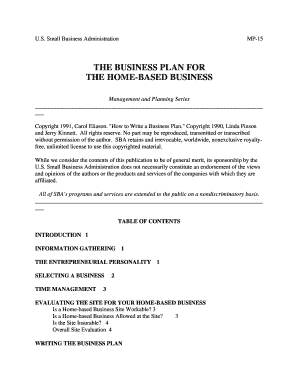

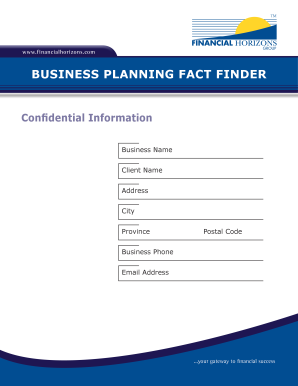

What is sba business plan template?

A sba business plan template is a pre-designed document that outlines the structure and content of a business plan. It serves as a framework for entrepreneurs and businesses to organize their ideas and present them in a professional and strategic manner. The sba business plan template includes sections such as executive summary, company description, market analysis, product or service offerings, financial projections, and more. By using a sba business plan template, individuals can save time and effort in creating a business plan from scratch and focus on the content that matters most.

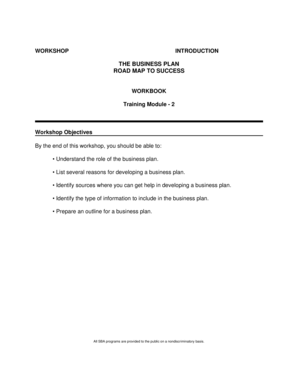

What are the types of sba business plan template?

There are various types of sba business plan templates available to cater to different industries and business needs. Some common types include:

Standard sba business plan template: This template follows the traditional structure of a business plan and includes essential sections such as executive summary, market analysis, financial projections, etc.

Startup sba business plan template: Specifically designed for new businesses, this template focuses on outlining the unique aspects of a startup, including market potential, competitive landscape, and growth strategies.

Online business sba business plan template: Tailored for online business ventures, this template emphasizes aspects such as website development, digital marketing strategies, and monetization models.

Restaurant sba business plan template: Created for the foodservice industry, this template covers areas like menu planning, staffing, location analysis, and cost projections.

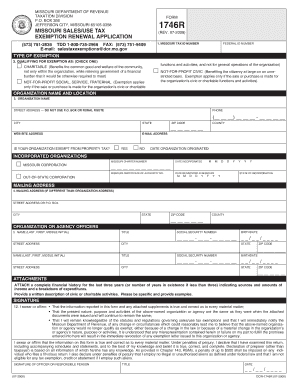

Nonprofit sba business plan template: Designed for nonprofit organizations, this template highlights the mission, objectives, and strategies specific to the nonprofit sector.

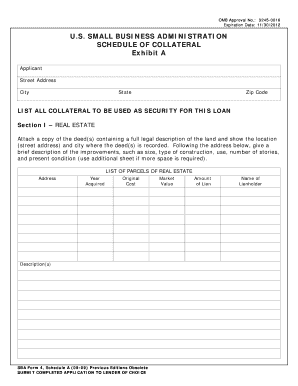

Real estate sba business plan template: Geared towards real estate professionals and investors, this template focuses on property acquisition, market trends, financing options, and return on investment calculations.

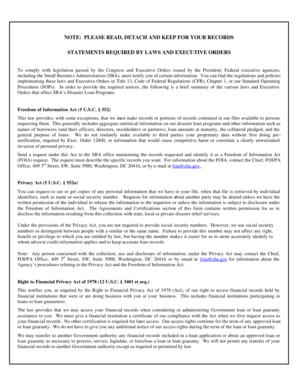

How to complete sba business plan template

Completing a sba business plan template involves following a systematic approach to fill out each section with relevant information. Here are the steps to complete an sba business plan template:

01

Start with the executive summary: Summarize the key aspects of your business plan, including the mission statement, target market, competitive advantage, and financial highlights.

02

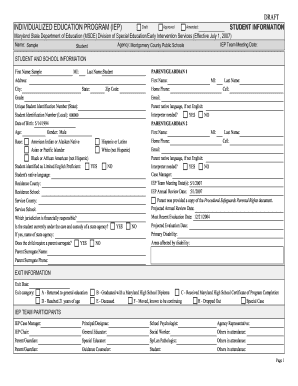

Describe your company: Provide an overview of your company, its history, legal structure, products or services, and target market.

03

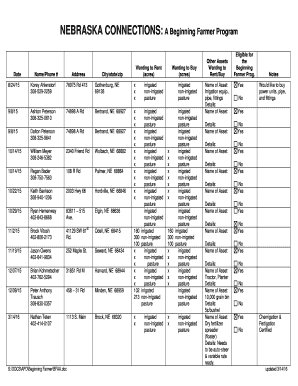

Perform market research: Analyze the industry and market trends, identify your target audience, analyze competitors, and outline your market strategies.

04

Outline your products or services: Detail the features, benefits, and pricing of your offerings, highlighting how they address customer needs or pain points.

05

Develop a marketing and sales strategy: Explain how you plan to promote and sell your products or services, including your pricing, distribution channels, and marketing initiatives.

06

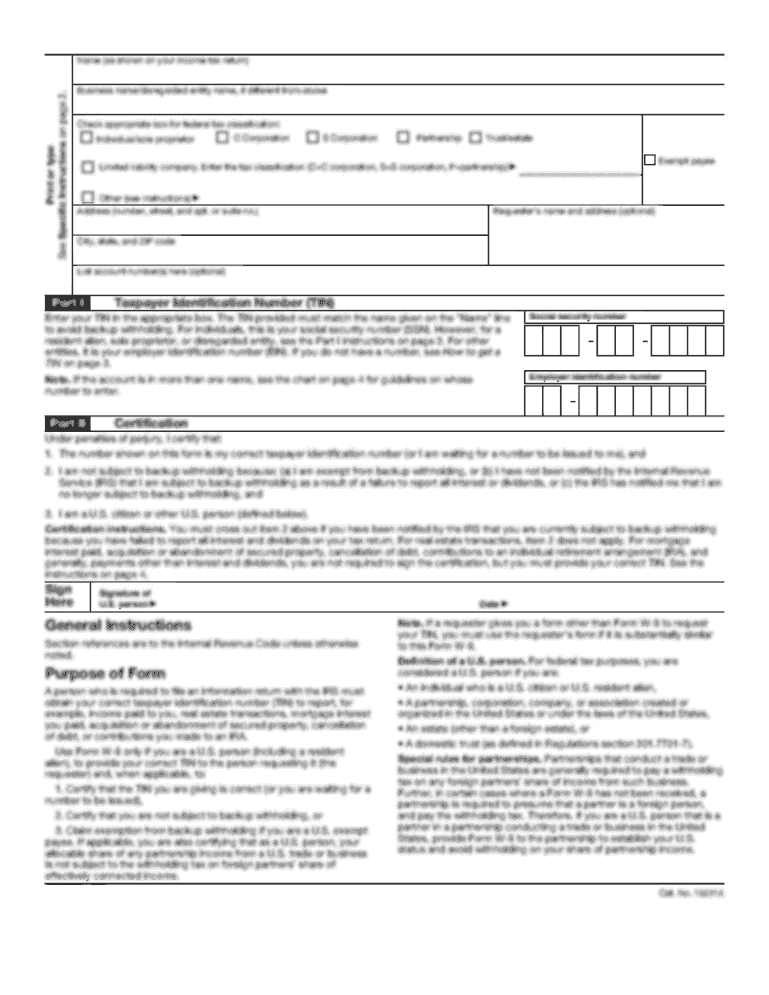

Project your financials: Include detailed financial projections such as sales forecasts, income statements, cash flow statements, and balance sheets.

07

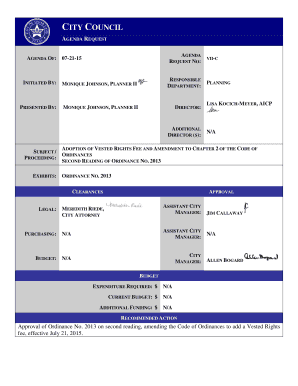

Address operational aspects: Describe your organizational structure, staffing plan, operational processes, and any legal or regulatory requirements.

08

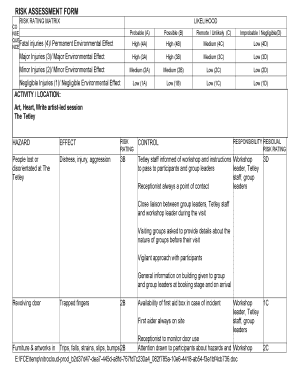

Create a comprehensive risk assessment: Identify potential risks and challenges your business may face, and outline contingency plans to mitigate them.

09

Review and revise: Go through your completed sba business plan template, ensuring accuracy, coherence, and logical flow of information. Revise as needed to make it a persuasive and well-presented document.

If you're looking for an efficient tool to create, edit, and share your sba business plan template online, pdfFiller is here to help. With unlimited fillable templates and powerful editing tools, pdfFiller empowers users to quickly and easily generate professional business plans. Start leveraging pdfFiller's capabilities today to streamline your business planning process.