Signed Electronically 1099-MISC Form

Users trust to manage documents on pdfFiller platform

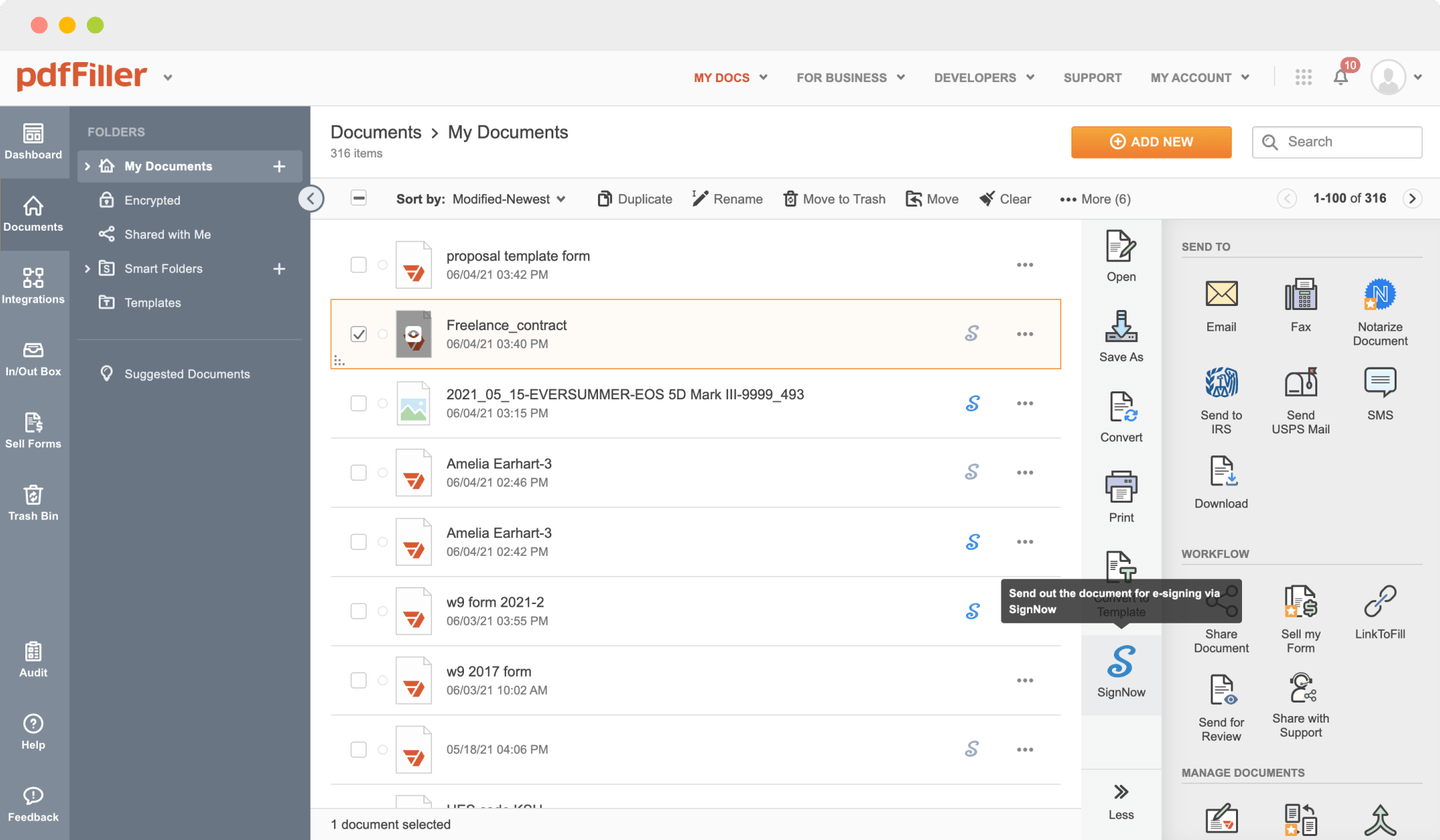

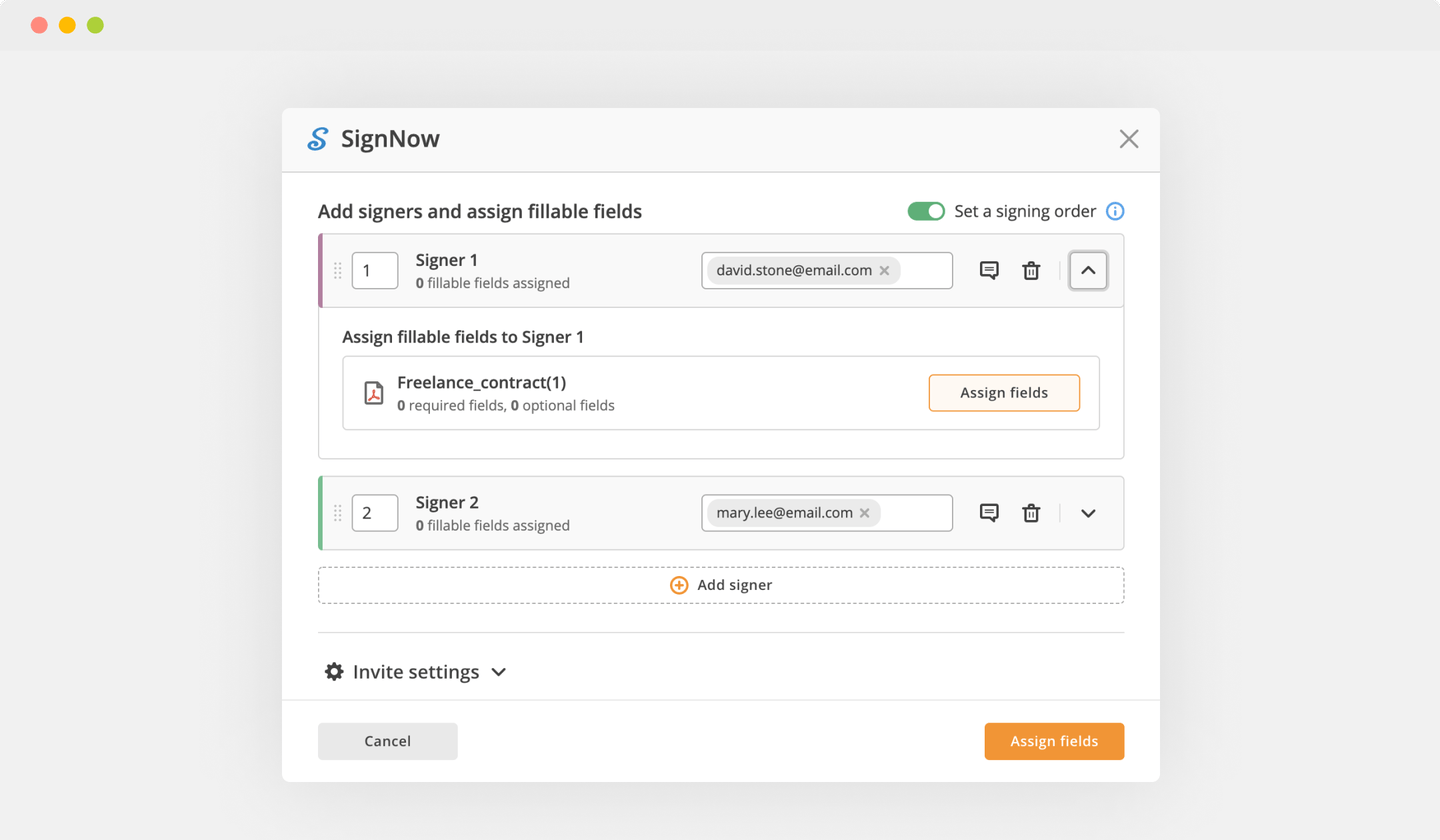

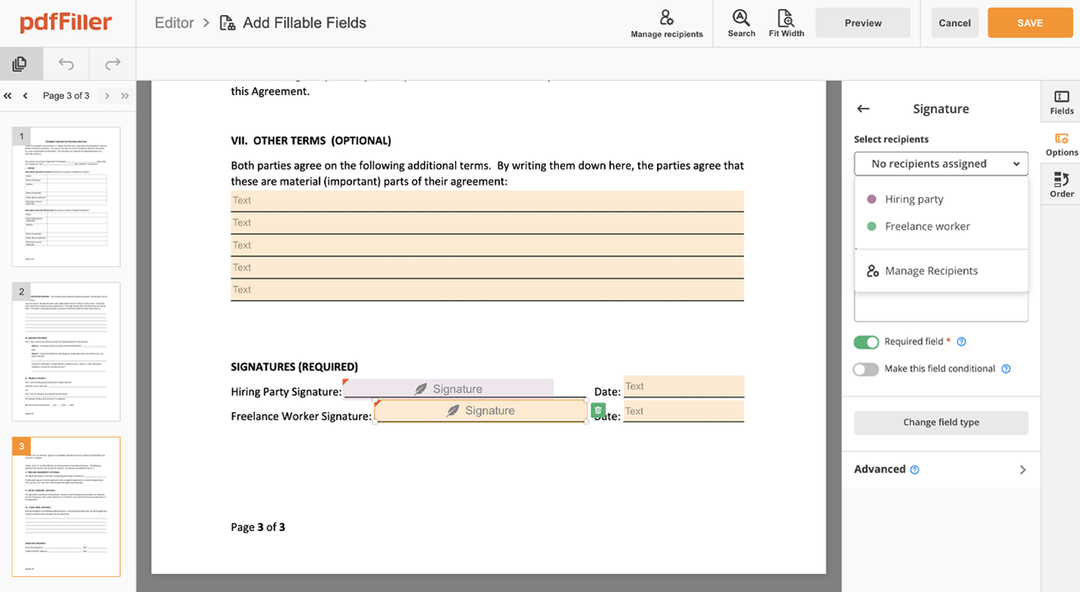

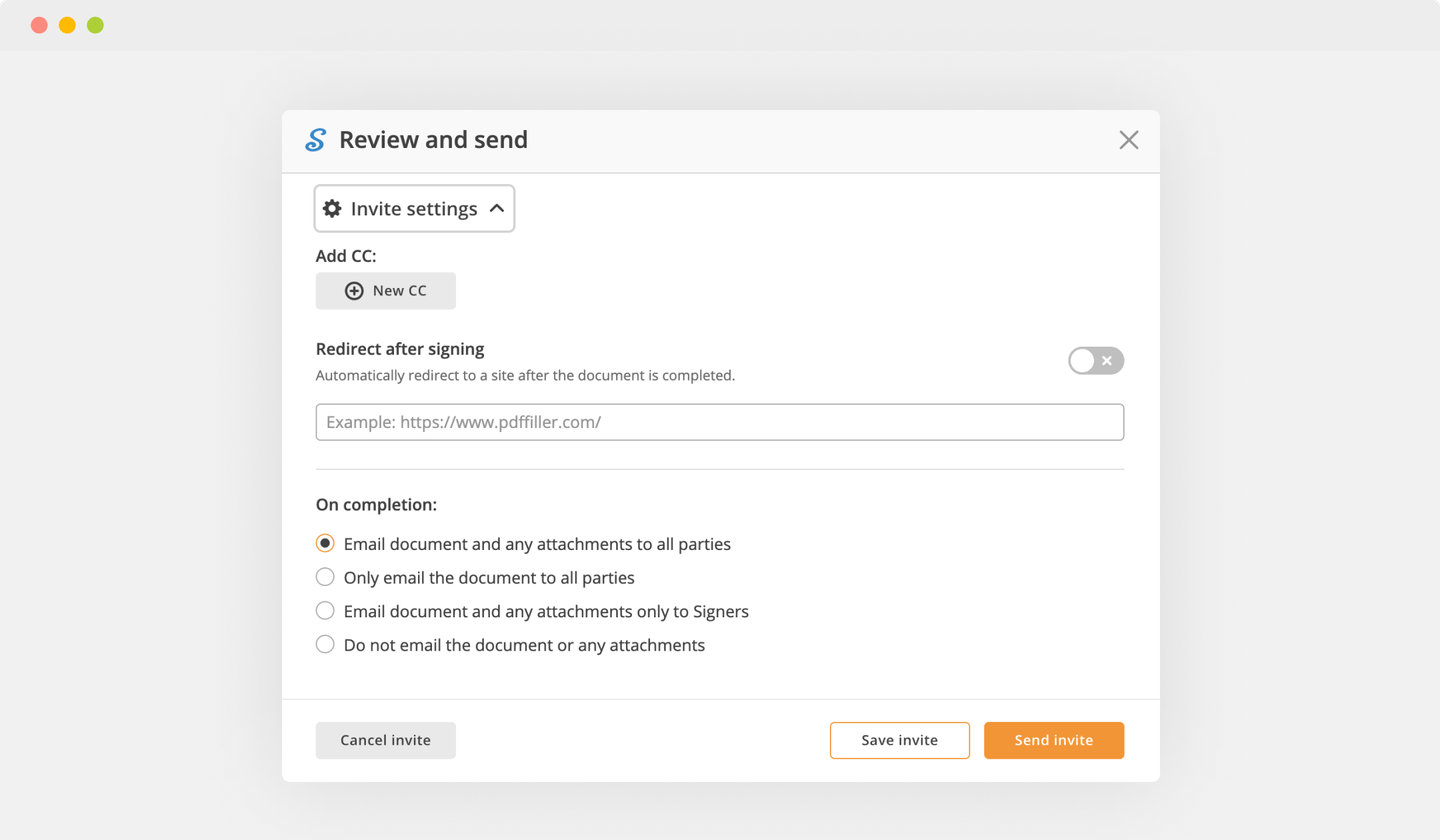

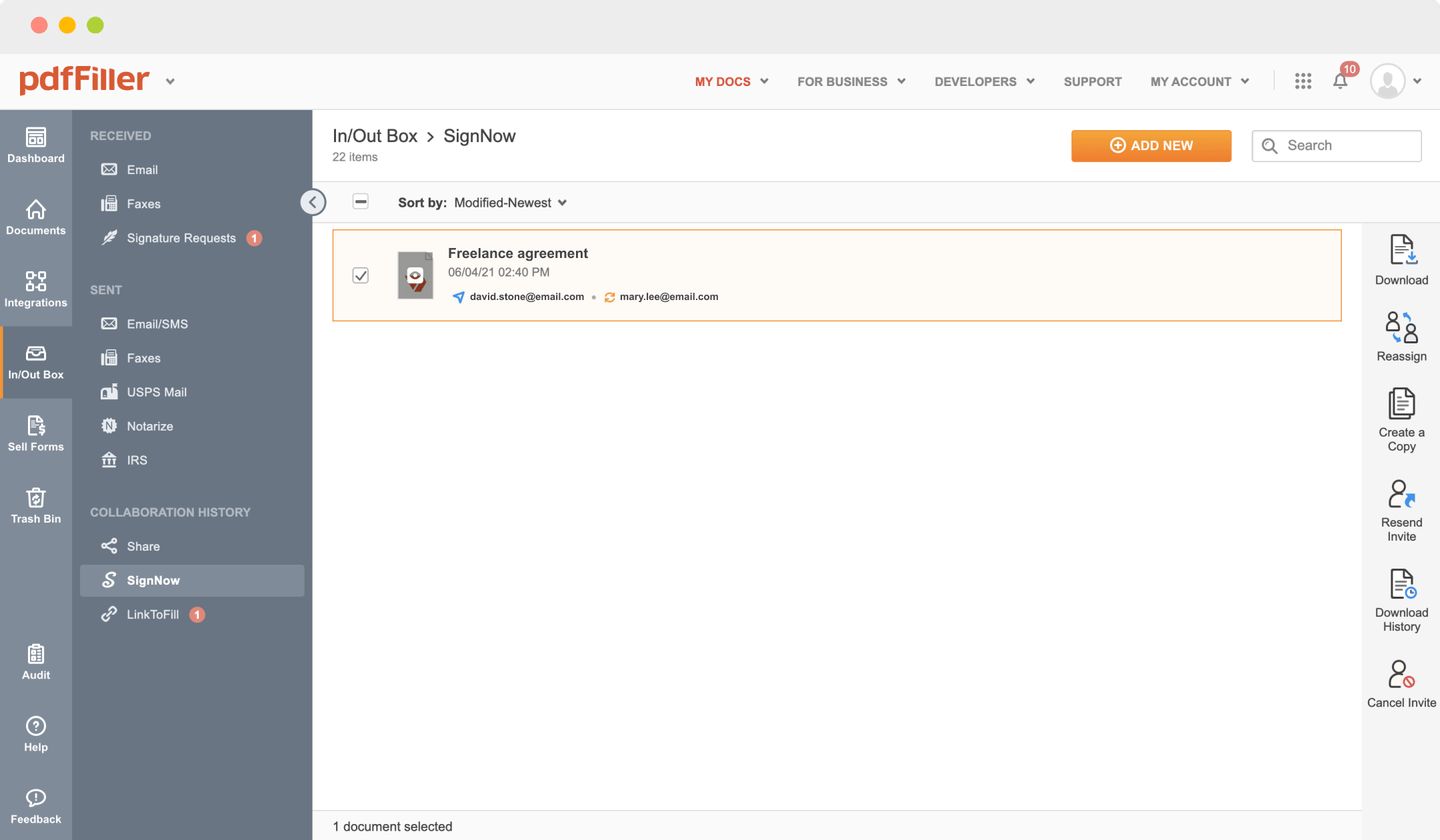

Send documents for eSignature with signNow

Watch a short video walkthrough on how to add an Signed Electronically 1099-MISC Form

pdfFiller scores top ratings in multiple categories on G2

Add a legally-binding Signed Electronically 1099-MISC Form with no hassle

pdfFiller allows you to manage Signed Electronically 1099-MISC Form like a pro. No matter the platform or device you use our solution on, you'll enjoy an instinctive and stress-free method of executing documents.

The whole pexecution flow is carefully protected: from uploading a file to storing it.

Here's the best way to generate Signed Electronically 1099-MISC Form with pdfFiller:

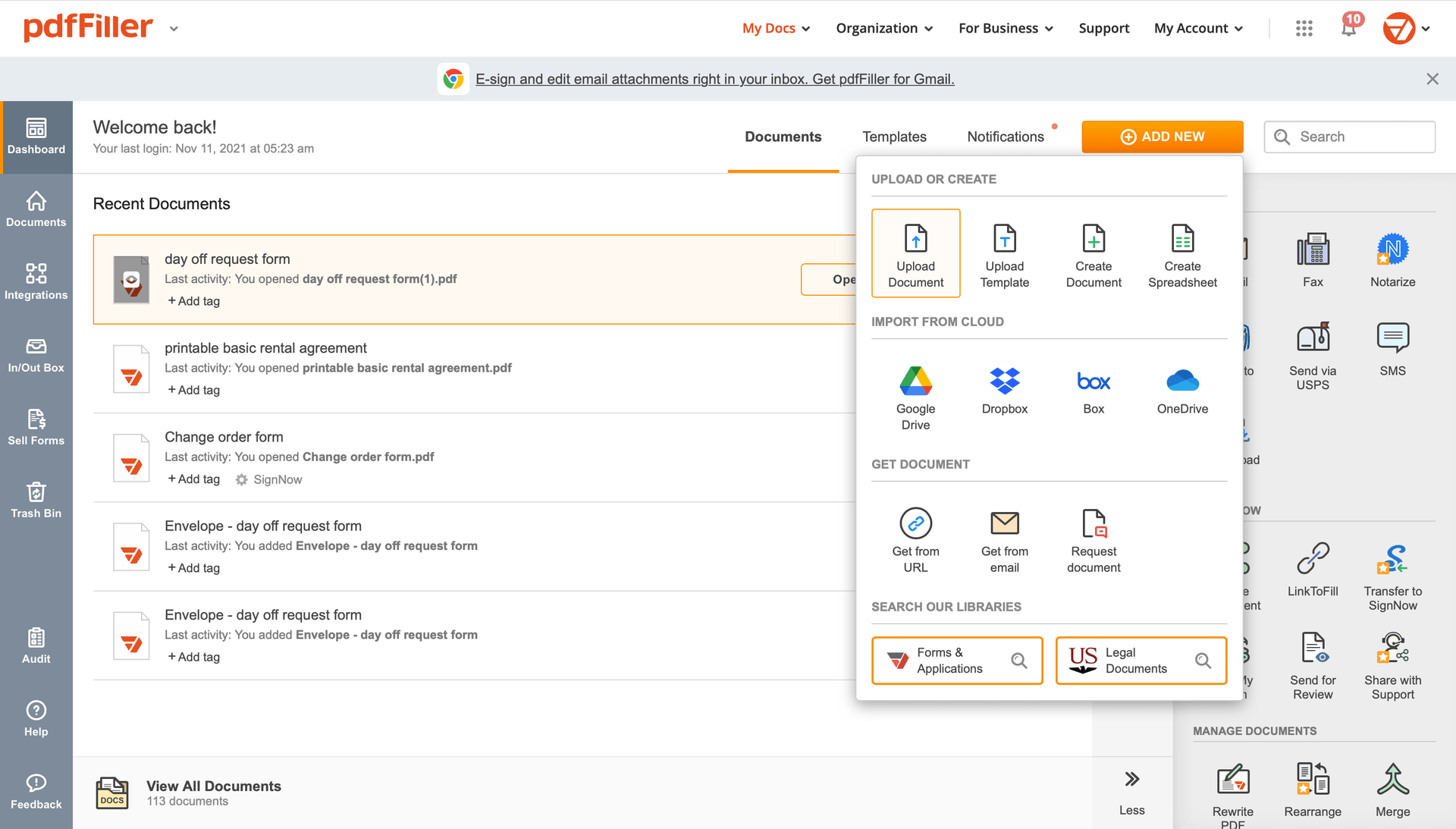

Choose any readily available option to add a PDF file for completion.

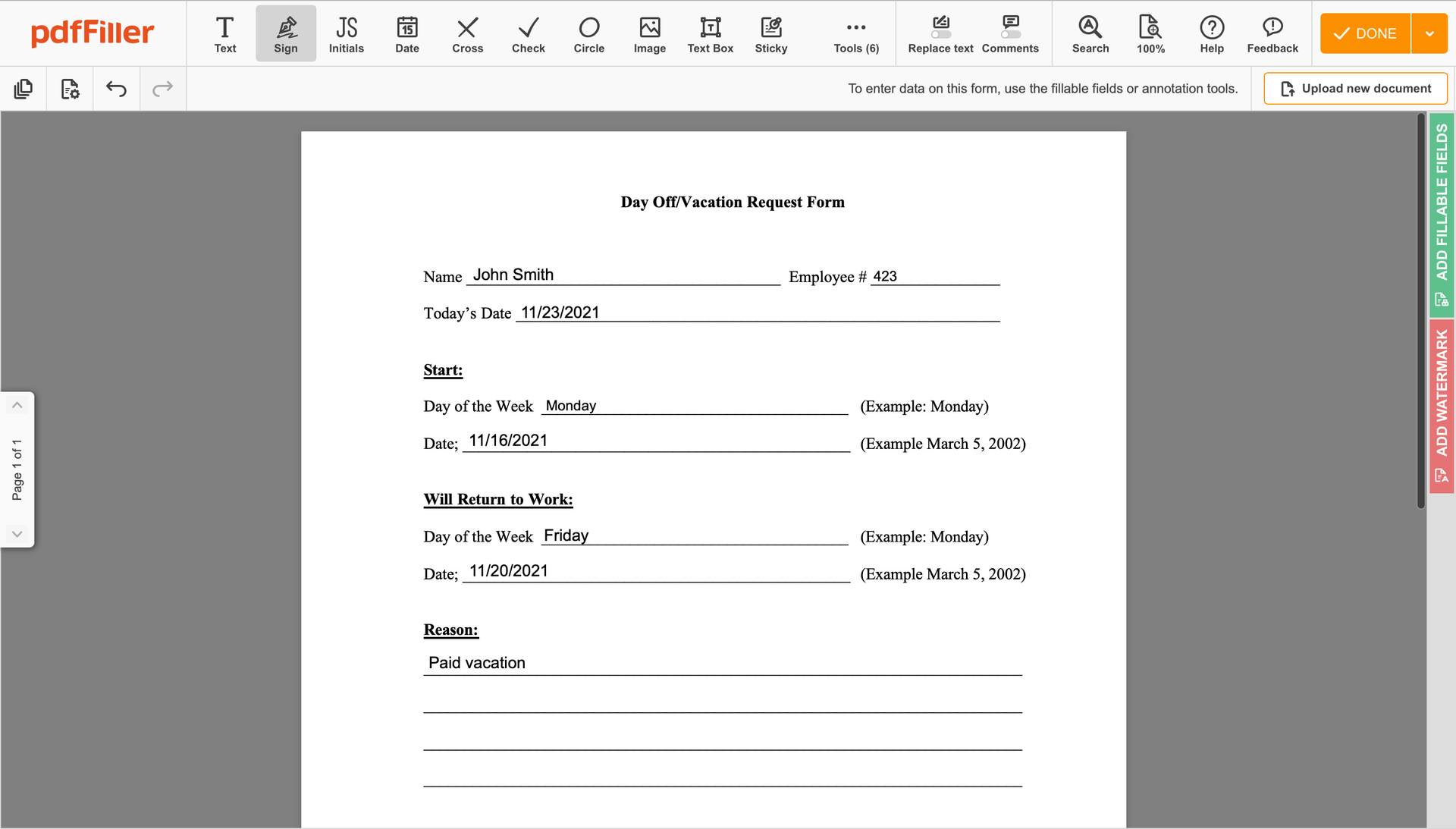

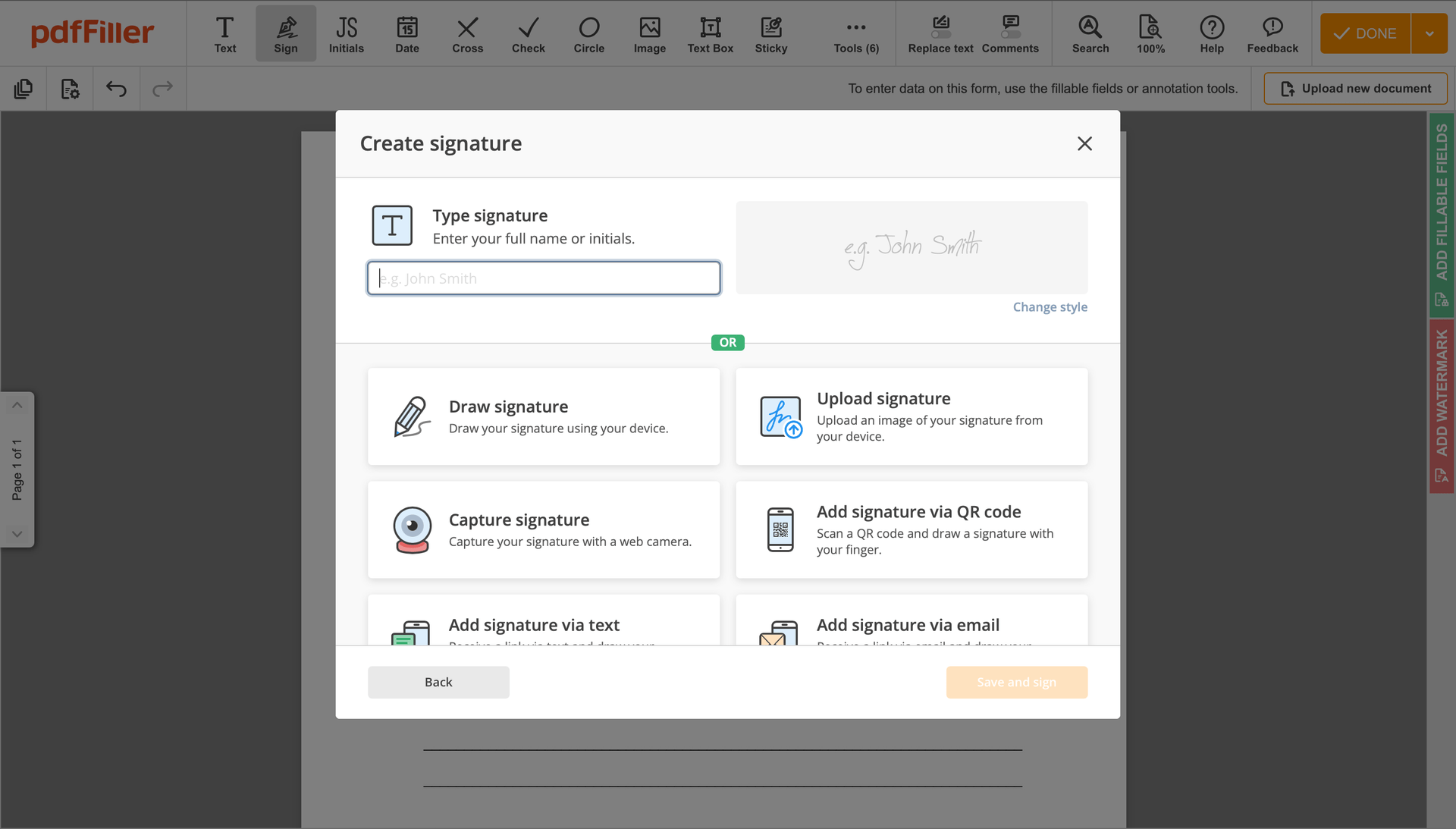

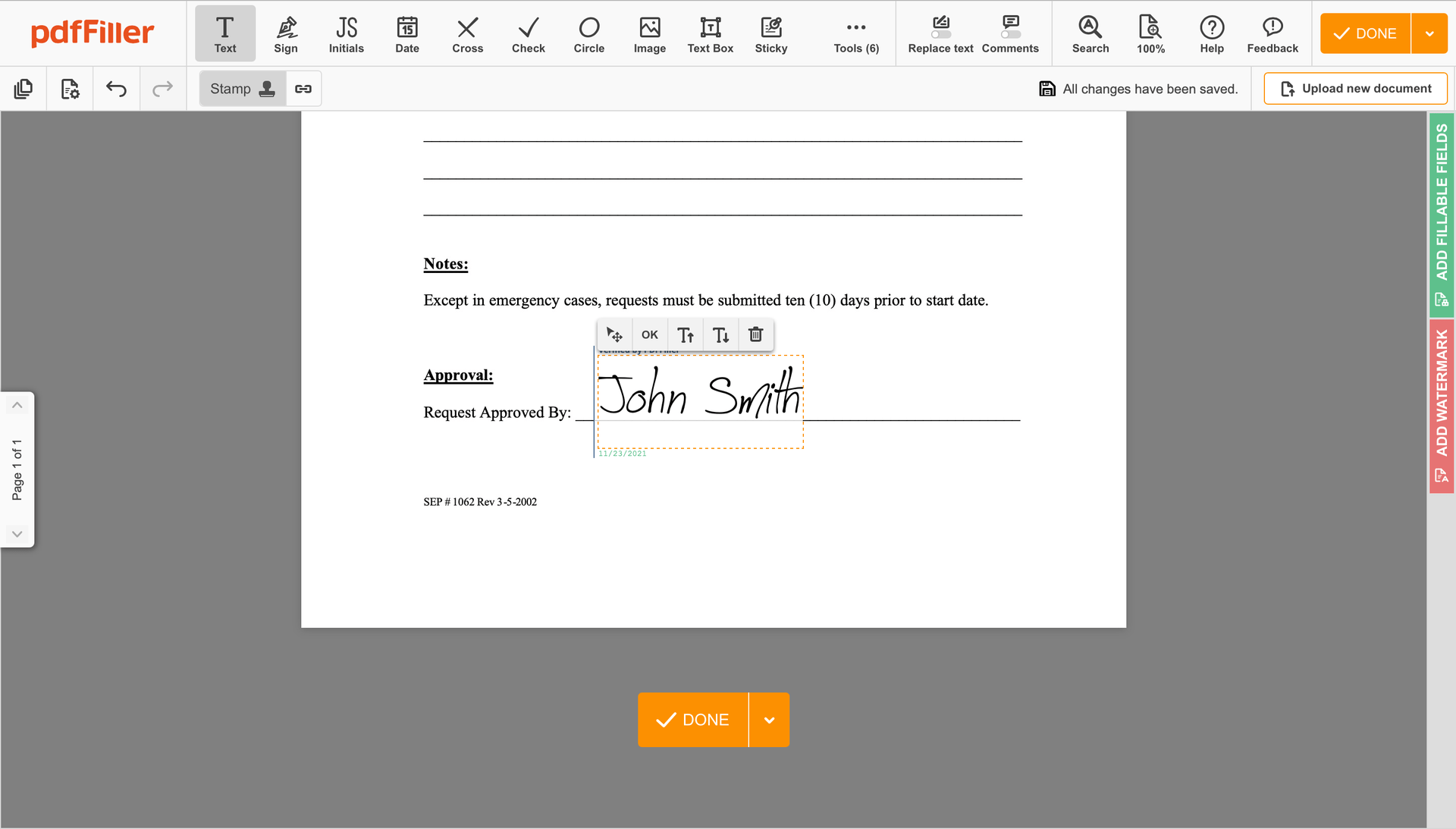

Use the toolbar at the top of the page and select the Sign option.

You can mouse-draw your signature, type it or add an image of it - our solution will digitize it in a blink of an eye. As soon as your signature is created, click Save and sign.

Click on the document place where you want to put an Signed Electronically 1099-MISC Form. You can move the newly generated signature anywhere on the page you want or change its settings. Click OK to save the changes.

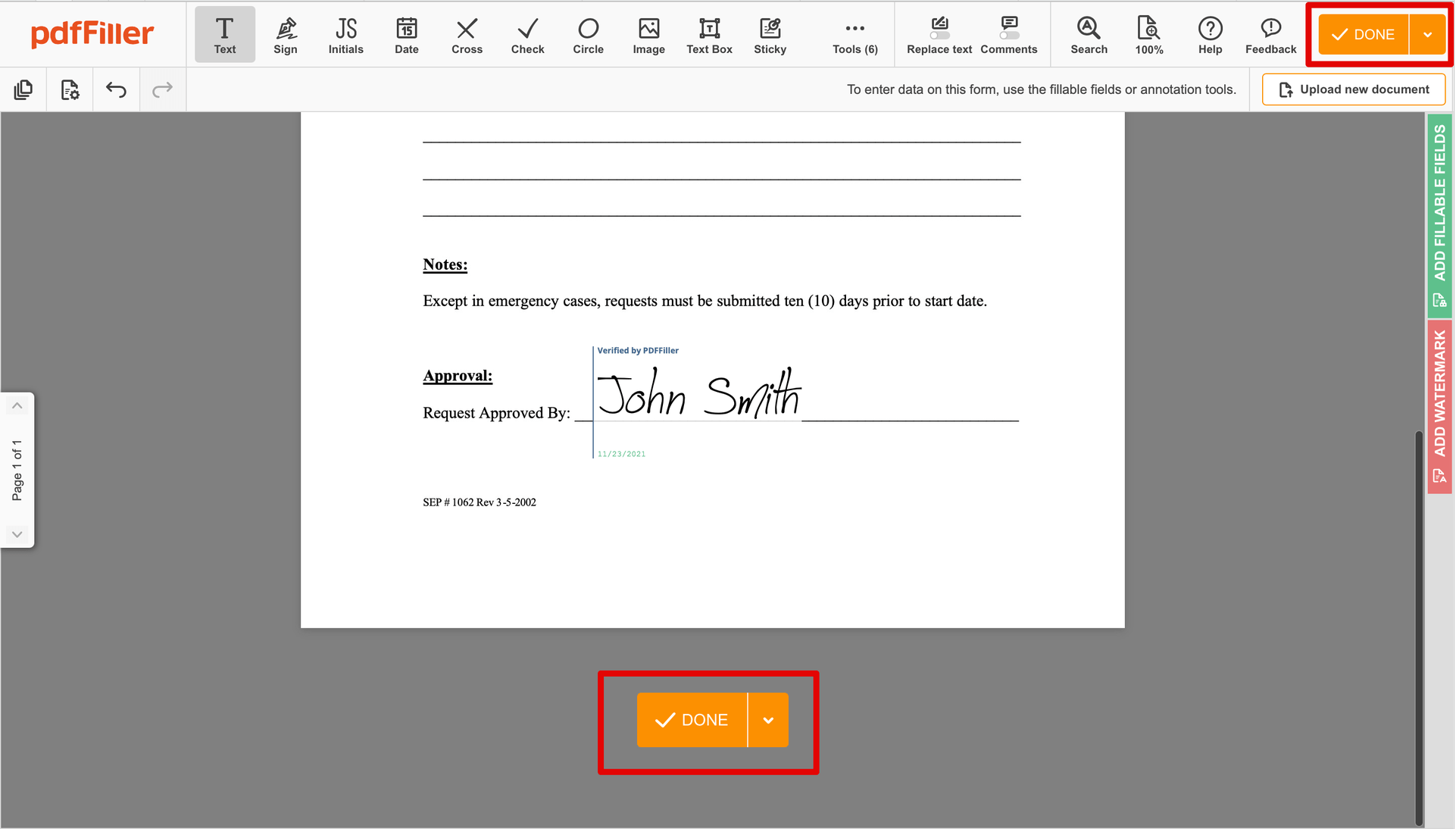

Once your form is ready to go, hit the DONE button in the top right corner.

Once you're done with signing, you will be taken back to the Dashboard.

Utilize the Dashboard settings to download the executed form, send it for further review, or print it out.

Are you stuck with numerous applications to create and edit documents? Try this solution instead. Document management becomes simple, fast and smooth using our tool. Create forms, contracts, make document templates, integrate cloud services and other features without leaving your browser. Plus, it enables you to use Signed Electronically 1099-MISC Form and add high-quality features like orders signing, reminders, attachment and payment requests, easier than ever. Pay as for a lightweight basic app, get the features as of pro document management tools.

How to edit a PDF document using the pdfFiller editor:

How to Send a PDF for eSignature

What our customers say about pdfFiller

I like how intuitive PDFfiller works compared to using a typical graphic design application to fill out PDF forms. PDFfiller does a good job at understanding how to format common documents and makes it easy for me to download files after filling them out. I think that the pricing for PDFfiller is very reasonable and the website is designed very professionally.

What do you dislike?

I have been able to use PDFfiller very smoothly in the time that I've used it, but it's not always perfect when it comes to formatting certain documents. I think they are improving all the time though.

Recommendations to others considering the product:

I would recommend PDFfiller for filling out digital documents, for sure. I think if you compare it to other cloud-based software tools, you'll see that it can work more smoothly with your workflow in many cases.

What problems are you solving with the product? What benefits have you realized?

We work with lots of digital documents, and since it can take a long time to fill them out through printing, writing and scanning, PDFfiller really helps to streamline the document filling and signing process. Everyone on our team that uses PDFfiller was able to start using it without problems pretty quickly.