Triple Net Lease Form New York

What is triple net lease form new york?

A triple net lease form in New York is a type of lease agreement where the tenant is responsible for paying not only the base rent but also the property taxes, insurance, and maintenance costs associated with the property. This type of lease is commonly used in commercial real estate, especially for long-term leases.

What are the types of triple net lease form new york?

In New York, there are three main types of triple net lease forms: 1. Single Net Lease: In this type of lease, the tenant is responsible for paying the property taxes. 2. Double Net Lease: In addition to property taxes, the tenant also pays for insurance. 3. Triple Net Lease: The tenant is responsible for paying property taxes, insurance, and maintenance costs.

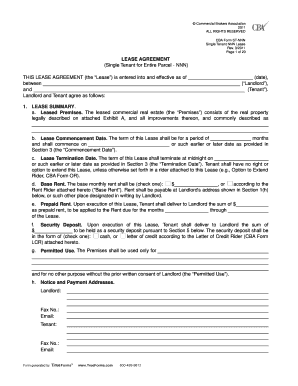

How to complete triple net lease form new york

Completing a triple net lease form in New York is a straightforward process. Here are the steps to follow: 1. Download a triple net lease form from a reputable source or use an online platform like pdfFiller. 2. Fill in the necessary information, including the names of the parties involved, property details, lease terms, and payment details. 3. Review the form to ensure all information is accurate and complete. 4. Sign the lease form electronically using a platform like pdfFiller. 5. Share the completed form with all parties involved for their review and signatures.

With pdfFiller's powerful editing tools and unlimited fillable templates, completing a triple net lease form in New York has never been easier. Empowering users to create, edit, and share documents online, pdfFiller is the go-to PDF editor for getting important documents done.