Business Expense Form

What is a Business Expense Form?

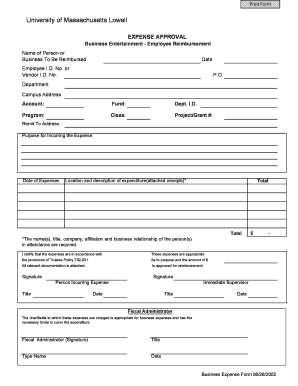

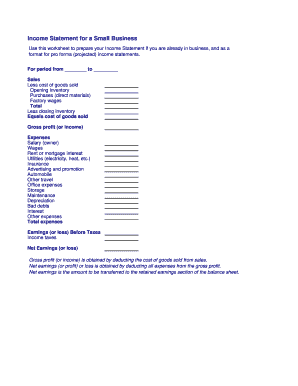

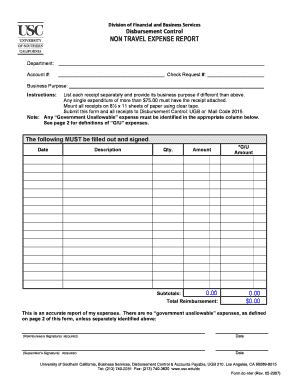

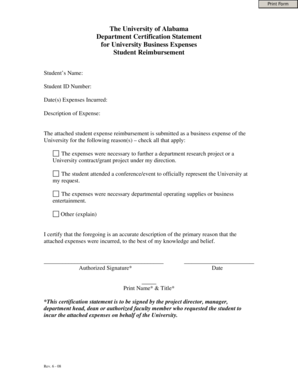

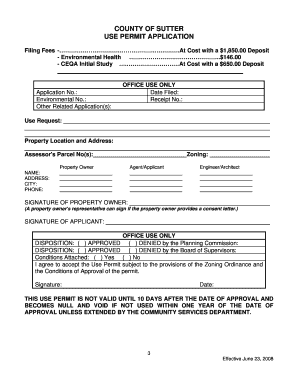

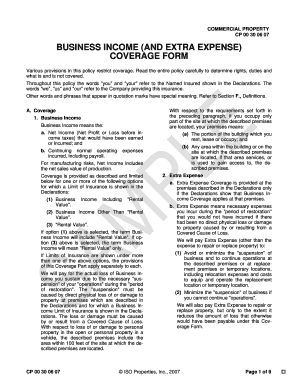

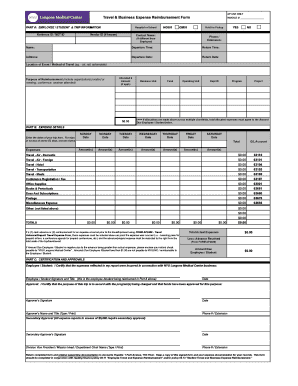

A Business Expense Form is a document used by businesses to track and record expenses incurred for business purposes. It contains fields where employees can input details of the expenses they have paid for, such as receipts, dates, amounts, and categories.

What are the types of Business Expense Form?

There are various types of Business Expense Forms tailored for different types of expenses. Some common types include:

Travel Expense Form

Meal Expense Form

Mileage Expense Form

Entertainment Expense Form

How to complete Business Expense Form

To successfully complete a Business Expense Form, follow these steps:

01

Gather all your receipts and supporting documents.

02

Fill in the necessary information for each expense item.

03

Double-check the accuracy of the information provided.

04

Submit the completed form to the designated person or department for approval.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

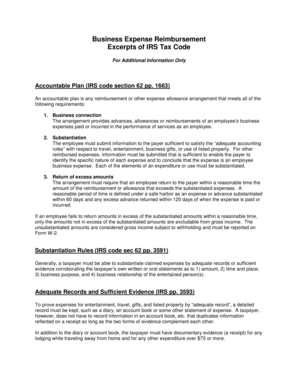

How do I claim business expenses on my tax return?

If you are a sole proprietor, you report your business income and claim your business deductions by filing IRS Schedule C, Profit or Loss From Business with our personal tax return. To make this task easy, Schedule C lists common expense categories—you just need to fill in the amount for each category.

What form do I use for business expenses?

About Form 2106, Employee Business Expenses.

What are 3 business expenses examples?

Business tax, fees, licenses and dues. Insurance expenses. Interest and bank charges. Maintenance and repairs.

Do you need receipts to claim business expenses?

In addition to receipts, other important documentation for expenses and income includes sales slips, paid bills, invoices, deposit slips, canceled checks, cash register tapes, deposit information, receipt books, invoices, and 1099-MISC forms. This documentation will also help you in the future if you are audited.

What qualifies as a business expense?

According to the Internal Revenue Service (IRS), business expenses are ordinary and necessary costs incurred to operate your business. Examples include inventory, payroll and rent. Fixed expenses are regular and don't change much — things like rent and insurance. Variable expenses are expected, but they can change.

What are the 4 business expenses?

Payroll costs (e.g., wages, benefits, and taxes) Advertising and marketing. Utilities. Small business insurance.

Related templates