ESign 1099-MISC Form with pdfFiller

How to ESign 1099-MISC Form

To e-sign a 1099-MISC form using pdfFiller, upload your document to the platform, utilize the e-signature feature to place your signature, and then save or send your completed form directly from pdfFiller. This streamlined process allows for quick completion and sharing of tax documents.

What is ESign 1099-MISC Form?

The 1099-MISC Form is a tax document used to report miscellaneous income. ESigning refers to electronically signing this form, allowing individuals and businesses to authenticate their signature without needing to print, sign, and rescan the document.

Why ESigning 1099-MISC Form matters for digital document workflows?

ESigning the 1099-MISC Form enhances efficiency within digital workflows by reducing the time needed to complete and send tax documents. It eliminates physical paperwork, minimizes the potential for errors associated with manual signatures, and ensures compliance with IRS regulations.

Use-cases and industries that frequently ESign 1099-MISC Form

Various industries utilize the 1099-MISC Form, making e-signing essential. Freelancers, independent contractors, and businesses that hire non-employee individuals often need to issue or receive these forms.

-

Freelancers issuing payments to subcontractors.

-

Consultants providing services and requiring payment proof.

-

Real estate professionals paying commissions.

-

Companies remitting payments for legal services.

-

Organizations issuing awards or prizes.

Step-by-step: how to ESign 1099-MISC Form in pdfFiller

ESigning a 1099-MISC Form in pdfFiller is straightforward. Follow these steps to complete the process:

-

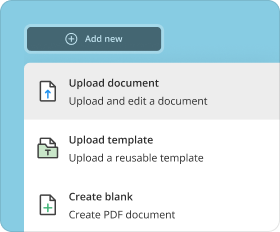

Log into your pdfFiller account or create a new account.

-

Upload the 1099-MISC Form you wish to sign.

-

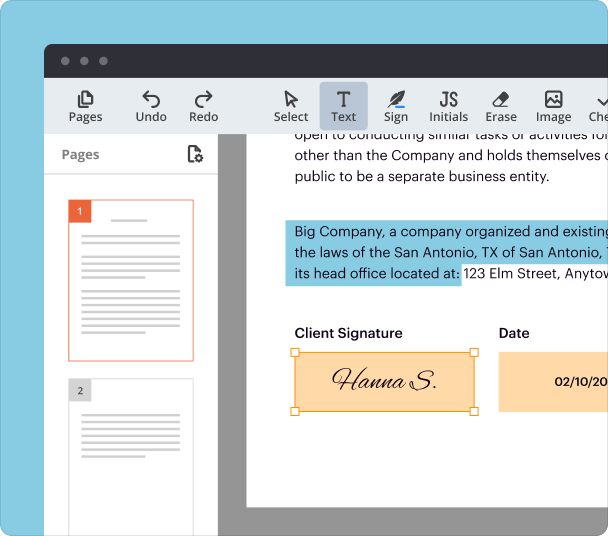

Click on 'Sign' to access the e-signature tool.

-

Draw or upload your signature and place it on the designated area.

-

Review the form for accuracy and completeness.

-

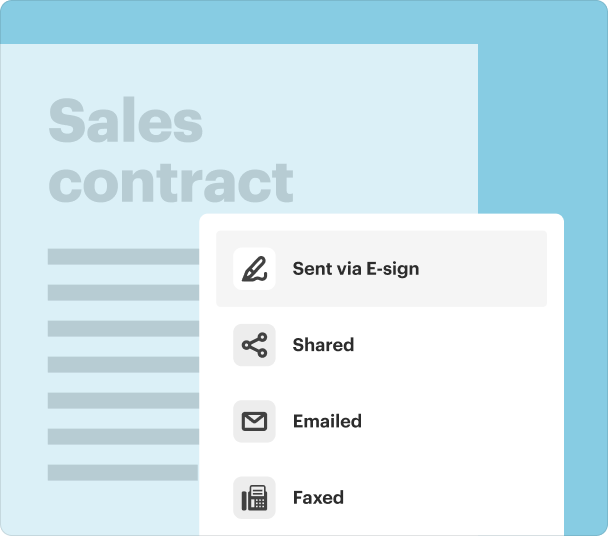

Click 'Finish' to save, download, or send your signed document.

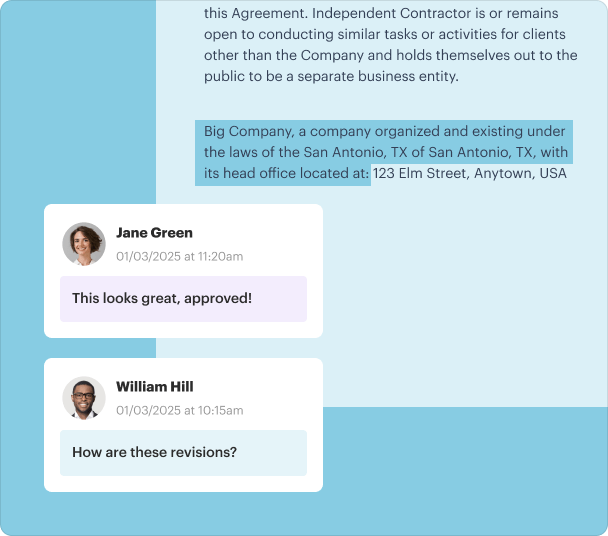

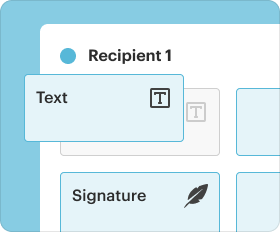

Options for customizing signatures, initials, and stamps when you ESign

pdfFiller allows for various customization options for your signature, initials, and stamps. You can draw your signature, upload an image, or select from pre-set options.

-

Draw your signature using your mouse or touchpad.

-

Upload a scanned signature or a signature image.

-

Use customizable stamps to indicate approval or authorization.

Managing and storing documents after you ESign

After signing the 1099-MISC Form, pdfFiller provides robust options for document management and storage. Users can categorize, tag, and retrieve documents easily, ensuring organization and compliance.

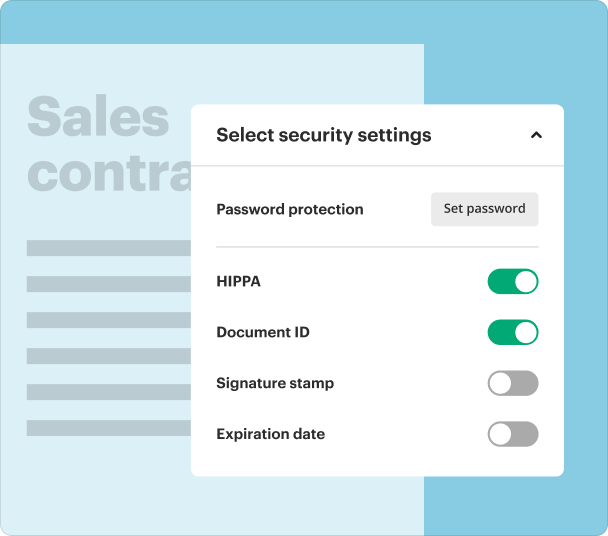

Security, compliance, and legal aspects when you ESign

When e-signing financial documents like the 1099-MISC Form, security and compliance are pivotal. pdfFiller follows industry standards for electronic signatures, ensuring that your signed forms are legally binding and securely stored.

-

Utilizes SSL encryption to protect your data.

-

Complies with eSignature laws, such as ESIGN and UETA.

-

Creates a secure audit trail of signed documents.

Alternatives to pdfFiller for ESigning workflows

While pdfFiller stands out for its comprehensive document management features, there are other alternatives in the e-signing space.

-

DocuSign: Focused solely on electronic signatures.

-

Adobe Sign: Integrates with various Adobe products.

-

HelloSign: Easy-to-use interface for signing documents.

Conclusion

ESigning the 1099-MISC Form with pdfFiller allows users to handle their tax documents swiftly and securely. Its robust features streamline the signing process while ensuring compliance with legal standards, making it an ideal choice for individuals and businesses alike.

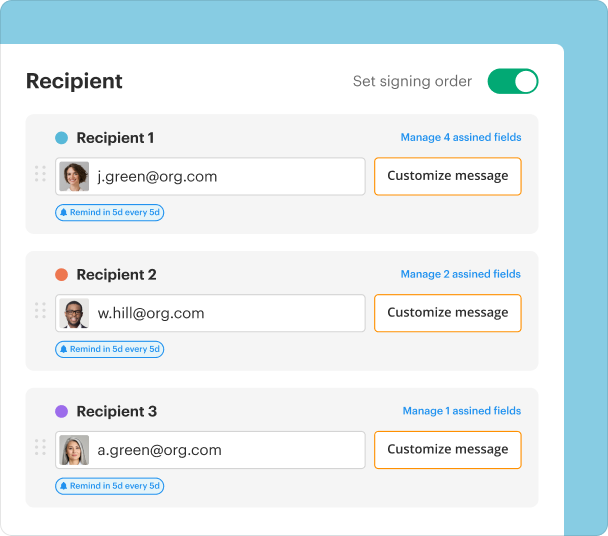

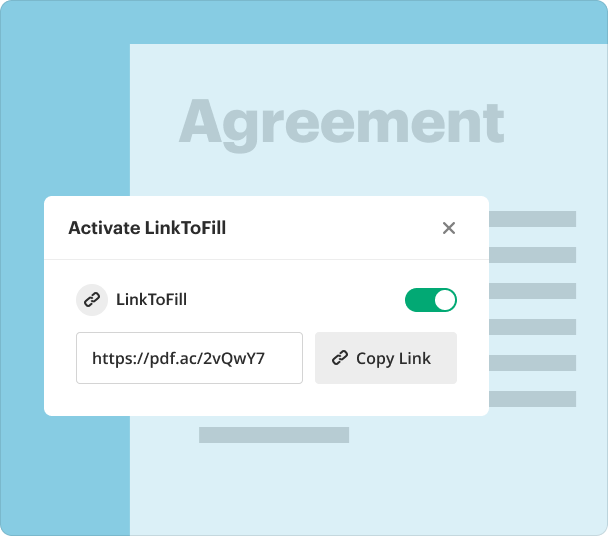

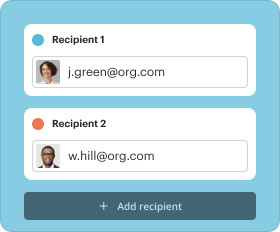

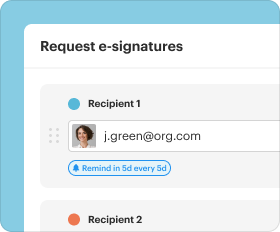

How to send a document for signature?

Who needs this?

Why sign documents with pdfFiller?

Ease of use

More than eSignature

For individuals and teams

pdfFiller scores top ratings on review platforms