Fill out your W-4 tax form online

W-4 is among the most frequently used employment-related forms. Unlike other IRS tax forms, it should be handed to your hirer, not the IRS. The employer then uses the data from your W-4 to figure out the amount of income tax that has to be withheld from your salary. Plainly speaking, the form determines how much money will be taken from your paycheck for tax purposes.

This page is for informative purposes only and does not constitute tax or legal advice

What is IRS Form W-4?

The W-4 is a two-page form followed by general instructions and instructions for employers. It is subdivided into the following sections:

Employee’s Withholding Allowance Certificate

Personal Allowances

Deductions, Adjustments, and Additional Income

Multiple Jobs Section

You can claim an exemption from withholding any money if you did not owe tax during the previous year and expect to have zero tax liability in the next year. Note that exemption from paying taxes is only applied to a particular category of taxpayers, depending on their age, yearly income and marital status. Most taxpayers must fill out all the fields in the first section of the document and state the number of allowances they claim.

Dates: There is no official deadline for filing a W-4. In most cases, you’re required to fill out Form W-4 when applying for a new job position or getting a raise.

Extensions: You are required to fill out your W-4 as soon as you get one or within the first month of your employment. If you don’t submit Form W-4, the IRS requires your employer to withhold at the highest rate.

Take into consideration: Some employers expect their employees to complete the W-4 every year. You may also be asked to fill out the form when there’s a significant personal or financial change in your life.

How to fill out Form W-4

If you are single or married to a spouse who doesn’t work, don’t have any dependents and only have one job, filling out a W-4 is a simple procedure. If your tax situation is more complex, you will need to provide information on dependents, your spouse’s earnings, additional income, and any tax credits and deductions you plan to claim.

Here’s how it’s done:

Here’s how it’s done:

01

Provide your name, address, Social Security Number and filing status.

02

Proceed to Step 2 of the form if you have more than one job or if your spouse works.

03

If you have dependents, fill out Step 3 to determine your eligibility for the Child Tax Credit and credit for other dependents.

04

Fill out Step 4 if you have interest, dividend, or retirement income or plan to claim itemized deductions when you file your taxes.

05

Sign and date your W-4.

All of the above data impacts your tax return.

E-file your tax forms directly to the IRS

According to new IRS rules, those that file their tax refund forms online will be the first to receive their refunds.

File your W-2, 1099-MISC, and 941 forms with the IRS online

Fill out your tax forms and submit them directly to the IRS with pdfFiller.

Submit your form to the IRS in a single click and email copies to your employees and independent contractors right from your pdfFiller account.

Experience simple, transparent, and stress-free filing from start to finish.

E-filing with pdfFiller is the absolute fastest and safest way to get your refund. All forms that are generated, completed, and sent using pdfFiller are securely stored in your personal account in the cloud, ensuring only you have access to them.

Pay IRS taxes online

The most convenient and straightforward way to file a W-4 is to fill out a fillable sample online. Get the newest editable PDF sample of Form W-4 and fill it out in seconds. There’s no need to download or install anything. Carefully fill in all the required fields and share it with your employer or your organization’s HR department.

Ability to file from anywhere

Ensured accuracy

Time and money savings

Avoid added interest and penalties

Welcome to the pdfFiller forms catalog

Browse Versions and Schedules for All Relevant Forms

IRS Forms with Versions and Schedules

Edit professional templates, download them in any text format or send via pdfFiller’s advanced sharing tools. See also Top Forms by user votes.

W4 form

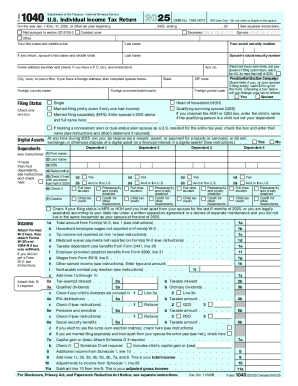

Individual tax return information to the IRS

W9 form

If you are providing Form W-9 to an FFI to document a joint account each holder of the account...

1040-ES form

Department of the Treasury Internal Revenue Service Form 1040-ES Estimated Tax for Individuals...

How to fill out other forms

Find the form you need, fill it out, and sign faster than ever before.

W-9 tax form

Request for Taxpayer Identification Number and Certification. For business owners and independent...

Read guide

1040-es tax form

Estimated Tax for Individuals. Helps self-employed with taxable income calculations

Read guide

1099-nec tax form

Wage and Tax Statement is used to report wages paid to employees

Read guide

All-in-one PDF software

A single pill for all your PDF headaches. Edit, fill out, eSign, and share – on any device.