Cra-arc Gc Forms

What are Cra-arc Gc Forms?

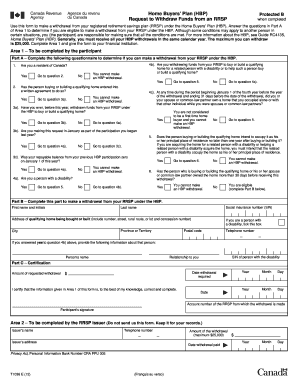

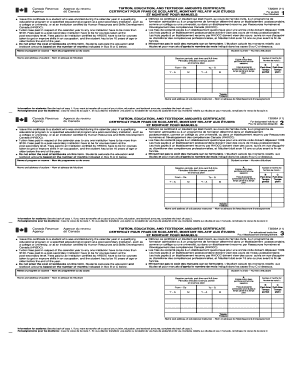

Cra-arc Gc Forms are official documents issued by the Canada Revenue Agency (CRA) that individuals and businesses use to report various tax information to the Canadian government.

What are the types of Cra-arc Gc Forms?

There are several types of Cra-arc Gc Forms that cater to different tax reporting needs. Some common forms include T1 General, T2 Corporation Income Tax Return, and T4 Statement of Remuneration Paid.

How to complete Cra-arc Gc Forms

Completing Cra-arc Gc Forms can seem daunting, but with the right guidance, it can be a straightforward process. Here are some tips to help you complete the forms accurately:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.