How Does Lease With Option To Buy A House Work

What is how does lease with option to buy a house work?

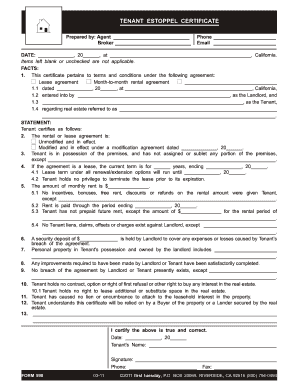

Lease with option to buy a house, also known as a rent-to-own agreement, is a unique arrangement that allows individuals to lease a property with the option to purchase it in the future. This can be an ideal solution for those who are not yet ready or able to buy a home through traditional means, but still want the opportunity to eventually own the property they are living in. With this arrangement, tenants have the flexibility to try out a property and make an informed decision before committing to a long-term mortgage.

What are the types of how does lease with option to buy a house work?

There are two common types of lease with option to buy agreements: lease purchase agreements and lease option agreements. 1. Lease Purchase Agreements: With this type of agreement, the tenant is legally obligated to purchase the property at the end of the lease term. A portion of the monthly rent is typically credited towards the purchase price, allowing tenants to build equity over time. 2. Lease Option Agreements: In a lease option agreement, the tenant has the option, but not the obligation, to buy the property at the end of the lease term. This provides more flexibility for the tenant, as they can choose whether to proceed with the purchase based on their experience living in the property.

How to complete how does lease with option to buy a house work

Completing a lease with option to buy a house requires the following steps: 1. Find a suitable property: Start by researching suitable properties in your desired location. Look for properties that are available for lease with an option to buy. 2. Negotiate terms: Once you find a property, negotiate the terms of the lease agreement with the landlord or property owner. Make sure to clarify the purchase price, lease term, and any other important details. 3. Conduct inspections: Before finalizing the agreement, thoroughly inspect the property to ensure it meets your expectations and is in good condition. 4. Sign the agreement: Once you are satisfied with the terms and the condition of the property, sign the lease with option to buy agreement. 5. Make monthly payments: As a tenant, you will be responsible for making monthly rent payments, which may include a portion credited towards the purchase price. 6. Decide on the purchase: At the end of the lease term, you will have the option to proceed with the purchase or walk away. Evaluate your financial situation and consider consulting a real estate professional before making a decision.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.