Depreciation Calculator

What is Depreciation Calculator?

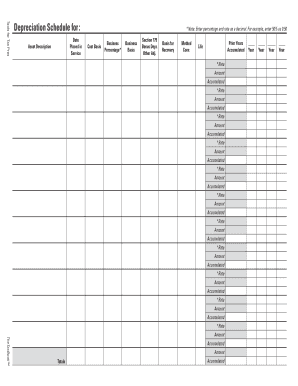

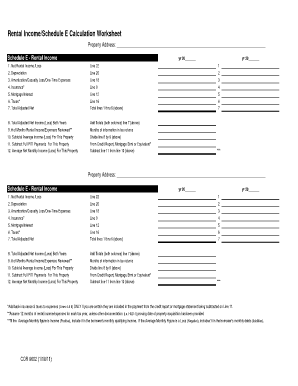

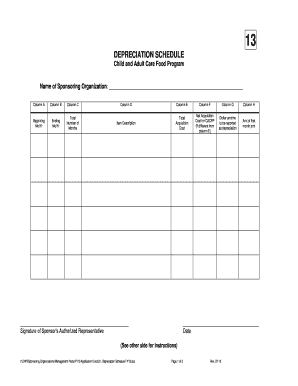

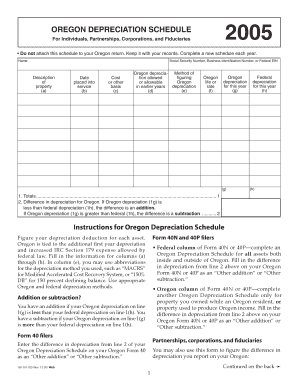

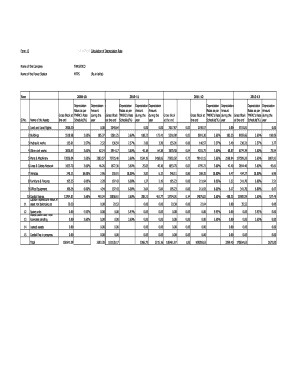

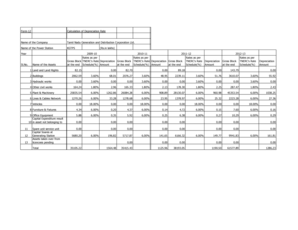

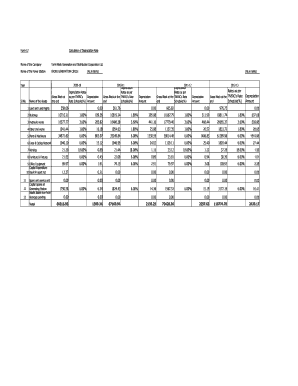

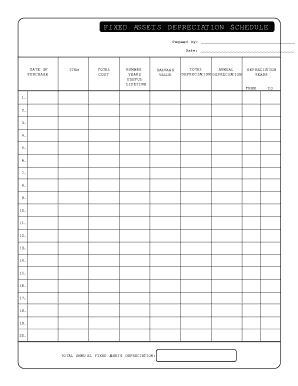

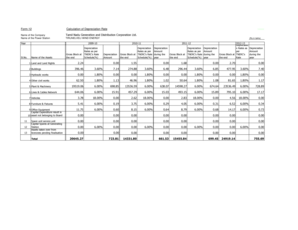

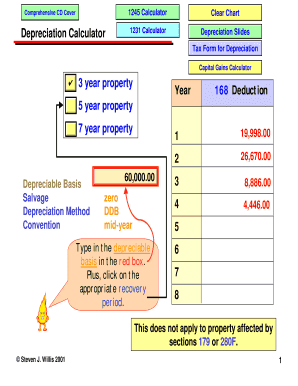

Depreciation Calculator is a tool used to calculate the decrease in value of an asset over time. It helps individuals and businesses determine the value loss of their assets and assists in financial planning. By entering the necessary information such as the purchase price, useful life, and depreciation method, the calculator provides accurate depreciation amounts.

What are the types of Depreciation Calculator?

Depreciation Calculator comes in various types depending on the method used to calculate depreciation. Some common types of Depreciation Calculator include:

How to complete Depreciation Calculator

Completing a Depreciation Calculator is simple and straightforward. Follow these steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.