Profit Loss Statement Sample free printable template

Fill out, sign, and share forms from a single PDF platform

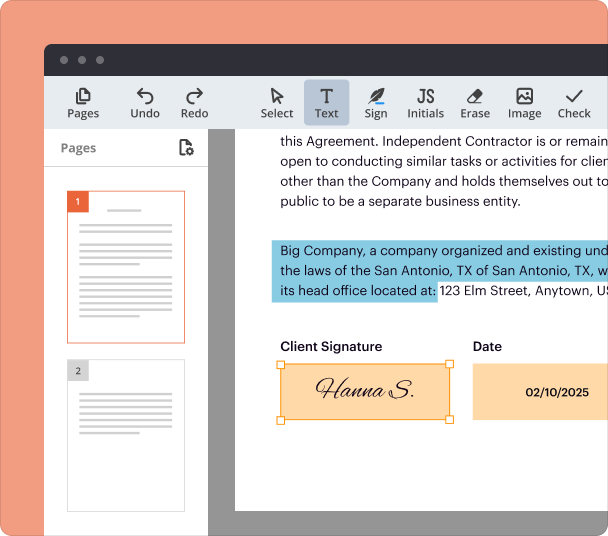

Edit and sign in one place

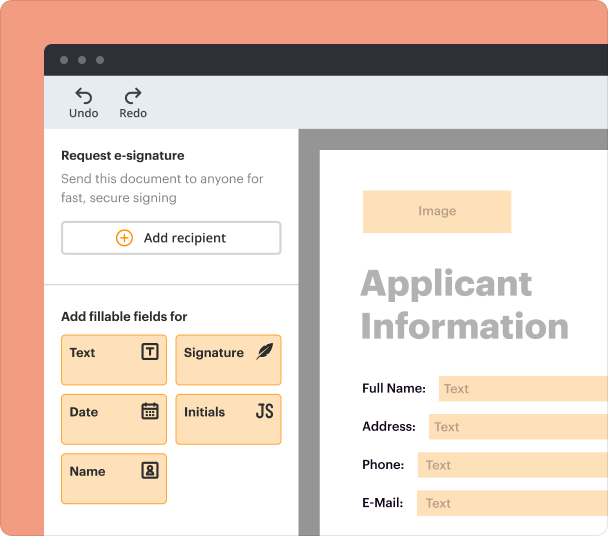

Create professional forms

Simplify data collection

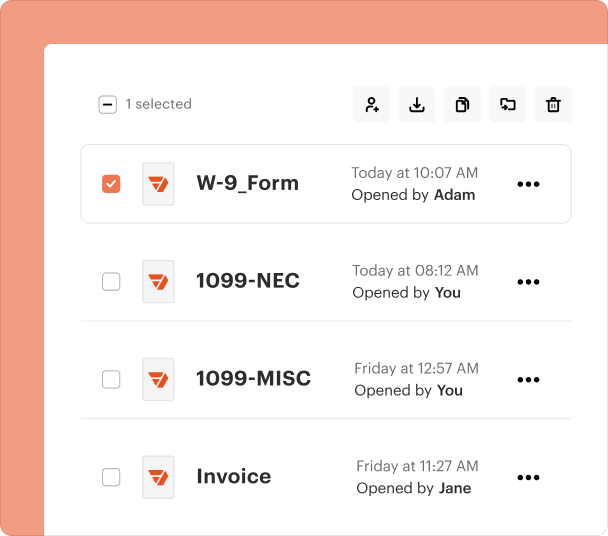

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

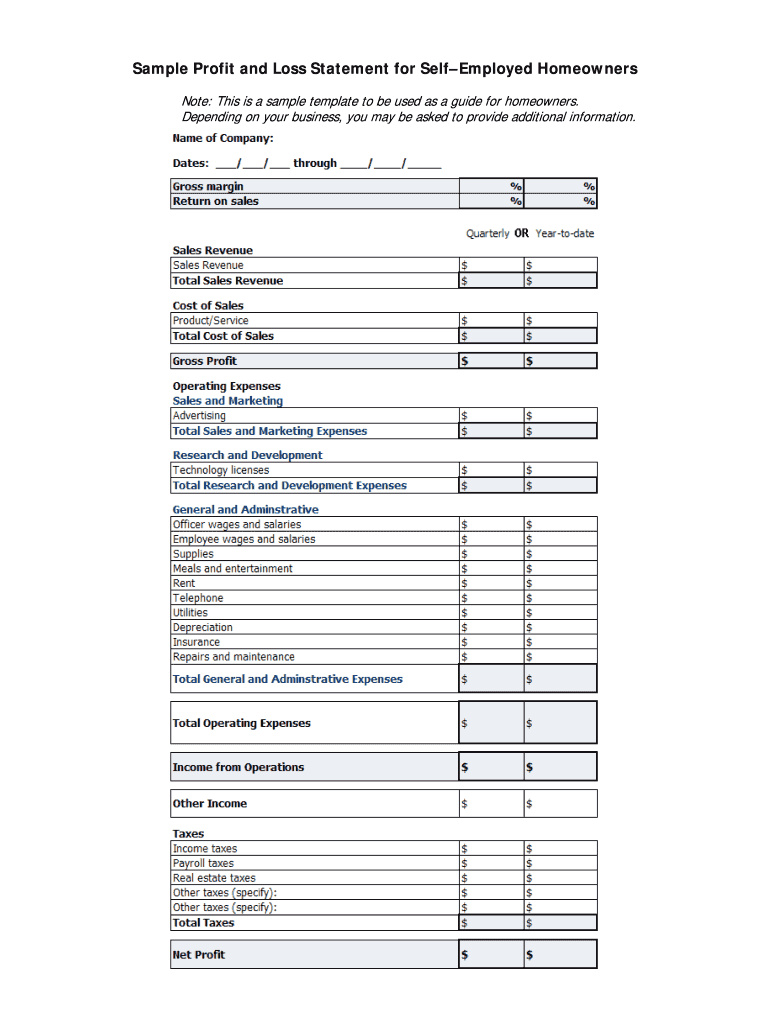

Profit and Loss Statement Sample Form Guide

What is a profit and loss statement?

A profit and loss statement (P&L) is a financial report that summarizes the revenues, costs, and expenses incurred during a specific period. This essential document helps business owners track their financial performance and is crucial for tax preparation, especially for self-employed homeowners. Understanding how to create a profit and loss statement sample form can significantly aid in effective financial planning.

What are the key components of a profit and loss statement?

-

Represents the difference between sales and the cost of goods sold.

-

Measures the company's operational efficiency; calculated as net profit divided by total sales.

-

The total income generated from sales before any expenses are deducted.

-

Total sales revenue minus the cost of goods sold.

-

All costs associated with running the business that are not directly tied to producing a product.

-

The earnings before tax and finance costs; calculated by subtracting operating expenses from gross profit.

-

Income from non-operational activities such as investment gains.

-

The final profit after all expenses, including taxes, have been deducted from total revenue.

How do you complete the sample form?

-

Collect all relevant documentation, such as receipts and invoices, to ensure all income and expenses are included.

-

Decide whether to report quarterly or year-to-date figures, based on your business needs.

-

Accurately input the gathered data into the respective categories as defined in the form.

-

Review all entries and calculations to ensure accuracy, preventing mistakes that could affect financial assessments.

What features should a profit and loss statement template have?

-

Allows users to customize the template according to their specific business requirements.

-

Facilitates automated data entry from accounting software, improving efficiency.

-

Enhances the template's utility by allowing users to sign documents digitally for legal compliance.

What common pitfalls should you avoid?

-

Regularly updating income and expense figures is crucial to gaining an accurate financial outlook.

-

Ensure all income sources are included to avoid underreporting revenue, which skews profits.

-

Accurate reporting of operating expenses is vital; errors can lead to overlooking financial issues.

What local compliance factors should you consider?

-

Different regions have specific laws regarding financial statements, which can impact self-employed homeowners.

-

Familiarize yourself with any unique reporting standards required in your region to ensure compliance.

How can pdfFiller help you?

-

Users can easily modify their profit and loss statement sample form on pdfFiller’s platform.

-

Share documents with accountants or team members seamlessly for better workflow.

-

Manage documents easily with cloud-based storage, allowing quick retrieval whenever needed.

Frequently Asked Questions about profit and loss statement form

What is the purpose of a profit and loss statement?

A profit and loss statement serves to summarize a business's revenues and expenses over a specific period. This helps owners analyze profitability and make informed financial decisions.

How often should I update my P&L statement?

It's advisable to update your profit and loss statement monthly or quarterly. This allows for real-time insights into your financial performance, ensuring timely adjustments to your business strategy.

What should I include in my profit and loss statement?

Include all revenue generated, direct costs like cost of goods sold, and operating expenses. This comprehensive approach provides an accurate picture of your financial health.

Can pdfFiller help with tax compliance?

Yes, pdfFiller provides customizable templates that can aid in maintaining accurate profit and loss statements, which are crucial for tax compliance. Its features allow for easy editing and storage, making tax preparation smoother.

What are common mistakes when preparing a P&L statement?

Common mistakes include failing to include all sources of income, misestimation of expenses, and not updating figures regularly. Being thorough can prevent these pitfalls and offer a clearer financial view.

pdfFiller scores top ratings on review platforms