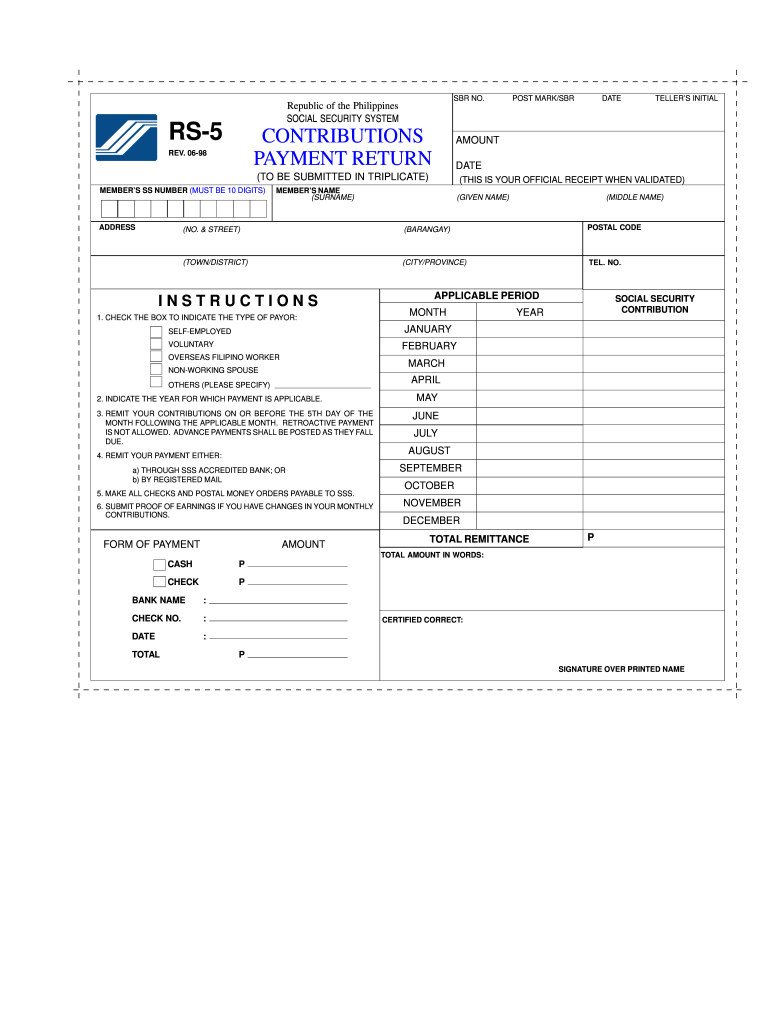

PH RS-5 1998 free printable template

Get, Create, Make and Sign PH RS-5

How to edit PH RS-5 online

Uncompromising security for your PDF editing and eSignature needs

PH RS-5 Form Versions

How to fill out PH RS-5

How to fill out PH RS-5

Who needs PH RS-5?

Instructions and Help about PH RS-5

In this lecture we#39’re going to do a few more examples in which we#39’re going to determine the absolute configuration four enantiomers using thecahn-ingold-prelog priority system sewer first job is to find a stereo geniccarbon and then we#39’re going to label the four different groups attached to our stereo genie carpet according to this priority system so we#39’re going to label them 1 2 4 1 having the highest priority and four having the lowest priority sole#39’s begin with enantiomer 1 so this amount Mir has the following Sturridgeand carbon this carbon is attached to four different groups so let's begin labeling so let#39’s beginning with 4 which one of these groups has the lowest priority which one of these groups has the lowest atomic number well out of all these four groups these two groups have the same exact atomic number they both have anatomic number of one, but this is an isotope of H it's called e Tyrion, and it has a higher atomic weight and that means this gets a four and this gets three, so this is higher in priority because it has a higher atomic weight so label this is for label this as three next we have an oh attached, and we have carbon attached since oxygen has higher atomic number we label this with 1 so that means this has the highest priority and this has the second highest priority, so we labeled our carbon within too now our goal is to hide this CH bond we want to look at this molecule in away so that this CH bond is hidden some look this way, so we're looking directly at this CH bond, so that means we have to flip this molecule this ways this bond will go here this bond will go here and this will be on top, and I'll show you in a second, so this is our cobond this is our Cocoon an CD bond the CH bond is in tieback it#39’s going into the board we can'see it and so let#39’s label this as a one this has a two this has a three, and now we draw an arrow starting from one go Toto and going to three, so our arrow goes this way and notice that it's going counterclockwise and that means this gets an S, so this isn't, so this is an Enantiomer so let's go to example two sconces again the same exact story we'relabeling one two fours here it's easy because this has the lowest atomic number and the molecular weight, so that means this gets a four next we have to differentiate between this carbon and this carbon well this oxygen clearly gets the highest, so this is a one because oxygen has a higher atomic number then both of these carbons, so this gets a one but which one of these gets a three and which one of these gets up to well notice that this carbon is attached to three deuterium atoms while these carbons attached to three H atoms since the Team has a higher atomic weight it's an isotope that means this gets a two, so this has second highest priority and this gets a three so once again we want to look at the bond that has the lowest priority this CH bond now we#39’re looking this way so let's draw our upside-down And we're...

People Also Ask about

Can I get my SSS ID immediately?

How fast can I get SSS ID?

How can I get SSS ID fast?

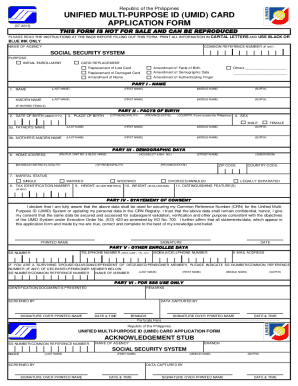

How can I get SSS UMID ID Online 2022?

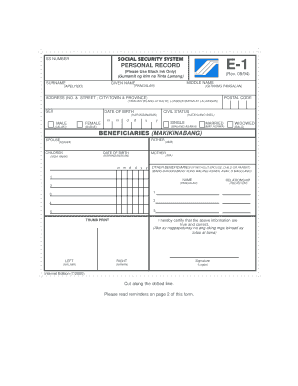

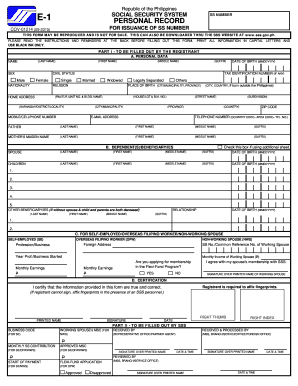

What is the requirements to get SSS ID?

How can I get my SSS ID for the first time?

How to apply for UMID ID 2022?

Can I get SSS ID without appointment?

How long will it take to get SSS ID card?

Can I get SSS ID card online?

How can I get my SSS ID online 2022?

How can I apply SSS ID online?

How much is the cost of SSS ID?

Can I get SSS ID walk in?

How can I get my SSS ID for the first time?

Can I get SSS ID in any branch?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute PH RS-5 online?

How do I make edits in PH RS-5 without leaving Chrome?

How can I fill out PH RS-5 on an iOS device?

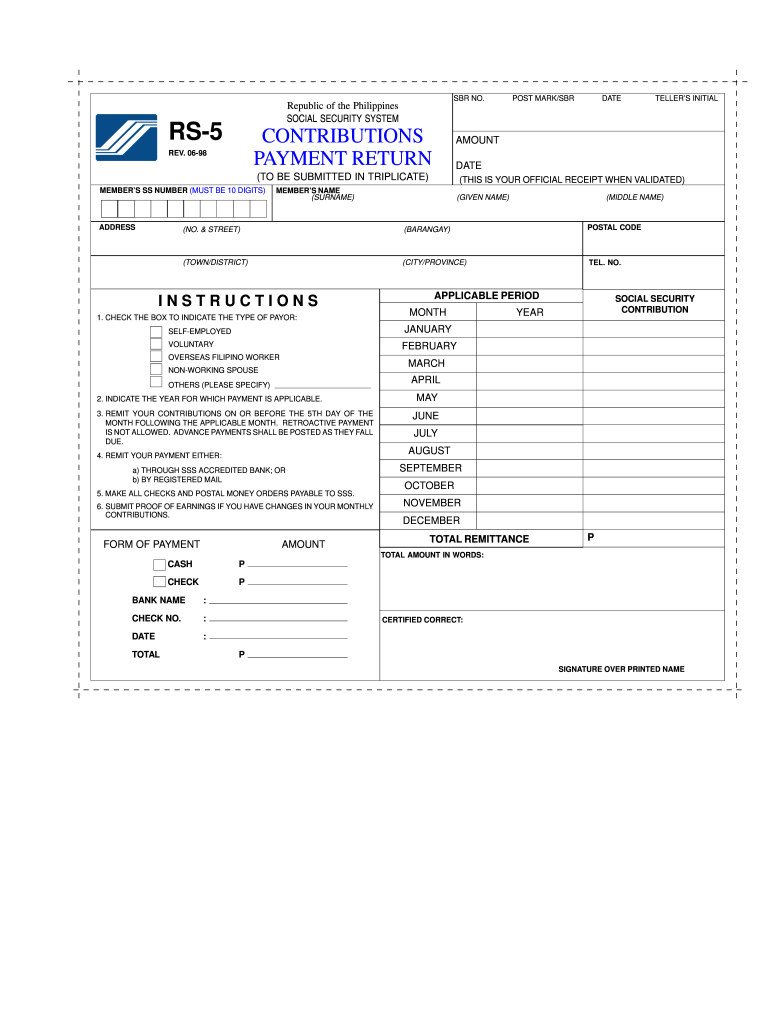

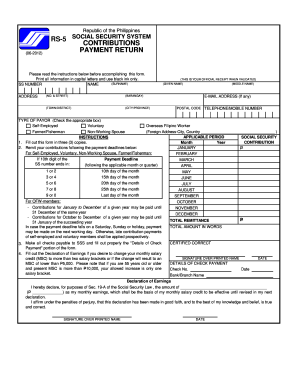

What is PH RS-5?

Who is required to file PH RS-5?

How to fill out PH RS-5?

What is the purpose of PH RS-5?

What information must be reported on PH RS-5?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.