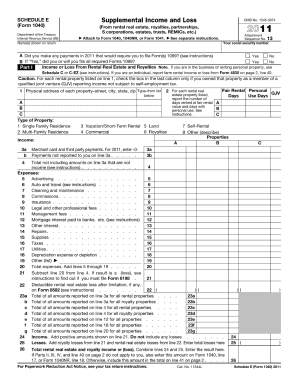

IRS Instruction 1045 2013 free printable template

Show details

Nov 5, 2013 ... 2013. Instructions for Form 1045. Application for Tentative Refund .... extension property, see Publication .... used in any prior tax year cannot.

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS Instruction 1045

Edit your IRS Instruction 1045 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS Instruction 1045 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS Instruction 1045 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit IRS Instruction 1045. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Instruction 1045 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS Instruction 1045

How to fill out IRS Instruction 1045

01

Obtain a copy of IRS Form 1045 and the accompanying instructions.

02

Gather necessary documentation such as income statements, tax returns, and records of any deductions from the relevant years.

03

Fill in your personal information at the top of the form, including your name, address, and Social Security number.

04

Complete Part I, which requires you to report your carryback amount and tax liability from the years you are carrying a net operating loss (NOL) back to.

05

In Part II, provide a detailed breakdown of any adjustments made to your income and deductions, including specific carryback years.

06

Calculate the refund amount for each year in which you are claiming a refund due to the NOL carryback in Part III.

07

Review the completed Form 1045 for accuracy, ensuring all calculations are correct and all necessary attachments are included.

08

Sign and date the form, and mail it to the appropriate address provided in the instructions.

Who needs IRS Instruction 1045?

01

Taxpayers who have incurred a net operating loss in a given tax year.

02

Individuals or businesses wishing to carry back NOLs to offset taxes paid in prior years.

03

Anyone eligible to claim a quick refund of taxes based on operating loss carrybacks.

Fill

form

: Try Risk Free

People Also Ask about

Can you still file form 1045?

The NOL for the tax year. Generally, you must file Form 1045 within 1 year after the end of the year in which an NOL, unused credit, net section 1256 contracts loss, or claim of right adjustment arose. If you were affected by a federally declared disaster, you may have additional time to file your Form 1045.

How long does it take to get a 1045 refund?

How long does it take to get a 1045 refund? The IRS states that it generally takes 16 to 20 weeks to process a Form 1045. However, the agency warns that processing times may vary depending on the individual case.

What is the filing deadline for 1045?

You can use Form 1045 when you have overpaid your taxes and want to request a refund of the overpayment. You must file Form 1045 within 1 year from the date your tax return was due or within 60 days from the date you paid your tax, whichever is later.

What is form 1045 application for tentative refund?

An individual, estate, or trust files Form 1045 to apply for a quick tax refund resulting from: The carryback of an NOL. The carryback of an unused general business credit. The carryback of a net section 1256 contracts loss.

Can IRS form 1045 be filed electronically?

E-Filing: You can e-file the return in which you generate Form 1045, but Form 1045 does not e-file with the return, nor may it be e-filed separately. Preparers should paper file Form 1045 the same way as they would paper file Form 1040 for the same taxpayer.

Can you still fax form 1045 to IRS?

The IRS announced on its website that, starting on April 17, 2020, and until further notice, it will accept eligible refund claims on Form 1139 submitted via fax to 844-249-6236, and eligible refund claims on Form 1045 submitted via fax to 844-249-6237.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit IRS Instruction 1045 from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your IRS Instruction 1045 into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I send IRS Instruction 1045 for eSignature?

To distribute your IRS Instruction 1045, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I make edits in IRS Instruction 1045 without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your IRS Instruction 1045, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

What is IRS Instruction 1045?

IRS Instruction 1045 provides guidance on how to claim a refund of taxes due to a net operating loss (NOL) carryback.

Who is required to file IRS Instruction 1045?

Taxpayers who have a net operating loss and wish to apply the loss to prior tax years to potentially receive a tax refund are required to file IRS Instruction 1045.

How to fill out IRS Instruction 1045?

To fill out IRS Instruction 1045, taxpayers must provide information about their net operating loss, calculate the extent of the loss that can be carried back, and complete the associated forms demonstrating the tax liabilities for prior years.

What is the purpose of IRS Instruction 1045?

The purpose of IRS Instruction 1045 is to outline the process for taxpayers to claim a refund resulting from a net operating loss carryback, allowing them to recover taxes paid in previous years.

What information must be reported on IRS Instruction 1045?

Information that must be reported on IRS Instruction 1045 includes details of the net operating loss, the tax year(s) being amended, calculations of the tax liability, and any tax payments made in those years.

Fill out your IRS Instruction 1045 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS Instruction 1045 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.