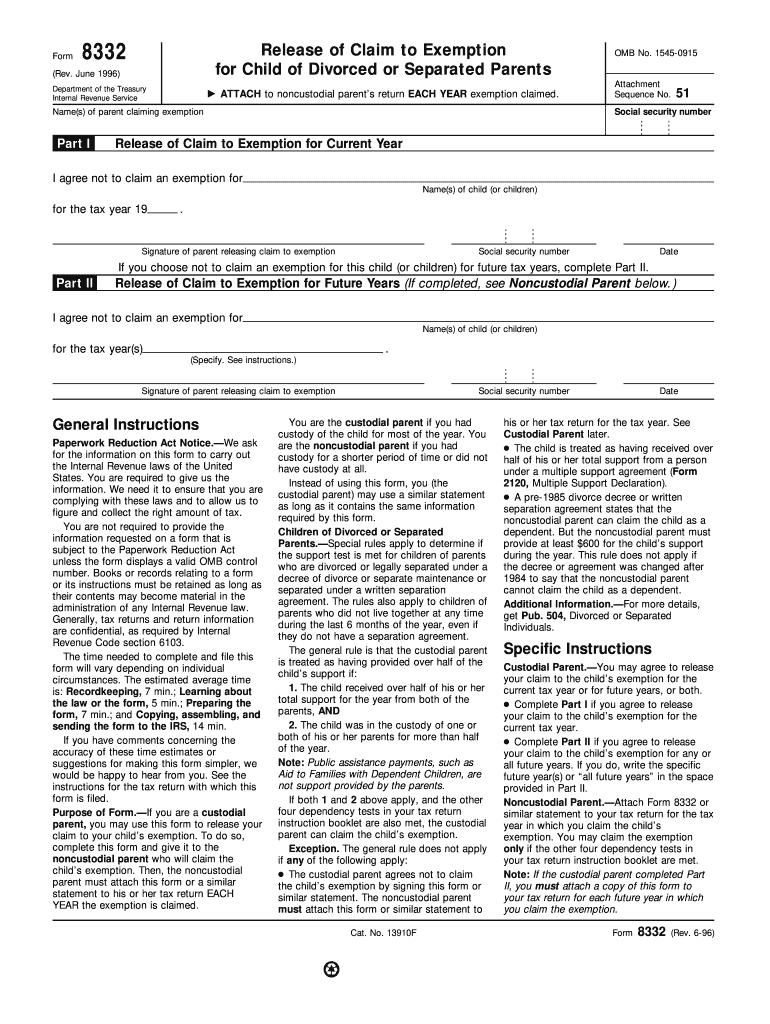

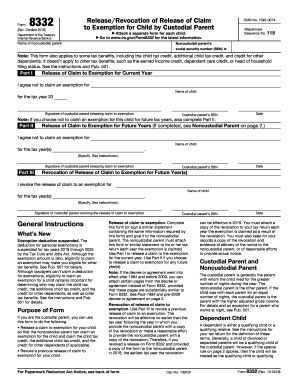

What is form 8332?

The purpose of IRS form 8332 is to give a noncustodial parent the chance to claim an exemption for a child. It also allows a noncustodial parent to claim the tax credit and the additional child tax credit. The information provided is forwarded to the IRS to decide the taxpayer’s case.

Who should file form 8332?

A custodial parent uses this form to release (or revoke a previous release of) a claim to exemption for the child so that the noncustodial parent can claim an exemption.

What information do you need when you file form 8332?

The custodial parent must provide the following details:

- Their name and SSN

- The name of the child

- The tax year

The form contains three parts to complete as required.

How do I fill out form 8332 in 1997?

Save time by filling out the 8332 form online with pdfFiller and have it delivered by USPS. Here’s how to do it:

- Click Get Form on this page

- Fill out the 8332 template providing all required information

- Sign the document in pdfFiller

- Click Done to finish editing

- Select the file and click Send via USPS

- Provide the addresses and select delivery terms

- Click Send

pdfFiller will print and send the form to the post office. It will be delivered according to the terms you’ve selected.

Is form 8332 accompanied by other forms?

This form is completed by the custodian parent and sent to the noncustodial parent. The latter attaches it to their tax return. If the custodial parent releases the claim of exemption for the child for a future year, they should attach the 8332 to their tax return.

When is form 8332 due?

A noncustodial parent should file the form with their tax return. The due date is the same as the tax return deadline.

Where do I send the 8332 form?

The completed form is forwarded to the noncustodial parent, who will send it to the IRS with their tax return.