CA Form CG 20 10 11 free printable template

Fill out, sign, and share forms from a single PDF platform

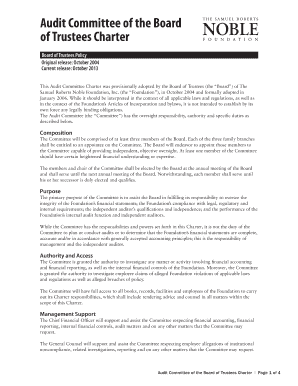

Edit and sign in one place

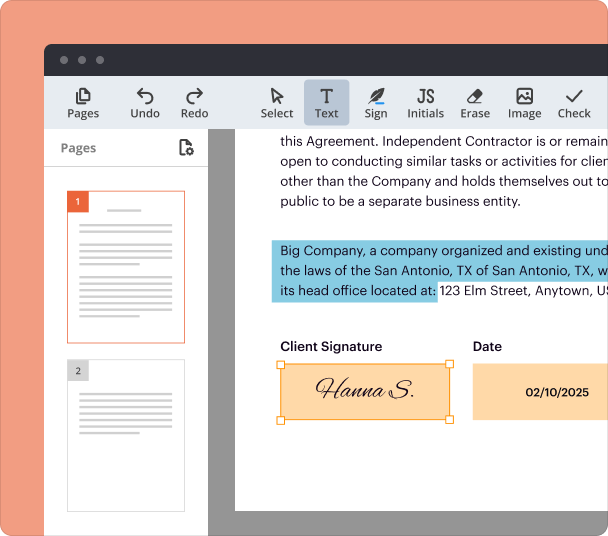

Create professional forms

Simplify data collection

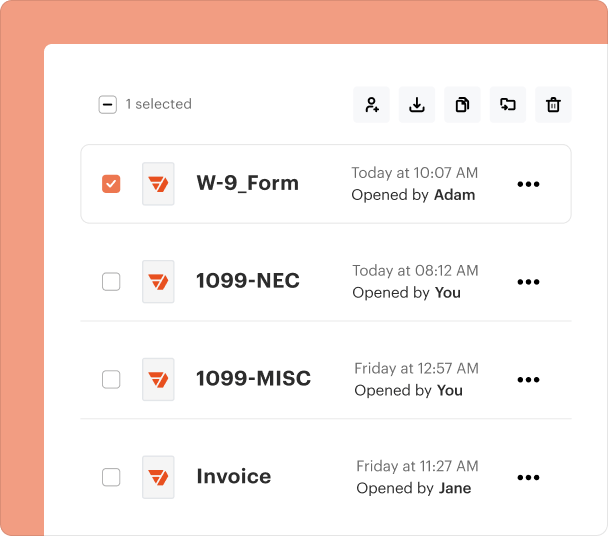

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

How to fill out a CA Form CG 20

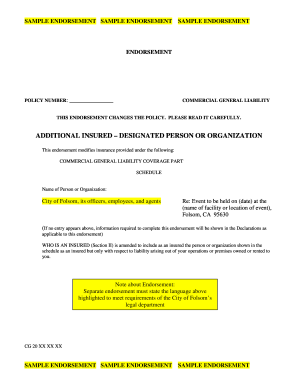

Understanding Form CG 20

Form CG 20 is a crucial endorsement in the realm of liability insurance. It provides specific coverage details, enabling individuals and organizations to ensure they have adequate protection. This form includes key terms like 'Endorsement', which is an amendment to an existing insurance policy, and 'Additional Insured', indicating individuals or entities added to the policy for coverage.

-

This form is essential as it delineates additional coverage, protecting both the insured and any additional parties involved.

-

Understanding terms such as 'primary insurance' is vital, as it indicates the insurance that responds first to a loss.

-

Form CG 20 differs from other insurance forms in its specificity regarding liability coverage provisions.

What are the key features of the endorsement?

The Endorsement in Form CG 20 provides comprehensive coverage for various situations. It specifies who is considered an Additional Insured under the policy, which may include contractors or other entities linked to the primary insured. Furthermore, understanding the distinction between primary and excess insurance is critical for in-depth risk management.

-

The Endorsement details the types of liabilities covered, ensuring clarity for all parties involved.

-

Only specific entities can qualify as additional insured, commonly tied to business relationships or contractual obligations.

-

Primary insurance is the first line of defense against claims, while excess insurance provides extra coverage once primary limits are exhausted.

How do you fill out the form correctly?

Filling out Form CG 20 accurately is imperative for ensuring coverage. Start by completing essential fields such as the INSURER, POLICY NUMBER, and ENDORSEMENT NUMBER. Avoid common mistakes like incorrect dates or misspellings, as these can lead to processing delays or coverage issues.

-

Follow a structured approach beginning with basic information and gradually include additional details.

-

Ensure that the INSURER and POLICY NUMBER are sourced from your policy documents to avoid inaccuracies.

-

Double-check all entries for typographical errors and ensure compliance with policy requirements.

What modifications and special notes should you consider?

Form CG 20 can be customized to an extent, allowing for modifications that reflect specific risk exposures. However, it's crucial to be aware of the implications of any changes—especially regarding cancellation and notice requirements—since these can affect the overall protection offered.

-

Discuss permissible alterations to the form that can tailor coverage to unique circumstances.

-

Understand how to correctly cancel the endorsement if coverage is deemed unnecessary.

-

Recognize the boundaries of liability coverage particularly when dealing with academic institutions.

How does Form CG interact with other insurance policies?

Form CG 20 may interact with other insurance policies held by an organization, creating a need for a cohesive understanding of overall coverage. This is particularly important when dealing with proprietary versus public insurance, as understanding these nuances can lead to better resource allocation and risk management.

-

Evaluate how CG 20 functions with other policies to eliminate gaps in coverage.

-

Assess differences in coverage provided by proprietary versus public insurance to mitigate excess liabilities.

-

Identify risks associated with having multiple policies that may lead to claim disputes or complications.

What are the signing and submission procedures?

Submitting Form CG 20 requires careful adherence to signature and submission guidelines. Ensure that an Authorized Representative signs the form to validate the submission. Utilizing tools like pdfFiller can streamline this process, allowing for easy signing and tracking of submission status.

-

Review who qualifies as an Authorized Representative and the required signature protocol.

-

Best practices include using pdfFiller for electronic submission to simplify document management.

-

Leverage pdfFiller features to monitor the progress of your submission efficiently.

How to contact support for assistance?

Getting help with Form CG 20 is straightforward when you know where to look. pdfFiller offers robust support options, ensuring that you have access to resources that clarify any uncertainties you might face while filling out the form.

-

Identify the best channels for contacting customer service regarding form-related queries.

-

Utilize pdfFiller’s extensive guides and FAQs for immediate assistance.

-

Navigate directly to support features embedded in the pdfFiller platform to expedite your assistance.

Frequently Asked Questions about pdffiller form

What is the purpose of Form CG 20?

Form CG 20 serves as an endorsement that provides additional liability coverage under an existing insurance policy. It clarifies the specific obligations and protections for both the insured and any additional insured parties.

Who can be listed as an Additional Insured?

Entities that have a financial interest or contractual relationship with the primary insured can be labeled as Additional Insureds on Form CG 20. This typically includes contractors, lessors, and partners.

What should I do if I make a mistake on the form?

If you discover a mistake on Form CG 20 after submission, contact your insurer immediately. In many cases, amendments can be made by submitting a correction or a new form.

How can I track the submission status of my form?

Using pdfFiller allows you to easily track your submission status by signing up for notifications or checking your user account. This feature helps you stay informed about the processing stages.

What modifications are allowed for Form CG 20?

Form CG 20 can be modified to some extent, allowing for changes related to coverage limits and specific endorsements. However, ensure alterations are compliant with regulation and policy terms.

pdfFiller scores top ratings on review platforms