Last updated on

Jan 19, 2026

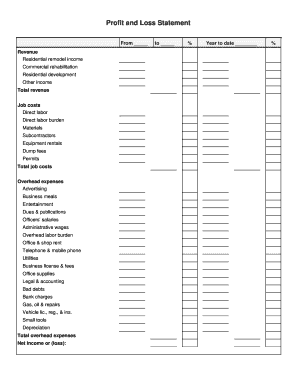

Customize and complete your essential Income Statement Quarterly template

Prepare to streamline document creation using our fillable Income Statement Quarterly template. Create exceptional documents effortlessly with just a few clicks.

Spend less time on PDF documents and forms with pdfFiller’s tools

Comprehensive PDF editing

Build documents by adding text, images, watermarks, and other elements. A complete set of formatting tools will ensure a polished look of your PDFs.

Fillable fields

Drag and drop fillable fields, checkboxes, and dropdowns on your PDFs, allowing users to add their data and signatures without hassle.

Templates for every use case

Speed up creating contracts, application forms, letters, resumes, and other documents by selecting a template and customizing it to your needs.

Electronic signature

Instantly sign any document and make it easy for others to sign your forms by adding signature fields, assigning roles, and setting a signing order.

Online forms

Publish fillable forms on your website or share them via a direct link to capture data, collect signatures, and request payments.

Easy collaboration

Work on documents together with your teammates. Exchange comments right inside the editor, leave sticky notes for your colleagues, highlight important information, and blackout sensitive details.

Millions of users trust pdfFiller to create, edit, and manage documents

64M+

million users worldwide

35M+

PDF forms available in the online library

53%

of documents created from templates

65.5K+

documents added daily

Customize Your Essential Income Statement Quarterly Template

Managing your finances effectively is crucial for your business success. With our essential Income Statement Quarterly template, you can customize key components to match your specific needs. This template simplifies your financial reporting process, allowing you to gain valuable insights into your business performance.

Key Features

Flexible customization options to align with your financial structure

Clear layout for easy comprehension and analysis

Automated calculations for accuracy and efficiency

Monthly, quarterly, and annual reporting capabilities

Compatible with various accounting software

Potential Use Cases and Benefits

Track your revenue and expenses effectively each quarter

Provide stakeholders with transparent financial information

Simplify tax preparation with organized financial data

Support strategic planning with clear financial trends

Make informed business decisions based on accurate reports

By using our Income Statement Quarterly template, you solve the problem of disorganized financial data. You can communicate your financial health clearly and confidently. This tool not only saves time but also enhances transparency and helps you tell your financial story. Take control of your business today.

Kickstart your document creation process

Browse a vast online library of documents and forms for any use case and industry.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Our user reviews speak for themselves

Your go-to guide on how to create a Income Statement Quarterly

Creating a Income Statement Quarterly has never been so easy with pdfFiller. Whether you need a professional forms for business or individual use, pdfFiller offers an intuitive platform to make, customize, and manage your paperwork effectively. Employ our versatile and editable web templates that line up with your precise needs.

Bid farewell to the hassle of formatting and manual customization. Employ pdfFiller to smoothly create polished forms with a simple click. Begin your journey by following our comprehensive guidelines.

How to create and complete your Income Statement Quarterly:

01

Sign in to your account. Access pdfFiller by logging in to your profile.

02

Search for your template. Browse our complete library of document templates.

03

Open the PDF editor. When you have the form you need, open it up in the editor and utilize the editing instruments at the top of the screen or on the left-hand sidebar.

04

Place fillable fields. You can select from a list of fillable fields (Text, Date, Signature, Formula, Dropdown, etc.).

05

Edit your form. Add text, highlight areas, insert images, and make any required modifications. The intuitive interface ensures the procedure remains smooth.

06

Save your changes. Once you are happy with your edits, click the “Done” button to save them.

07

Send or store your document. You can send out it to others to eSign, download, or securely store it in the cloud.

To conclude, crafting your documents with pdfFiller templates is a smooth process that saves you time and ensures accuracy. Start using pdfFiller right now to take advantage of its robust features and seamless paperwork management.

Ready to try the award-winning PDF editor in action?

Start creating your document in pdfFiller and experience firsthand how effortless it can be.

Questions & answers

Below is a list of the most common customer questions.If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

When should the income statement be prepared?

An income statement should be prepared monthly at the end of each accounting period, quarterly, and year-end for financial reporting. A projected (forecast) income statement for future accounting periods should be prepared when business plans, cash flow forecasts, or other financial models are needed.

Is an income statement only ever prepared for a month or a year?

While the balance sheet provides a snapshot of a company's financials as of a particular date, the income statement reports income through a specific period, usually a quarter or a year. The period the income statement covers is indicated in its heading.

Can income statement be prepared monthly?

Most companies create annual income statements, though you can prepare one for other periods of time, depending on your company's needs, like by month or by quarter. There are several types of income statements, often used to share information with different internal or external stakeholders.

Can the statement of income be prepared monthly quarterly or annually?

Income statements can be prepared monthly, quarterly, or annually, depending on your reporting needs. Larger businesses typically run quarterly reporting, while small businesses may benefit from monthly reporting to better track business trends.

Is an income statement done monthly or yearly?

Frequent reports: While other financial statements are published annually, the income statement is generated either quarterly or monthly. Due to this, business owners and investors can track the performance of the business closely and make informed decisions.

Can you do an income statement monthly?

If an income statement reports data for shorter intervals, for example monthly or quarterly, it may include the total anticipated amounts for the year in one column, followed by revenue and expenses for the current period, year-to-date amounts, and current period and year-to-date amounts as a percentage of the

Can income statements either be reported quarterly or annually?

Most accounting teams create an income statement monthly, quarterly, or annually. Annual income reports are always essential to compare your revenue and expenses year-to-year, but it's recommended that you generate one more than once a year.

How often should income statements be prepared?

Frequent reports: While other financial statements are published annually, the income statement is generated either quarterly or monthly. Due to this, business owners and investors can track the performance of the business closely and make informed decisions.

How to make a monthly income statement?

Steps to Prepare an Income Statement Pick a Reporting Period. Generate a Trial Balance Report. Calculate Your Revenue. Determine the Cost of Goods Sold. Calculate the Gross Margin. Include Operating Expenses. Calculate Your Income. Include Income Taxes. How To Prepare An Income Statement - FreshBooks FreshBooks Accounting FreshBooks Accounting

How often is an income statement completed?

Introduction to Income Statements Your income statement (sometimes called a statement of revenue and expense) shows the revenue your practice earned and the costs associated with running your business. Although an income statement can be prepared for any interval, it is usually prepared annually. How to Read and Use Your Income Statement - APA Services business finances inc business finances inc

Is income statement prepared every month?

An income statement is a document that tracks a business's revenue and expenses over a set period of time. Most companies create annual income statements, though you can prepare one for other periods of time, depending on your company's needs, like by month or by quarter. How To Prepare an Income Statement: With Examples | career-development how-to- Indeed career-development how-to-

Are income statements by year or month?

A profit and loss statement, also known as an income statement, shows the profitability of your business over a specific period. It can cover any period of time, but is most commonly produced monthly, quarterly or annually. A profit and loss statement is a useful tool for monitoring business activity. Financial statements | Business Queensland Business Queensland finance essentials s Business Queensland finance essentials s

Are income statements prepared only once a year?

To prepare an income statement, we begin by determining a specific period for the income statement. The period can be in the form of a monthly, quarterly, or annual basis. Public traded companies usually have a yearly income statement, while smaller ones tend to create a monthly or quarterly report.

Is the income statement monthly or yearly?

An income statement is a financial report detailing a company's income and expenses over a reporting period. It can also be referred to as a profit and loss (P&L) statement and is typically prepared quarterly or annually.

How frequently should balance sheets and income statements be prepared?

Publicly traded companies are required to prepare financial statements on a quarterly and yearly basis, but small businesses aren't as heavily regulated in their reporting. Creating monthly income statements can help you identify trends in your gross profit and expenditures over time.