What is small estate affidavit california?

A small estate affidavit in California is a legal document that allows the transfer of assets such as real estate, personal property, and bank accounts to heirs without the need for probate. It is a simplified and cost-effective alternative to the lengthy and expensive probate process.

What are the types of small estate affidavit california?

There are two main types of small estate affidavit in California: 1. Affidavit for Personal Property: This type of affidavit is used when the total value of the estate's personal property, excluding real estate and joint tenancies, does not exceed $166,250. 2. Affidavit for Real Property: This type of affidavit is used when the total value of the estate's real property, excluding joint tenancies, does not exceed $55,425.

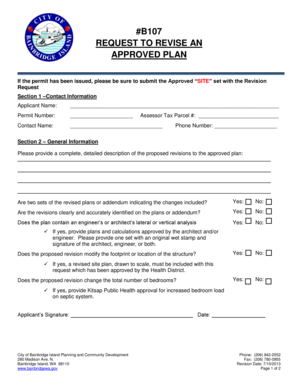

How to complete small estate affidavit california

Completing a small estate affidavit in California involves the following steps: 1. Gather required information: Collect all the necessary details about the deceased, the estate's assets, and the potential heirs. 2. Download the appropriate affidavit form: Visit the California Courts website or consult an attorney to download the correct form based on the type of property. 3. Provide accurate information: Fill in the form with accurate information about the deceased, assets, heirs, and other required details. 4. Sign the affidavit: The affiant, the person completing the affidavit, needs to sign it in the presence of a notary public. 5. File the affidavit: Submit the completed and signed affidavit to the county clerk's office where the deceased person resided. 6. Notify interested parties: Provide copies of the affidavit to interested parties such as creditors, banks, or other relevant entities. 7. Transfer assets: Once the affidavit is accepted by the county clerk, the assets can be transferred to the designated heirs.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.