Underwrite Signature Service Request

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Upload your document to the PDF editor

Type anywhere or sign your form

Print, email, fax, or export

Try it right now! Edit pdf

Users trust to manage documents on pdfFiller platform

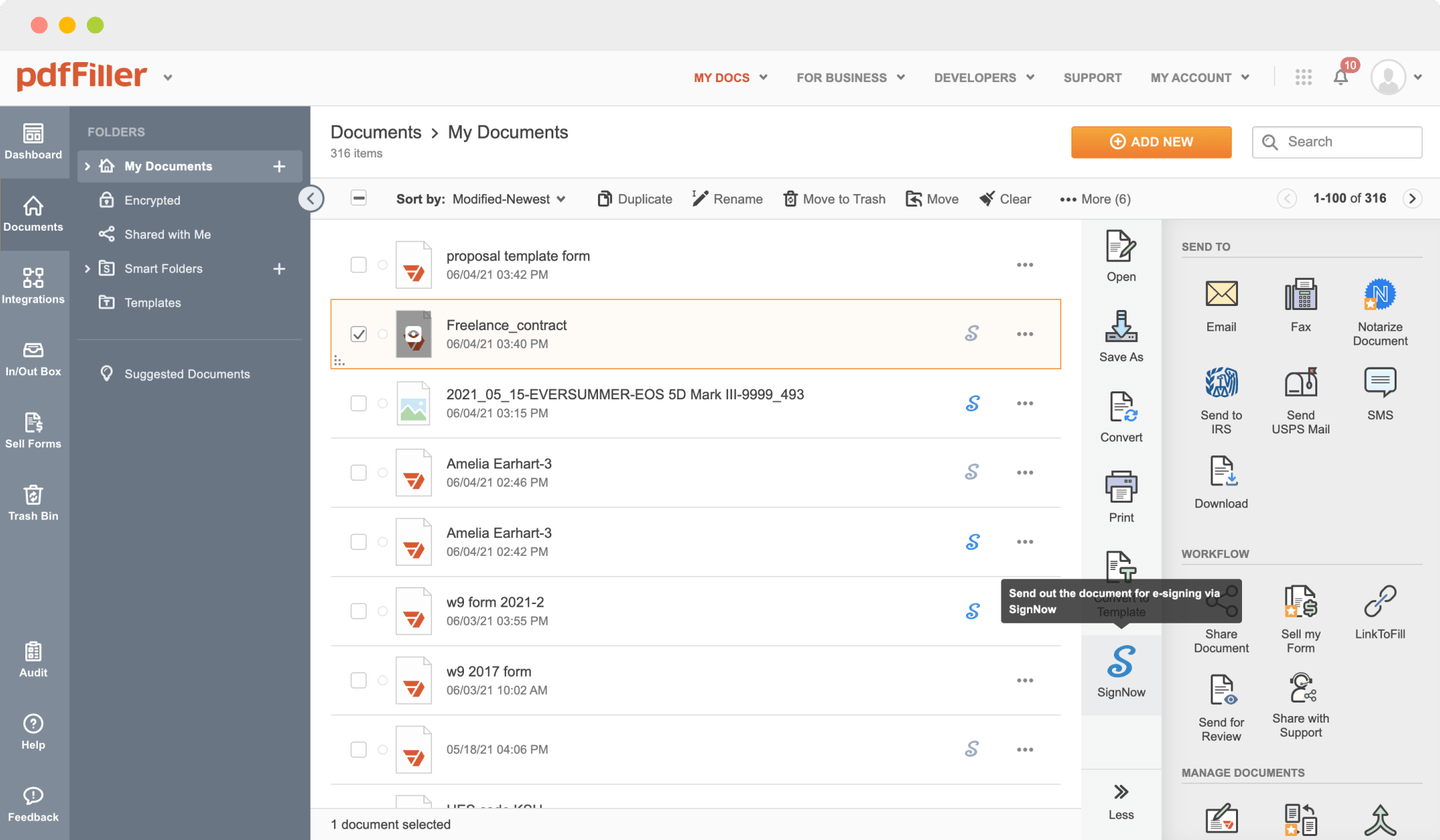

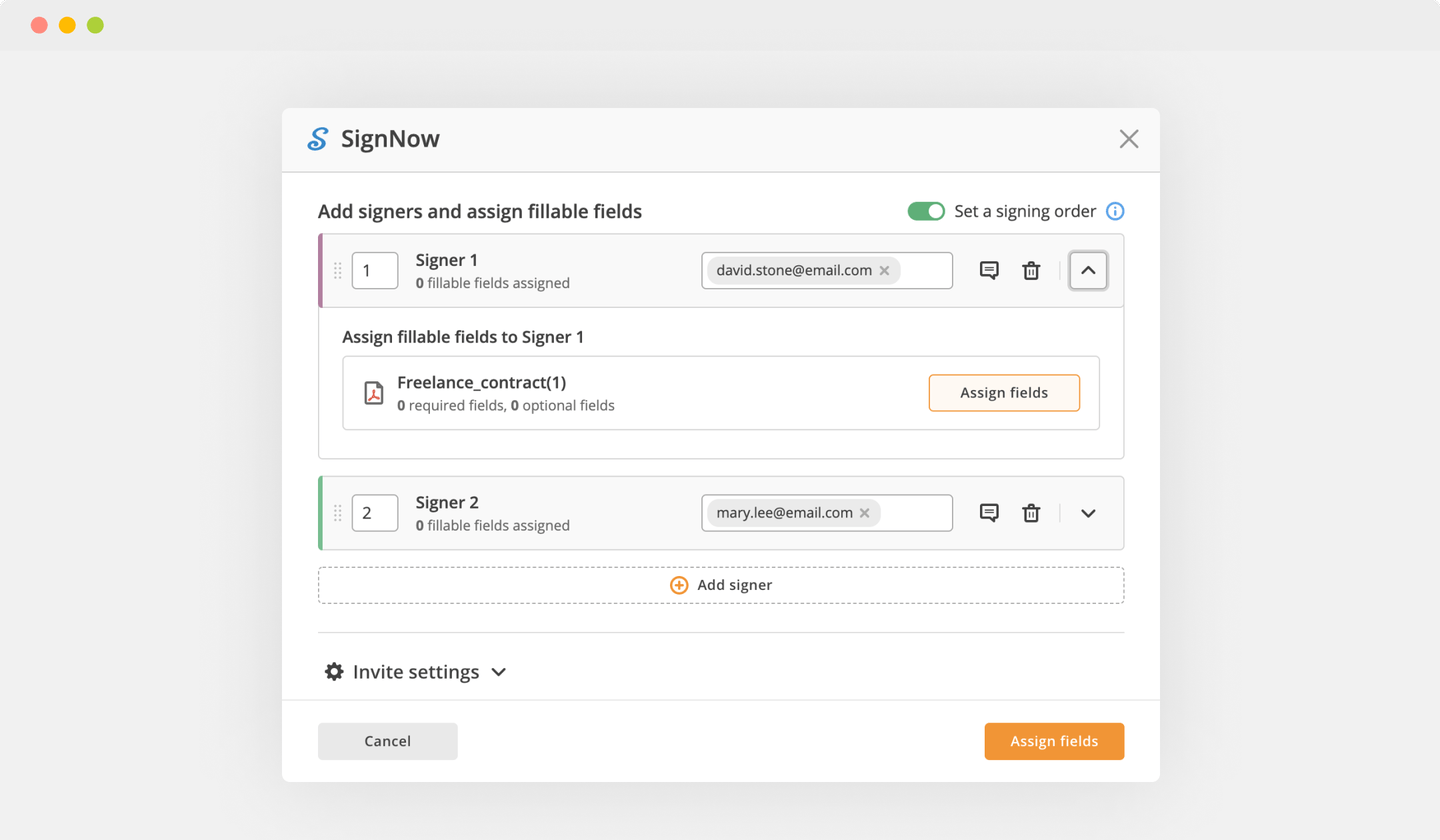

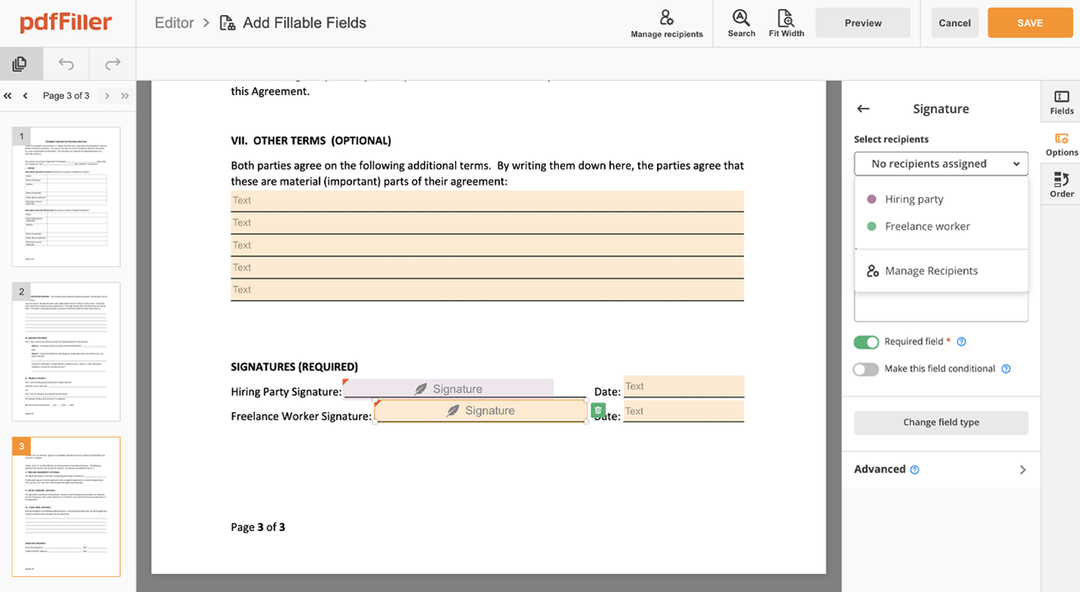

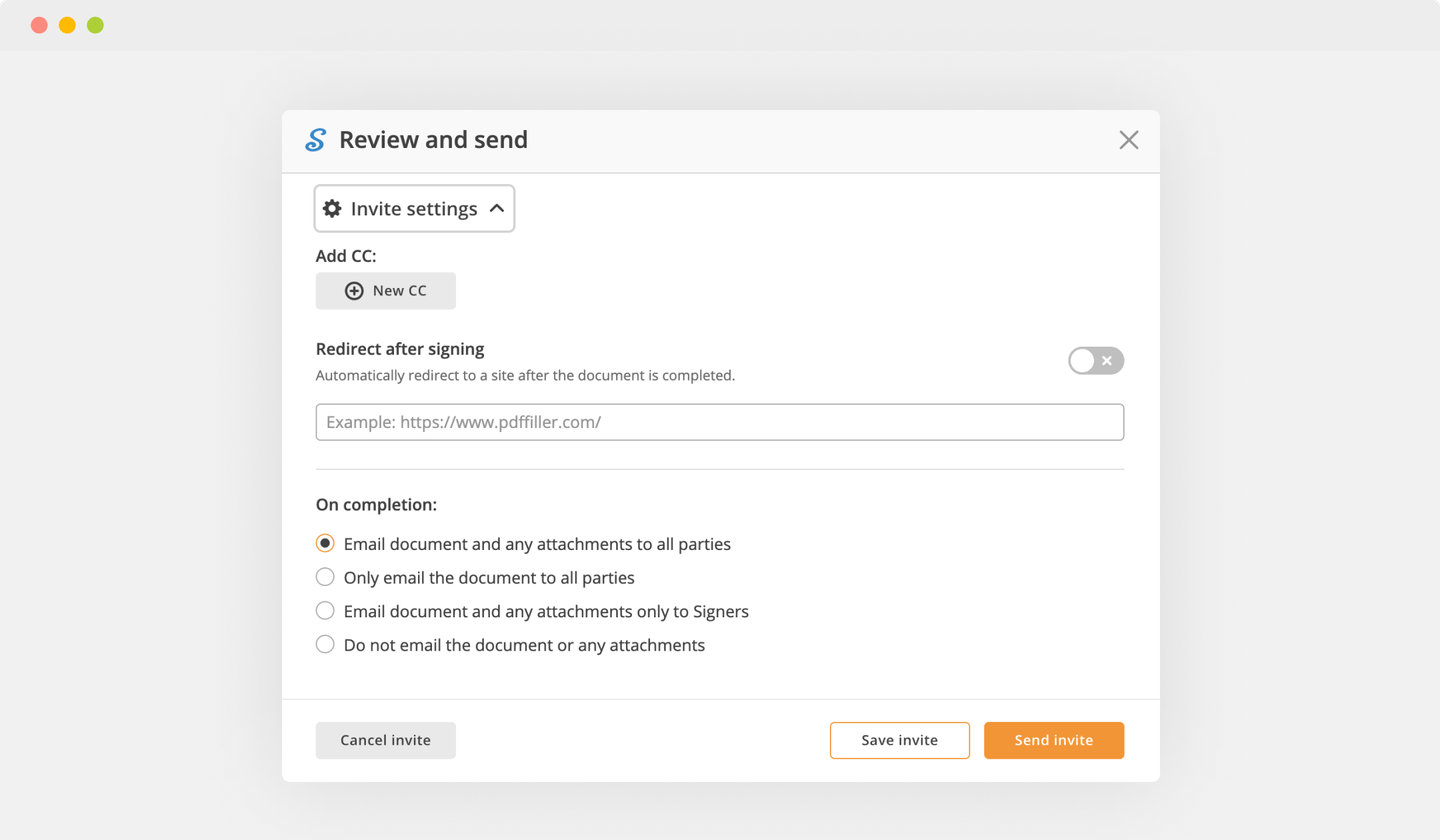

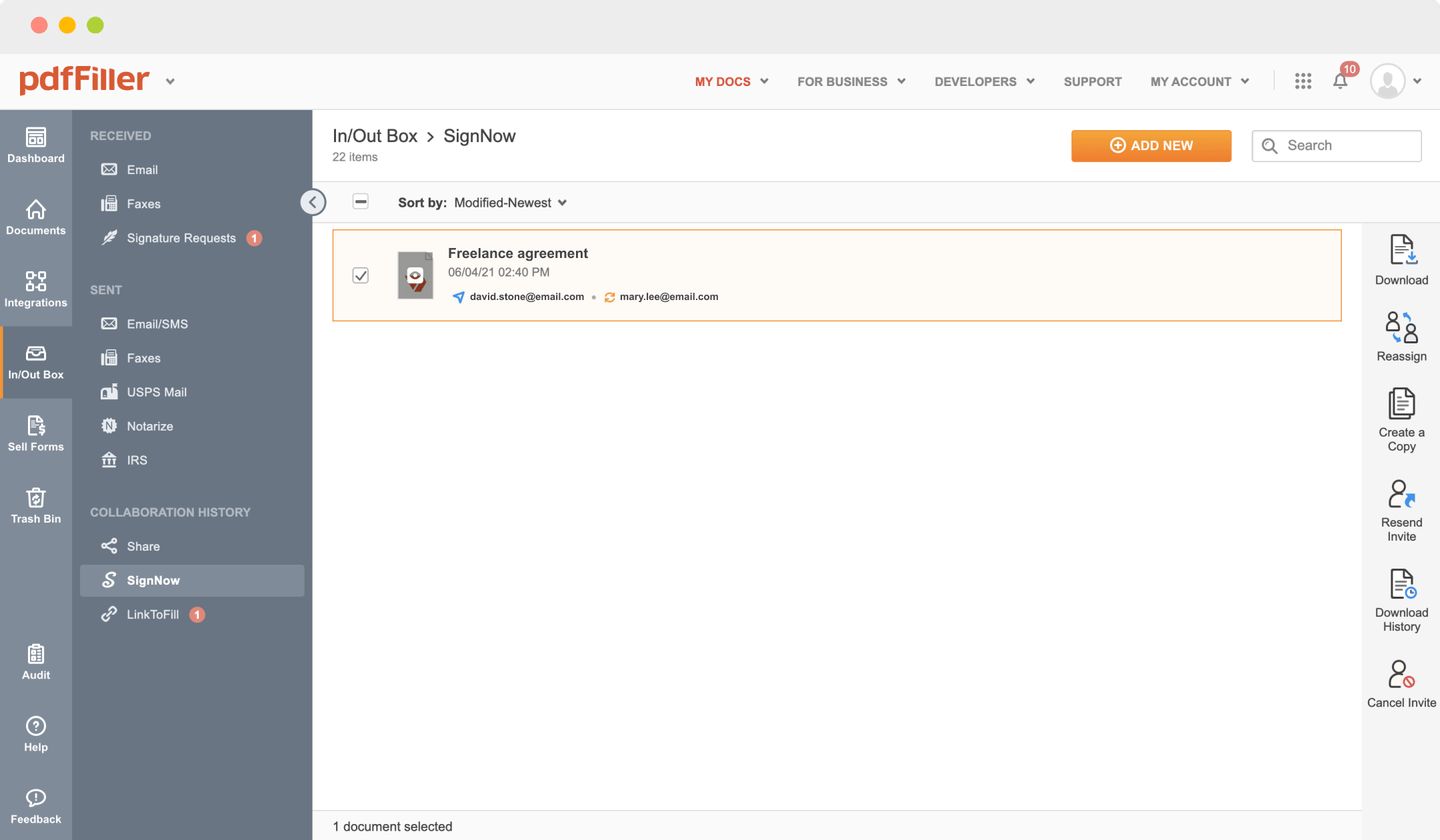

Send documents for eSignature with signNow

Create role-based eSignature workflows without leaving your pdfFiller account — no need to install additional software. Edit your PDF and collect legally-binding signatures anytime and anywhere with signNow’s fully-integrated eSignature solution.

All-in-one PDF software

A single pill for all your PDF headaches. Edit, fill out, eSign, and share – on any device.

pdfFiller scores top ratings in multiple categories on G2

How to Underwrite Signature Service Request

Still using multiple programs to manage and modify your documents? Use our solution instead. Document management becomes notably easier, faster and more efficient using our document editor. Create fillable forms, contracts, make templates and more useful features, within one browser tab. You can Underwrite Signature Service Request right away, all features are available instantly. Pay as for a lightweight basic app, get the features as of a pro document management tools. The key is flexibility, usability and customer satisfaction.

How-to Guide

How to edit a PDF document using the pdfFiller editor:

01

Drag & drop your template to the uploading pane on the top of the page

02

Select the Underwrite Signature Service Request feature in the editor's menu

03

Make all the required edits to your file

04

Click the orange “Done" button at the top right corner

05

Rename the file if necessary

06

Print, email or download the form to your desktop

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

sandy c

2019-01-18

overall I like pdffiller, but there are some things I wish I could do, like circle items in word docs. The only circle function I see does not seem to work very well. I would like to be able to draw circles around items more easily. As for signature authentication, is it necessary to include date? It would be easier if the authentication did not include the date. This isn't a big deal, since I can see why the date is necessary... but sometimes I sign a contract on for example, Sept 1st at midnight, but I don't want my clients to know I signed at midnight Sept 1st, particularly if I should have signed the document sooner. Anyway, these are just little issues that I've come across and changes would make my business a bit easier.

Gary Wong, MBA

2020-01-23

What do you like best?

I like how the service is not that expensive and there's a lot of functionality and they keep upgrading their features.

What do you dislike?

They could improve the user interface to be more user friendly in some ways.

What problems are you solving with the product? What benefits have you realized?

I'm able to have my clients sign documents by just emailing them the link and if they make a mistake, they can always open up the link and sign again.

I like how the service is not that expensive and there's a lot of functionality and they keep upgrading their features.

What do you dislike?

They could improve the user interface to be more user friendly in some ways.

What problems are you solving with the product? What benefits have you realized?

I'm able to have my clients sign documents by just emailing them the link and if they make a mistake, they can always open up the link and sign again.

Get a powerful PDF editor for your Mac or Windows PC

Install the desktop app to quickly edit PDFs, create fillable forms, and securely store your documents in the cloud.

Edit and manage PDFs from anywhere using your iOS or Android device

Install our mobile app and edit PDFs using an award-winning toolkit wherever you go.

Get a PDF editor in your Google Chrome browser

Install the pdfFiller extension for Google Chrome to fill out and edit PDFs straight from search results.

List of extra features

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How long does underwrite take after conditions are met?

Homebuyers have hard deadlines they must meet, so they get underwriting dibs. Under normal circumstances, your purchase application should be underwritten within 72 hours of underwriting submission and within one week after you provide your fully completed documentation to your loan officer.

How long does it take for the underwriter to make a decision?

Underwriting the process by which mortgage lenders verify your assets, and check your credit scores and tax returns before you get a home loan can take as little as two to three days. Typically, though, it takes over a week for a loan officer or lender to complete.

What are conditions from underwriter?

Mortgage underwriting conditions It analyzes your application and delivers a recommendation. Then, a human takes over and here come the conditions: Your first set of conditions is the paperwork that proves your income and assets. You may also have to show a divorce decree or business license or explain a credit problem.

What does it mean when your loan is out of underwriting?

Approved with conditions And then you'll complete an application and submit it for mortgage pre-approval. After your loan comes out of underwriting, the goal is to have your loan approved with conditions. Don't be fearful when your lender tells you your approval has conditions.

What happens after the underwriter approves a loan?

After a first review, the underwriter will issue a list of requirements. These requirements are called conditions or prior-to-document conditions. Your loan officer will submit all your conditions back to the underwriter, who then issues an okay for you to sign loan documents.

Why would an underwriter deny a loan?

Your loan is never fully approved until the underwriter confirms that you are able to pay back the loan. Some of these problems that might arise and have your underwriting denied are insufficient cash reserves, a low credit score, or high debt ratios.

How long does underwrite take after conditional approval?

Under normal circumstances, your purchase application should be underwritten within 72 hours of underwriting submission and within one week after you provide your fully completed documentation to your loan officer.

What is next after conditional loan approval?

A conditionally approved loan is separate and comes after a preapproval once you've found the house. You can think of this as being approved for the loan, but with a few conditions, usually concerning documentation and income, that must be met before a client can be approved to close.

Does conditional approval mean approved?

A conditional approval means you have been approved for a loan once certain conditions are met. These conditions may be that you sell your current home, provide more documentation, pay off an account, or settle an outstanding balance. Here is an example of a conditional approval.

How long does it take for an underwriter to approve a loan?

Underwriting the process by which mortgage lenders verify your assets, and check your credit scores and tax returns before you get a home loan can take as little as two to three days. Typically, though, it takes over a week for a loan officer or lender to complete.

What happens after underwriter approved loan?

After a first review, the underwriter will issue a list of requirements. These requirements are called conditions or prior-to-document conditions. Your loan officer will submit all your conditions back to the underwriter, who then issues an okay for you to sign loan documents.

eSignature workflows made easy

Sign, send for signature, and track documents in real-time with signNow.