Comparative Income Statement free printable template

Show details

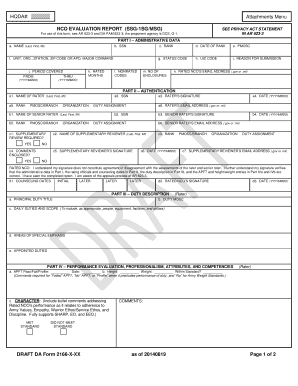

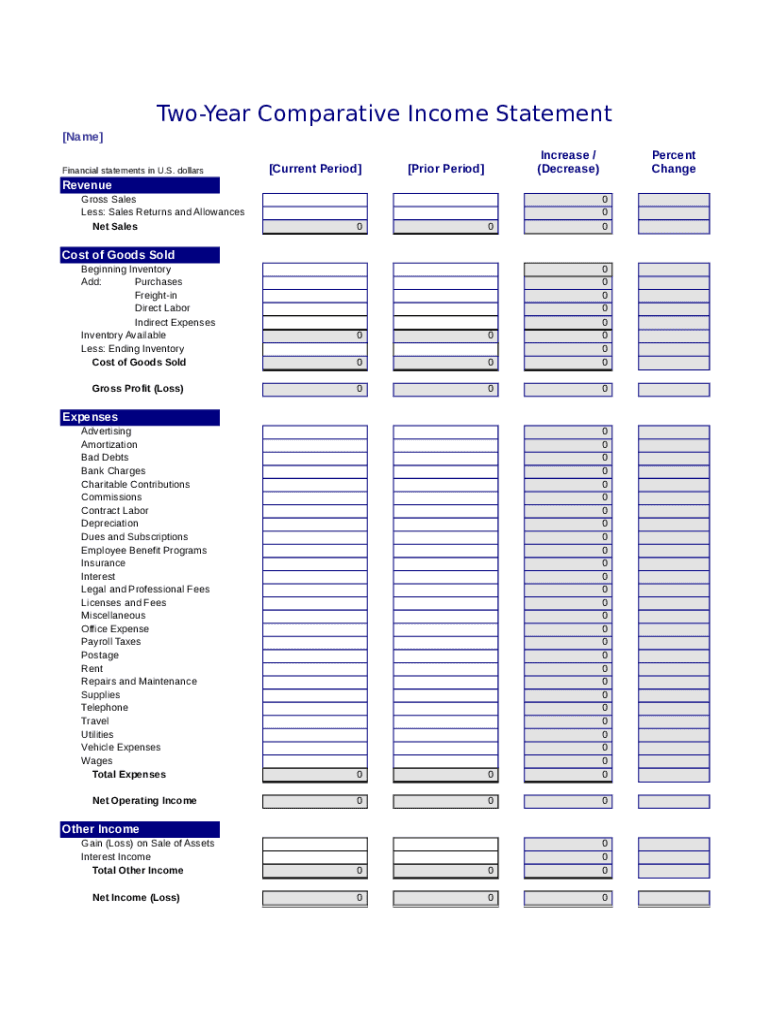

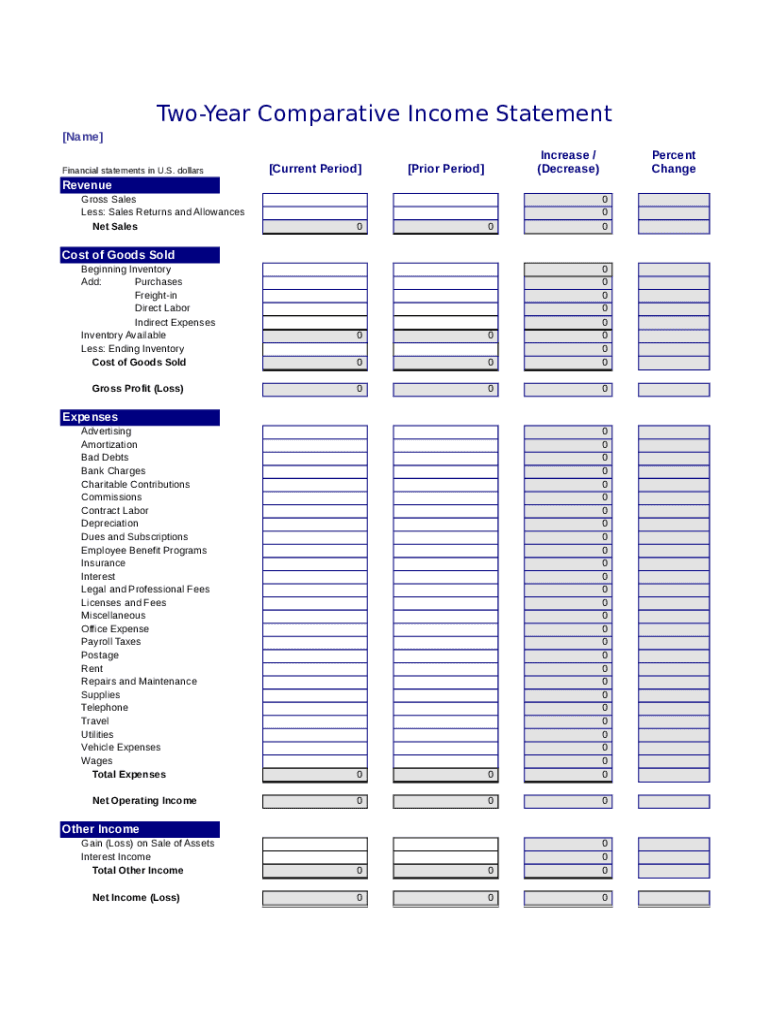

Twofer Comparative Income Statement Name Financial statements in U.S. dollars Current Period Increase / (Decrease) Prior Period Percent ChangeRevenue Gross Sales Less: Sales Returns and Allowances

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign Comparative Income Statement

Edit your Comparative Income Statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Comparative Income Statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Comparative Income Statement online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit Comparative Income Statement. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out Comparative Income Statement

How to fill out Comparative Income Statement

01

Gather financial data for the periods you want to compare (e.g., current year and previous year).

02

Organize the data into relevant categories such as revenue, expenses, and net income.

03

Create a table with columns for each period being compared.

04

List each category (e.g., total revenue, operating expenses) in separate rows.

05

Input the financial figures for each category under the appropriate column.

06

Calculate the changes in figures between the periods for easier comparison.

07

Include percentage changes to better understand growth or decline.

08

Review for accuracy and ensure all figures are sourced from trustworthy financial records.

Who needs Comparative Income Statement?

01

Businesses wanting to analyze financial performance over time.

02

Investors looking to evaluate profitability trends.

03

Financial analysts preparing reports on company growth.

04

Management teams needing insights to inform decision-making.

05

Stakeholders requiring performance data for business assessment.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in Comparative Income Statement?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your Comparative Income Statement and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How can I edit Comparative Income Statement on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing Comparative Income Statement.

How do I edit Comparative Income Statement on an Android device?

With the pdfFiller Android app, you can edit, sign, and share Comparative Income Statement on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is Comparative Income Statement?

A Comparative Income Statement is a financial statement that shows the income and expenses of a company for multiple periods, allowing for side-by-side comparisons of financial performance over time.

Who is required to file Comparative Income Statement?

Organizations that are publicly traded or those that need to comply with certain regulatory requirements may be required to file Comparative Income Statements for stakeholders, analysts, and investors.

How to fill out Comparative Income Statement?

To fill out a Comparative Income Statement, list revenues and expenses for the current period and previous periods in a tabular format, ensuring to calculate net income for each period.

What is the purpose of Comparative Income Statement?

The purpose of a Comparative Income Statement is to provide insights into the financial performance trends of a company over time, helping stakeholders assess growth, profitability, and financial health.

What information must be reported on Comparative Income Statement?

The Comparative Income Statement must report revenues, cost of goods sold, gross profit, operating expenses, other income and expenses, taxes, and net income for each period being compared.

Fill out your Comparative Income Statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Comparative Income Statement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.