Get the free oregon monthly mileage report - odot state or

Show details

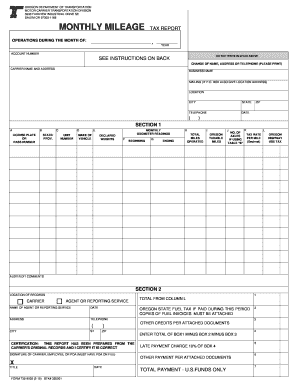

OREGON DEPARTMENT OF TRANSPORTATION MOTOR CARRIER TRANSPORTATION DIVISION 550 CAPITOL ST NE SALEM OR 97301-2530 Reset TAX REPORT Print MONTHLY MILEAGE OPERATIONS DURING THE MONTH OF: MONTH ACCOUNT

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign oregon monthly mileage report

Edit your oregon monthly mileage report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your oregon monthly mileage report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing oregon monthly mileage report online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit oregon monthly mileage report. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out oregon monthly mileage report

How to fill out OR 735-9002

01

Start by downloading the OR 735-9002 form from the official website.

02

Read the instructions provided on the form carefully.

03

Fill in your personal information, including name, address, and contact details in the designated sections.

04

Provide details related to the purpose for completing the form, ensuring all relevant information is included.

05

Sign and date the form at the bottom as required.

06

Review the completed form for any errors before submission.

07

Submit the form according to the instructions, either via mail or electronically, as applicable.

Who needs OR 735-9002?

01

Individuals who are applying for specific benefits or services that require the form.

02

Organizations assisting clients in need of these benefits.

03

State or local agencies involved in processing applications for the relevant benefits.

Fill

form

: Try Risk Free

People Also Ask about

How do I report Oregon miles?

To report mileage on an Over-Dimensional Permit, contact OD Permits at 503-373-0000. DUE DATE: Your report and payment must be postmarked by the Postal Service by the last day of the month following the end of the calendar month.

How does the Oregon mileage tax work?

OReGO participants pay 1.9 cents for each mile they drive on Oregon roads. That money goes into the State Highway Fund for construction, maintenance, and preservation of roads and bridges. Participants sign up with an account manager, select a mileage reporting option, and receive a bill for reported miles.

Does Oregon have a mileage tax?

Oregon Weight-Mile Tax The Weight-mile tax applies to vehicles in commercial operations on public roads within Oregon with a registered weight over 26,000 pounds. Motor carriers: With established accounts must enroll all weight-mile tax qualified vehicles under the account and pay the weight-mile tax on a tax report.

What is the per mile rate in Oregon?

1, 2022 and June 30, 2022 the Full rate is $0.585 per mile, Reduced rate is $0.18 per mile. For travel between July 1, 2022 and Dec. 31, 2022 the Full rate is $0.625 per mile, Reduced rate is $0.22 per mile.

What is the mileage reimbursement rate for Oregon 2023?

The rate established for client mileage reimbursement is set at $0.44 per mile, without exception for the period January 1, 2023, to December 31, 2023.

What is a reasonable travel fee per mile?

The new IRS mileage rates apply to travel starting on January 1, 2023. The new mileage rates are up from 58.5 cents per mile for business purposes and 18 cents per mile for medical or moving purposes in early 2022 and 62.5 cents per mile for business purposes in the second half of 2022.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my oregon monthly mileage report directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your oregon monthly mileage report along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I edit oregon monthly mileage report online?

With pdfFiller, the editing process is straightforward. Open your oregon monthly mileage report in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I sign the oregon monthly mileage report electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

What is OR 735-9002?

OR 735-9002 is a specific form used for reporting certain financial or operational information to the relevant authorities, often related to businesses operating in specific industries.

Who is required to file OR 735-9002?

Typically, businesses or entities that meet certain criteria, such as size or revenue thresholds in specific industries, are required to file OR 735-9002.

How to fill out OR 735-9002?

To fill out OR 735-9002, provide the necessary financial data and operational details as required by the form's instructions, ensuring all entries are accurate and complete.

What is the purpose of OR 735-9002?

The purpose of OR 735-9002 is to collect important information that helps regulatory bodies monitor compliance, assess industry performance, and inform policy decisions.

What information must be reported on OR 735-9002?

Information that must be reported on OR 735-9002 typically includes financial metrics, operational statistics, and other relevant data specific to the entity's activities over the reporting period.

Fill out your oregon monthly mileage report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Oregon Monthly Mileage Report is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.