Utilize Number Transcript For Free

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

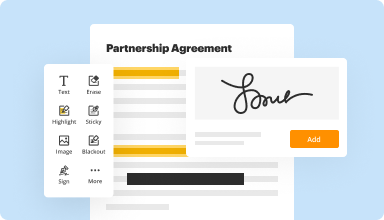

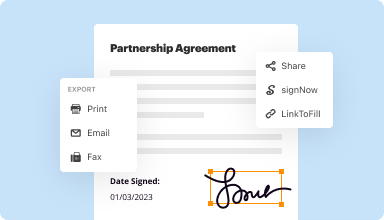

Fill out & sign PDF forms

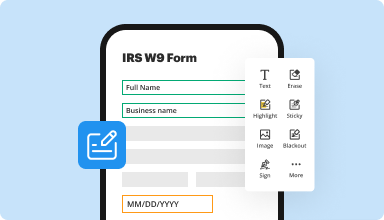

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

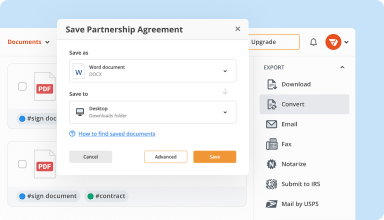

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

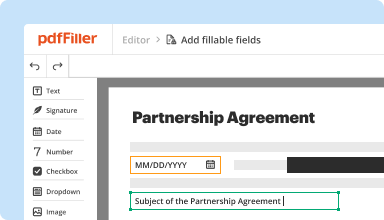

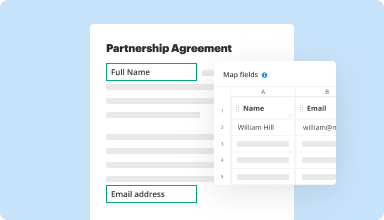

Collect data and approvals

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

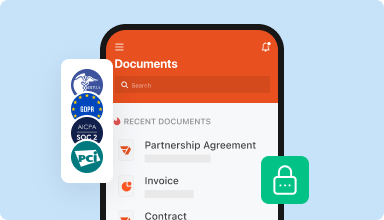

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

My experience on line with anything new is always a bit frustrating because of my inexperience. That said I was able to complete my form and print it out in one sitting

2015-04-22

I needed this for an emergency document and paid for it thinking I probably will not use this much....but was I wrong. I use it all the time and LOVE IT!!!

2016-06-15

Much easier/more intuitive than past editing systems I've used! Don't love that I found out only after editing an intensive document that I had to pay though :/

2016-06-19

I thought the software was excellent. Did not like the "gimmick" of paying an annual fee in advance, then offering the same service at a huge discount. That makes potential customers feel like smucks.

2016-08-19

It was really easy to modify the text but it didn't allow for modifying the form itself. When I ran out of blocks (Employee Review Form), I couldn't add any lines to the bottom or even take away some of the "Reviewer comments" to give me space to add more lines for categories.

2019-02-11

What do you like best?

I use Quickbooks and have to send out 1099NT which is not a capability in Quickbooks. 1099 forms must be scannable and I can purchase the printed forms and fill it out on PDFfiller. I can then print on the scannable forms and they are perfectly aligned. Saves time and money. Also, I like the fact that I can create a template so I don't have to re-type the same company information, tax numbers, etc. The product is easy to use.

What do you dislike?

I don't really dislike anything about PDFfiller. Other than maybe the fact that I probably don't use it enough to offset the cost.

Recommendations to others considering the product:

Easy to use - I intended to use for a month and then cancel, but I ended up keeping it.

What problems are you solving with the product? What benefits have you realized?

I mostly use for 1099NT's as mentioned above. I really need to explore!

I use Quickbooks and have to send out 1099NT which is not a capability in Quickbooks. 1099 forms must be scannable and I can purchase the printed forms and fill it out on PDFfiller. I can then print on the scannable forms and they are perfectly aligned. Saves time and money. Also, I like the fact that I can create a template so I don't have to re-type the same company information, tax numbers, etc. The product is easy to use.

What do you dislike?

I don't really dislike anything about PDFfiller. Other than maybe the fact that I probably don't use it enough to offset the cost.

Recommendations to others considering the product:

Easy to use - I intended to use for a month and then cancel, but I ended up keeping it.

What problems are you solving with the product? What benefits have you realized?

I mostly use for 1099NT's as mentioned above. I really need to explore!

2019-03-05

Great Service - Great Support Team

I used this service just once, but it was very easy to navigate the site and all of its capabilities. I thought I had canceled my subscription after I was done and forgot about it until I was charged the full annual fee. I reached out to them to see if I was eligible for a refund since I had not logged into my account in 29 days. They agreed to refund the charge and were very timely about it! I will use this service again if I ever need it again.

2022-04-26

Pdf Filler Great Review

My overall experience with pdf filler has been great so far

I like the customizable features of pdf filler and being able to use pdf filler for my business and it makes my customers lives easier.

I dislike the third party integration as sometimes it loads slowly.

2022-02-14

Ryan on the Support Team was extremely helpful and patient. He walked me through all of the steps to complete the form to my satisfaction. Thank you Ryan for teaching me!

2020-05-21

Utilize Number Transcript Feature

Discover the power of the Number Transcript feature. This tool simplifies your data handling, converting complex numbers into clear, easily understandable transcripts. It is designed to enhance your workflow and improve the way you manage numerical information.

Key Features

Converts numbers into readable transcripts

Integrates seamlessly with existing platforms

Customizable output to fit your needs

User-friendly interface requiring minimal training

Quick processing to save you time

Potential Use Cases and Benefits

Data analysis for clear reporting and insights

Preparing financial documents for stakeholders

Educational materials for teaching numerical concepts

Research and presentations requiring number clarity

Streamlining communication around numeric data

The Number Transcript feature directly addresses your challenges with complex numbers. It turns intricate data into simple transcripts, allowing you to focus more on analysis and decision-making. By using this tool, you can reduce errors, save time, and enhance understanding for yourself and your audience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How can I get my tax transcripts immediately?

Order online. They can use the Get Transcript tool on IRS.gov. Order by mail. Taxpayers can use Get Transcript by Mail or call 800-908-9946 to order a tax return transcripts and tax account transcripts. Complete and send either 4506-T or 4506T-EZ to the IRS.

How can I get my tax transcript online immediately?

You can get your free transcripts immediately online. You can also get them by phone, by mail or by fax within five to 10 days from the time IRS receives your request. To view and print your transcripts online, go to IRS.gov and use the Get Transcript tool. To order by phone, call 800-908-9946 and follow the prompts.

How can I get my tax transcript online?

Order online. Use the 'Get Transcript tool available on IRS.gov. There is a link to it under the red TOOLS bar on the front page. Order by phone. The number to call is 800-908-9946. Order by mail. Complete and send either Form 4506-T or Form 4506T-EZ to the IRS to get one by mail.

How can I get my tax transcripts fast?

Order Online. The fastest way to get a Tax Return or Account transcript is through the 'Get Transcript' tool available on IRS.gov. Order by phone. You can also order by phone at 800-908-9946 and follow the prompts. Order by mail.

How long does it take for a tax transcript to be available?

If you filed your tax return electronically, IRS's return processing takes from 2 to 4 weeks before a transcript becomes available. If you mailed your tax return, it takes about 6 weeks.

Why is my tax transcript not available?

If you don't see a return transcript available for download, it likely means that you didn't file a return for that year, or that the IRS hasn't processed the return. Record of account transcripts: Current tax year, five prior years, and any years with recent activity, such as a payment or notice.

How long does it take to get a transcript of tax return?

Delivery times for online and phone orders typically take five to 10 days from the time the IRS receives the request. You should allow 30 days to receive a transcript ordered by mail and 75 days for copies of your tax return.

How do I get a transcript from the IRS?

Order online. They can use the Get Transcript tool on IRS.gov. Order by mail. Taxpayers can use Get Transcript by Mail or call 800-908-9946 to order a tax return transcripts and tax account transcripts. Complete and send either 4506-T or 4506T-EZ to the IRS.

#1 usability according to G2

Try the PDF solution that respects your time.