ESign 1099-MISC Form For Free

Join the world’s largest companies

How to Send a PDF for eSignature

Why choose pdfFiller for eSignature and PDF editing?

Cross-platform solution

Unlimited document storage

Widely recognized ease of use

Reusable templates & forms library

The benefits of electronic signatures

Efficiency

Accessibility

Cost savings

Security

Legality

Sustainability

Enjoy straightforward eSignature workflows without compromising data security

GDPR compliance

SOC 2 Type II Certified

PCI DSS certification

HIPAA compliance

CCPA compliance

ESign 1099-MISC Form Feature

The ESign 1099-MISC Form feature simplifies your tax reporting process. Designed for businesses and freelancers, this tool ensures smooth electronic signatures for the essential 1099-MISC form, making compliance easier than ever.

Key Features

Use Cases and Benefits

By using the ESign 1099-MISC Form feature, you can solve the problem of cumbersome paperwork and tight deadlines. This tool not only makes it easier to collect signatures but also helps ensure you meet compliance standards without the hassle. You will save time, improve accuracy, and focus more on your business while we take care of your tax form needs.

ESign 1099-MISC Form in minutes

pdfFiller allows you to ESign 1099-MISC Form quickly. The editor's convenient drag and drop interface ensures quick and intuitive signing on any device.

Ceritfying PDFs electronically is a quick and safe method to validate papers at any time and anywhere, even while on the fly.

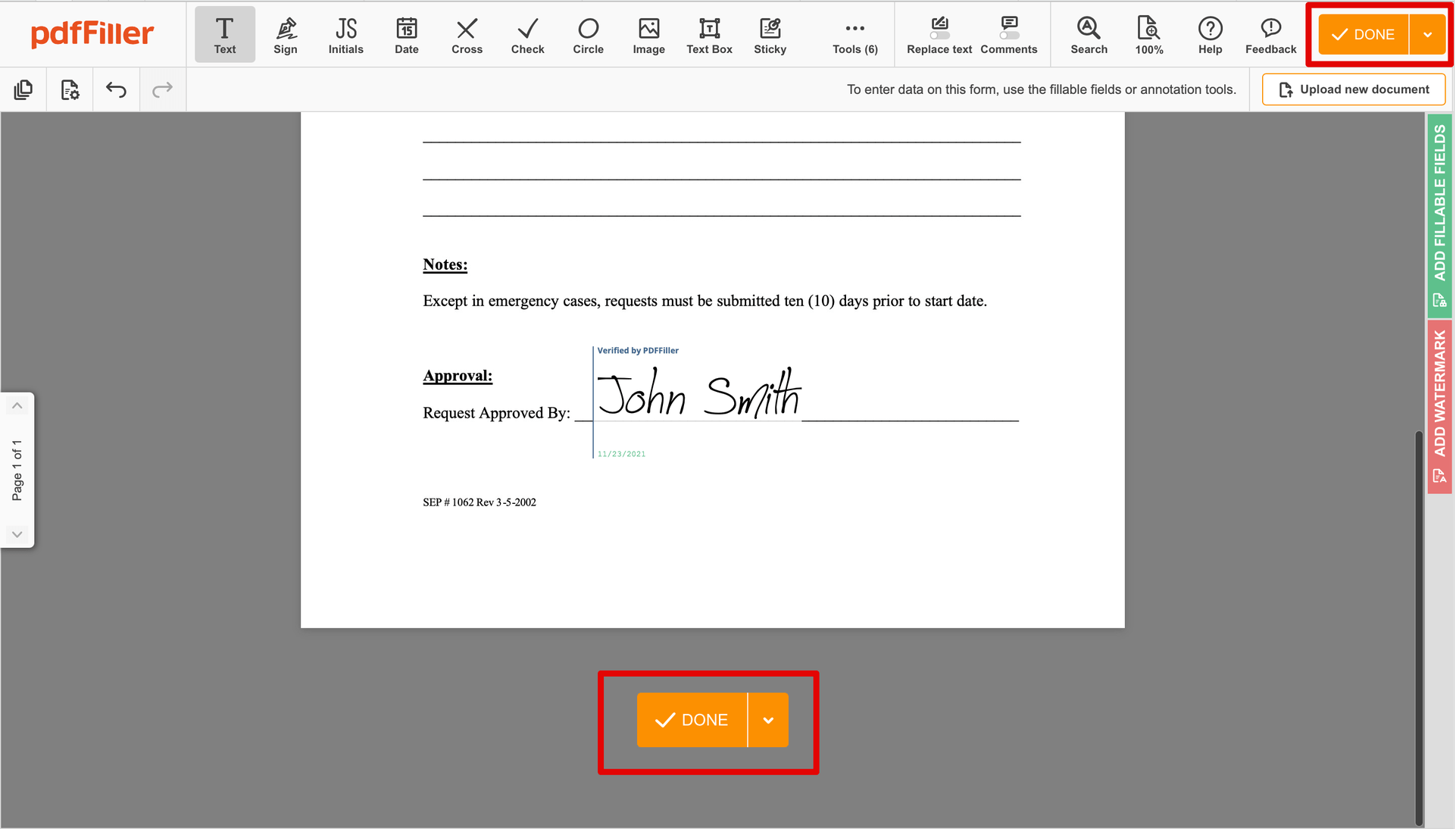

See the step-by-step instructions on how to ESign 1099-MISC Form electronically with pdfFiller:

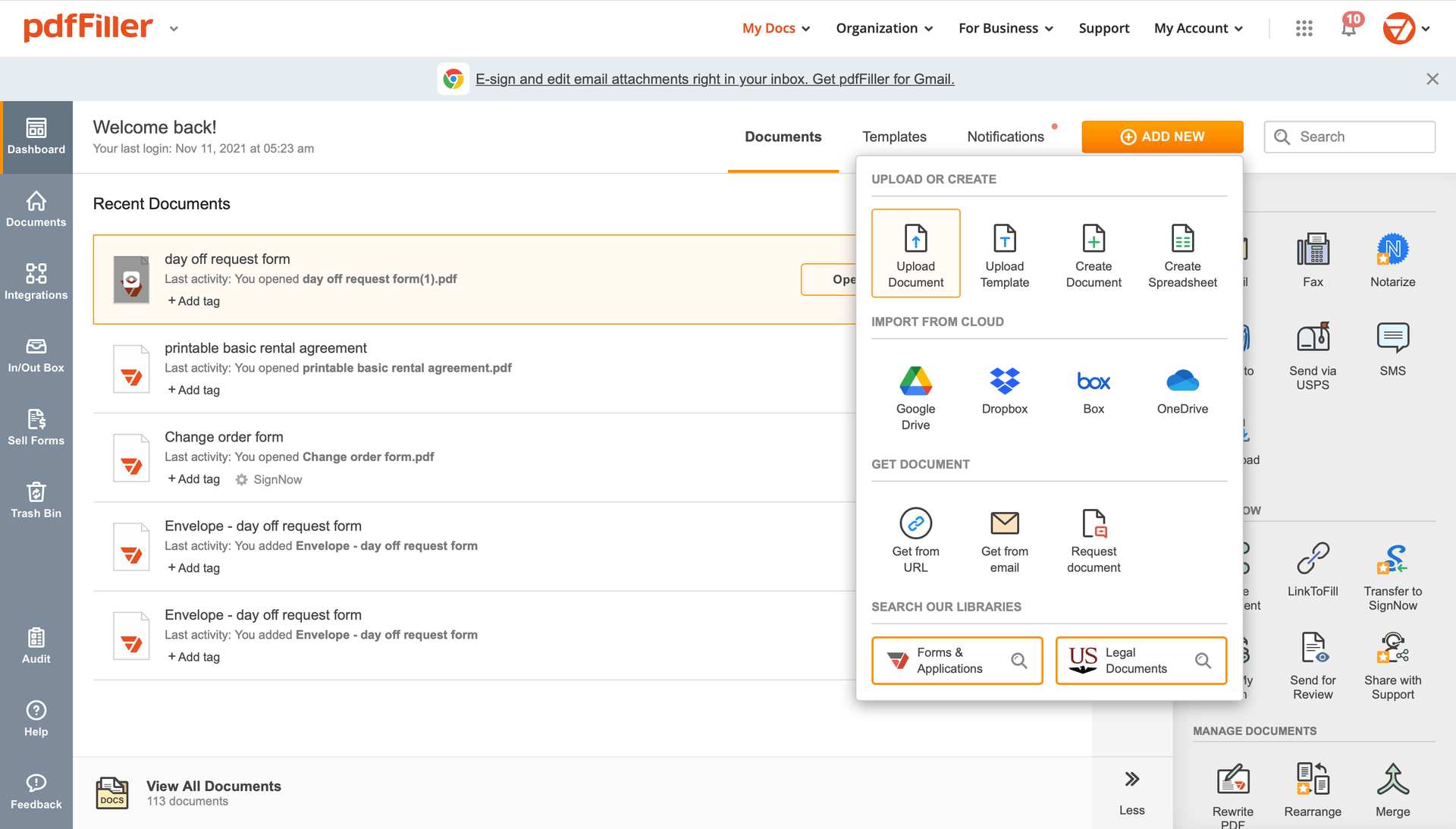

Upload the document for eSignature to pdfFiller from your device or cloud storage.

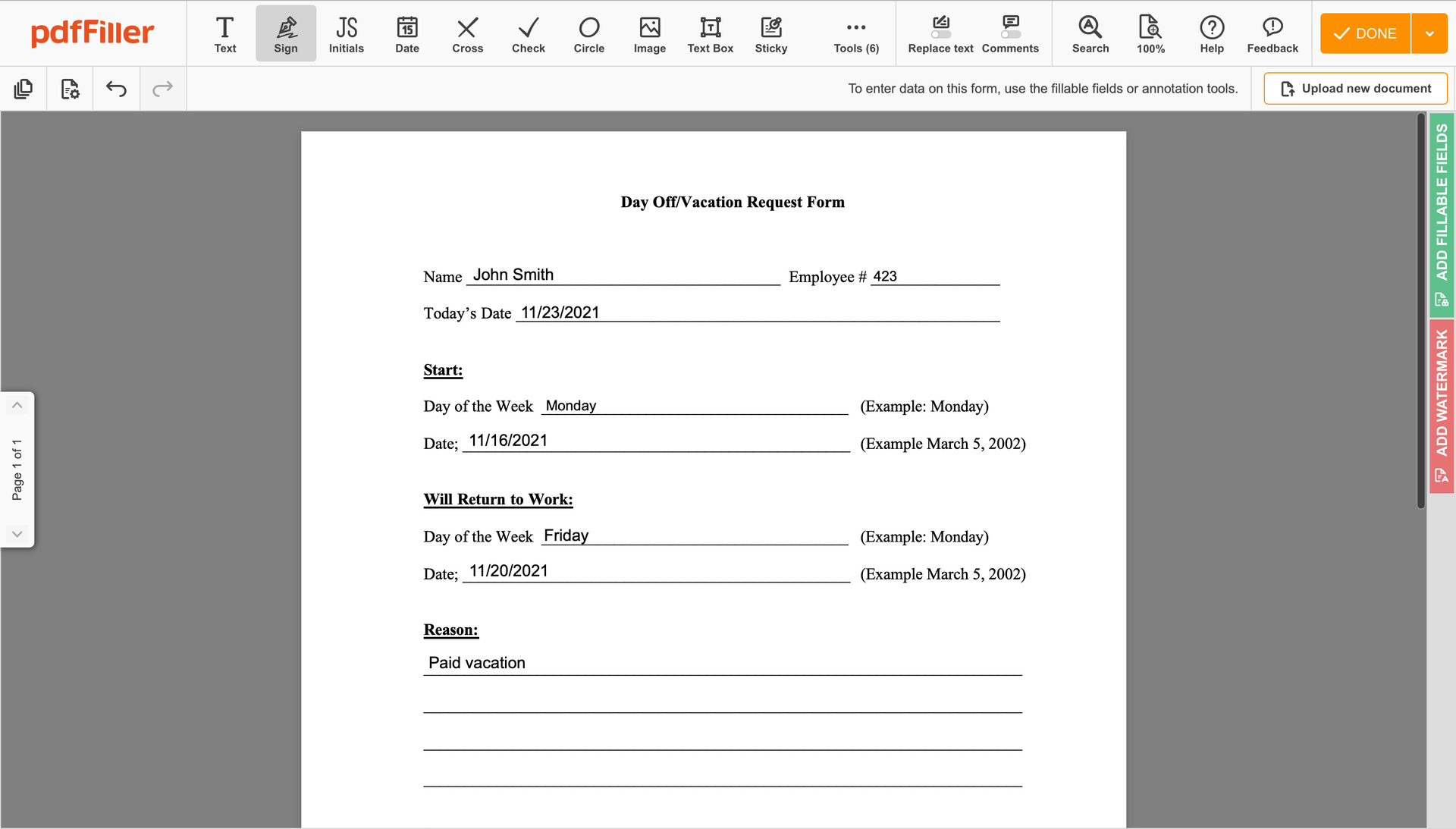

Once the file opens in the editor, hit Sign in the top toolbar.

Create your electronic signature by typing, drawing, or adding your handwritten signature's photo from your device. Then, hit Save and sign.

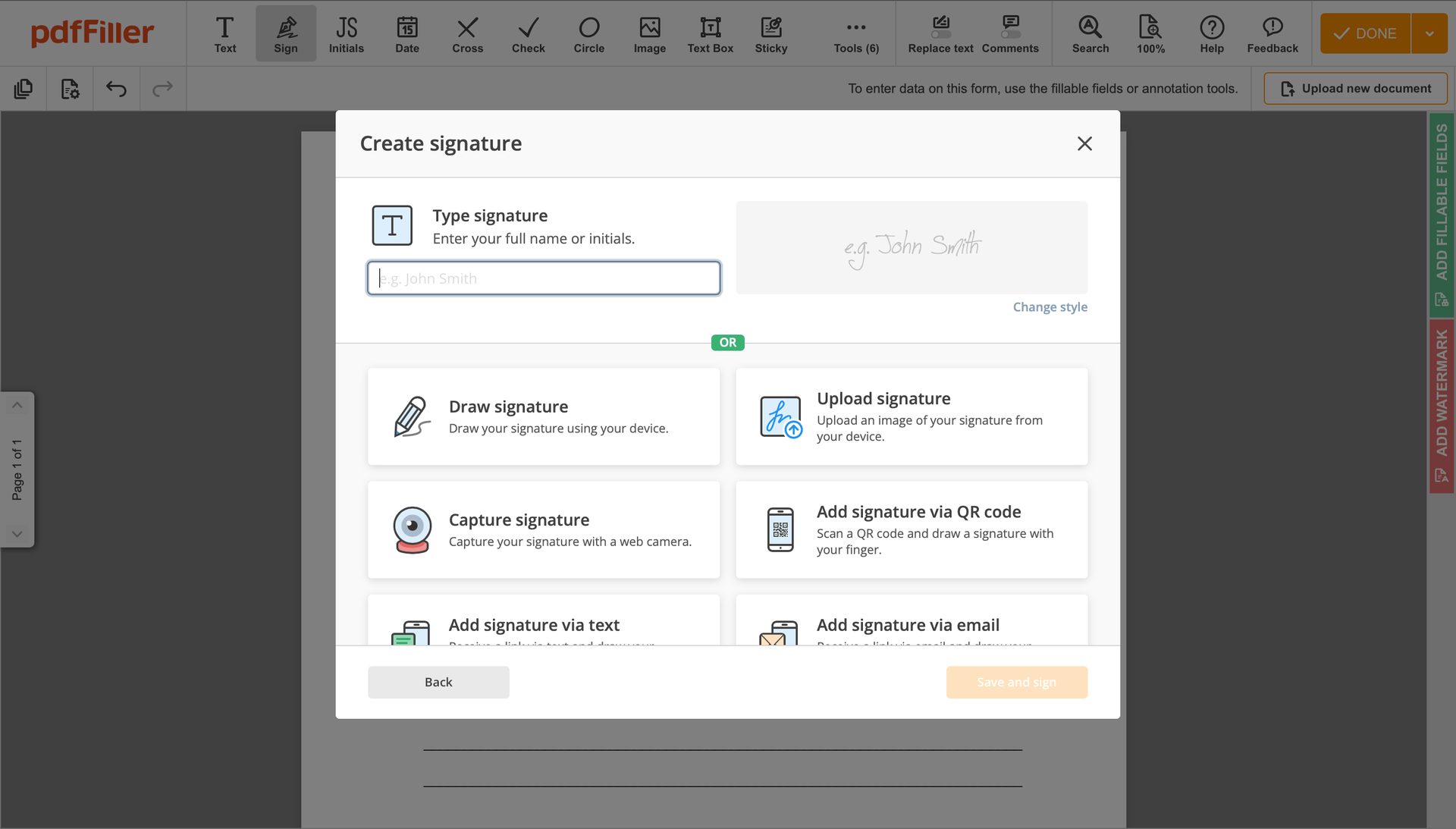

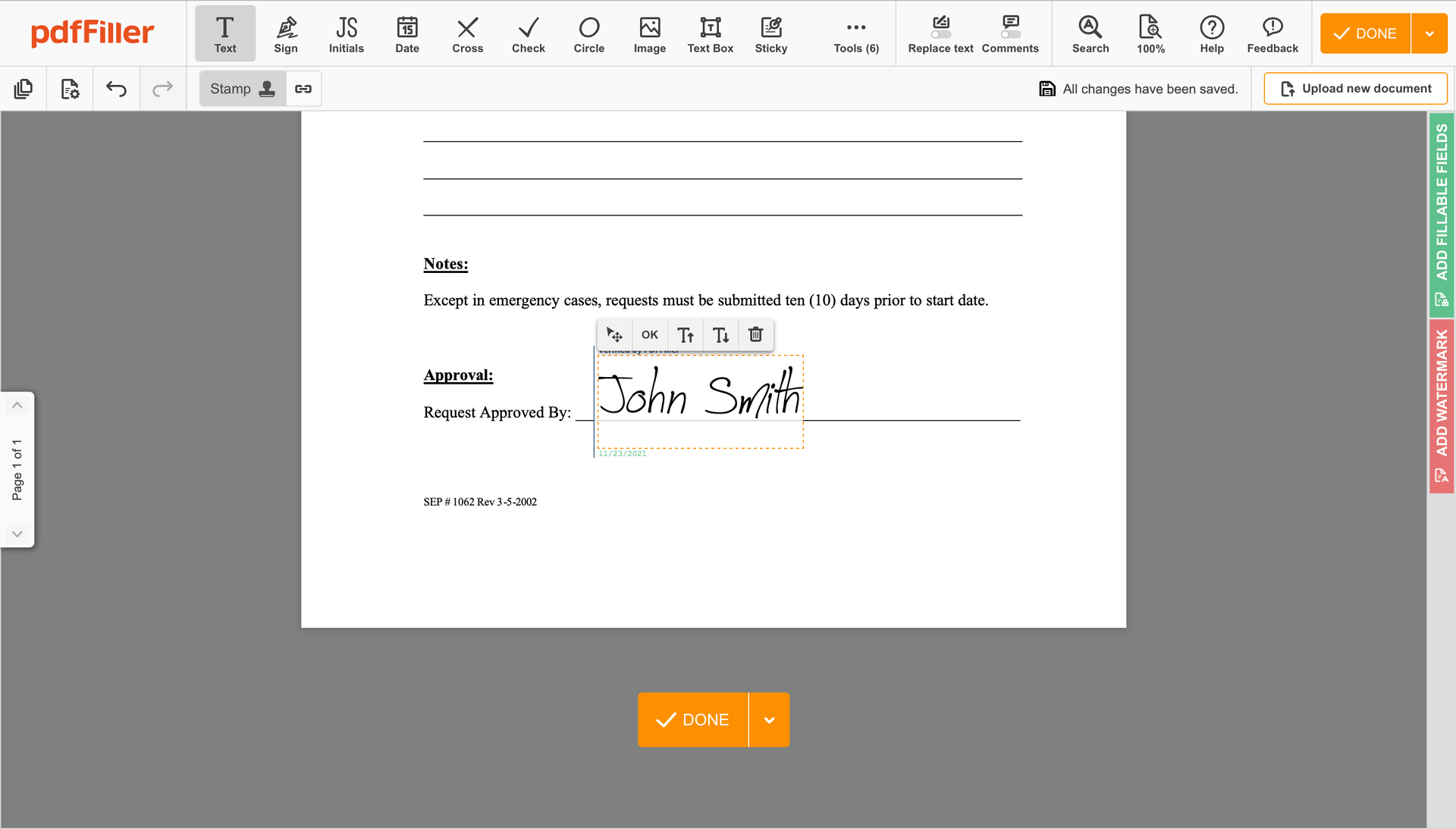

Click anywhere on a document to ESign 1099-MISC Form. You can drag it around or resize it utilizing the controls in the floating panel. To apply your signature, click OK.

Complete the signing process by clicking DONE below your document or in the top right corner.

Next, you'll go back to the pdfFiller dashboard. From there, you can download a signed copy, print the document, or send it to other parties for review or validation.

Stuck with different programs for editing and signing documents? We have a solution for you. Use our tool to make the process efficient. Create document templates completely from scratch, modify existing form sand other useful features, within your browser. You can use design 1099-MISC Form right away, all features are available instantly. Have a major advantage over other tools.

How to edit a PDF document using the pdfFiller editor:

How to Use the ESign 1099-MISC Form Feature

Thank you for choosing pdfFiller! We are here to guide you through the process of using the ESign 1099-MISC Form feature. Follow these simple steps to complete your form electronically:

We hope this guide has been helpful. If you have any further questions or need assistance, please don't hesitate to reach out to our support team. Happy form filling!

For pdfFiller’s FAQs

Ready to try pdfFiller's? ESign 1099-MISC Form