Last updated on

Sep 27, 2024

Customize and complete your essential Share Donation Agreement template

Prepare to streamline document creation using our fillable Share Donation Agreement template. Create exceptional documents effortlessly with just a few clicks.

Spend less time on PDF documents and forms with pdfFiller’s tools

Comprehensive PDF editing

Build documents by adding text, images, watermarks, and other elements. A complete set of formatting tools will ensure a polished look of your PDFs.

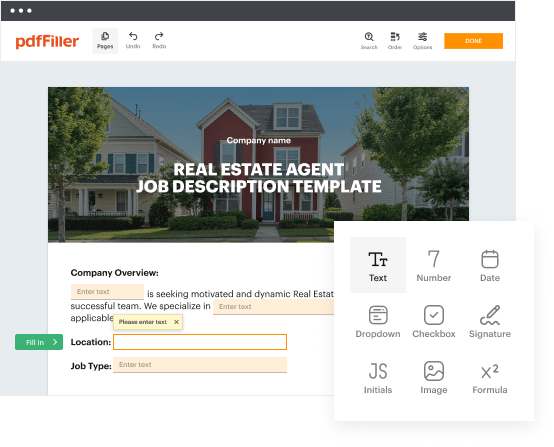

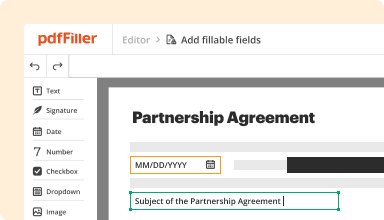

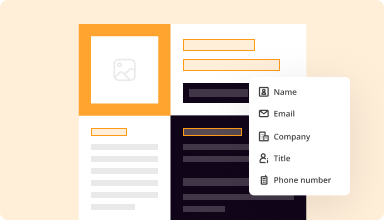

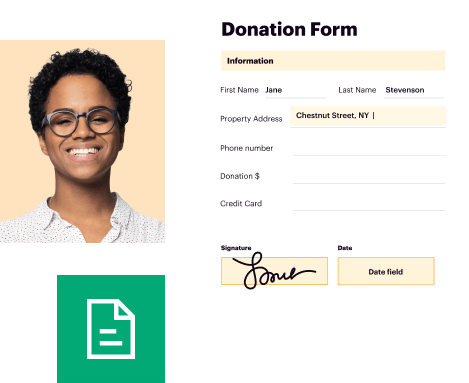

Fillable fields

Drag and drop fillable fields, checkboxes, and dropdowns on your PDFs, allowing users to add their data and signatures without hassle.

Templates for every use case

Speed up creating contracts, application forms, letters, resumes, and other documents by selecting a template and customizing it to your needs.

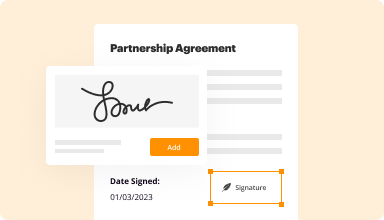

Electronic signature

Instantly sign any document and make it easy for others to sign your forms by adding signature fields, assigning roles, and setting a signing order.

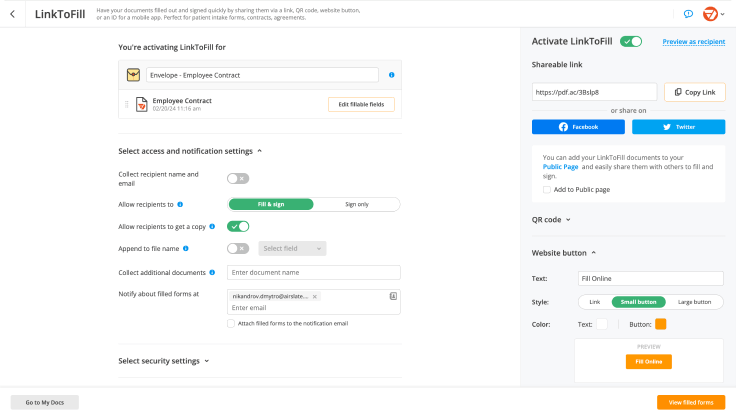

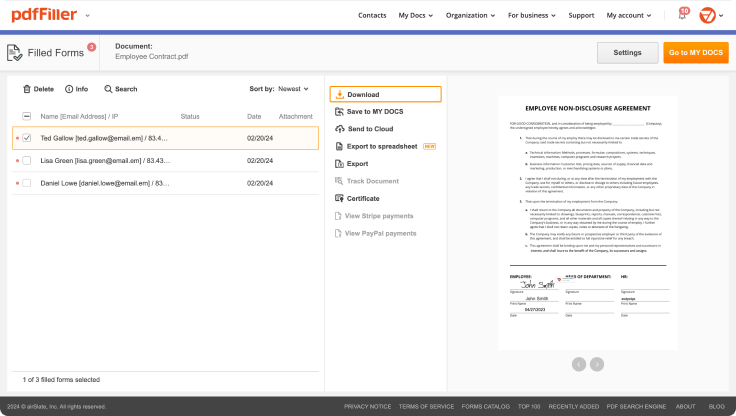

Online forms

Publish fillable forms on your website or share them via a direct link to capture data, collect signatures, and request payments.

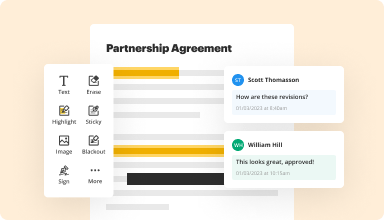

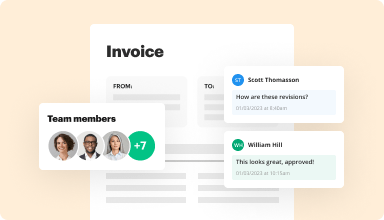

Easy collaboration

Work on documents together with your teammates. Exchange comments right inside the editor, leave sticky notes for your colleagues, highlight important information, and blackout sensitive details.

Millions of users trust pdfFiller to create, edit, and manage documents

64M+

million users worldwide

35M+

PDF forms available in the online library

53%

of documents created from templates

65.5K+

documents added daily

Customize Your Essential Share Donation Agreement Template

Simplify your donation process with our customizable Share Donation Agreement template. This tool allows you to tailor documents to fit your specific needs quickly and easily. Ensure all necessary information is included and that both parties are protected.

Key Features

Fully customizable template to suit individual requirements

User-friendly interface for easy navigation

Pre-filled legal terms to save time and effort

Downloadable in multiple formats, including PDF and Word

Guidelines to help you fill out the agreement effectively

Potential Use Cases and Benefits

Nonprofits can use the template to formalize share donations

Individuals can secure documentation for personal asset transfers

Businesses can streamline internal share donation processes

Financial advisors can provide clients with a professional agreement structure

Organizations can comply with tax regulations while offering transparency

With our Share Donation Agreement template, you avoid confusion and legal pitfalls. This tool directly addresses the complexities of share donations, making the process clear and efficient for everyone involved. You can confidently manage donations, knowing that you have a solid foundation to rely on.

Kickstart your document creation process

Browse a vast online library of documents and forms for any use case and industry.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Our user reviews speak for themselves

Your go-to guide on how to craft a Share Donation Agreement

Creating a Share Donation Agreement has never been so easy with pdfFiller. Whether you need a professional forms for business or individual use, pdfFiller provides an intuitive solution to create, customize, and manage your documents effectively. Use our versatile and fillable templates that align with your precise demands.

Bid farewell to the hassle of formatting and manual editing. Utilize pdfFiller to smoothly create polished forms with a simple click. Begin your journey by using our comprehensive guidelines.

How to create and complete your Share Donation Agreement:

01

Create your account. Access pdfFiller by signing in to your profile.

02

Find your template. Browse our extensive collection of document templates.

03

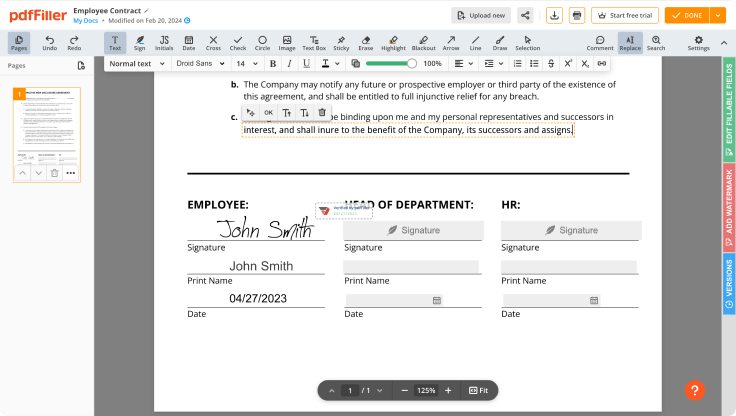

Open the PDF editor. Once you have the form you need, open it in the editor and use the editing instruments at the top of the screen or on the left-hand sidebar.

04

Place fillable fields. You can select from a list of fillable fields (Text, Date, Signature, Formula, Dropdown, etc.).

05

Edit your form. Add text, highlight areas, add images, and make any needed modifications. The intuitive interface ensures the procedure remains smooth.

06

Save your changes. When you are happy with your edits, click the “Done” button to save them.

07

Share or store your document. You can deliver it to others to eSign, download, or securely store it in the cloud.

To summarize, creating your documents with pdfFiller templates is a smooth process that saves you efforts and guarantees accuracy. Start using pdfFiller today to benefit from its powerful capabilities and seamless paperwork management.

Ready to try the award-winning PDF editor in action?

Start creating your document in pdfFiller and experience firsthand how effortless it can be.

Questions & answers

Below is a list of the most common customer questions.If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

Are donated stocks tax-deductible?

Donating securities that have been held for a year or more offers the potential for a double tax benefit—a full fair market value tax deduction and elimination of capital gains taxes.

What is the journal entry for inventory donation?

When you make a donation of your own products or inventory, keep in mind that you are giving away a product, not selling it. To record this type of donation, debit your Donation account and credit your Purchases account for the original cost of goods.

How do nonprofits record stock donations?

Receipts are required by the IRS for any donation of more than $250. Once the stock donation is listed in your brokerage account, send the donor a tax receipt that lists the date of transfer, the number of shares, and the stock's ticker name.

How do I write a donation agreement?

The Donor and [Your Organization] agree as follows: Donor Commitment. The Donor hereby pledges to [Your Organization] the sum of [insert amount] or more, which as provided for herein is designated for the benefit of [Fund Name] Endowment. Donor Purpose. Purpose. Payment.

How to report donation of stock on 1040?

Filling Out Your Tax Forms: Form 8283 Form 8283 is the Noncash Charitable Contributions form for the 1040 tax return. If you're using a tax service, they'll ask you the appropriate information to populate this form. Either way, you'll need to have the information at the ready.

Is a donation agreement legally binding?

A promise to make a gift, bequest or devise of cash or other property to an organization described in section 501(c)(3) of the Internal Revenue Code is contractually binding with or without consideration if the promisor indicated in writing an intent that the promise be a binding legal obligation.

How to record a gift of stock?

Once a donation of stock has been received, a thank you letter should be sent to the donor. This letter should acknowledge the gift of stock, such as the name and number of shares. It should not list the value of the stock received since the organization is not in the business of valuing stock.

How to record donation of stock on tax return?

Form 8283 has two sections. If you must file Form 8283, you must complete either Section A or Section B depending on the type of property donated and the amount claimed as a deduction. Members in a pass-through entity completing their own Form 8283 should complete the same section of the Form (Section A or B)

How do you write a donation statement?

What do you need to include in your donation acknowledgment letter? The donor's name. The full legal name of your organization. A declaration of your organization's tax-exempt status. Your organization's employer identification number. The date the gift was received. A description of the gift and the amount received.

How do you politely ask for donations?

Make it urgent. Giving now is better than giving later, so make sure your language reflects that. Be clear and direct. Craft a great subject line. Keep it optimistic. Say thank you in advance. Use "you" in your asking for a donation wording. Use action verbs. Follow the numbers.

What is an example of a good donation letter?

I'm writing to ask you to support me and my [cause/project/etc.]. Just a small donation of [amount] can help me [accomplish task/reach a goal/etc.]. Your donation will go toward [describe exactly what the contribution will be used for]. [When possible, add a personal connection to tie the donor to the cause.

Are donations legally binding?

A promise to make a gift, bequest or devise of cash or other property to an organization described in section 501(c)(3) of the Internal Revenue Code is contractually binding with or without consideration if the promisor indicated in writing an intent that the promise be a binding legal obligation.

Can you back out of a donation pledge?

If you have good reason to believe that the nonprofit will do significantly more good than the donations, that founding the nonprofit is not compatible with donating your pledged amount, and that you would not be able to make up the gap in donations within a couple of years, withdrawing your pledge would be a

Is a gift agreement enforceable?

It is generally not enforceable by law unless two elements have been met: there has been consideration given to the donor and the charity can establish that it has detrimental reliance on the pledge. There are several items that should be included or considered when creating a gift agreement.

Can you ask to return a donation?

If your donation was specifically earmarked for a canceled project, the charity should contact you to offer a refund. You may also choose to allow the charity to keep your donation for another use. If you must ask for a donation back, try to make your refund as painless as possible.