Get the free 760cg

Show details

760CG Substitute Forms Vendor Test Scripts Tax Year 2011 Processing Year 2012 Issued October 2011 Introduction The Virginia Tax Department (the Department) Software Vendor Test Package provides the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign va760cg form

Edit your 760cg form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 760cg form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 760cg form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 760cg form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 760cg form

How to fill out VA 760CG:

01

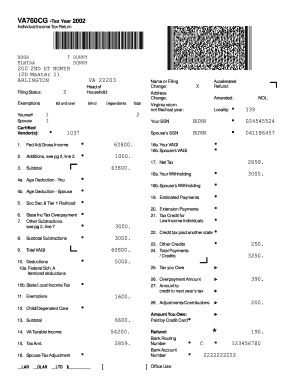

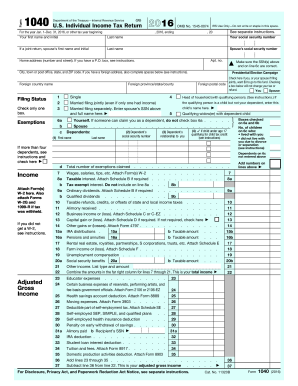

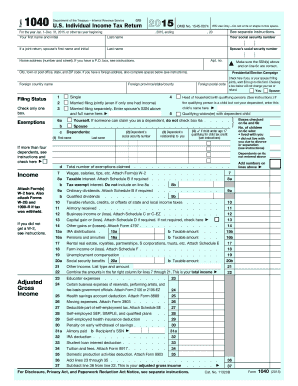

Gather all necessary documents such as your W-2 forms, 1099 forms, and any other relevant income statements.

02

Collect any supporting documents such as receipts for deductions or credits you plan to claim.

03

Complete the personal information section of the form, including your name, address, and Social Security number.

04

Indicate your filing status, either single, married filing jointly, married filing separately, or head of household.

05

Provide information about your income, including wages, self-employment income, and any other sources of income.

06

Report any deductions you are eligible for, such as student loan interest, mortgage interest, or state and local taxes paid.

07

Determine if you qualify for any tax credits, such as the Child Tax Credit or the Earned Income Credit, and provide the necessary information.

08

Double-check all entries for accuracy and ensure that you have signed and dated the form.

09

Submit the completed VA 760CG form to the appropriate tax authority.

Who needs VA 760CG:

01

Individuals who are residents of the Commonwealth of Virginia for tax purposes.

02

Taxpayers who need to report their income, deductions, and tax liabilities for the state of Virginia.

03

Those who are claiming specific tax credits or deductions unique to Virginia, such as the Subtraction for Elderly or Disabled Individuals or the Small Business Investor Credit.

Fill

form

: Try Risk Free

People Also Ask about

What is a VA 760 form?

2022 Virginia Resident Form 760 Individual Income Tax Return.

What is VA form 760cg?

Full-year residents of Virginia must include income earned in other states to compute total Adjusted Gross Income for the appropriate tax year. Credit for taxes paid to another state may be claimed by filing Virginia Schedule OSC. Solution Id.

What is a 760 760PY or 763 Virginia return?

760 - Individual Resident Income Tax Return. 760PY - Part Year Resident Individual Income Tax Return. 763 - Nonresident Individual Income Tax return.

What does return is amended return mean?

An amended return is a form filed in order to make corrections to a tax return from a previous year. An amended return can correct errors and claim a more advantageous tax status, such as a refund. For example, one might choose to file an amended return in instances of misreported earnings or tax credits.

What is a 760 Virginia return?

Complete Form 760, Lines 1 through 9, to determine your Virginia Adjusted Gross Income (VAGI). If the amount on Line 9 is less than the amount shown below for your filing status, your Virginia income tax is $0 and you are entitled to a refund of any withholding or estimated tax paid.

Do I need to attach my W-2 to my Virginia state tax return?

You are also required to attach all W-2 and 1099 forms, showing Virginia tax withheld with a single staple at the left center of page 1 of the return.

What do you need to fill out tax forms?

What documents do I need to file my taxes? Social Security documents. Income statements such as W-2s and MISC-1099s. Tax forms that report other types of income, such as Schedule K-1 for trusts, partnership and S corporations. Tax deduction records. Expense receipts.

What do you need to have completed before you fill out your Virginia state income tax form?

Generally, you will need a copy of your completed federal income tax return (Form 1040, 1040A, or 1040EZ), any supporting federal schedules (A, C, D, E, F), your W-2 wage forms and 1099 income forms showing Virginia tax withheld, Virginia Schedule ADJ, and Virginia Schedule CR.

What is Virginia 760cg form?

Full-year residents of Virginia must include income earned in other states to compute total Adjusted Gross Income for the appropriate tax year. Credit for taxes paid to another state may be claimed by filing Virginia Schedule OSC.

What do you attach to VA 760?

REQUIRED ATTACHMENTS TO FORM 760 Forms W-2, 1099 & VK-1 showing Virginia withholding. Schedule ADJ. Schedule VAC. Schedule OSC. Schedule CR. Form 760C or Form 760F. Virginia Credit Schedules. Other Virginia Statements or Schedules.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 760cg form on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign 760cg form on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I edit 760cg form on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute 760cg form from anywhere with an internet connection. Take use of the app's mobile capabilities.

How do I complete 760cg form on an Android device?

Use the pdfFiller app for Android to finish your 760cg form. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

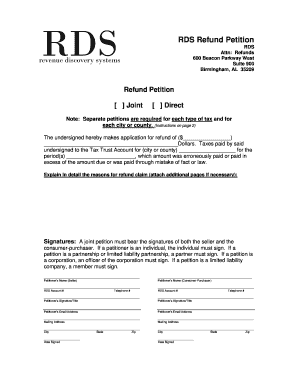

What is va 760cg?

The VA Form 760CG is the Virginia Individual Income Tax Return for Claiming a Refund of Taxes Withheld. It is specifically designed for residents of Virginia who are claiming a refund of income taxes that were withheld during the year.

Who is required to file va 760cg?

Individuals who have had Virginia state income taxes withheld from their pay and are expecting a refund may be required to file VA 760CG. This includes both residents and non-residents who worked in Virginia and had taxes withheld.

How to fill out va 760cg?

To fill out VA 760CG, individuals should gather their W-2 forms, complete personal information sections, report income, calculate deductions, and determine any credits. They must also report the amount of Virginia income tax withheld and follow the instructions provided on the form.

What is the purpose of va 760cg?

The purpose of VA 760CG is to facilitate the filing of individual income tax returns in Virginia and to allow taxpayers to claim any refund due based on taxes withheld.

What information must be reported on va 760cg?

VA 760CG requires reporting of personal information (name, address, etc.), income details (wages, salaries, etc.), Virginia tax withheld, and any applicable deductions and credits.

Fill out your 760cg form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

760cg Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.