Canada GST66 E 2000 free printable template

Show details

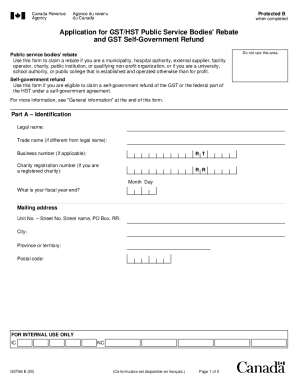

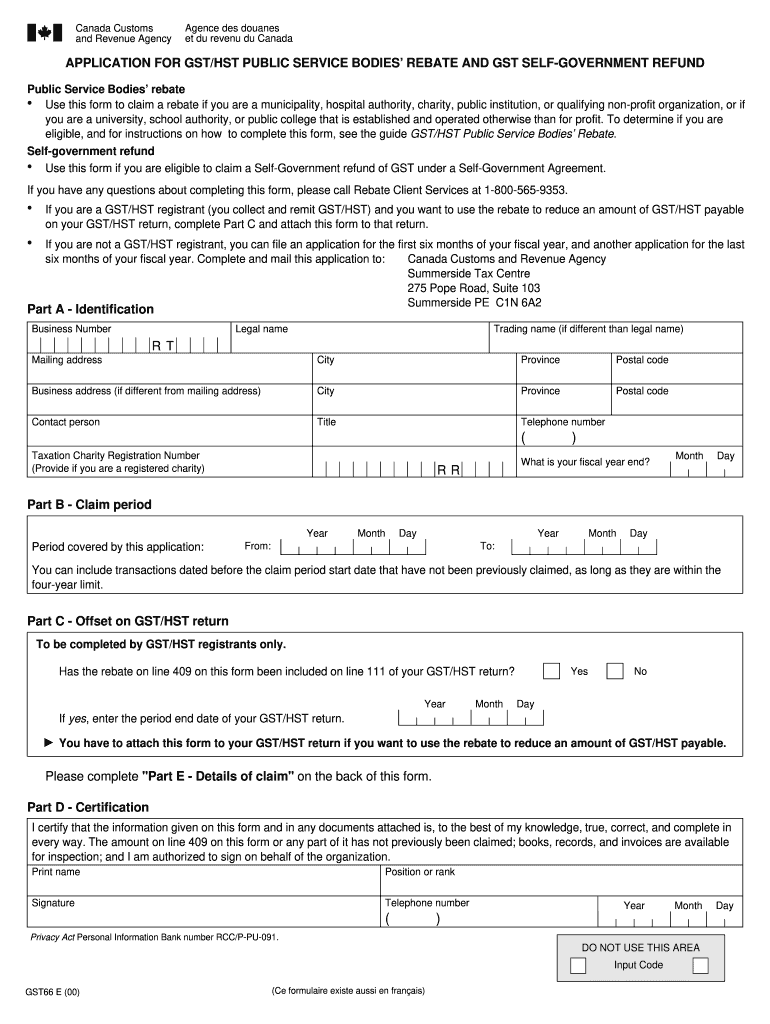

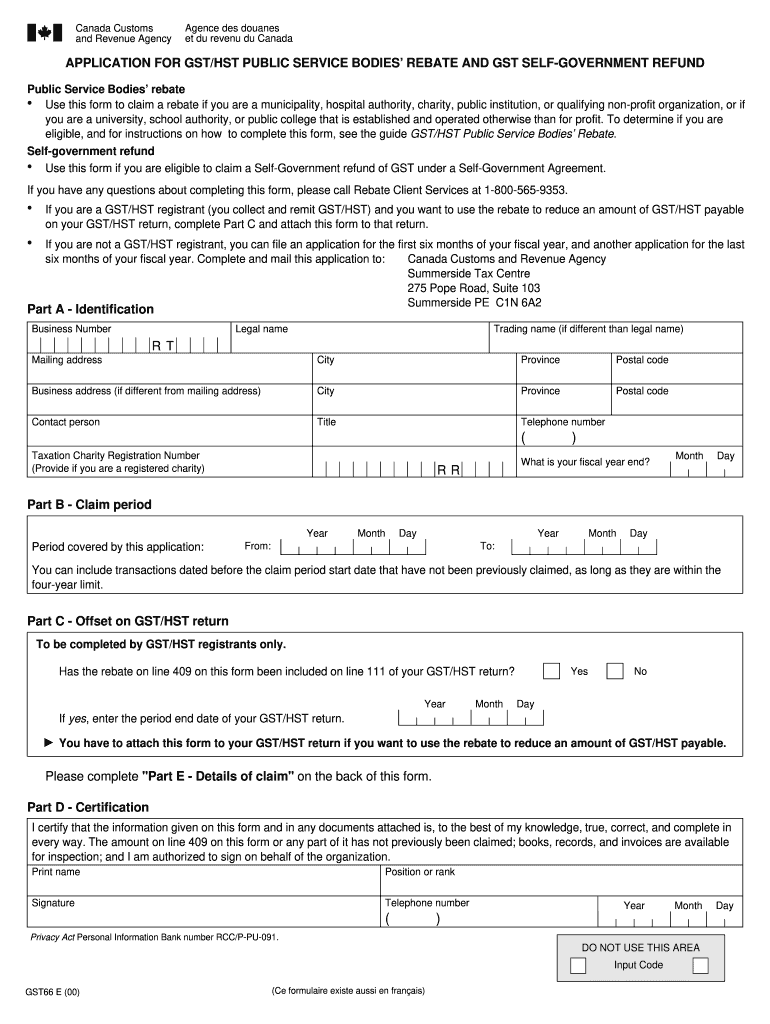

DO NOT USE THIS AREA Input Code GST66 E 00 Ce formulaire existe aussi en fran ais Part E - Details of claim Enter the amount of rebate that you are claiming for the activities that you perform on the appropriate line of the table below. Canada Customs and Revenue Agency Agence des douanes et du revenu du Canada APPLICATION FOR GST/HST PUBLIC SERVICE BODIES REBATE AND GST SELF-GOVERNMENT REFUND Public Service Bodies rebate l Use this form to claim a rebate if you are a municipality hospital...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your gst66 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gst66 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit gst66 form online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit gst66 form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Canada GST66 E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out gst66 form

How to fill out gst66 form:

01

Gather all necessary information, such as your business number, contact details, and financial information.

02

Start by filling out the general information section, including your name, address, and business activity.

03

Provide the reporting period for which you are submitting the form, along with any applicable changes to your business.

04

Enter your net GST/HST remittance, which is the difference between your GST/HST collected and the input tax credits claimed.

05

Fill in any additional information or adjustments required, such as self-assessed tax or a credit for bad debts.

06

Review all the details entered and ensure accuracy before submitting the form to the Canada Revenue Agency (CRA).

Who needs gst66 form:

01

Businesses registered for the Goods and Services Tax (GST) or Harmonized Sales Tax (HST) in Canada are required to submit the gst66 form.

02

If your business earns more than a certain threshold annually, you are obligated to collect and remit GST/HST, making the gst66 form necessary.

03

Even if your business is not currently making sales that qualify for GST/HST, you may still need to complete the form if you are eligible for input tax credits or want to claim a refund.

Fill form : Try Risk Free

People Also Ask about gst66 form

What is GST66?

How do I claim my GST refund Canada?

What is the HST refund in Ontario?

Can you claim GST back when leaving Canada?

What is the HST rebate for small business in Ontario?

What is the GST refund for tourists in Canada?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is gst66 form?

The GST66 form, also known as the Declaration for the Goods and Services Tax/Harmonized Sales Tax (GST/HST) for the Province of Quebec, is used by businesses operating in Quebec, Canada, to register for the GST/HST. This form is specifically for businesses located in Quebec and requires information such as business details, contact information, and the effective date of registration. The form is submitted to the Canada Revenue Agency (CRA) to initiate the registration process.

Who is required to file gst66 form?

The GST66 form is required to be filed by businesses that are registered for the Goods and Services Tax (GST) in Canada and are making a claim for a GST/HST rebate or input tax credit. This form is used to report the details of the expenses for which the rebate or credit is being claimed.

How to fill out gst66 form?

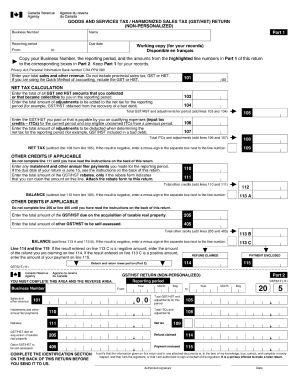

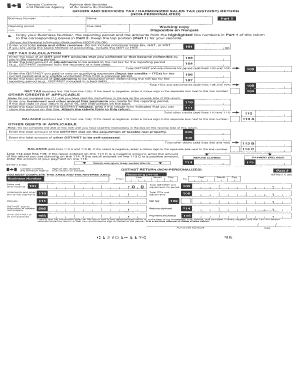

To fill out the GST66 form, follow these steps:

1. Obtain the GST66 form: You can download the form from the Canada Revenue Agency (CRA) website or request a copy by calling the CRA.

2. Read the instructions: The form comes with instructions. Make sure to read them carefully before filling out the form to understand the information required and any specific guidelines.

3. Provide your business information: Fill in your business name, address, and contact information in the designated sections of the form.

4. Select the reporting period: Indicate the reporting period you are filing for. This may be monthly, quarterly, or annually, depending on your business's GST filing schedule.

5. Provide the gross sales and net tax for each category: In the appropriate sections of the form, enter the gross sales amount and the net tax amount for each applicable category. These categories typically include taxable supplies, zero-rated supplies, and exempt supplies.

6. Calculate the net tax: Subtract the net tax amount from the gross sales amount for each category to calculate the net tax payable.

7. Total the amounts: Add up the individual net tax amounts to obtain the total net tax payable for the reporting period.

8. Complete the remittance section: If you have an amount to remit, fill out the remittance section with the appropriate payment details, including the payment method and the amount you'll be remitting.

9. Sign and date the form: Once you have filled out all the required information, sign and date the form to validate it.

10. Keep a copy for your records: Make a copy of the completed GST66 form for your records before submitting it to the CRA.

11. Submit the form: Mail or e-file the completed form, following the instructions provided by the CRA for submission.

Note: It is recommended to consult with an accountant or tax professional to ensure accuracy and compliance with specific requirements related to your business and tax situation.

What is the purpose of gst66 form?

The GST66 form is used in Canada to apply for a GST/HST (Goods and Services Tax/Harmonized Sales Tax) refund for individuals who are eligible for the GST/HST credit. This form is primarily used by individuals who do not have to file an income tax return and are applying solely for the GST/HST credit. The purpose of the form is to gather the necessary information to determine eligibility and calculate the amount of the credit.

What information must be reported on gst66 form?

The GST66 form is used in Canada to report a deemed supply of property or services under the Excise Tax Act. The information that must be reported on the GST66 form includes:

1. The taxpayer's name, address, and business number.

2. The period covered by the form.

3. A description of the property or services being deemed supplied.

4. The total consideration for the deemed supply, including any taxes.

5. The amount of tax payable on the deemed supply.

6. Any adjustments to the consideration or tax payable, such as rebates or credits.

7. The taxpayer's certification and signature.

It's important to note that the specific requirements and reporting instructions for the GST66 form may vary, so it's recommended to consult the official form and instructions provided by the Canada Revenue Agency (CRA) for accurate and up-to-date information.

What is the penalty for the late filing of gst66 form?

The penalty for the late filing of the GST66 form depends on the jurisdiction and the specific circumstances. In general, penalties for late filing may include:

1. Late filing penalties: This penalty may be calculated based on a percentage of the outstanding tax amount for each month that the form is late. The specific percentage can vary by jurisdiction.

2. Interest charges: Late filing may also incur interest charges on the outstanding tax amount, calculated from the original due date until the date of payment.

3. Additional penalties: In some cases, there may be additional penalties imposed for intentional or repeated late filings, or for other non-compliance issues.

It is recommended to consult the tax authority or a tax professional in your jurisdiction to get accurate information on the specific penalties for late filing of the GST66 form.

How do I make changes in gst66 form?

The editing procedure is simple with pdfFiller. Open your gst66 form in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I fill out gst66 form using my mobile device?

Use the pdfFiller mobile app to complete and sign gst66 form on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I complete gst66 form on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your gst66 form. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

Fill out your gst66 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.