Incorporate Elect Notice

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

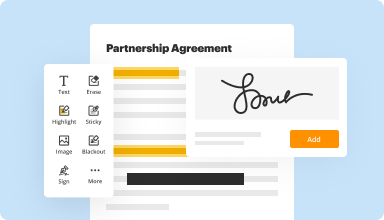

Fill out, edit, or eSign your PDF hassle-free

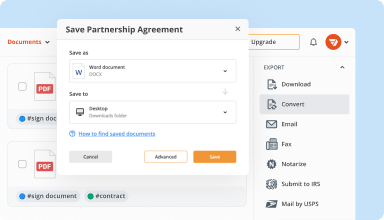

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

Fill out & sign PDF forms

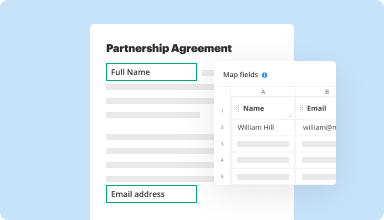

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

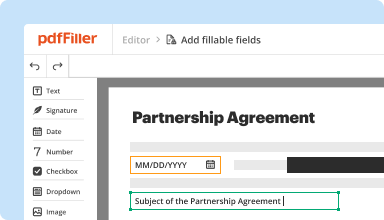

Collect data and approvals

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

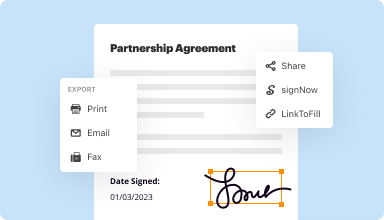

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

First experience was perfect. I'm having difficulty finding the current version of the form I need; specifically, the 2014 Revision of the Standard Agreement for the sale of real estate/Pennsylvania.

2014-05-30

What do you like best?

Good value and much better than Adobe. I highly recommend this product.

What do you dislike?

Sometimes slow to upload and save but not too bad most of the time.

Recommendations to others considering the product:

Good value - go for it!

What problems are you solving with the product? What benefits have you realized?

I have to complete many Government forms and docs that are antiquated and not fillable online - PDF filler solaced the problem every time.

Good value and much better than Adobe. I highly recommend this product.

What do you dislike?

Sometimes slow to upload and save but not too bad most of the time.

Recommendations to others considering the product:

Good value - go for it!

What problems are you solving with the product? What benefits have you realized?

I have to complete many Government forms and docs that are antiquated and not fillable online - PDF filler solaced the problem every time.

2019-05-29

Go so far but not sure if I am willing…

Go so far but not sure if I am willing to pay for it because I am only using during tax season for a few clients.

2019-03-08

PDF FIller was an answer to many questions.

Our business is an industrial maintenance business. We have had to use PDF filler several times with applications and insurance documents. PDF filler made it easier.

We liked how they explained everything we needed to know to fill in applications and other papers online without having to scan and download everything separately. I always thought it was my computer that was the problem, but with PDF filler, it doesn't matter what software is already on your laptop, you can work with any documents.

Sometimes I would go duplicate a step in saving the document, but after a couple of documents, it was easy to figure out what I should do.

2019-03-12

It's a great service that operates smoothly and is good value for money (especially when deals are applied) compared to Adobe. I prefer the interface and the amount of options is comprehensive.

2022-01-06

What do you like best?

pdfFiller is an excellent product at a great price. The 5-user shareable version is only $15 a month. That is the total for all 5-=users. They also have exceptional support, though you rarely need it. It also gets new features often, such as an inexpensive library of 80,000+ legal and tax forms. Michael Block CPA mblock@blocktax.com

What do you dislike?

The fax option is $10 a month. It should be $5. However, a $3 third-party fax add-on works with it

What problems are you solving with the product? What benefits have you realized?

We fill out many forms quickly, which would be very time-consuming.

2021-08-16

I LOVE IT!!!

I LOVE IT!!!! this tool is so awesome and user friendly. You can't get any better than this. and it shows it is only $8.00 a month, so cheap. :)

2021-03-05

It was something I needed temporarily. If I had a continuous need for this program, I would keep it and continue to use it. I really did enjoy the ease of this program.

2020-12-24

Relatively easy to use and work with…

Relatively easy to use and work with files. Although, it takes a bit of effort for age challenged individuals.

2020-07-15

Get documents done from anywhere

Create, edit, and share PDFs even on the go. The pdfFiller app equips you with every tool you need to manage documents on your mobile device. Try it now on iOS or Android!

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

When can I elect S corp status?

How to Elect S Corporation Tax Status. In the same way, as a corporation elects S corporation status, an LLC elects S corporation status by filing IRS Form 2553 with the IRS. The election must be made no more than two months and 15 days after the beginning of the tax year when the election is to go into effect.

How long do you have to elect S corp status?

A corporation or LLC must file an S-Corp election within two months and 15 days (~75 days total) of the date of formation for the election to take effect in the first tax year.

Who can elect S corp status?

Qualifications to Elect S Corporation Status It must be a domestic (U.S.) corporation, with no foreign investors. It must have no more than 100 shareholders. It has only one class of stock. Furthermore, it must use a December 31 year-end.

Can a single member LLC elect S corp status?

The default federal tax status for a single-member limited liability company (SM LLC) is disregarded entity. To elect S corporation tax status, you need to file IRS Form 2553, Election by a Small Business Corporation. You can file an election for S corporation tax status at any time after setting up your SM LLC.

Should an LLC elect S corp status?

For tax purposes, by default, an LLC with one member is disregarded as an entity. If so, the LLC will be taxed under Subchapter C of the Code. And, once it has elected to be taxed as a corporation, an LLC can file a Form 2553, Election by a Small Business Corporation, to elect tax treatment as an S corporation.

Can you make an S election mid-year?

Enter the first day of the tax year for which you wish the S corporation election to be effective in Line E. The election must begin on the first day of the business tax year. You cannot elect a change in tax filing status mid-year.

How do I make an S Corp election?

S-Corp election To elect for S-Corp treatment, file Form 2553. You can make this election at the same time you file your taxes by filing Form 1120S, attaching Form 2533 and submitting along with your personal tax return.

#1 usability according to G2

Try the PDF solution that respects your time.