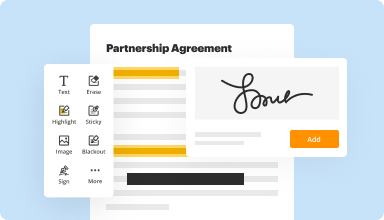

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

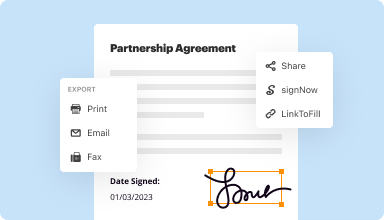

Fill out & sign PDF forms

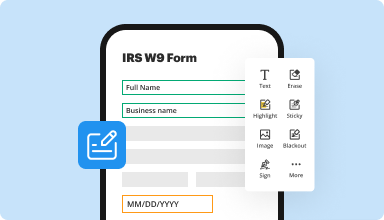

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

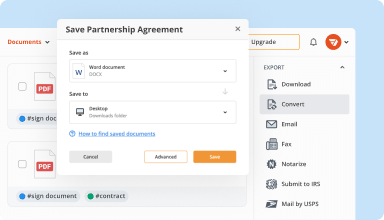

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

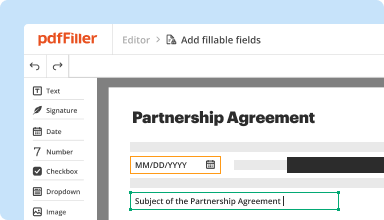

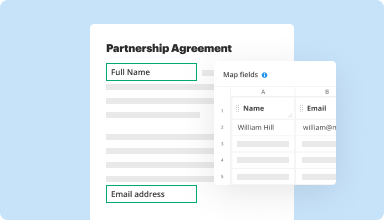

Collect data and approvals

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

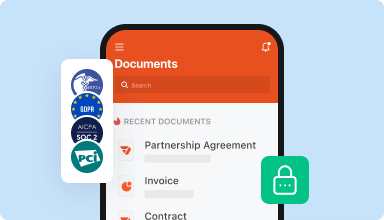

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

First experience was perfect. I'm having difficulty finding the current version of the form I need; specifically, the 2014 Revision of the Standard Agreement for the sale of real estate/Pennsylvania.

2014-05-30

What do you like best?

The site is intuitive and everything is organized in a no fuss manner. Scanning in documents and making changes is easy.

What do you dislike?

The printing of documents can be tricky sometimes. Most of the time I save as a PDF and open with Adobe.

Recommendations to others considering the product:

Have the basic Adobe software as well. It makes printing documents, in the proper size, much easier.

What problems are you solving with the product? What benefits have you realized?

We have many documents that have to be changed constantly. Tax Exemption Forms, Charts and Invoices. This makes it very easy.

The site is intuitive and everything is organized in a no fuss manner. Scanning in documents and making changes is easy.

What do you dislike?

The printing of documents can be tricky sometimes. Most of the time I save as a PDF and open with Adobe.

Recommendations to others considering the product:

Have the basic Adobe software as well. It makes printing documents, in the proper size, much easier.

What problems are you solving with the product? What benefits have you realized?

We have many documents that have to be changed constantly. Tax Exemption Forms, Charts and Invoices. This makes it very easy.

2019-05-28

Easy to Use but Not Free

This is a typical program that is easy to use as long as you are familiar with PDF editing programs. They do provide tips when you first begin in case you need them. My only complaint and it is for all these "free" programs, is that there are no free programs. All of them make you sign up with your info for a trial period and if you don't like it you better be sure to cancel before the intro period is up or you will be hit with an annual fee.

2023-04-05

So helpful. I can fill out the form instead of scanning, printing, filling out, and then scanning again so that I can send it back. I did try other programs... this one is by far the very best.

2023-03-30

Cannot thanks Kara enough

Cannot thanks Kara enough. She went above and beyond to help me with my technical issues and spent a lot of time making sure I was happy and had what I needed.

2023-01-18

excellent pdf file editing tools

Today it is much easier to work on pdf, no need for physics. pdf filler saves us paper

pdf filler is a great tool for editing pdf files online. with many features like add text, note, watermark, add image, spell checker etc. the software supports the largest platforms such as Dropbox, one drive, google drive which makes this software an essential tool for storing and classifying its documents

by its many features that the software brings together, a learning curve is essential. the software tends to become slow during sessions on very large documents.

2022-03-25

Good Features but you have to nothing is for free

I was so delighted by how easy and intuitive this pdf editor is to use.

You upload a word doc you want to convert to pdf or a pdf file that you want to edit. You edit and are very impressed.

Until I tried to save.

It's browser based but it basically does everything you wish you can do to a pdf file. The interface is very intuitive and can get you going n the first sitting.

It will let you edit but you will be unable to save your work until you subscribe.

Not another free trial!

2020-12-11

pdfFiller is an easy-to-navigate…

pdfFiller is an easy-to-navigate one-stop shop for all things pdf. Excellent customer support and good trial period.Only thing I'd wish for is a proper redactment feature

2020-10-15

What do you like best?

PDF Filler makes it easy to get documents filled and signed remotely.

What do you dislike?

I believe the mobile experience could be improved. It's sometimes confusing when a client is prompted to download the app.

Recommendations to others considering the product:

If you need to have forms filled and signed remotely, PDF Filler is a great resource!

What problems are you solving with the product? What benefits have you realized?

PDF FIller has played an essential role in helping us conduct contact-free business during the COVID pandemic.

2020-08-08

Review Wage Permit Feature

The Review Wage Permit feature offers a streamlined approach to managing wage permits for your team. It simplifies the process of reviewing, approving, and monitoring wage-related requests, ensuring compliance and fairness in wage management.

Key Features

User-friendly interface for easy navigation

Automated notifications for pending approvals

Customizable approval workflows based on company policies

Detailed reporting tools for tracking permit status

Integration with existing HR systems for seamless operation

Potential Use Cases and Benefits

Reviewing wage permits for new hires or promotions

Ensuring compliance with labor laws in various regions

Maintaining records for audits and internal reviews

Facilitating communication between departments regarding wage changes

Enhancing employee satisfaction through transparent processes

This feature solves common problems like confusion over wage approvals, delays in processing requests, and insufficient tracking of permit statuses. By implementing the Review Wage Permit feature, you empower your HR team to manage wage permits efficiently, leading to more informed decisions and a happier workforce.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How much can you legally deduct from an employee's paycheck?

If the employee is paid an hourly wage of $9.25 per hour and worked 30 hours in the workweek, the maximum amount the employer could legally deduct from the employee's wages would be $60.00 ($2.00 × 30 hours), so the full $15.00 deduction for the cash register shortage would be allowed under law.

Can you deduct from an employee's paycheck?

Under federal law, the general rule is that employers may deduct certain expenses from their employees' paychecks, as long as the deductions don't bring the employee's earnings below the minimum wage. For example, some states prohibit employers from passing certain business costs on to employees.

Can voluntary deductions take an employee below minimum wage?

The law places limits on voluntary deductions. The federal Fair Labor Standards Act (FLEA) requires employers to pay eligible employees at least the minimum wage for all hours worked. Voluntary deductions that reduce an employee's pay below the minimum wage are prohibited, with a couple of exceptions.

Can you charge an employee for a lost paycheck?

In some states, employers may be able to take precautionary steps by charging employees the stop payment fee for replacing a lost or stolen check. Alternatively, under the FLEA, it is unlawful to make a deduction from an employee's wages without their authorization.

Is it legal for an employer to take money out of your check?

The only way an employer can take money from employee pay is: The exception to this, according to the Wage and Hours Law, is that an employer can make deductions from an employee's pay without consent for items that are “primarily for the benefit or convenience of the employer” (uniforms, for example).

What are illegal payroll deductions?

Illegal wage deductions generally include: Employment taxes that, by law, the employer must pay. Employers generally must pay the federal unemployment tax, known as FTA, as well as state unemployment taxes. Workers' compensation premiums.

Can a company take money from your wages?

Employees and Workers are protected from employers making unauthorized deductions from their pay or wages. Your employer cannot deduct money from your pay unless: It's required by law (e.g. National Insurance contributions, tax, student loan repayments) It is a result of a Court Order or Employment Tribunal decision.

How much can my employer charge me for health insurance?

On average, employers paid 82 percent of the premium, or $5,655 a year. Employees paid the remaining 18 percent, or $1,241 a year. For family coverage, the average policy totaled $19,616 a year with employers contributing, on average, 71 percent, or $13,927. Employees paid the remaining 29 percent or $5,689 a year.

#1 usability according to G2

Try the PDF solution that respects your time.