Blue and Co CTORG01 2011 free printable template

Show details

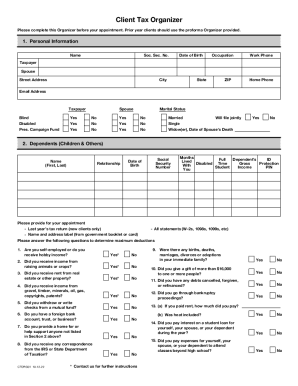

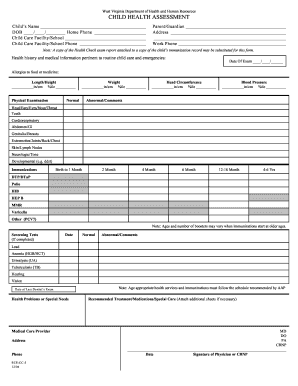

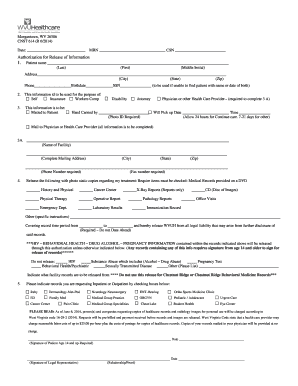

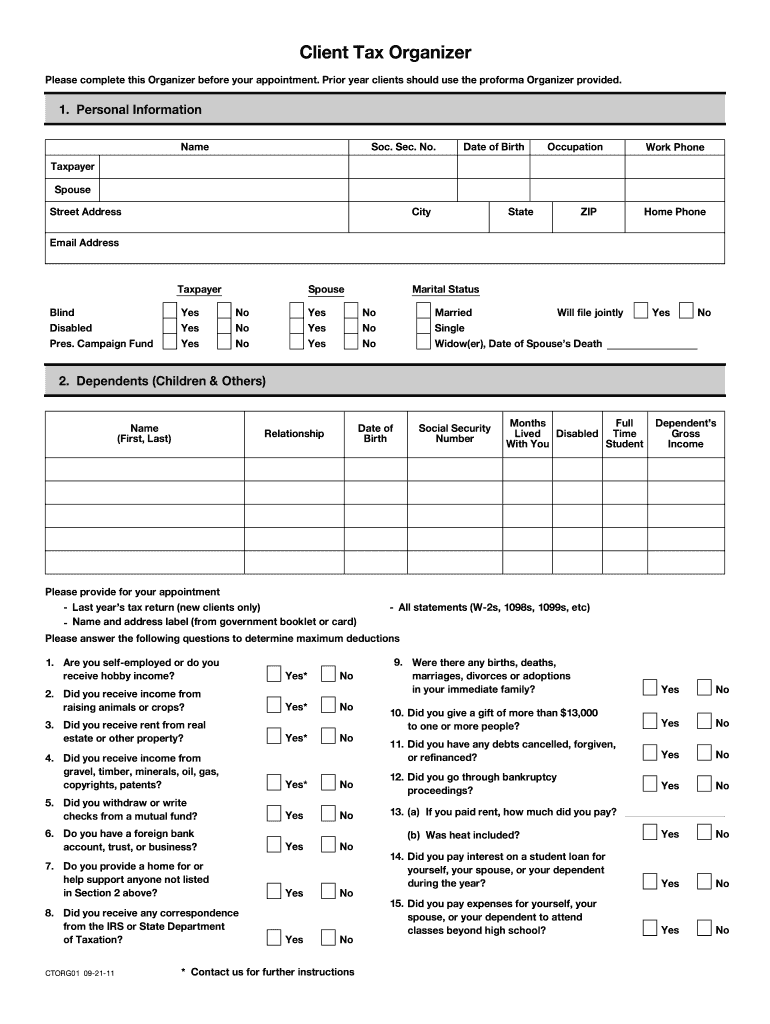

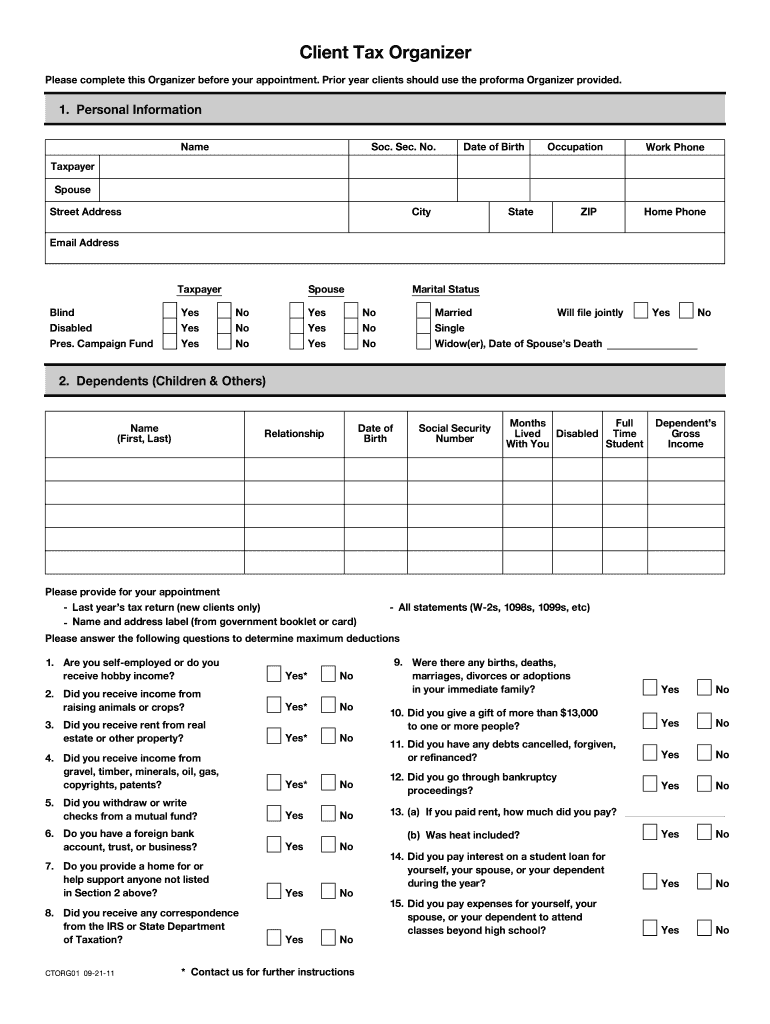

Client Tax Organizer Please complete this Organizer before your appointment. Prior year clients should use the proforma Organizer provided. 1. Amount used to buy bonds for someone else or yourself only or spouse only if filing jointly. Owner s name Co-owner or Beneficiary s name if applicable X if name is for a beneficiary Bond purchase Amount To the best of my knowledge the information enclosed in this client tax organizer is correct and includes all income deductions and other information...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Blue and Co CTORG01

Edit your Blue and Co CTORG01 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Blue and Co CTORG01 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Blue and Co CTORG01 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit Blue and Co CTORG01. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Blue and Co CTORG01 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Blue and Co CTORG01

How to fill out Blue and Co CTORG01

01

Begin by gathering the necessary documentation and information required for the Blue and Co CTORG01 form.

02

Carefully read the instructions provided with the form to understand the specific requirements.

03

Fill in your personal details, including name, address, and contact information in the designated sections.

04

Provide any required financial or organizational details as per the guidelines mentioned on the form.

05

Review each section to ensure all information is accurate and complete before submission.

06

Sign and date the form in the appropriate section to validate your submission.

07

Submit the completed form according to the instructions, whether electronically or via mail.

Who needs Blue and Co CTORG01?

01

Entities and individuals required to report tax information or comply with regulatory standards may need to fill out Blue and Co CTORG01.

02

Businesses seeking to apply for grants or funding opportunities may also need to complete this form.

Fill

form

: Try Risk Free

What is client tax organizer?

The client organizer is questionnaire and information document that tax preparers use to gather tax data from their clients. ... The organizer helps your client assemble the information you will need to prepare their tax return, and it can be printed to paper or PDF.

People Also Ask about

What is a 14157 a form?

Purpose of Form Use Form 14157 to file a complaint against a tax return preparer or tax preparation business. Tax professionals can use this form to report events that impact their PTIN or business.

What is a paid preparer?

A paid tax return preparer is primarily responsible for the overall substantive accuracy of your return and by law, is required to sign the return and include their preparer tax identification number (PTIN) on it.

How do I get an ERO pin?

If the taxpayer agrees to allow the ERO to determine the taxpayer PIN, the taxpayer will consent to the ERO's choice by completing and signing a Form 8879 which contains the taxpayer PIN used as the return signature. The taxpayer PIN can be systemically generated or manually assigned by the ERO.

What is form 14817 used for?

What is Form 14817 used for? Purpose of Form: Use Form 14157-A if (1) a tax return preparer filed a Form 1040 series tax return or altered your Form 1040 series tax return information without your knowledge or consent AND (2) you are seeking a change to your tax account.

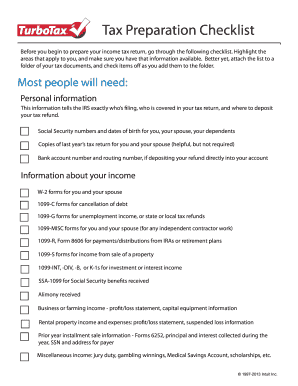

What should I include in my tax return Canada?

Pre-tax filing checklist Social insurance number and other personal data. Income T-slips (T4s, T5s, etc.) or RL-slips (RL-1, RL-2, RL-3, etc.) Records of any other income, such as an income statement from your self-employment.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my Blue and Co CTORG01 in Gmail?

Blue and Co CTORG01 and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I send Blue and Co CTORG01 to be eSigned by others?

When your Blue and Co CTORG01 is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How can I fill out Blue and Co CTORG01 on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your Blue and Co CTORG01, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is Blue and Co CTORG01?

Blue and Co CTORG01 is a specific form or document used for reporting purposes, likely associated with Blue and Co, an accounting firm or organization.

Who is required to file Blue and Co CTORG01?

Entities or individuals that fall under certain compliance or regulatory requirements set by Blue and Co are required to file Blue and Co CTORG01.

How to fill out Blue and Co CTORG01?

To fill out Blue and Co CTORG01, one must accurately provide required information in the designated fields on the form, following any guidelines provided by Blue and Co.

What is the purpose of Blue and Co CTORG01?

The purpose of Blue and Co CTORG01 is to collect relevant data for compliance, reporting, or assessment purposes as determined by Blue and Co.

What information must be reported on Blue and Co CTORG01?

The information that must be reported on Blue and Co CTORG01 typically includes financial data, organizational details, and any other relevant information as specified by Blue and Co.

Fill out your Blue and Co CTORG01 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Blue And Co ctorg01 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.