Safeguard Wage Warranty For Free

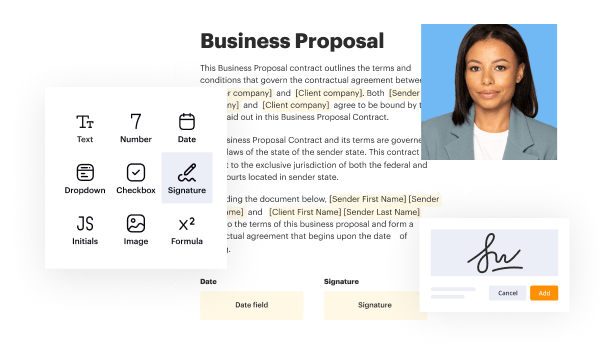

Create a legally-binding electronic signature and add it to contracts, agreements, PDF forms, and other documents – regardless of your location. Collect and track signatures with ease using any device.

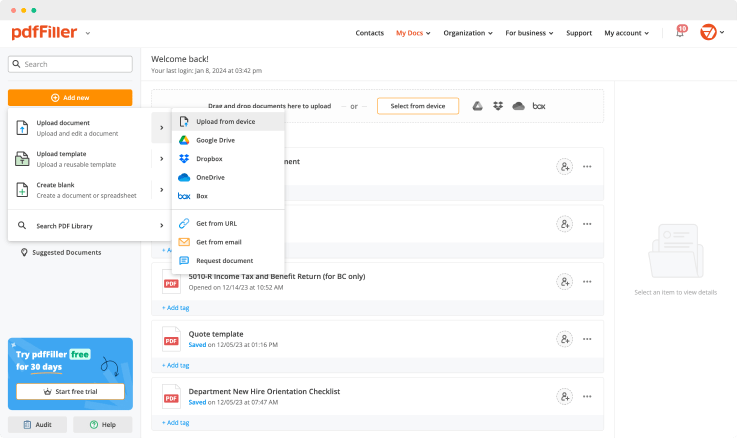

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

Upload a document

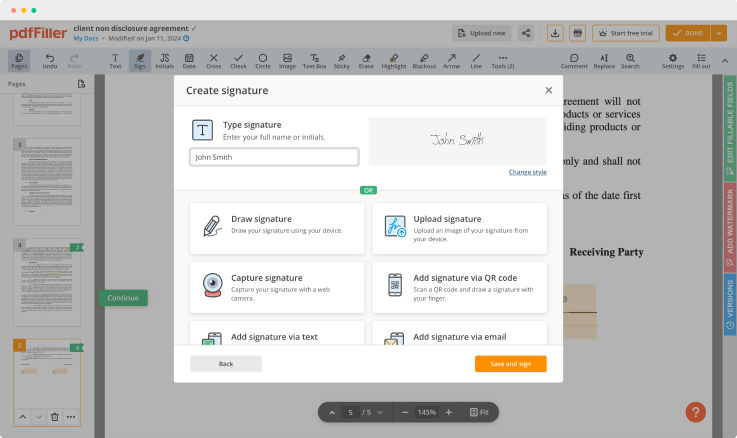

Generate your customized signature

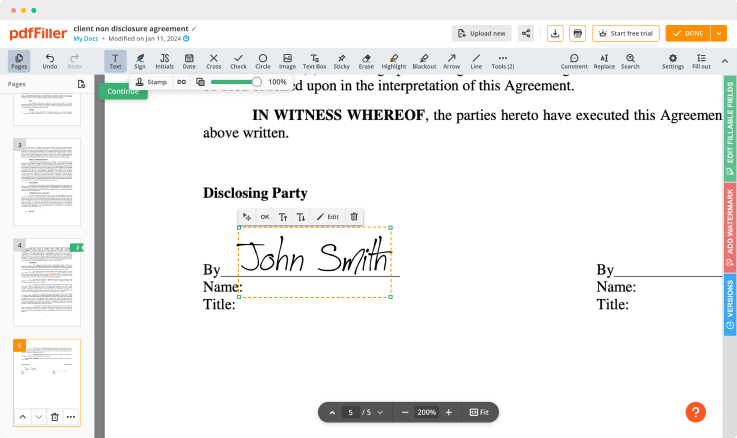

Adjust the size and placement of your signature

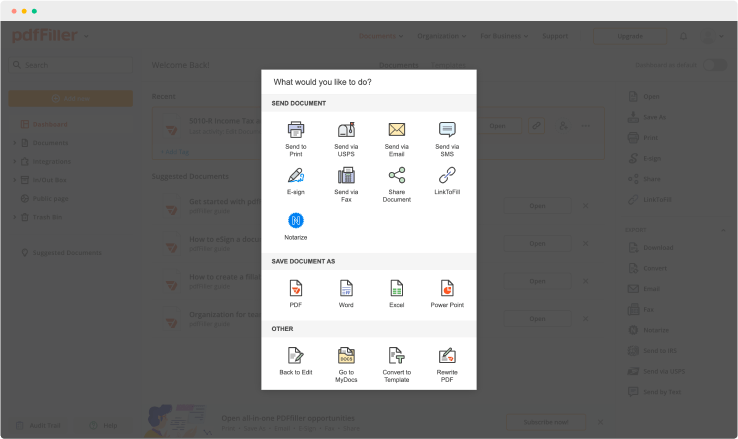

Download, share, print, or fax your signed document

Join the world’s largest companies

Employees at these companies use our products.

How to Add a Signature to PDF (and Send it Out for Signature)

Watch the video guide to learn more about pdfFiller's online Signature feature

pdfFiller scores top ratings in multiple categories on G2

4.6/5

— from 710 reviews

Why choose pdfFiller for eSignature and PDF editing?

Cross-platform solution

Upload your document to pdfFiller and open it in the editor.

Unlimited document storage

Generate and save your electronic signature using the method you find most convenient.

Widely recognized ease of use

Resize your signature and adjust its placement on a document.

Reusable templates & forms library

Save a signed, printable document on your device in the format you need or share it via email, a link, or SMS. You can also instantly export the document to the cloud.

The benefits of electronic signatures

Bid farewell to pens, printers, and paper forms.

Efficiency

Enjoy quick document signing and sending and reclaim hours spent on paperwork.

Accessibility

Sign documents from anywhere in the world. Speed up business transactions and close deals even while on the go.

Cost savings

Eliminate the need for paper, printing, scanning, and postage to significantly cut your operational costs.

Security

Protect your transactions with advanced encryption and audit trails. Electronic signatures ensure a higher level of security than traditional signatures.

Legality

Electronic signatures are legally recognized in most countries around the world, providing the same legal standing as a handwritten signature.

Sustainability

By eliminating the need for paper, electronic signatures contribute to environmental sustainability.

Enjoy straightforward eSignature workflows without compromising data security

GDPR compliance

Regulates the use and holding of personal data belonging to EU residents.

SOC 2 Type II Certified

Guarantees the security of your data & the privacy of your clients.

PCI DSS certification

Safeguards credit/debit card data for every monetary transaction a customer makes.

HIPAA compliance

Protects the private health information of your patients.

CCPA compliance

Enhances the protection of personal data and the privacy of California residents.

Safeguard Wage Warranty Feature

The Safeguard Wage Warranty feature provides a reliable safety net for your workforce. This unique feature ensures that your employees receive their promised wages, even in uncertain circumstances. You can enhance your employee satisfaction and maintain a strong reputation within your industry.

Key Features

Guaranteed wage payments during financial uncertainties

Easy integration with existing payroll systems

Transparent reporting on wage guarantees

Support from dedicated team for inquiries

Potential Use Cases and Benefits

Use during economic downturns to maintain employee morale

Implement as a competitive advantage in hiring practices

Reduce turnover by fostering employee trust

Provide peace of mind for employees regarding financial stability

By implementing the Safeguard Wage Warranty feature, you can effectively resolve concerns about wage reliability in your organization. This feature not only protects your employees but also strengthens your business's reputation as a dependable employer. With Safeguard, you invest in your workforce's future, ensuring their loyalty and commitment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How much can be garnished from your paycheck?

Federal law places limits on how much judgment creditors can take from your paycheck. The amount that can be garnished is limited to 25% of your disposable earnings (what's left after mandatory deductions) or the amount by which your weekly wages exceed 30 times the minimum wage, whichever is lower.

How are garnishments calculated?

The federal minimum hourly wage is currently $7.25 an hour. If you make $500 per week after all taxes and allowable deductions, 25% of your disposable earnings is $125 ($500 ×. 25 = $125). The amount by which your disposable earnings exceed 30 times $7.25 is $282.50 ($500 30 A $7.25 = $282.50).

How do you calculate a wage garnishment?

The federal minimum hourly wage is currently $7.25 an hour. If you make $500 per week after all taxes and allowable deductions, 25% of your disposable earnings is $125 ($500 ×. 25 = $125). The amount by which your disposable earnings exceed 30 times $7.25 is $282.50 ($500 30 A $7.25 = $282.50).

What is the maximum amount that can be garnished from a paycheck?

Federal law places limits on how much judgment creditors can take from your paycheck. The amount that can be garnished is limited to 25% of your disposable earnings (what's left after mandatory deductions) or the amount by which your weekly wages exceed 30 times the minimum wage, whichever is lower.

What is considered disposable income for wage garnishment?

(When it comes to wage garnishment, disposable income means anything left after the necessary deductions such as taxes and Social Security.) Either 25% or the amount by which your weekly income exceeds 30 times the federal minimum wage (currently $7.25 an hour), whichever is less.

Is wage garnishment every paycheck?

Paycheck deductions are amounts withheld from a worker's regular paycheck, often for things such as approved pension contributions or health care expenses. Wage garnishment allows a creditor who obtains a court order to require your employer to set aside part of your paycheck and send this directly to your creditor.

Can you stop a wage garnishment?

If you receive a notice of a wage garnishment order, you might be able to protect or exempt some or all of your wages by filing an exemption claim with the court. You can also stop most garnishments by filing for bankruptcy. Your state's exemption laws determine the amount of income you'll be able to keep.

Can you reverse a wage garnishment?

One way to end your wage garnishment is to call your creditor and get them to agree to a repayment plan. Look at your budget and see what you can pay. Then can call your creditor and see if they will agree to a repayment plan for you to pay a lower monthly amount than the garnishment.

Ready to try pdfFiller's? Safeguard Wage Warranty

Upload a document and create your digital autograph now.