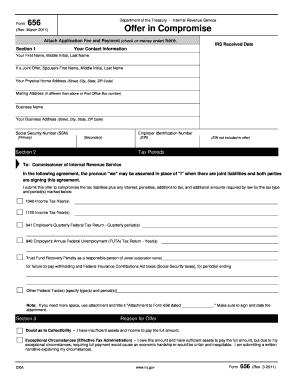

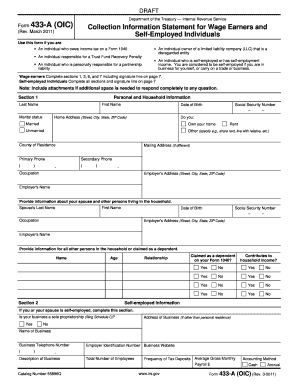

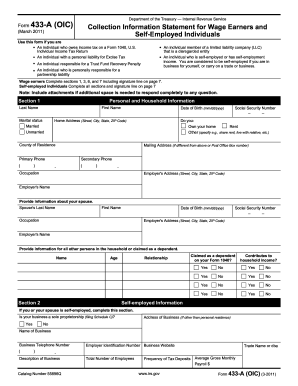

Form 656

What is form 656?

Form 656, also known as the Offer in Compromise Application, is a form used by taxpayers to request a reduction in their tax debt. This form is typically submitted to the IRS when a taxpayer is unable to pay the full amount of taxes owed.

What are the types of form 656?

There are three main types of Form 656 that taxpayers can choose from based on their financial situation:

Doubt as to Liability

Doubt as to Collectibility

Effective Tax Administration

How to complete form 656

Completing Form 656 can be a daunting task, but with the right guidance, it can be done efficiently. Here are some steps to help you complete Form 656:

01

Gather all necessary financial information and supporting documentation.

02

Fill out the form accurately and completely, making sure to double-check all information.

03

Submit the form to the IRS along with the required fee and supporting documents.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out form 656

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

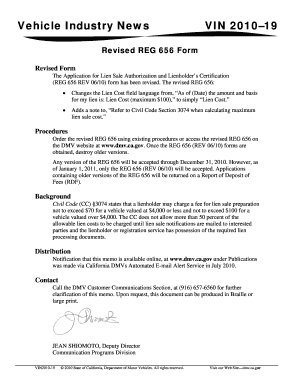

Related templates