Get the free cg2010

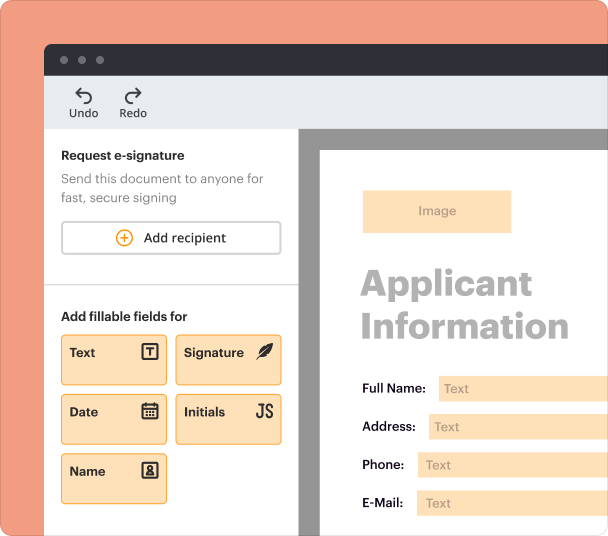

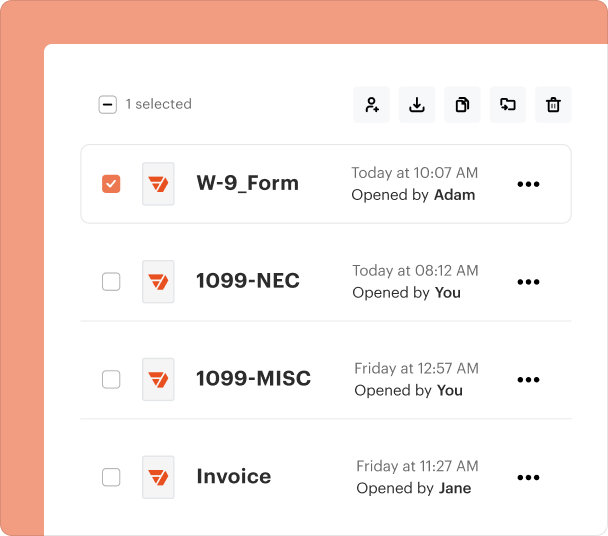

Fill out, sign, and share forms from a single PDF platform

Edit and sign in one place

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

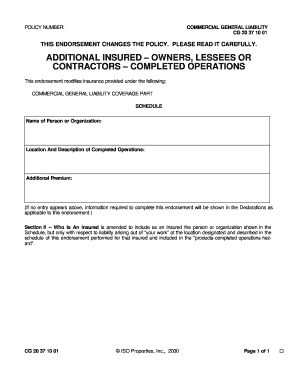

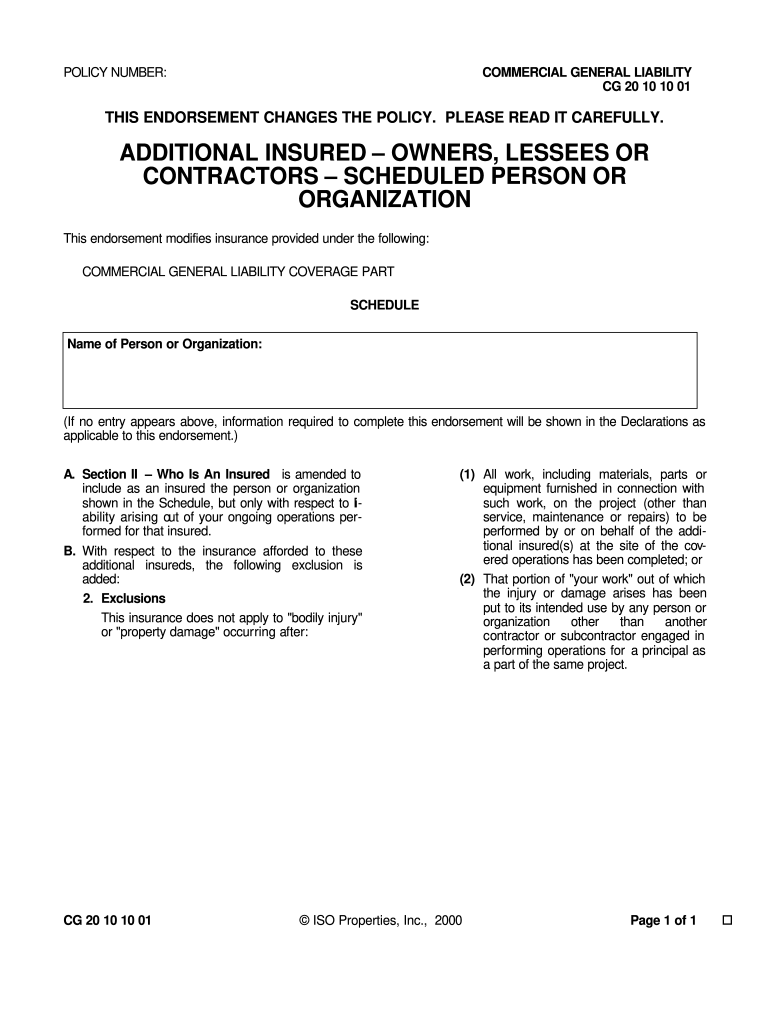

Your Guide to CG 20 10 Form and Its Application

How do you understand the CG 20 10 endorsement?

The CG 20 10 endorsement, also known as the Additional Insured — Owners, Lessees, or Contractors — Scheduled Person or Organization endorsement, is a significant component of commercial general liability insurance. It allows a business to extend its insurance coverage to another entity, protecting them from claims made against the policyholder related to ongoing operations. Understanding its importance is crucial for contractors and subcontractors alike.

-

The CG 20 10 endorsement is vital for ensuring that all parties involved in a project are covered under the primary insurance policy, preventing costly legal battles.

-

Some key features include the ability to name specific additional insured parties and the assurance that the coverage extends only to liability arising out of the named insured’s operations.

-

This endorsement is typically utilized in construction and contracting scenarios, but can also be relevant in any situation where third-party entities are at risk.

What is the role of the CG 20 10 in commercial general liability?

Commercial general liability coverage is designed to protect businesses from potential lawsuits and damages that may arise during their operations. The CG 20 10 endorsement plays a crucial role in enhancing this coverage by providing additional protections. This is especially important for contractors and subcontractors who often work under the risk of exposure to liabilities that could impact their project and financial stability.

-

Commercial general liability coverage includes protection against injuries and damages to property that a business may be responsible for because of its operations or products.

-

This endorsement integrates seamlessly by ensuring that subcontractors are also protected, which can help subcontractors secure their own contracts.

-

For contractors, this endorsement helps in mitigating risks as they navigate complex project environments with multiple stakeholders.

How do you fill out the CG 20 10 form?

Filling out the CG 20 10 form requires careful attention to specific details to ensure that the documentation is accurate and legally compliant. It's crucial to understand which sections need to be filled entirely to avoid delays in obtaining coverage.

-

Sections such as named insured, additional insured parties, and effective dates must be included accurately.

-

Double-check all entries against policy requirements to prevent any miscommunication with involved parties.

-

Common errors to avoid include leaving out required information or incorrectly labeling additional insured parties.

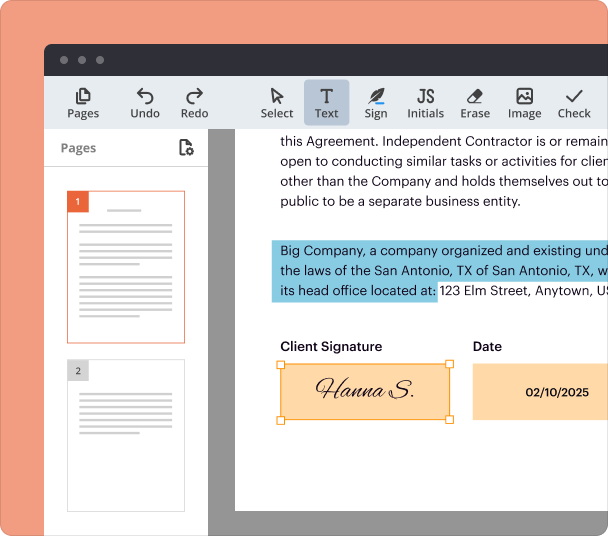

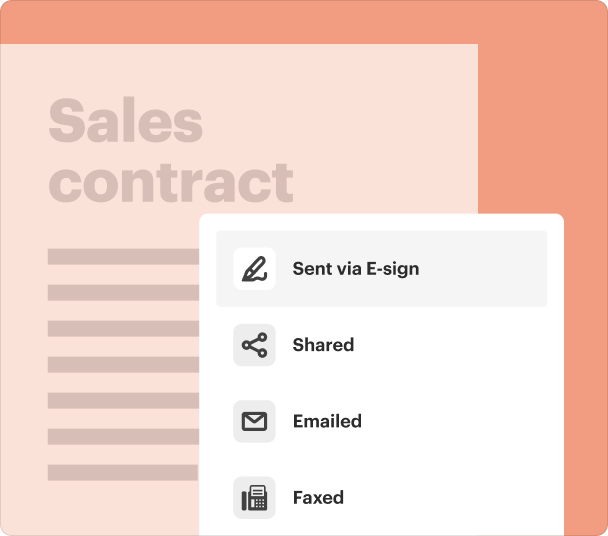

How can you manage your CG 20 10 documentation with pdfFiller?

Managing CG 20 10 documentation can be streamlined through pdfFiller, which offers comprehensive features for document handling. Using pdfFiller allows users to create, edit, and sign PDF documents directly from its cloud-based platform.

-

pdfFiller simplifies the entire process, from drafting your CG 20 10 form to final execution.

-

It enhances collaboration among team members, allowing for simultaneous editing and feedback.

-

Version control in pdfFiller ensures that everyone has access to the latest version of the document.

What are some tips for insurance professionals handling CG 20 10?

For insurance professionals, navigating the questions surrounding the CG 20 10 endorsement can be overwhelming, yet essential for client satisfaction. By understanding the nuances of the endorsement, agents can provide their clients with the support they need.

-

Insurance agents should familiarize themselves with common questions to provide quick references.

-

Effectively communicating the benefits ensures clients understand what protection they are getting.

-

Developing a checklist allows agents to systematically guide clients through the necessary steps regarding the endorsement.

What are key takeaways about the CG 20 10 endorsement?

Understanding the CG 20 10 endorsement is essential for any individual involved in projects requiring additional insured status. Key takeaways should focus on the importance of comprehending your policy’s exclusions and ensuring that adequate coverage is maintained.

-

The CG 20 10 plays a pivotal role in real-world situations where risk management is critical.

-

Awareness of exclusions can prevent gaps in coverage, which can be detrimental during claims.

-

By utilizing CG 20 10, businesses can ensure adequate coverage during multi-party projects.

Frequently Asked Questions about cg 2010 form

What is a CG 20 10 form?

The CG 20 10 form is an endorsement that provides additional insured status to specified parties under a commercial general liability insurance policy. It is crucial in situations where multiple parties are involved in a project, ensuring they are protected.

Who needs a CG 20 10 endorsement?

Typically, contractors or subcontractors require a CG 20 10 endorsement to protect clients or other contractors from claims during a project's lifecycle. This is often a requirement in contract agreements.

How do I fill out the CG 20 10 form?

Filling out the CG 20 10 form involves identifying the named insured, specifying additional insured parties, and entering the effective date. It’s crucial to double-check all entries to ensure accuracy.

What are the benefits of using pdfFiller for managing CG 20 10 forms?

pdfFiller offers features like collaborative editing, eSigning, and real-time updates, making it easier to navigate through the CG 20 10 documentation process. This helps streamline approvals and enhances productivity.

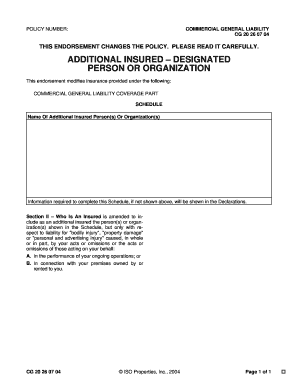

How does the CG 20 10 endorsement interact with other endorsements?

The CG 20 10 endorsement can work alongside other endorsements, such as CG 20 37, which addresses liability in completed operations. Understanding these interactions is key to comprehensive coverage.

pdfFiller scores top ratings on review platforms