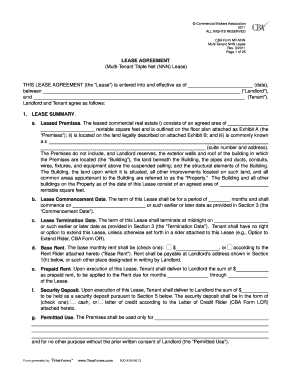

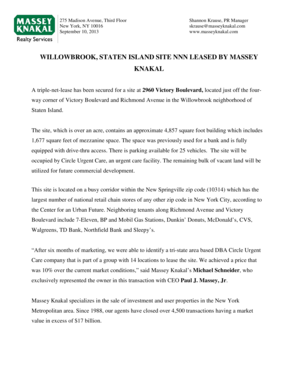

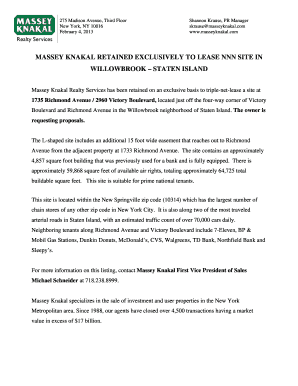

What is Triple Net Real Property Lease?

A Triple Net Real Property Lease, also known as NNN lease, is a lease agreement in which the tenant is responsible for paying not only the base rent but also the property taxes, insurance, and maintenance costs associated with the property. This type of lease transfers the financial burden of these expenses from the landlord to the tenant, making it an attractive option for property owners.

What are the types of Triple Net Real Property Lease?

There are three main types of Triple Net Real Property Leases:

Single Net Lease: In this type of lease, the tenant is responsible for paying only the property taxes. The landlord covers all other expenses such as insurance and maintenance costs.

Double Net Lease: In a Double Net Lease, the tenant is responsible for paying both property taxes and insurance. The landlord is responsible for the maintenance costs.

Triple Net Lease: This is the most comprehensive type of Triple Net Lease. The tenant is responsible for paying all three expenses: property taxes, insurance, and maintenance costs.

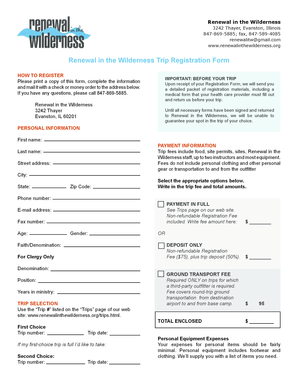

How to complete Triple Net Real Property Lease

Completing a Triple Net Real Property Lease involves several steps to ensure a smooth process. Here is a step-by-step guide:

01

Understand the terms: Familiarize yourself with the terms of the lease agreement, including the rent amount, the duration of the lease, and the responsibilities of both the landlord and the tenant.

02

Negotiate the terms: If there are any clauses or terms that you are not comfortable with, negotiate with the landlord to reach a mutually beneficial agreement.

03

Review the lease agreement: Carefully review the lease agreement to ensure that all the necessary details are included and accurately stated.

04

Seek legal advice: It is always recommended to consult with a real estate attorney to review the lease agreement and ensure that your rights and interests are protected.

05

Sign the lease agreement: Once everything is in order, sign the lease agreement and ensure that all parties involved receive a copy for their records.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.