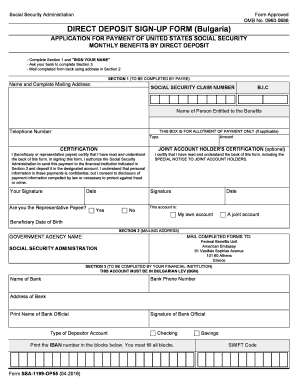

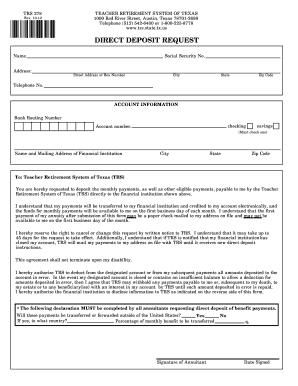

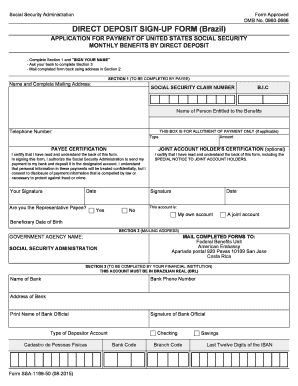

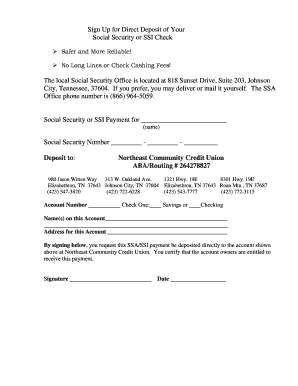

Social Security Direct Deposit Forms

What is social security direct deposit forms?

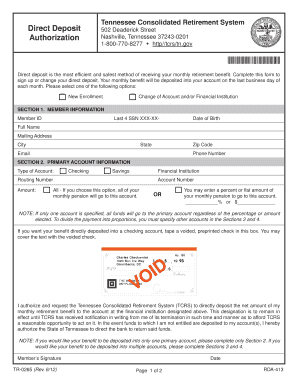

A social security direct deposit form is a document that enables individuals to receive their social security benefits directly into their bank accounts. By completing this form, beneficiaries can avoid the hassle of receiving paper checks and can conveniently access their funds through direct deposit.

What are the types of social security direct deposit forms?

There are two main types of social security direct deposit forms:

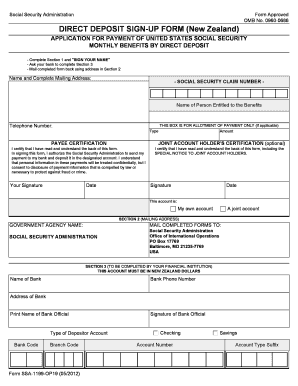

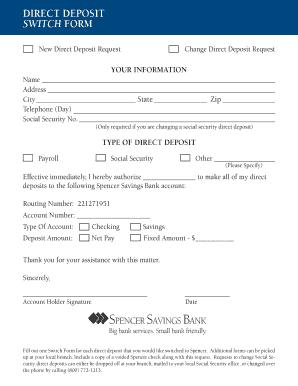

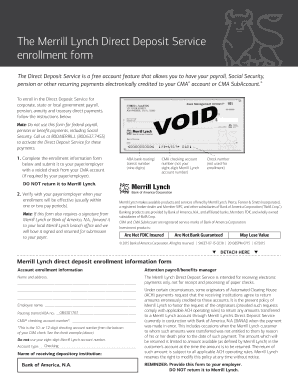

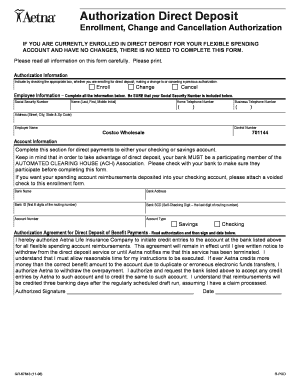

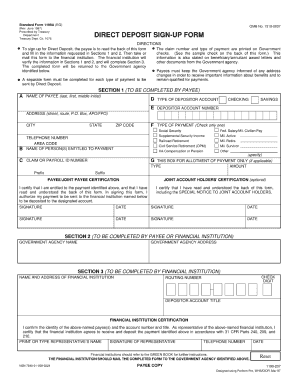

Social Security Administration (SSA) Form 1199A: This form is used by individuals who receive social security benefits and want to set up or change their direct deposit information.

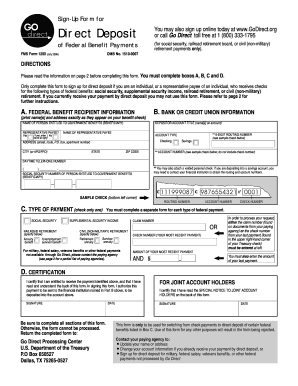

Treasury Department's Go Direct Enrollment Form: This form is specifically designed for individuals who receive federal benefits, including social security, and want to enroll or make changes to their direct deposit details.

How to complete social security direct deposit forms

Completing social security direct deposit forms is a simple process. Here are the steps you need to follow:

01

Obtain the appropriate form: Depending on whether you are an individual receiving social security benefits or a federal benefits recipient, you need to acquire the respective form mentioned above.

02

Provide personal information: Fill in your name, address, social security number, and other required details accurately.

03

Enter banking information: Provide the necessary banking details, such as your account number and routing number, to ensure the direct deposit is made to the correct account.

04

Review and sign: Double-check all the information you have entered before signing the form to ensure accuracy.

05

Submit the form: Once completed, submit the form to the Social Security Administration or the Treasury Department, depending on the form you are using.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out social security direct deposit forms

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Can I change my direct deposit for Social Security by phone?

starting or changing Direct Deposit online (Social Security benefits only), or. contacting your bank, credit union or savings and loan association, or. calling Social Security toll-free at 1-800-772-1213 (TTY 1-800-325-0778), or. visiting your local Social Security Field Office.

How long does it take to change direct deposit bank for Social Security?

How Long Does It Take to Change to Direct Deposit with Social Security? Once you sign up (regardless of the method), it takes 30 to 60 days for any direct deposit changes or new accounts to take effect. Make sure you don't close or switch your bank account before you see that first successful deposit.

Can I change my Social Security direct deposit over the phone?

Another way to change your direct deposit is by calling Social Security at 1-800-772-1213 (TTY 1-800-325-0778) to make the change over the phone. If you prefer to speak to someone in-person, you can visit your local Social Security office with the necessary information.

How do I change my bank information for Social Security direct deposit?

Log in to your account. Sign in and Select the blue Benefits & Payment Details link on the right side of the screen. Scroll down and select the Update Direct Deposit button, and choose if you are the owner or co-owner of the bank account. Enter your bank account information and select Next.

How do you change your automatic deposit for Social Security?

How can I change or sign up for direct deposit for my Social Security or Supplemental Security Income (SSI) payments? contacting your bank, credit union, or savings and loan association. or. calling us at 1-800-772-1213 (TTY 1-800-325-0778).

Can I change my direct deposit information with Social Security online?

You can also create a my Social Security account and start or change Direct Deposit online. In extremely rare circumstances, Treasury may grant exceptions to the electronic payment mandate. For more information or to request a waiver, call Treasury at 855-290-1545.

Related templates