Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

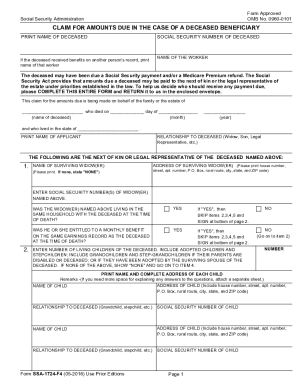

SSA 1724 is a form used by the Social Security Administration (SSA) in the United States. It is known as the Supplemental Security Income (SSI) Statement of Claimant or Other Person. This form is used to gather information from individuals who are applying for or receiving SSI benefits, or from those acting on behalf of the claimant. It helps the SSA assess the claimant's financial situation, living arrangements, income sources, and other relevant information to determine their eligibility and benefit amount for SSI.

Who is required to file ssa 1724?

The SSA (Social Security Administration) Form 1724 should be filed by a representative payee who receives Social Security or Supplemental Security Income benefits on behalf of another person who is unable to manage their own finances.

How to fill out ssa 1724?

To fill out the SSA-1724 form, also known as the Claim for Amounts Due in the Case of a Deceased Beneficiary, follow these steps:

1. Obtain a copy of the SSA-1724 form from the official Social Security Administration (SSA) website or obtain a physical copy from a local SSA office.

2. Begin the form by providing your personal information, including your full name, Social Security number, address, phone number, and relationship to the deceased beneficiary.

3. Provide the necessary information about the deceased individual, including their full name, Social Security number, date of birth, date of death, and any other relevant details.

4. Section A of the form requires you to indicate the type of claim being filed. Check the appropriate box for the type of benefit being claimed, such as retirement, survivor, spouse, or parent's claim.

5. In Section B, provide information about any other family members who may be eligible for the deceased person's benefits, particularly if they were financially dependent on the deceased.

6. Section C requires you to provide details about any benefits already paid to the deceased individual. This information is typically gathered from the last SSA benefit check, bank statements, or other relevant documents.

7. In Section D, specify the amount anticipated to be payable from the deceased individual's Social Security account. This amount may be calculated based on the deceased's earnings, tax records, or other relevant information.

8. In Section E, provide the details of the person completing the form. This section requires the completed date, your signature, and contact information.

9. Review the completed form for accuracy and completeness, ensuring all required sections are filled out correctly.

10. Make copies of the completed form and any supporting documents for your records.

11. Submit the completed SSA-1724 form, along with any required documents, to your local SSA office. It is recommended to retain a receipt or confirmation of submission for future reference.

Ensure to consult the instructions provided along with the SSA-1724 form for any specific details or additional requirements while completing the form.

What is the purpose of ssa 1724?

The SSA-1724 form, also known as the Appointment of Representative, is used by the Social Security Administration (SSA) to appoint someone as a representative on behalf of an individual applying for or receiving Social Security benefits. The purpose of the form is to give the appointed representative legal authority to act on behalf of the applicant or beneficiary in matters related to their Social Security benefits, such as filing paperwork, accessing records, and communicating with the SSA on their behalf. This form helps ensure that individuals who are unable to manage their affairs themselves have someone who can assist and advocate for them in dealing with the Social Security Administration.

What information must be reported on ssa 1724?

The SSA 1724 Form "Authorization to Disclose Information to the Social Security Administration (SSA)" is used to give authorization for disclosure of information to the Social Security Administration (SSA). The form typically includes the following information:

1. Personal Information: Full name, Social Security Number (SSN), date of birth, address, and contact information.

2. Representative Information: If someone is representing the applicant, their name, address, and relationship to the applicant are typically required.

3. Reason for Disclosure: The form may require an explanation or description of why the authorization is being provided and what specific information needs to be disclosed.

4. Authorization Period: The form may specify the duration or expiration date for which the authorization is intended.

5. Signature: The individual providing authorization must sign and date the form.

While these are the general details that are typically required, the exact information requested on the SSA 1724 may vary based on the specific circumstances or purpose of the authorization being sought.

What is the penalty for the late filing of ssa 1724?

The Social Security Administration (SSA) Form 1724 is used for reporting wages paid to a deceased employee after their date of death. The form should be filed within 30 days of the end of the calendar quarter in which the overpayment occurred.

If the SSA 1724 is filed late, the penalty would depend on the specific circumstances and the reason for the delay. It is important to note that SSA penalties can vary and are determined on a case-by-case basis. In general, late filing penalties can include:

1. Interest: The SSA may charge interest on any late payments made after the due date. The interest rate is determined by the Treasury Department and is subject to change.

2. Administrative penalties: The SSA may impose administrative penalties for late filing, generally assessed as a fixed monetary amount. The penalty amount might vary depending on the length of the delay and the specific circumstances.

Since penalty assessments can differ, it is recommended to contact the SSA directly to inquire about the specific penalty that may apply to a late filing of Form 1724.

Where do I find ssa 1724?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the ssa 1724 f4 pdf fillable form in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I edit ssa form 1724 online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your social security form 1724 to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I edit form ssa 1724 on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share social security form ssa 1724 on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.