OH Deferred Compensation Withdrawal Guide & Payment Options 2011-2025 free printable template

Show details

OHIO PUBLIC EMPLOYEES DEFERRED COMPENSATION PROGRAM Don't wait. Call a Retirement Planning Specialist today! As you near retirement, it's important to think about how and when you might begin using

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ohio deferred compensation withdrawal guide form

Edit your ohio compensation withdrawal guide form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ohio deferred comp withdrawal form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ohio deferred comp withdrawal online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ohio deferred compensation withdrawal form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out deferred comp ohio form

How to Fill Out Ohio Deferred Comp Withdrawal:

01

Obtain the necessary withdrawal form from the Ohio Deferred Compensation website or contact their customer service for assistance.

02

Carefully read through the instructions and guidelines provided with the form to ensure you understand the process and requirements for withdrawal.

03

Fill out all required personal information accurately, including your full name, social security number, and contact details.

04

Provide information about your deferred compensation account, such as the account number and the specific investments or funds you wish to withdraw from.

05

If you have multiple accounts or investment options within your deferred compensation plan, indicate which account/fund you would like to withdraw from.

06

Specify the withdrawal amount or percentage you would like to take out, keeping in mind any minimum or maximum withdrawal limits set by the plan.

07

Indicate the reason for your withdrawal. Common reasons may include retirement, disability, financial hardship, or reaching the required minimum distribution age.

08

If applicable, provide any supporting documentation or paperwork required to support your withdrawal request. This may include proof of age, disability, or other necessary forms.

09

Review the completed form to ensure all information is accurate and legible.

10

Sign and date the form before submitting it to the Ohio Deferred Compensation program.

Who Needs Ohio Deferred Comp Withdrawal:

01

Ohio state employees who have participated in the Ohio Deferred Compensation program and wish to access their funds for various reasons.

02

Individuals who have reached the age of retirement and are eligible to make withdrawals from their deferred compensation account.

03

Participants who are facing financial hardship and meet the criteria for withdrawal based on the program guidelines.

04

Employees who are permanently disabled and require funds from their deferred compensation account to support their financial needs.

05

Individuals who have other qualifying reasons for withdrawal, such as death, divorce, or separation from employment.

Fill

ohio deferred comp

: Try Risk Free

People Also Ask about ohio deferred compensation reviews

Is Ohio Deferred Comp a Roth IRA?

Ohio DC now offers a Roth 457 option for your employees.

What is the difference between 401k and deferred comp in Ohio?

Deferred compensation plans are funded informally. There's essentially a promise from the employer to pay the deferred funds, plus any investment earnings, to the employee at the time specified. In contrast, with a 401(k), a formally established account exists.

Is deferred comp considered a 401k?

A 401(k) plan is a qualified deferred compensation plan. If you're eligible under the plan, you generally can elect to have your employer contribute a portion of your compensation to the plan on a pretax basis.

Is Ohio deferred comp a 401k?

Ohio Deferred Compensation is a supplemental 457(b) retirement plan for all Ohio public employees.

What is the 457 B deferred compensation program in Ohio?

Ohio Deferred Compensation is a supplemental 457(b) retirement plan for all Ohio public employees and one of the largest 457(b) plans in the country. Deferred compensation has been Ohio DC's only responsibility since 1976. Because of Ohio DC's size, plan expenses are low.

Can I transfer my Ohio deferred comp?

Ohio Deferred Compensation is prepared to accept a transfer of the participant's account value, and hereby releases the transferring plan from all obligation to pay distributions to the participant from its plan for the amount transferred.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit ohio deferred comp early withdrawal in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing ohio deferred compensation forms and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I fill out the ohio deferred comp rollover form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign ohio deferred compensation withdrawal election form and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Can I edit ohio deferred compensation on an Android device?

The pdfFiller app for Android allows you to edit PDF files like OH Deferred Compensation Withdrawal Guide Payment. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

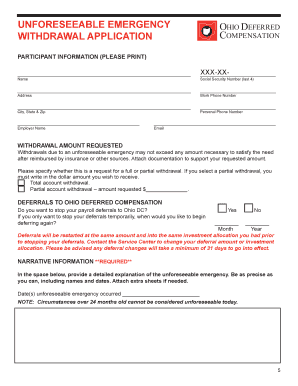

What is OH Deferred Compensation Withdrawal Guide Payment?

OH Deferred Compensation Withdrawal Guide Payment refers to the regulations and procedures that govern how participants can withdraw funds from their Ohio Deferred Compensation accounts.

Who is required to file OH Deferred Compensation Withdrawal Guide Payment?

Participants in the Ohio Deferred Compensation plan who wish to withdraw their funds are required to file the OH Deferred Compensation Withdrawal Guide Payment.

How to fill out OH Deferred Compensation Withdrawal Guide Payment?

To fill out the OH Deferred Compensation Withdrawal Guide Payment, participants must complete the withdrawal application form provided by the Ohio Deferred Compensation program, ensuring all required information and documentation are included.

What is the purpose of OH Deferred Compensation Withdrawal Guide Payment?

The purpose of the OH Deferred Compensation Withdrawal Guide Payment is to provide structured guidelines for participants on how to access their deferred compensation funds while complying with applicable regulations.

What information must be reported on OH Deferred Compensation Withdrawal Guide Payment?

The information that must be reported on the OH Deferred Compensation Withdrawal Guide Payment includes personal identification details, balance amounts, withdrawal amounts requested, and purpose of withdrawal.

Fill out your OH Deferred Compensation Withdrawal Guide Payment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OH Deferred Compensation Withdrawal Guide Payment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.