Get the free lic maturity claim form

Show details

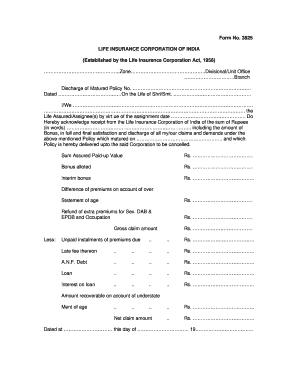

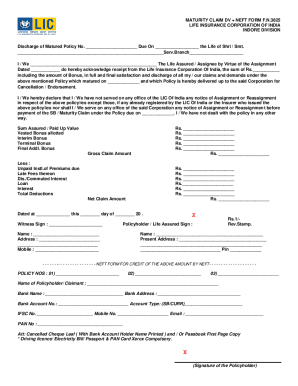

MUMBAI DIVISION DISCHARGE OF (1) * CASH OPTION UNDER C.D.A. POLICY (2) * MATURITY PROCEEDS UNDER TRIPLE BENEFIT POLICY. (3) *ANTICIPATED Installment UNDER ANTICIPATED ENDOWMENT POLICY, MONEY-BACK

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign lic maturity form pdf

Edit your how to fill out lic maturity claim form 10 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your lic claim form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing lic discharge form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit lic discharge form pdf download. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out how can i claim my lic policy after maturity due date of maturity claim form

How to fill out LIC maturity claim form:

01

Start by gathering all the necessary documents such as the original policy bond, identity proof, bank details, and any other required documents.

02

Carefully read the instructions provided on the LIC maturity claim form to understand the information you need to provide.

03

Begin filling out the form by entering your personal details, such as your name, address, date of birth, and policy number.

04

Provide details about the policy, such as the date of commencement, maturity date, sum assured, and any additional details as required.

05

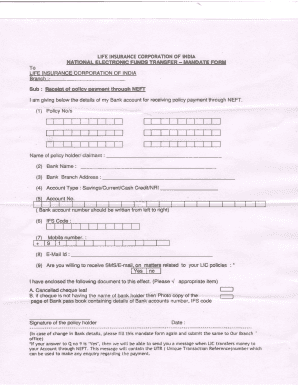

Fill in the bank details correctly, including the account number, branch name, and IFSC code, to ensure smooth processing of the claim amount.

06

In case of any nominees or legal heirs, provide their details accurately, including their names, addresses, and relationship with the policyholder.

07

If there are any necessary declarations or signatures required, make sure to fill them out properly and sign where necessary.

08

Double-check all the information provided to ensure its accuracy and completeness.

09

After filling out the form, attach all the required documents as mentioned in the instructions.

10

Finally, submit the LIC maturity claim form with all the necessary documents to the nearest LIC branch office.

Who needs LIC maturity claim form:

01

Policyholders who have reached the maturity date of their LIC policy and are eligible to receive the claim amount.

02

Individuals who are the nominees or legal heirs of the policyholders and need to claim the maturity amount in case of the policyholder's demise.

03

Anyone who has a valid LIC policy and wishes to receive the maturity benefits as per the terms and conditions of their policy.

Fill

where can i claim my and attach the necessary documents

: Try Risk Free

People Also Ask about lic maturity discharge form

What is maturity claim form LIC?

In a life insurance policy with maturity benefits, the insured will be entitled to claim maturity benefits if he or she outlives the term of the policy. The insured is entitled to claim the maturity benefits only when the policy is in force and all premiums have been paid duly.

Where can I claim my LIC maturity amount?

Step 1: Visit the official website of LIC. Step 2: Click on the “Customer Services” tab and select the “Claim Forms” option. Step 3: Choose the Maturity claim form based on the policy type. Step 4: Fill in the form with the required details and attach the necessary documents.

How can I claim my LIC maturity online?

How Can I Claim LIC Maturity Online? Step 1: Visit the official website of LIC. Step 2: Click on the “Customer Services” tab and select the “Claim Forms” option. Step 3: Choose the Maturity claim form based on the policy type. Step 4: Fill in the form with the required details and attach the necessary documents.

What is the difference between maturity claim and death claim?

The death benefit is an amount that the insurance company provides to the nominee on the unforeseen demise of the life assured on the other hand the maturity benefit amount is an amount which the insurance company has to pay to the policy holder in the of their life insurance policy being matured.

How can I claim my LIC policy after maturity?

Maturity Claims: The servicing Branch usually sends maturity claim intimations two months in advance. Please submit your Discharged Receipt in Form No.3825 with original policy document atleast one month before the due date so that the payment is received before the due date of maturity claim.

How long does it take to claim LIC policy maturity?

Both maturity and death claims are settled in no more than 30 days from the date of receipt of all the documents.

What is maturity claim in LIC policy?

Maturity Claims: The Branch Office which services the policy sends out a letter informing the date on which the policy monies are payable to the policyholder at least two months before the due date of payment.

What is the meaning of maturity claim is due?

The claim for which a policyholder/life insured can apply for after surviving the complete policy term is called maturity claim.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute lic maturity form pdf download online?

pdfFiller has made it simple to fill out and eSign lic policy discharge form. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I make changes in editing lic maturity form pdf download in you are a new user establish a?

With pdfFiller, it's easy to make changes. Open your how can i claim lic maturity claim and death claim in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I edit lic maturity claim neft form on an Android device?

You can make any changes to PDF files, such as lic maturity form, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

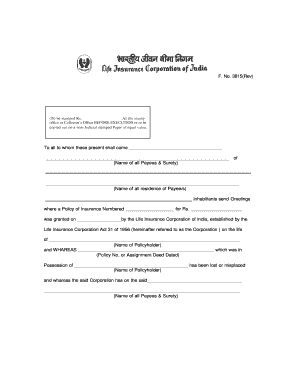

What is lic maturity claim form?

The LIC maturity claim form is a document that policyholders must complete to claim the benefits upon the maturity of a life insurance policy provided by the Life Insurance Corporation of India (LIC).

Who is required to file lic maturity claim form?

The policyholder, or the nominee designated by the policyholder, is required to file the LIC maturity claim form to receive the maturity benefits.

How to fill out lic maturity claim form?

To fill out the LIC maturity claim form, the policyholder or nominee must provide personal details, policy number, the amount due, details of the bank account for payment, signature, and any required documentation such as identity proof and policy document.

What is the purpose of lic maturity claim form?

The purpose of the LIC maturity claim form is to officially request the disbursement of the maturity benefit from LIC and to ensure that all relevant information is documented to process the claim accurately.

What information must be reported on lic maturity claim form?

The information that must be reported on the LIC maturity claim form includes the policyholder's name, policy number, date of maturity, contact information, bank account details, and any other specifics required by LIC for processing the claim.

Fill out your lic maturity claim form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Lic Maturity Claim Form 3825 In English Pdf is not the form you're looking for?Search for another form here.

Keywords relevant to pdffiller

Related to how can i claim lic maturity claim in lic policy

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.